Summary of key points: -

- Strong gains for the NZD and AUD as the USD falters

- A return of foreign capital inflows into New Zealand?

Strong gains for the NZD and AUD as the USD falters

It has been another positive week for the New Zealand dollar and the Australian dollar in global currency markets. Both currencies end the week on 21-month highs against the US dollar at 0.6350 and 0.6910 respectively. As is often the case in foreign exchange markets, it is not just one factor that has caused the gains for the antipodean currencies. However, it is a combination of developments that have lifted the boat for the Australasian currencies in their own right, as well as the continuing US dollar depreciation on lower US interest rates.

The following positive factors have contributed to the NZD and AUD gains over recent weeks and are expected to continue to push both exchange rates higher over coming weeks/months: -

Potential for weaker US economic data to spur even more aggressive interest rate cuts from the Fed:

It may not be reflected in US bond market pricing today, however a continuation of weaker US jobs data, in particular, will increase the probability of the Fed executing another 0.50% jumbo-sized interest rate cut at their next meeting on 7th November (two days after the Presidential election date). The Fed are now more worried about a rapid increase in unemployment than they are about inflation. They will remove the tight/restrictive monetary policy settings more quickly if the labour market deteriorates with job losses. Already the forward interest rate market pricing is indicating a 55% probability that the next cut will be another 0.50%. US interest rates falling away more rapidly than what anyone anticipated a few months back is certainly pulling the USD value down as foreign investors holding US dollar’s, sellout and return funds to their home currencies. The USD Dixy Index has already depreciated 5% from 105.60 to 100.15 over the last three months and appears on track to decrease another 5% to 95.00 over coming months.

The US Non-Farm Payrolls jobs data next Friday 4th October should determine how rapid that forecast for further US dollar depreciation turns out to be over coming months. A soft increase in jobs, below the consensus forecast of +145,000 for the month of September, will increase the chances of another 0.50% interest rate cut by the Fed, and therefore a lower USD value.

The new stimulus package to lift the ailing Chinese economy:

The Chinese government surprised the markets earlier last week with a major economic stimulus package designed to help them achieve the forecast 5.00% GDP growth rate for this year. The package included cutting interest rates, reducing capital ratio requirements on banks and reducing the deposit needed for a second home from 25% to 15%. Global financial and investment markets reacted positively to the announcement, and it is very good news for commodity producers like Australia and New Zealand. Copper commodity prices reversed out of their current downtrend and iron ore prices have held above US$90.00/tonne (currently US$92.50/tonne), whereas the commodity markets were expecting iron ore prices to continue to fall away to US$80.00/tonne. Chinese share markets also reversed out of their downtrends as some optimism returns to the Chinese economy for the first time in many months.

The Reserve Bank of Australia hold firm on their interest rate stance:

As was expected, the Reserve Bank of Australia (“RBA”) did not waiver at their meeting last week from the staunch monetary policy stance that inflation is still too high and that interest rates cannot be cut until 2025. The RBA are ignoring the Australian Government energy subsidy to households over the next 12 months that artificially reduces the annual inflation rate. RBA Governor, Michele Bullock again reiterated her previous warning that she cannot lower interest rates whilst high wage increases are occurring in an economic environment of low or negative productivity growth. The local economists and interest rate markets either do not understand the wages/productivity relationship to inflation, or they choose to ignore it. The interest rate market continues to price an expectation that Ms Bullock will do a U-turn on interest rates before Christmas. It is not going to happen. However, the FX markets, in pricing the AUD higher, are more accurately representing the reality that the RBA is the proverbial “shag on a rock”, as they are the only central bank holding interest rates when everyone else is cutting (except Japan of course!). Ms Bullock will also be welcoming the higher AUD/USD exchange rate at 0.6900 as it helps reduce import inflation. The dramatic closing-up of the interest rate gap between the US and Australia now points to further gains for the Aussie dollar against the USD to well above 0.7000.

New Japanese Prime Minister in favour of interest rate increases:

The Japanese Yen exchange rate to the USD pulled back to 145.00 last week, undoing some of the strong earlier gains in the Yen to 140.00. The reason for the short-term Yen reversal was a confusing statement from the Bank of Japan on Friday 20th September where they seemed overly cautious about future interest rate hikes. However, more recent developments with former Defence Minister, Mr Shigeru Ishiba set to become Japan’s new Prime Minister have been more positive for the Yen. Mr Ishiba has won the leadership contest of Japan’s ruling Liberal Democratic Party in a narrow victory. In the past, Mr Ishiba has been a critic of monetary stimulus, and he endorses the current policy to increase interest rates as “on the right policy track”. Financial markets had been expecting a win for the hard line nationalist Mr Sanae Takaichi, who has been against interest rate increases. The Ishiba win paves the way for further interest rate increases by the Bank of Japan before Christmas and a return to the stronger Yen trend towards 130.00 against the USD.

Whilst all the four factors discussed above point to ongoing US dollar depreciation as economic conditions change around the world, the risks to the weaker USD outlook in the short-term are twofold: -

- Global geo-political risk – Middle East tensions: The US dollar will strengthen if the current tensions in Palestine and Lebanon escalate to full-out war between Israel and Iran (through the Iranian-backed terrorist groups Hamas and Hezbollah). We saw an example of this risk played out last week with the NZD/USD exchange rate reeling back from 0.6350 to 0.6250 when there was a threat of Israeli troops being on the ground in Lebanon.

- Global geo-political risk – US Presidential election: We have previously highlighted the risk that the USD will strengthen if Donald Trump is elected President again on 5 November. Trump will increase tariffs on imports into the US, which in turn will lead to global/retaliatory trade wars. It does appear that Democratic candidate Kamala Harris is gaining the upper hand on economic policies, however Trump continues to play the anti-China and anti-immigration cards that attract a lot of support for him. Over recent week, the global FX markets do not appear to be giving the marginally deranged Trump much chance of victory as they continue to sell the USD lower. However, the risk of a higher USD is still there, as the political opinion polls can be inaccurate.

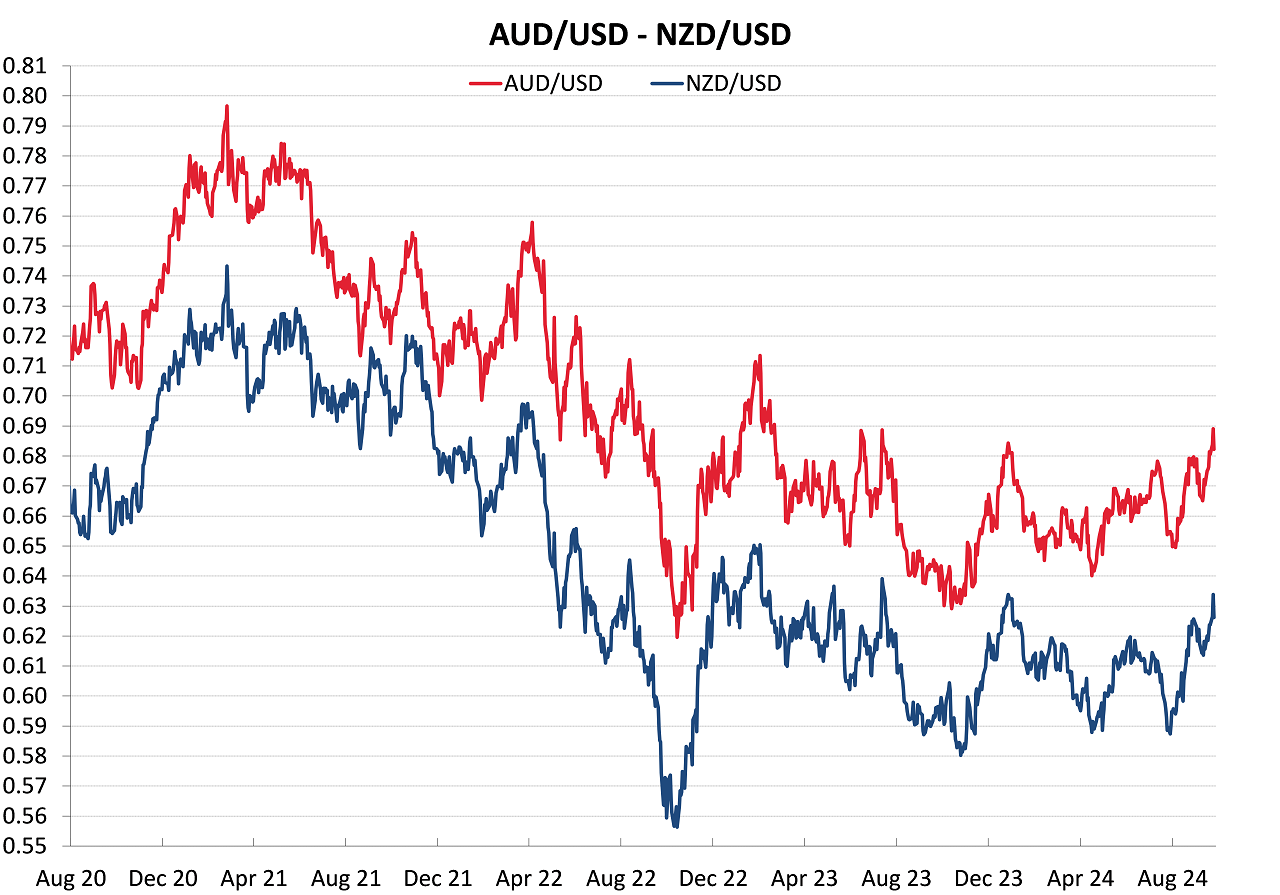

The chart below is a timely reminder that the NZD/USD exchange rate follows where the AUD/USD exchange rate goes. The five to six cent gap between to two currencies does not narrow too often.

A return of foreign capital inflows into New Zealand?

There are two types of foreign capital inflow into the New Zealand economy that could potentially have an impact on the Kiwi dollar’s value. The first type is portfolio investment flows, offshore fund managers coming into our Government Bond and listed equity markets. The impact on the NZ dollar value of these portfolio funds coming in and out is only occasionally observed when there is a significant change in foreign ownership levels over a short period of time. High yielding NZ dividend stocks were once attractive to offshore fund managers; however, interest has waned with the relatively poor performance of the New Zealand share market over recent years. The offshore ownership levels of NZ Government Bonds on issue have not moved away from the 65% to 75% region for quite some years.

Foreign direct investment into New Zealand has been in the doldrums since former Prime Minister, Jacinda Ardern changed the rules in draconian fashion overnight on offshore oil/gas exploration and investment in April 2018. The damage that Ardern inflicted on the economy with that “no notice” decision is still being witnessed today. Any interest from foreign direct investors to look at New Zealand as a destination was instantly killed off as the New Zealand Government could just not be trusted, as they might change the rules at any time. New Zealand has been totally off the radar for foreign direct investors ever since that retrograde step.

The current Government has been working very hard this year to restore New Zealand’s reputation as an economy open for business and welcoming of foreign capital investment. Speaking at a recent Bloomberg function, Prime Minister Christoper Luxon highlighted five things that New Zealand had to do to create a highly productive economy: world class education system, modern reliable infrastructure, embracing more science, technology and innovation, and strengthening connections to the world. We have “some ways to go” on the first two, however there are many smart people working hard on the last three. The Government has arguably more work to do to make it easier for foreigners to invest in New Zealand businesses and assets, removing the bureaucratic barriers. In his travels abroad, Mr Luxon has noticed a willingness to invest into New Zealand, however that was combined with a perceived difficulty in getting things done here. The competition around the world for foreign investment is intense, there is no question that New Zealand has to up its game considerably in this area of selling New Zealand as an investment destination.

Unfortunately, the recent financial performance of foreign-owned companies in some of our primary export industries (dairy, sheep meat and forestry) has not been that flash for a variety of reasons. However, if profits and values are down, it may be an opportune time for new foreign investors to come in. We should get a gauge as to the level of interest from offshore investors into two of our big companies when they complete their recently announced equity raises. Auckland International Airport is issuing $1.4 billion in new shares to investors in New Zealand and Australia. Fletcher Building is issuing $700 million of new shares to pay down debt and improve its financial stability. Offshore investors participating in these issues will have to buy NZ dollars to settle (if they have not purchased their Kiwi dollar’s already!).

Potentially counteracting any offshore investment inflows pushing the NZ dollar higher over coming weeks, will be the actions of the big four Aussie-owned banks who traditionally are buying AUD’s, selling NZD’s in very large amounts at this time for year as the repatriate dividends to their respective parent banks in Australia. Typically, the NZD/AUD cross-rate is squeezed lower in this environment of one-sided, multi-billion-dollar transactional FX flows.

The prospects for the New Zealand economy may need to improve somewhat from current conditions for offshore investors to sit up and take note. However, New Zealand does have a requirement for large infrastructure funding over coming years, and we will need to attract offshore players into those project offerings. Signing a free-trade deal with the UAE is one excellent step to open the way to attracting in the massive sovereign wealth funds that are based in Dubai.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

4 Comments

This is truly excellent analysis of where NZ stands at the moment. Many foreign investors realize that New Zealand could bring back in a left-wing government with a wealth tax that would result in capital moving offshore. While Barbara Edmonds from Labour has some understanding of the NZ economy, most of the rest of the Labour MPs have no concept, and the Greens who would be in coalition would take a wrecking ball to any prospect of investment both from overseas interests and New Zealand capital. With the NZ media acting in league with the Opposition parties instead of objectively reporting, there is a real danger that in two years time we will have a government that will cause even local investment to leave NZ.

The good news is that this current government will last at least a 2 term... Extremely unusual to have only a one term government.. I can't see how labour would get back.. What do they have to offer.. And the greens..Just Scary even to think about

Thanks for the encouraging view. Hope you are right!

Still pitifully weak currency the inexperienced govt asleep at the wheel

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.