Summary of key points: -

- “Trump Trade” speculators are sitting on large profits, when will they cash up?

- US housing costs continue to distort official CPI Inflation measures

- How can US bond yields remain at 4.45%?

“Trump Trade” speculators are sitting on large profits, when will they cash up?

The financial market speculation, that started a month before the US Presidential Election, of buying the US dollar and selling US Treasury Bonds in expectation of a Donald Trump victory, has continued with some momentum after the stunning “clean sweep” Republican win. Mr Trump’s nominees for his cabinet appear to be loyal supporters rewarded, however they are all hardliners on Chinese tariffs, deregulation and deportation of illegal immigrants. Therefore, the “Trump Trade” has been extended over the last 12 days since the election result. The immediate conclusion by the markets is that the implementation of the Trump regime’s tariff and deportation policies in 2025 will result in higher inflation and higher interest rates than would otherwise be the case. Federal Reserve Chair, Jerome Powell stated in a speech last Friday that there was no rush to cut interest rates. The forward interest rate market pricing for a another 0.25% cut at the next Fed meeting on 18th December has shifted down from an 80% probability to a 61% probability.

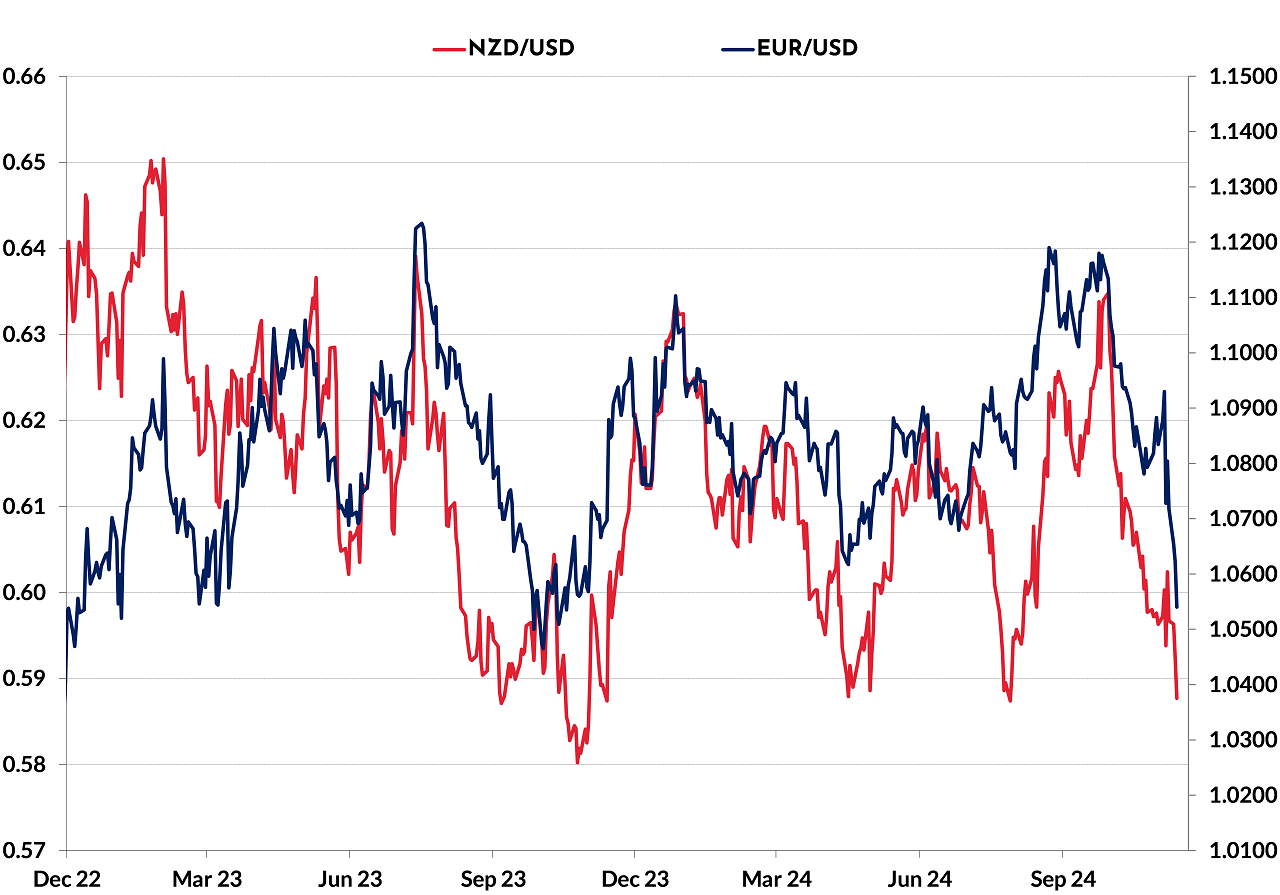

The question for future US dollar direction (and therefore NZD/USD direction), is how much further can the Trump Trade go and when will it reverse?

The key determinant to answer the question on when a reversal will occur (USD back down and bond yields also back down) appears to be the time of year we are in right now. It is only a few weeks until the end of the 31 December financial year for US companies. Currently, the hedge funds and investment bank proprietary trading desks are sitting on massive unrealised “marked-to-market” revaluation gains on the long-USD and short-sold bond positions. The traders will only be paid their 2024 bonuses on those revaluation gains if they are closed-out and converted into realised cash profits. There are very large incentives for the Trump Trade to be unwound over coming weeks.

The second incentive to unwind the Trump Trade speculative positions would be a view that despite all the euphoria and hoop-la surrounding the proposed shake-up of the US Federal bureaucracy, government and institutions, actually making the changes and seeing an improvement in US economic performance as a result might be harder to achieve in practice than just extolling the threatening words. It remains to be seen exactly what tariffs will be levied and whether it is logistically feasible to deport 10 million undocumented workers. The most US deportations ever achieved in history over a 12-month period is one million. The markets will soon realise that there is a wide gap between Trump’s rhetoric and actual change. Be prepared for the normal chaos as the Trump appointees botch up and provide evidence that they are not up to the job and are ceremonially fired!

US equity markets are already displaying some nervousness and uncertainty around the continuing momentum of the Trump Trade. A slower pace of interest rate reductions from the Fed and the substantially higher 10-year treasury Bond yields at 4.45% are significant negatives for equities. Fund managers switching out of equities and into bonds over coming weeks would see the US dollar retreat from its highs (following bond yields lower) and allow the NZD/USD exchange rate to recover from its lows of 0.5850. The Kiwi dollar has experienced several spikes below 0.6000 to the 0.5800/0.5900 region over recent years, however they have all never been too long lasting with something causing a smart reversal back upwards. These recurring dips are nearly all related to USD movements against major global currencies and have generally been stimulated by the shifting sands on the outlook for US inflation, employment and interest rates. The latest spike lower to 0.5850 has been due to a well-signposted “event risk” of Donald Trump returning to the Whie House, the greater probability from here appears to be a Kiwi recovery before year-end as the Trump Trades are unwound.

US housing costs continue to distort official CPI Inflation measures

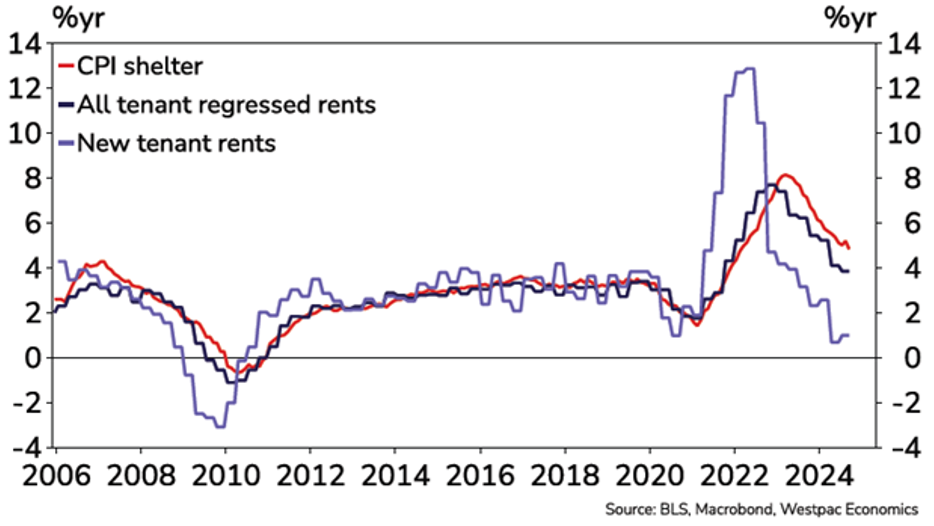

The general market consensus after the election result is that US inflation will struggle to stay in the 2.00% region and move up to 3.00% in 2025 as import tariffs and higher wages from labour shortages (due to deportations) lift consumer prices. The market players seem to be completely ignoring the largest and ongoing factor pushing US inflation downwards at this time and into 2025 – housing costs.

The US CPI inflation increase of 0.20% for the month of October released last week was again dominated by increases in the housing/shelter CPI component (rents and implied rents). The shelter CPI increase of 0.40% in October represented over half of the 0.20% inflation increase for the month. The 0.40% housing/shelter CPI increase in October was surprisingly high (likely an outlier). The overall trend is sharply lower as the 12 to 18-month time-lagged house cost data comes through into the current CPI figures. The housing cost/shelter component in the CPI inflation index has a high 33% weighting and further reductions will totally swamp any price increase in imported consumer products from tariffs. Household furnishings and supplies have only a low 4.00% weighting in the US CPI Index, and not all those products will be imported from China. Shelter, food, energy, transportation, education and medical components combined make up 81% of the US CPI index weightings. The fears about Trump’s tariffs on US inflation are likely misplaced.

The lagged data on housing/shelter will continue to pull the annual US inflation rate to below 2.00% over coming months. It is just arithmetic, as the following two charts confirm.

How can US bond yields remain at 4.45%?

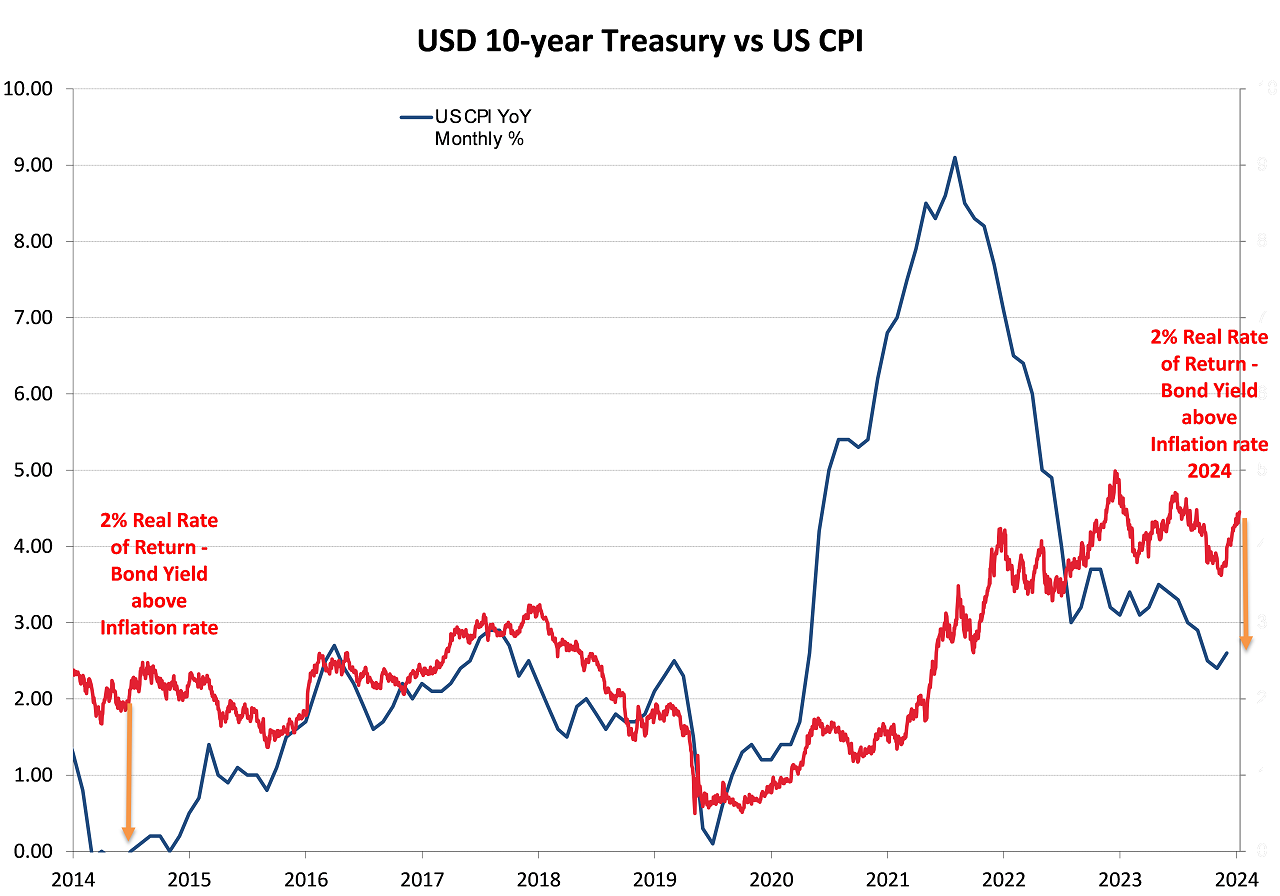

Since mid-September, US 10-year Treasury Bond yields have increased by 0.85% from 3.60% to 4.45%. The selling of the bonds that has caused the yields to rise does not appear to be from long-term investors exiting the market as they are worried that the Fed has lost control of inflation. All the selling appears to be short-term speculative in nature based around Trump’s policies and how they may be inflationary and cause the budget deficit and therefore US government debt to be even larger. The latter reason is likely to be the case, but the higher inflation argument is negated by our previous section above.

The dramatic increase in yields to 4.45% has been caused by a once-off risk event (the election), that has now occurred and is no longer a factor. We are left with a unique, once in 20-year situation, of US 10-year Treasury Bond yields trading at 2.00% above the inflation rate. The real rate of return of 2.00% (bond yield margin over inflation) that is achievable for an investor into bonds today is an extraordinary opportunity not seen since 2004.

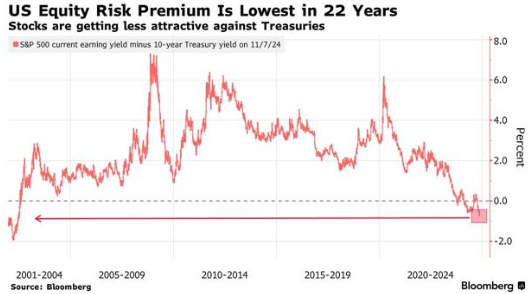

The second chart below compares US Treasury Bond yields to current earnings yields on US equities. The “equity risk premium” is at the lowest point in 22 years, resulting is equities being much less attractive as an investment than the safety and security of a Government Treasury Bond at 4.45%.

It seems inevitable that the speculative selling of US bonds will unwind over coming week, resulting in a lower US dollar value as the USD Dixy Index closely tracks the falling bond yields.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

One of the considerations is the roll back of regulations and to what extent that will grow the economy as the view would be that releases a present handbrake on medium/large business.

And possibly tax cuts if he can eliminate waste in the government sector. That aspect will be very interesting to see.

Lets see!

PS He is a showman clearly so the reality will be different from the pre election promo.

Expect the US Rent portion of the US CPI could turn even more negative once FEMA stops paying for the rents of the millions of illegals about to leave the country.

https://dailycaller.com/2024/05/22/illegal-immigration-contributed-hous…

Will be a big relief in the inner cities like Chicago where the surge has impacted rents the most

What 'trump trade' the S&P is about the same since the election?!? Went up for a couple of days...went back down ..thexyears gains have zero to do with the DUMBster.

Buffet sold everything (almost) and moved into cash.

So; he is expecting things to go pretty pear shaped and then pick up bargains.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.