Summary of key points: -

- A long list of negative New Zealand economic news – so why has the NZ dollar not depreciated?

- Counteracting the negatives are the realities of global FX markets

- NZD/AUD cross-rate bounces back up

A long list of negative New Zealand economic news – so why has the NZ dollar not depreciated?

In the wonderful world of global currency markets the movements of one currency against another often bears no resemblance to underlying and/or relative economic performance.

The economic theory of foreign exchange values is that (in the long term) a currency will appreciate if the economy grows at a stronger pace, relative to others, due to being internationally cost competitive and therefore the economy receives more foreign currency inflows for exports than it pays away for imports. That superior economic performance will attract foreign investors to buy assets or establish new businesses in the country, the resultant capital inflows adding to the currency appreciation. In other words, the external Balance of Payments Current Account (including international trade surpluses) will move strongly into surplus. Always a signal that this would be a strong and safe currency to invest your funds in.

So much for theory...

The reality is that in the short to medium term (up to two years forward) it is relative inflation, monetary policy settings and interest rates that determine exchange rate movements. The role of highly mobile hedge funds, macro funds and proprietary trading desks of investment banks placing short-term currency bets based on their expectations of future interest rate movements is also highly influential. Anticipating how upcoming and emerging economic data will turn out against prior consensus forecasts is often the driving force for how these funds set their currency trading/investment strategies. Understanding how and when the high inflation in the post Covid economic era will reduce has become the major currency value determinant, as it is the guiding signal for when interest rates will be reduced by central banks.

The above prologue is provided to understand why the New Zealand dollar has not depreciated (or appreciated for that matter!) over recent months despite the New Zealand economy experiencing a double-dip recession. The New Zealand economy is not displaying any of the positive attributes for currency appreciation listed above. However, the Kiwi dollar has been relatively stable. trading between 0.5800 and 0.6400 over the last 12 months, spending most of the time in the inner range of 0.5900 to 0.6200. The Kiwi dollar has bounced back up to above 0.6000 from the 0.5800/0.5900 area on three separate occasions. Over this last week, that recovery upwards has extended to 0.6130.

The constant stream of weaker economic outcomes in New Zealand has not resulted in a weaker NZ dollar over the last 12 months because NZ interest rates are expected to stay higher for longer, relative to US interest rates i.e. our stagflation problem has saved the Kiwi dollar (for the meantime!).

The long list of negative economic trends include: -

- Weaker retail sales and consumer sentiment • Property market woes (high interest rates)

- Poor relative sharemarket performance • Soft manufacturing PMI’s

- Weak business investment • Poor productivity

- Low foreign direct/portfolio investment inflows • Large/permanent Current A/c deficit

- Increasing Government debt and deficits

- High inflation causing less price competitiveness globally for exports

It is not all doom and gloom, we now finally have a government in power who understands what needs to be done to rectify our poor economic performance, caused in many respects by the ineptitude of the previous Government. The Coalition Government’s budget this week will be a reminder to all and sundry that the government must live within its means and there are limits on debt, just like any business or household.

Counteracting the negatives are the realities of global FX markets

It has been an expectation for some time that the US dollar would depreciate against the major currencies as the US would be cutting their interest rates well ahead of others. Interestingly, it is now transpiring that the UK and the ECB in Europe may be reducing their interest rates at the same time as the US, however the US dollar has not appreciated on that development. Over recent weeks the USD, as measured by the USD Dixy Index, has depreciated from 106.30 to 104.30 on the back of weaker than expected US inflation, retail sales and employment data. The weaker US dollar trend is expected to extend lower as May and June figures for inflation and employment also print on the softer side. The Fed may not make their first interest cut until August because they will want to see additional confirmation that the weaker economic outcomes in April continue into May and June. However, that does not mean the USD will not depreciate, as the FX and interest rate markets always anticipate developments ahead.

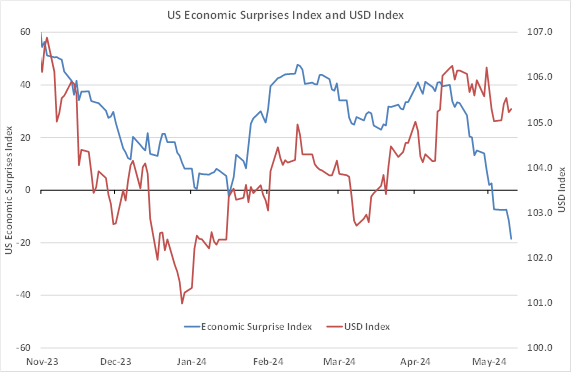

As the chart below depicts, the US dollar has further to depreciate as the “Economic Surprises Index” continues its slide into negative territory. The Index is negative when actual economic outcomes are weaker than prior consensus forecasts.

As stated on many previous occasions, The RBNZ will not be cutting our interest rates until late 2024 or early 2025, as the baked-in and high non-tradable inflation holds overall inflation well above the 1.00% to 3.00% target band.

It is not all bad news for the NZ economy, the productive export sector and tourism industry are holding things together, resulting in a relatively shallow economic recession overall. Export commodity prices are quite stable and should improve from here as Chinese consumer demand slowly returns.

On several measures the Australian dollar must be still regarded as undervalued at 0.6700 to the US dollar. The pressure remains on the RBA to get their inflation under control, so Australian interest rates will not be remaining below US interest rates for very much longer.

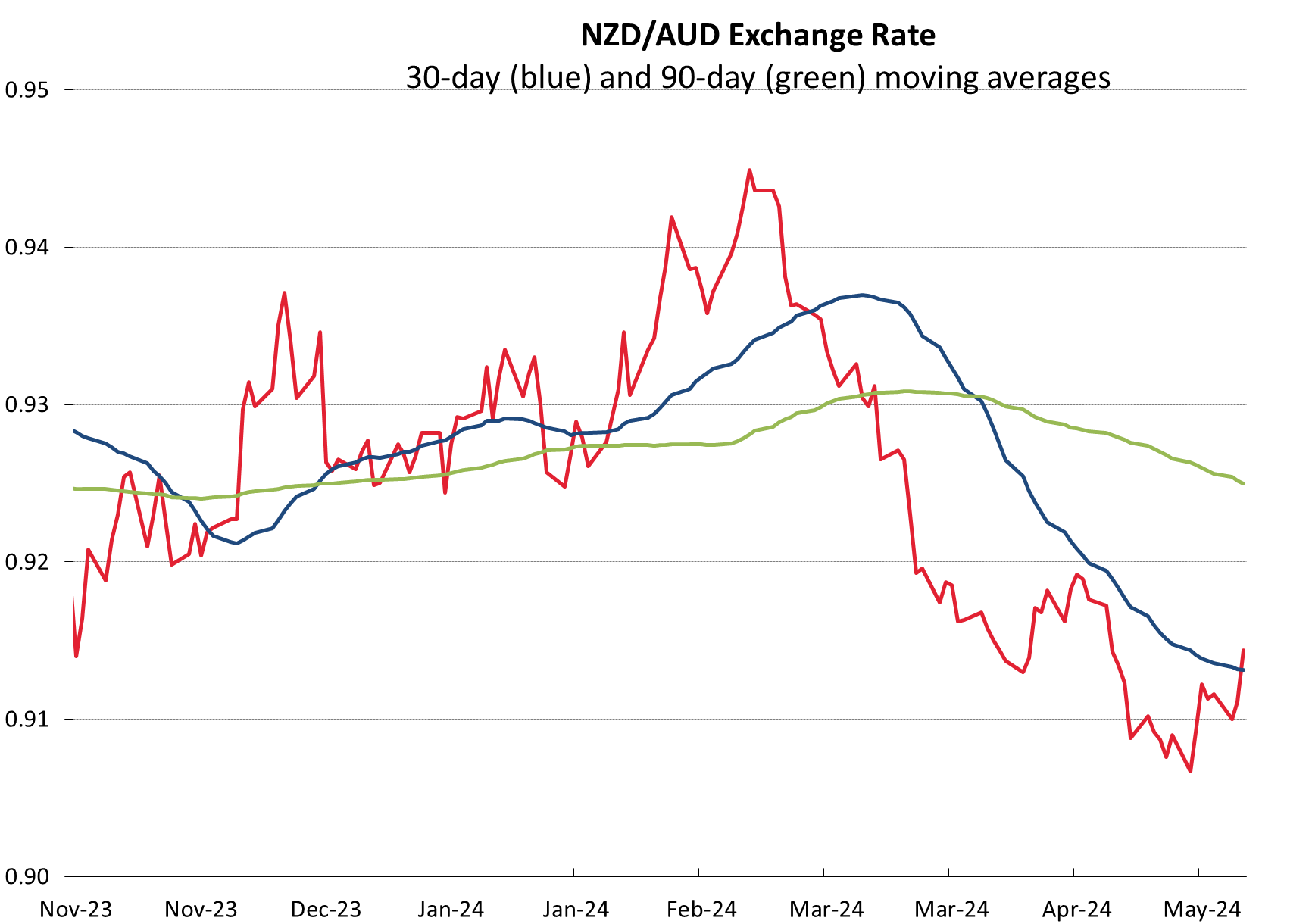

NZD/AUD cross-rate bounces back up

Local exporters selling product into Australia in AUD’s have been rewarded for their patience with the NZD/AUD cross-rate. Many exporters had FX orders in place to lift hedging percentages from 0.9150 to 0.9050, the recent drop to a 0.9060 low would have triggered those orders. The NZD/AUD cross-rate has since bounced back up to a high of 0.9180 on profit-taking by speculators who sold the NZD against the AUD above 0.9400 in February.

In a weaker USD FX market environment over coming months the Aussie dollar should outperform the Kiwi dollar on economic performance and closing interest rate differentials. Therefore, we would not expect to see the NZD/AUD cross-rate go a great deal higher.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.