Summary of key points: -

- Dramatic upturn in US employment – or not?

- Potential for embarrassment if RBNZ cut by 0.50%

- Another Japanese U-turn on interest rates – or not?

Dramatic upturn in US employment – or not?

A week ago, the NZD/USD exchange rate was sitting on its highs at 0.6350 and looking set to make further gains as the US dollar side of the currency pair was continuing to depreciate on lower US inflation and a softer employment growth. The changes over the course of the week have been dramatic with the Kiwi dollar hit by a “one-two” punch combination that it might struggle to recover from in the short-term.

The NZD/USD exchange rate reversing 3.00% lower over the week to close at 0.6160 on Friday 4th October. The USD Dixy Index appreciating 1.80% over the same one-week period from 30-month lows of 100.50 to close at 102.28. The additional NZ dollar selling, over and above the USD gains, being due its lower FX market liquidity and an element of the local interest rate markets pricing in a higher likelihood of a 0.50% OCR cut at this week’s RBNZ announcement.

The first blow was a risk of a lower NZ dollar we identified in last week’s commentary piece. An escalation in the war in the Middle-East was the type of global geo-political risk event that would be positive for the US dollar, even though the US economic conditions and outlook suggested a continuation of a weaker USD. The US dollar made gains earlier in the week as Israel put army boots on the ground in Southern Lebanon and Iran fired missiles (nearly all intercepted) into Israel. The markets are on tenterhooks as the world awaits Israel’s retaliatory response to the Iranian aggression. Oil prices have spiralled higher as Israeli bombing of Iran’s oil installations is one response that could occur. Iran exports most of its oil to China, so such a move would have international ramifications that would not be good for anyone.

The second blow that sent the Kiwi dollar sharply lower to 0.6160 was the market reaction to the blockbuster 254,000 increase in jobs in the US economy in September. No-one saw that spectacular increase coming. It was a risk event that had such a low probability of occurring that it did not register on the financial market’s radar. Prior consensus forecasts were for a soft 140,000 increase in the Non-Farm Payrolls employment measure. Interest rates reversed sharply higher in response in US markets as the whole Federal Reserve unwinding of tight monetary policy over coming months was thrown into jeopardy. Forward interest rate pricing moved from a 53% chance of a 0.50% Fed cut a week ago, to a 31% probability ahead of the jobs data last Friday, to 0% chance after the employment data shocker. Updated estimates from Wall Street investment banks are that the Fed will cut interest rates by 0.25% per meeting through to March 2025 (four meetings over that period will reduce the Fed Funds rate from the current 5.00% to 4.00%), thereafter 0.25% reductions per quarter over the balance of 2025, ending in a terminal interest rate of 3.25%. Off course, if the US economic data is weaker over that period the interest rate reductions will come earlier, and in larger dollops.

The unanswered question is whether this surprising increase in jobs is reflective of a resurging US economy and the Fed have simultaneously achieved the nirvana of low 2.00% inflation and strong employment, or the jobs data is highly suspicious as a “rouge” number that is just not accurate and will be revised significantly lower over coming months? We favour the latter, as the US jobs data is just not trustworthy!

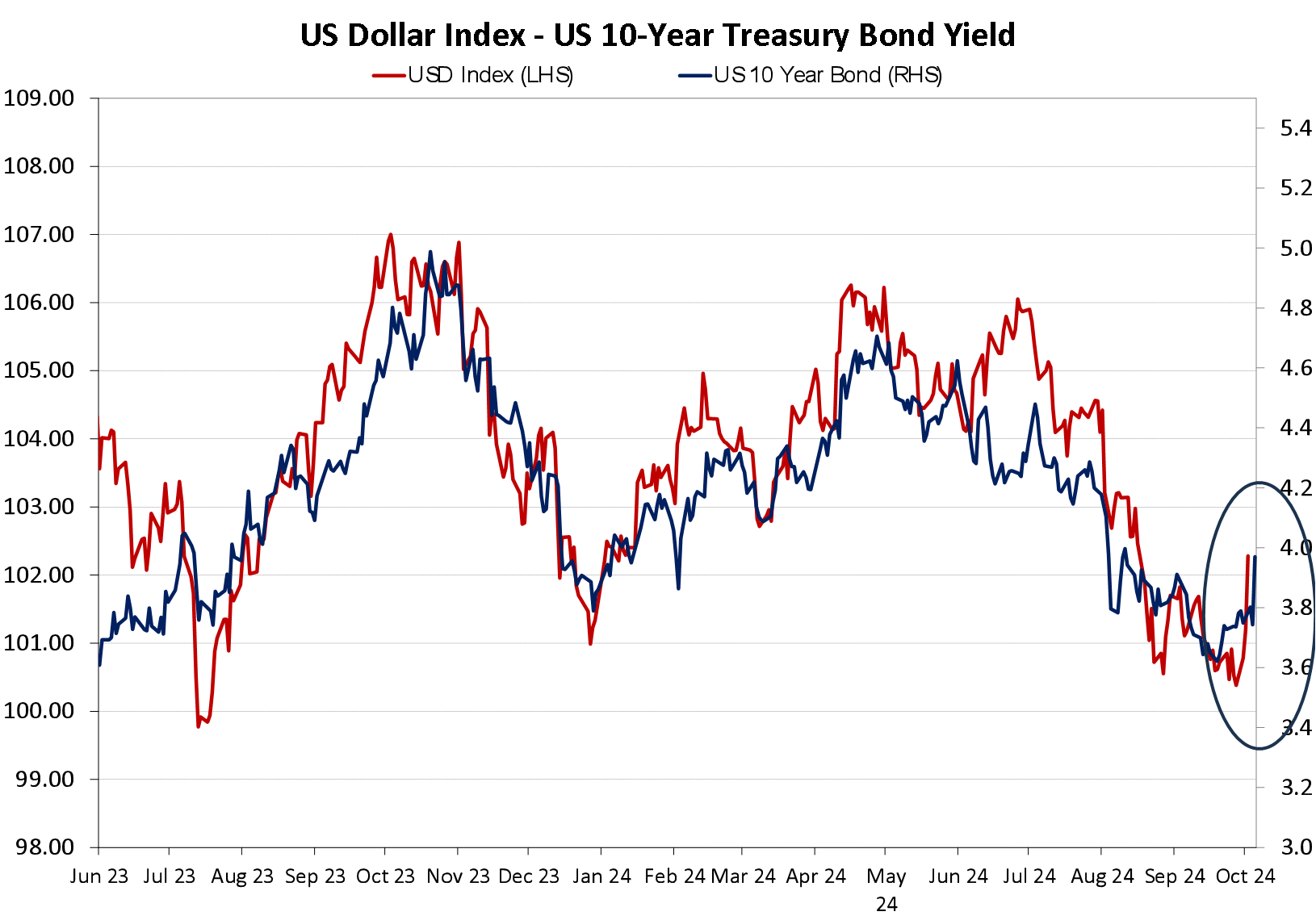

The US dollar jumped higher as it followed US 10-year Treasury Bond yields upwards following the outrageous jobs figures. The bond yield increasing over this last week from 3.70% to 3.97% (refer chart below).

It is certainly surprising the bond and currency markets have reacted so conclusively to one month’s jobs number that could well be subsequently proven to be dodgy i.e. not an accurate measure. Earlier this year, from January to April, we witnessed bond yields and the USD Index rising as they reacted to stronger than expected inflation and Non-Farm Payroll employment results (as seen in the chart above). We later learnt that the US Bureau of Labour Statistics, who produce the employment data, announced an 800,000 revision lower in the number of jobs added over the 12 months to 31 March 2024. Bond yields and the US dollar both trended lower from May until last week on the lower inflation and jobs outcomes.

A more mature and considered reaction to the boomer jobs increase in September would be that it is highly suspicious in term of accuracy and should not be relied upon. Yet again, the large increases in jobs in the US economy in the month of September was in the hospitality and healthcare sectors. Over the last 12 months we have witnessed very large subsequent revisions downwards in job increases in these two sectors. Manufacturing jobs contracted in September. It has been reported that the Bureau of Labour Statistics is asking the Federal Government for more funding as their models and data collection methods are old and need modernising – only in America!

The US employment data it totally unreliable, therefore there is a reasonably high probability that the bond and currency market reaction last week will reverse in due course, as further measures of employment indicate that the US economy is not suddenly re-surging.

Local New Zealand USD importers have been well protected against this unexpected dive lower in the Kiwi dollar, as they have earlier implemented high levels of hedging through to 31 December 2024 to cover against the “Trump Presidential Election Victory” risk factor for the USD. Local USD exporters have another bite of the cherry to add to existing hedging levels at very attractive 0.6160 entry levels.

Potential for embarrassment if RBNZ cut by 0.50%

It is an intriguing and potentially highly embarrassing situation for the RBNZ. Their choice to time their OCR Review Date for this Wednesday 9th October, just one week ahead of the September quarter CPI inflation data on Wednesday 16th October suggests that their bureaucratic rigidity (not unexpected) is more important than making decisions on the most up to date data. The risk for the RBNZ is that they cut the OCR by 0.50% to 4.75% this week in expectation of the annual inflation rate moving well below 3.00% to 2.30% the following week, only to find out that the inflation increase was materially above their forecast. Back in May, the RBNZ produced a forecast for inflation to increase by 1.30% in the September quarter. In their August statement they had revised that forecast significantly lower to +0.80%. The annual rate of inflation reduces sharply next week as the out-sized 1.80% increase in the September 2023 quarter drops out of the annual rate calculation. The RBNZ did not disclose the detail behind their sudden change in forecast, whether the much lower forecast was a result of tradable inflation tumbling further into negative territory or it was due to domestic non-tradable inflation miraculously reducing. The RBNZ commentary hinted at domestic non-tradable inflation falling away as price-setters were influenced by the overall lower inflation environment. History tells us that the public sector price-setters and non-competitive industry price-setters in New Zealand have no regard for overall inflation levels and/or economic conditions whatsoever. They merrily increase their prices by 3.00% on average every year and have done so for 15 years. The RBNZ expectation on lower non-tradable inflation does not stack up to scrutiny in our view.

There are a wide range of forecasts for the September quarter inflation increase, from the RBNZ at +0.80% to +1.40%. Pushing the outcome towards the lower end will be lower fuel prices, as crude oil prices tumbled 19% from US$84/barrel to US$68/barrel over the quarter and the NZD/USD exchange rate was broadly unchanged. On the other side of the equation, electricity prices, local government rates and insurance premiums all continued to increase. On balance, an increase of 0.90% to 1.00% seems more likely, which will reduce the annual rate of inflation from the current 3.30% to 2.50%/2.60%. The NZ dollar is more likely to increase on a result above the RBNZ forecast

Over recent days all the local bank economists have shifted their official forecasts to a 0.50% cut by the RBNZ this week. It is enlightening that they all only change their forecasts after the forward interest rate market pricing moved to a 0.50% cut. So much for independently deriving your own forecasts! A 0.50% cut is therefore already priced-in to the NZD/USD exchange rate at 0.6160, so do not expect further significant depreciation in the Kiwi dollar on the RBNZ going 0.50%.

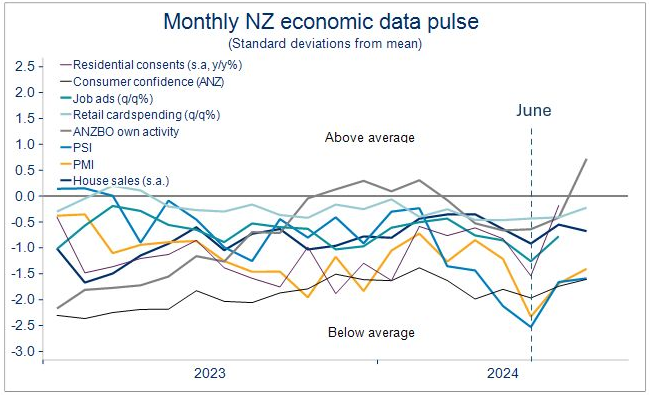

Another intriguing aspect of the RBNZ U-turn in August was the fact they highlighted the sudden downturn in “high frequency” economic pulse data over May and June as a justification for cutting interest rates earlier than expected. The chart below from Mike Jones at the BNZ reveals that all eight high frequency economic measures have reversed straight back upwards in July, August and September. The improvement in consumer and business confidence was in response to the interest rate cut, however it can be equally argued that the plunge in economic activity and confidence in May and June was due to the RBNZ’s hawkish stance at the May meeting where they finally recognised the problem with high/sticky non-tradable inflation.

The much stronger than expected US employment data sent US two-year to 10-year market interest rates up by 0.25% to 0.30% over the course of last week. Our local New Zealand swap interest rates follow the US, so therefore expect a re-rating upwards in our interest rate market pricing when the markets open on Monday 7th October. If the RBNZ cut by 0.25% and that is closer to the current market pricing, it will be the bank economists who might be feeling the embarrassment as they have just all moved to forecasting a 0.50% cut. A 0.25% cut by the RBNZ will perversely be positive for the Kiwi dollar as a 0.50% cut is priced-in.

(Source: BNZ)

Another Japanese U-turn on interest rates – or not?

Contrary to market expectations, the new Japanese Prime Minister Shigeru Ishiba has not encouraged the Bank of Japan to increase interest rates. He has dramatically pivoted the other way, asking his Government to formulate an economic relief package to ease the bite of inflation. In doing so, Mr Ishiba sent the Japanese Yen tumbling against the USD from 143.00 at the start of last week to 148.70 at the close of the week.

The Bank of Japan is however still widely expected to increase their interest rates before the end of the year. The closing of the interest rate differentials against the USD still points to a stronger Yen exchange rate to 130.00 by the end of December 2024.

A recent Bloomberg report highlights the fact that “Japanese investors are starting to lose the decades-long infatuation with overseas assets”. Over the first eight months of this year Japanese investors increased their buying of local domestic bonds and equities and dramatically reduced their buying of overseas bonds and equities. Japanese investors have US$4.4 trillion invested abroad, just a small adjustment downwards in that amount will have major implications for the Yen’s value i.e. a stronger Yen as funds are repatriated home. The interests rate yield on Japanese 30-year Government Bonds has increased to 2.00%, making it more attractive for the large insurance funds and investment houses to invest locally and not offshore. According to Mizuho Securities “investors everywhere are underestimating the risk of big repatriation flows in the long run”.

Japanese investors returning funds invested offshore to home base could well be the next big super cycle or mega trend that results in capital inflows pushing the Yen significantly stronger.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

Roger Kerr is one of the few economists to get it right. The U.S. labour stats are indeed dodgy, and have been manipulated to help ensure that in the U.S. election on November 5, the Biden-Harris administration is credited with good economic management. In fact, much of the expansion in GDP has been the result of government spending, not activity in the private sector or manufacturing.

Their jobs data has been dodgy for years. At the moment its all extra spin for the election. It works until it doesn't and at that tipping point you can no longer hide the lies.

I'm somewhat confused " Oil prices have spiralled higher as Israeli bombing of Iran’s oil installations is one response that could occur." Hasn't Russia got plenty to spare which via the back door would make up at least as much as an Iranian reduction ?

I am shocked, shocked to find that unreliable data is coming from the BLS!

[sarc]

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.