Average mortgage costs for Kiwis are likely to keep rising and approach 5.5% by the start of 2024, ASB economists say.

And they say that even if the Reserve Bank (RBNZ) cuts the Official Cash Rate in 2024, average borrowing costs are unlikely to move lower till 2025.

ASB senior economist Mark Smith has done a detailed crunch on household living costs, which follows on from one he did earlier in the year.

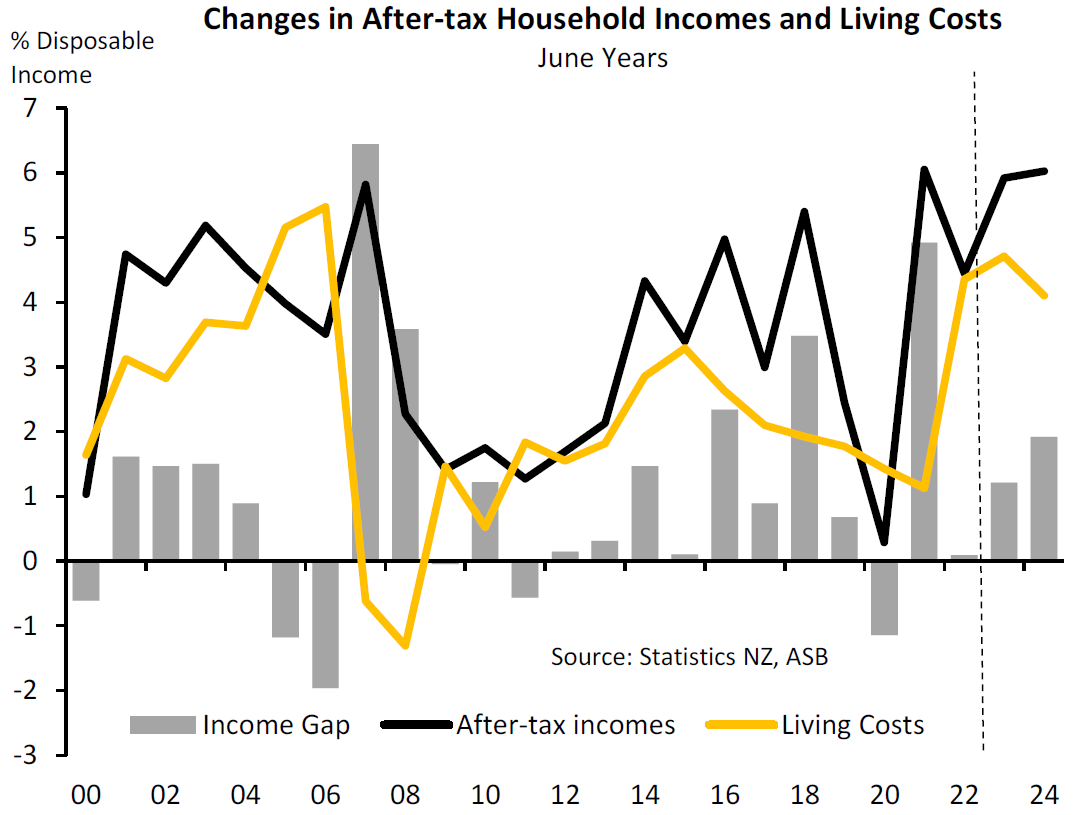

In the latest update Smith estimates households may face an approximate $110 weekly increase in living costs for the year to June 2023. However, he notes that household incomes are also rising strongly.

In terms of mortgages and debt servicing, Smith says these costs "have further to run".

The OCR is currently at 3.0%. The ASB has recently raised its forecast of the OCR peak from 4.0% to 4.25%.

"Current carded mortgage interest rates, particularly for shorter terms, look set to move up further," Smith says.

"Moreover, fixed mortgages are rolling on to much higher rates, which is pushing up average debt servicing costs, albeit gradually. All up, the average mortgage interest rate facing borrowers should climb slightly above 4.5% by the end of 2022, and approach 5.5% by the start of 2024.

"Even if the OCR is cut in 2024, average borrowing costs are unlikely to move lower until 2025."

Although the ASB economists expect annual CPI inflation to have peaked (at 7.3% as of June) they believe domestically-generated inflation will be slow to recede from its 6.3% record high.

"Assuming households maintain their current spending habits, more of the increases in living costs we expect are likely to be domestically-focused. Of the approximate $110 weekly increase in household living costs in the June 2023 year, around two-thirds of those would either be non-tradable goods/services or debt servicing," Smith says.

He notes that these figures are averages for the household sector.

"Households without much debt will be faring better, whereas highly-indebted households and those without a decent income buffer will find the going much tougher."

But he says while costs and prices have risen strongly, so have household incomes.

"In fact, we have been surprised with how quickly household income growth has responded. Having an exceptionally tight labour market has clearly helped with firms having to pay more to attract and retain staff. According to June 2022 income figures from the Household Labour Force Survey, average household incomes rose by close to 6% in the June 2022 year. Wage and salary earners did particularly well, registering an 8.7% increase in weekly gross income. The strength in the recent numbers has been corroborated from a number of other surveys."

Smith says that after netting off income taxes and Kiwisaver contributions (in total assumed to be slightly under 40% of the increase in household incomes), the figures suggest after-tax incomes rose by just over $100 per week per household in the June 2022 year, broadly on par with the rise in living costs.

"We expect household incomes to post more sizeable increases in the next couple of years, largely reflecting sizeable increases in wages and salaries and the expected rebound in other incomes. This should mean households in general should have sufficient funds to pay the bills and potentially increase consumer spending. However, the impacts will vary hugely depending on the individual circumstances of households."

The economists have calculated a household income gap that is the difference between weekly increases in after tax incomes and living costs.

"Weekly increases in living costs in the June 2022 year were the highest for at least 20 years, but this has been more than offset by sizeable increase in after tax incomes," Smith says.

He says the ASB economists' analysis suggests that the outlook for household spending "is not as dire as it looked last year when we flagged upside risks to the inflation outlook".

"The economy could continue to surprise with its resilience, adding to capacity pressures. The wage inflation outlook is clearly stronger and in the absence of a labour productivity miracle there is limited scope for strong wage growth to be sustained without blowing an inflationary gasket. Risks of a prolonged period of high wage and core inflation remain.

"What are the implications for monetary policy settings? We expect a further 125bps of OCR hikes by early 2023 and a 4.25% OCR peak.

"The higher the OCR goes the larger the subsequent fall, and we feel that pressures on household budgets will be felt acutely by some households. Prolonged subpar rates of household spending could trigger OCR cuts, but not until the RBNZ is confident it is on top of inflation, which looks to be some way away in the context of anaemic labour supply and potential output growth.

"Conversely, persistently high rates of wage inflation that are not offset by rising productivity and/or a more resilient household sector outlook point to a longer period of restrictive monetary settings and potentially a higher OCR peak that what our (upwardly revised) forecasts suggest."

33 Comments

No Fed pivot until 2024, that's another 14 months.

At the moment rates are still climbing and if they do pivot not way will rates be going under 3% for years.

The more resilient the economy, the more of a spanking the property market will get secondary to the OCR changes. Here's hoping!

Yip the argument was that unemployment would be bad for the housing market. But record low unemployment with inflation at 7% could be just as bad for the housing market. As it gives the RBNZ ammunition to continue hiking interest rates until either unemployment rises (which at that point could be bad for house prices) and/or inflation comes down.

That first graph is quite telling. Lots of people have been claiming the lack of forced sales means there is no “stress” on owners. This graph tells us is that rates have risen so quickly we have yet to see the impact on existing owners.

Exactly. A lot of lag effects still to play out…

If National wins, and undo the tax on interest (rentals), will house prices recover next year.

If Labour wins, rentals will not be appealing, and therefore decline in price.

National told us in 2007 that New Zealand housing was out of balance with our economy. They were right.

And it's got worse since then. Any change to what we have in progress at the moment will be seen as political pandering, and likely to be punished at the ballot box.

But National reversing labour's changes on interest and the bright line test seem to be their most known policies (to me anyway). Last election they also wanted to reintroduce foreign property buyers. If you ask why they would want to do these things you'll see their true colours. They aren't the party for business, they are just the party for the rich. This is why my vote will be against them, for the betterment of the country longterm. While I'll be punishing them at the ballot box, I'm sure it will buy them plenty of votes too.

They aren't the party for business, they are just the party for the rich.

The party for property speculators, sadly, yes. It'll be up to struggling working Kiwis to fund the bulk of NZ society while these folk get to enjoy subsidies and tax cuts.

Labour has already allowed foreign property buyers by granting 60,000 permanent residence visas

You can buy if you are resident. U don't need to be PR.

Unless you are voting for ACT the punishment from a re elected Labour clown show will be on you Jesse 1 so even if you are a beneficiary or a Millionaire you will be hurt in the wallet with new taxes, regulations and bureacracy.

If that's the cost of us moving away from this property fixation then that's fine with me.

Agree, the biggest challenge facing New Zealand is the overpriced housing. It trickles through to almost everything else from social issues to lack of productivity to lack of investment in new business.

The fact that National's policies are geared towards trying to reverse the the current housing crash means it has to be anyone but National or Act for the sake of the economy.

This downturn is far bigger than our government the housing market is way overpriced compared to incomes, no way will any government be able to lower rates while NZD is tanking and inflation is way above target levels.

If you are even slightly pro-business, Labour and the Greens should be the very last option that you should even be contemplating. Their utter neglect and contempt for businesses has reached epic proportions. On the other hand, there is sadly some truth in your statement that National are more the party for the rich than the party for business.

Looks like Rabobank getting in ahead of The Fed with upped T/D rates this morning.

Basically ASB is saying that currently we are standing at lowest mortgage rate that we will see in next two or three years SO this is start/middle of another leg of jump from hereon.

Hopefully it settles in 7s and never touch 8s

99% chance this prediction is incorrect...

They're trying to get people fix long, they should be barred from this type of fake nonsense. Regulate the banks.

Everyone is dreaming with an OCR topping up in the 4%.

Inflation is out of control and NZD is getting smashed by the days.

Don't worry, recessions are deflationary

This sarcasm (I can't tell)?

Meanwhile...the queen of tokenism test runs a Margaret Thatcher style coiffure. Back to the future at warp speed.

And that's the only other thing they will have in common.....

5.5% is not high at all, historically. I don't see what all the fuss is about.

Debt levels...?

Only those who leveraged up thinking that low rates were normal. Long term average is 7-8%, and we are heading there quickly. Leverage is quite nasty works in reverse.

So FHBs have been 'leveraging' up?... it's been impossible for most to avoid taking on high debt levels to purchase a property.

We also had nearly a decade of relentless house prices and political/institutional protectionism, but no one wants to talk about how this 'trend' is something FHBs also had to factor in as well, because then they wouldn't be able to wag their finger in anyone's face.

You can add 3% to what this article is saying. Forecasters simply can't forecast correctly. 8.5% is the most likely outcome. And look at the graph - its indicating inflation will be WORSE in 2023 but are they saying that? NOPE

i would wish that interest.co.nz stopped reporting what the banks are saying.

but id be interested in some journalism where the banks were asked a few hard questions.

they are controlling the narrative

here's another example of players controlling the narrative

Oliver harwich from the new zealand initiative writing about.......................????????

https://www.newsroom.co.nz/pro/how-italy-could-end-up-with-its-most-rig…

italian politics?????.......has he nothing to say about NZ......they must be happy with things are going???? or maybe there only purpose is too special for us to know and all done behind closed doors

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.