Summary of key points: -

- US employment trends, “in totality”, weaker than expected – Fed may cut by 0.50%

- Reserve Bank of Australia stick to their guns

- Tight US Presidential election race has implications for the US dollar

US employment trends, “in totality”, weaker than expected – Fed may cut by 0.50%

The two most important variables that drive the NZD/USD exchange rate direction, the US dollar and the Australian dollar, are both entering a period where interest rate decisions by their respective central banks will determine the future direction of the USD and AUD, and therefore, in turn, the Kiwi dollar.

In the US, the financial markets are in fierce debate with themselves as to whether the first Federal Reserve interest rate cut next week on 18th September will be considered 0.25% or a bumper 0.50%. Currently, the interest rate market is pricing-in a 40% probability of a 0.50% cut. It would be expected that if the Fed did decide to cut by 0.50% the US dollar would be sold down to below 100 on the USD Dixy Index (currently 101.15). The eagerly anticipated US Non-Farm Payrolls jobs data for August (released Friday 6th August) was seen as a determining factor as to whether the Fed would go 0.25% or 0.50%. Another weak jobs increase, and higher unemployment rate would push the Fed to 0.50% as the labour market would be confirmed as slowing up at a more rapid pace than what the Fed had earlier anticipated. An employment increase above the 160,000- consensus forecast would keep the Fed at 0.25%.

As it transpired, the jobs data was a complexing and confusing “mixed bag” of signals. Not one way or the other, leaving the markets in a quandary of whether to buy or sell! The August Non-Farm Payrolls jobs increase was softer than forecast at 142,000 with the previous July increased revised lower to +89,000. In the second household survey of employment, the unemployment rate reduced from 4.30% to 4.20%, not what was expected. The average hourly earnings (wages) increased in August by a hotter 0.40%, lifting the annual wages increase to 3.80% from 3.60% in July. The net take-away from the contradicting data is that overall, the US employment market is continuing to weaken. Taking into account the weaker than forecast ADP Employment change and lower than forecast JOLTS job vacancies data earlier last week, the building picture that the Fed cannot ignore (under their dual inflation/employment remit) is a more rapid deterioration in employment than their forecasts. Therefore, there is a greater risk today of the US economic slowdown transferring from a widely anticipated “soft-landing” to a “more bumpy landing”, however not plunging all the way into recession. Tellingly, the industry breakdown of where jobs increased and decreased in August shows business and professional services losing jobs, as did manufacturing. Not positive signs by any stretch.

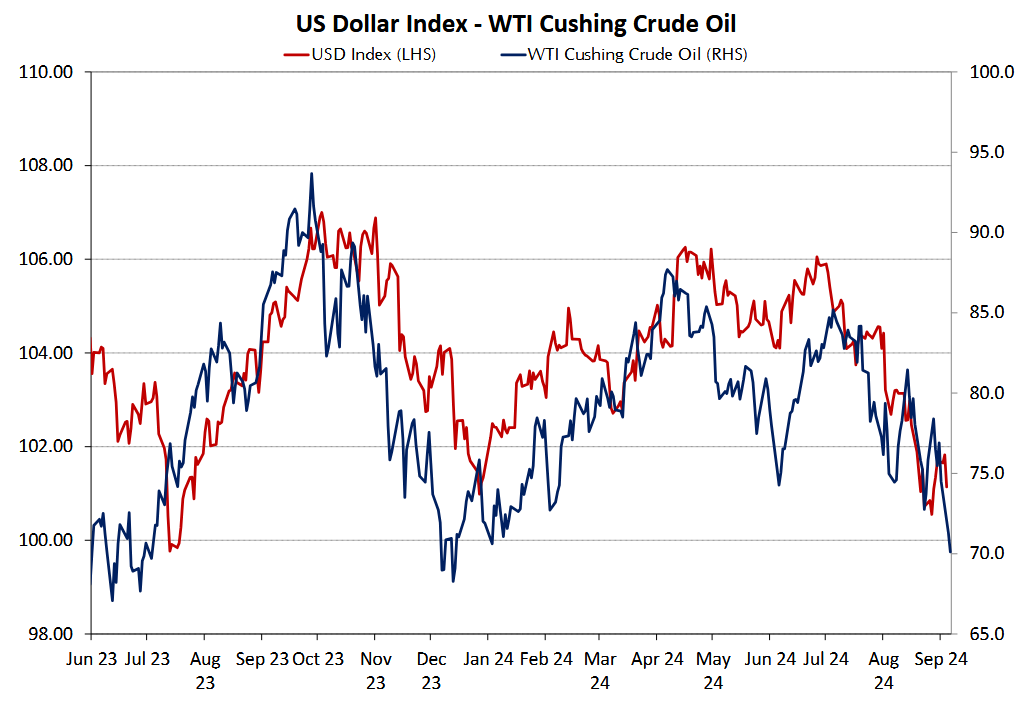

What might tip the scales for the voting Fed members on 18th September to a jumbo 0.50% interest rate cut would be lower than forecasted +0.20% CPI inflation result for August (released Wednesday 11th September) and lower than forecast +0.10% PPI wholesale prices for August, released the following day on Thursday 12th September. Tumbling crude oil prices over the last month to below US$70/barrel for WTI, points to lower inflation outcomes.

One thing is for sure with the Fed meeting on 18th September, is that the Fed member’s individual “dot-plot” interest rate forecasts for the rest of 2024 and into 2025, will all be sharply lower than their “knee-jerk, higher for longer” interest rate forecasts made in June! The “Adrian handstand” of reversing inflation/interest rate forecasts within a three-month period is not confined to the RBNZ.

All the economic indicators and financial market direction in the US point to continuing lower interest rates and a depreciating US dollar value. The US 10-year bond yields interpreted the mixed jobs data as overall negative, yields reducing to fresh 16-month lows of 3.70%. The US 2-year Treasury Bond yield also falling away to 24-month lows of 3.65%. By contrast, the New Zealand 2- year bond yield is now trading more than 30 points above the US at 3.98%.

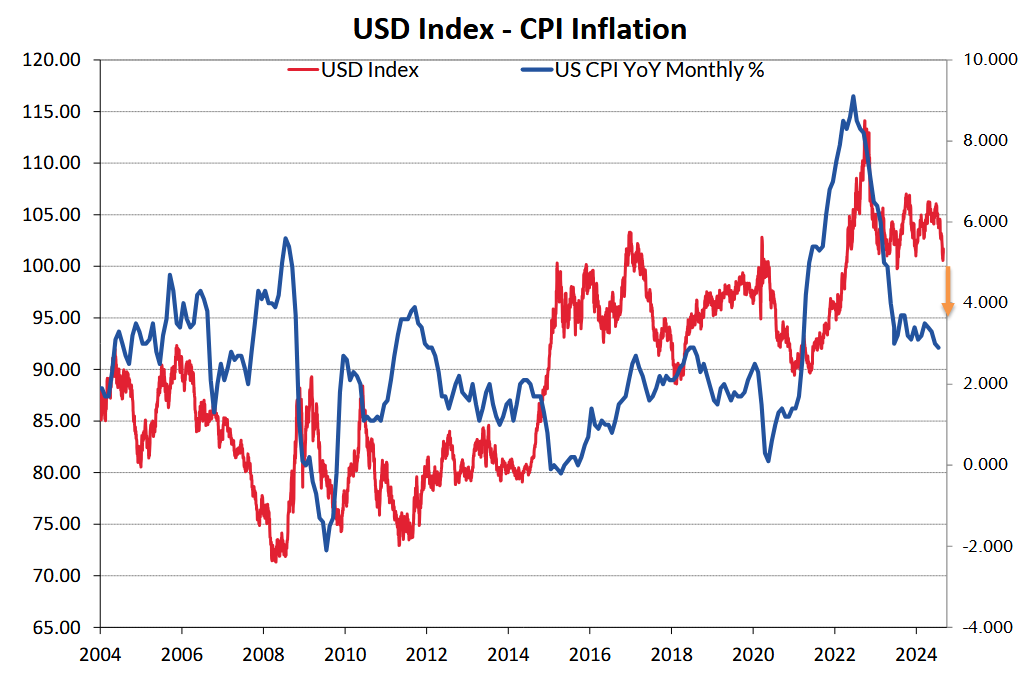

The sharply lower oil prices points to further depreciation in the now correlated and following USD Dixy Index (first chart below). US inflation headed to 2.00% also suggests further USD weakness ahead (second chart below).

Reserve Bank of Australia stick to their guns

The other fierce debate going on around inflation and interest rates is the continuing stand-off between the RBA holding firm on their stance that interest rates cannot be cut until February 2025, and in the other corner of the ring, the interest rate markets and the majority of economists who confidently predict two 0.25% cuts by Christmas. Not adding a lot clarity to the debate are the well- publicised views of the current Labour Government Treasurer, Jim Chalmers that “the 13 interest rate rises since May 2022 and all this global uncertainty are smashing the economy”. Also not helping where statements on the subject by two previous Aussie Treasurers.

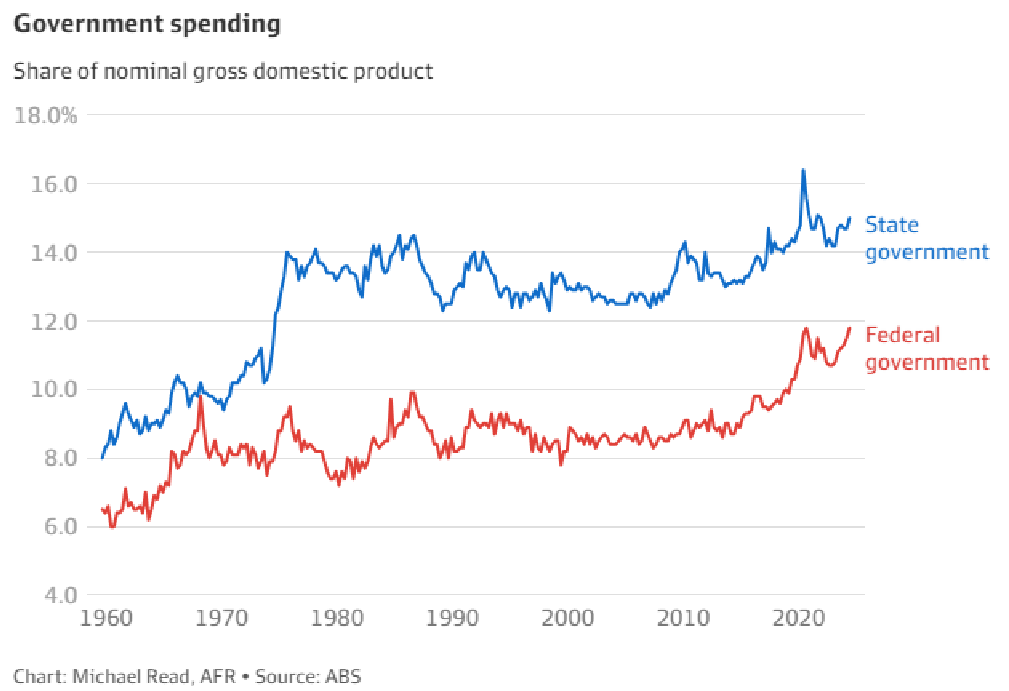

Former Labour Treasurer, Wayne Swann claimed the RBA was being dogmatic, rather than rational in setting interest rates. Australia’s longest-serving Treasurer, Peter Costello dared the Labour Government to lift the RBA’s inflation target band, rather than continue to attack the central bank over monetary policy settings. It is all a bit rich with these politicians blaming the RBA for high interest rates when the Government and public sector (just like in NZ) are the main culprits behind the stubbornly high domestic inflation with continuing high wage increase settlements. There is no question that the Albanese Labour Government in Australia is expanding its fiscal spending and causing most of the inflation (refer chart below). Federal Government spending is back up to Covid levels.

Australia’s GDP growth result for the June quarter (+0.20% for the quarter) released last Wednesday, confirmed that economic growth was being propped up by recurring State and Federal Government spending on public sector wages and expanding social programmes. The Aussie Government is making the RBA’s job harder, yet the RBA is receiving all the flak for damaging the economy. RBA Governor, Michelle Bullock, doesn’t give many speeches, however when she does, she goes for it, confirming in an on-the-record speech last Thursday:

“As of now, the board does not expect to be in a position to cut rates in the near term. The board remains vigilant to the upside risks to inflation. We need to see results on inflation before lowering rates. The Board is not going to focus on one inflation number. A slightly elevated AUD is positive for inflation fight. We will be looking closely at Q3 CPI, but there are other indicators as we need to see inflation slowing in the actual numbers before acting. The labour market remains relatively tight and labour cost growth is strong, reflecting wage increases and weak productivity.”

It is a pity that our RBNZ Governor, Adrian Orr is not a “straight-talker” like Michele Bullock. Reference in the speech to needing a higher AUD currency value to help bring inflation down is exactly what this column has been pestering Adrian to do here for quite some time now. We expect that the RBA will hold their ground and the rapidly changing Australian interest rate differential to the US is unquestionably positive for the AUD exchange rate against the USD.

However, continuing falls in Australia’s key mining commodity export prices (iron ore in particular) is already holding the Aussie dollar back from making the gains we would expect to see in an overall weaker USD environment. It always comes back to Chinese demand and latest Chinese economic data trends have been mixed, at best. The Chinese Government appears reluctant to stimulate the flagging economy. The fiscal stimulus used in the past to build infrastructure and houses does not work this time around as they have already overbuilt in those areas. To boost consumer spending to get stronger growth back into the economy they either need to slash interest rates or cut tax rates. They appear reluctant to implement such measures. Unless there is more positive economic news out of China, the Australian economy and the Aussie dollar will be held back.

Tight US Presidential election race has implications for the US dollar

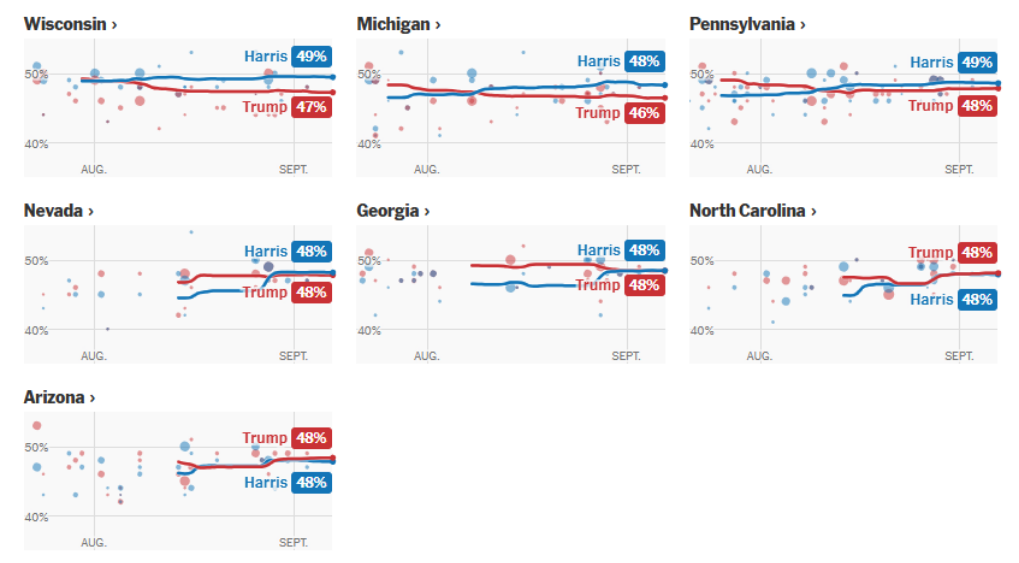

Whilst the US economic trends clearly signal a weaker US dollar value, a Donald Trump victory at the US Presidential election on Tuesday 5th November will send the USD higher on the prospect of global trade wars from Trump’s protectionist/tariff policies. Political opinion polls can be inaccurate, however whilst Democratic candidate, Kamala Harris leads the polls in the seven swing/battleground states the US dollar is unlikely to make any gains. Currently Harris leads the nationwide polls 49% to 46%, however she only leads in three of the seven swing states, with the remaining four states dead even. The first televised debate this Tuesday may well dictate the poll trends from here.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.