Summary of key points: -

- NZ economy: Is the RBNZ on the right course?

- Pivotal decision for the Fed this week

- Hard landing for the Chinese economy?

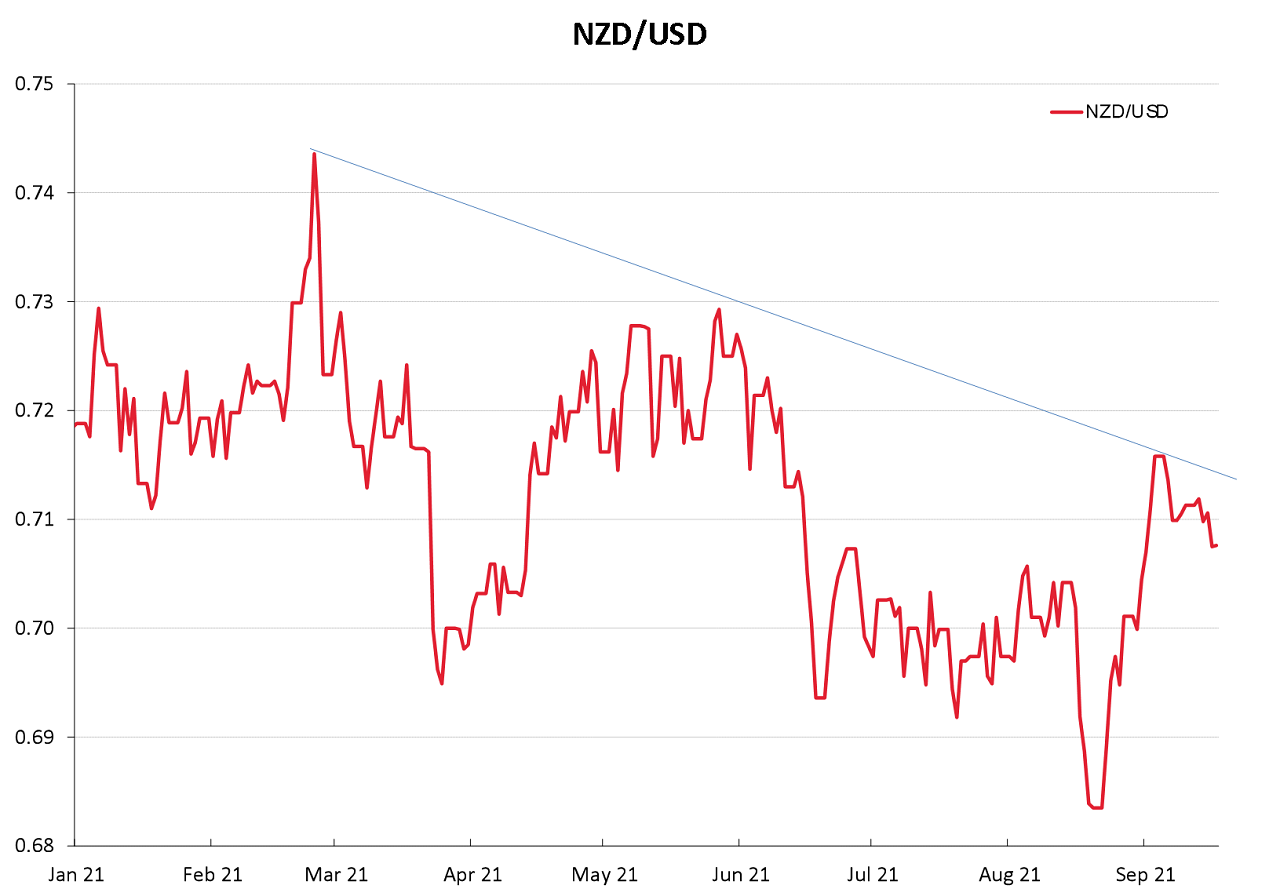

The Kiwi dollar failed a major test this week. It was unable to break above the key 0.7150 resistance point against the USD and has retreated lower to 0.7030. The FX markets have delivered a polar-opposite response to the “stunning” GDP growth outcome for the June quarter to what the local pundits (the interest rate market and bank economists) were confidently predicting.

What is going on here? Typically, a domestic financial market environment of a hawkish RBNZ about to shove the OCR up and an economic expansion over three months double that of consensus forecasts would have propelled the Kiwi dollar sharply higher.

However, the locals appear to be disregarding and not understanding some greater forces at work which are pricing the NZD/USD exchange rate lower for good reasons at this time.

The FX markets are reflecting future risks and forces for the Kiwi dollar that stem from the nexus of three influences, namely: 1. Upcoming RBNZ monetary policy decisions, 2. The US economy and Fed decisions and 3. Fundamental changes in China.

1. NZ economy: Is the RBNZ on the right course?

The response from local banks this week in increasing mortgage lending interest rates ahead of the October 6th RBNZ monetary policy decision, was that it is a “lay-down mesire” that the OCR is increased by 25 or 50 points with a lot more to come. The stellar GDP growth result last Wednesday confirmed their view that the economy is ”on fire” and higher interest rates are required immediately to dampen down activity and control inflation.

An alternative view, which the FX markets seem to be reflecting, is that the historical GDP growth numbers are questionable and the risks ahead for the NZ economy outweigh any positive past performance.

There is something screwy in the GDP numbers when the fishing and aquaculture industry expands by a whopping 13.2% over the June quarter when it last recorded a quarterly increase of over 10% in 1988.

The massive Covid-induced dive in the economy in the June 2020 quarter and subsequent rebound in the September quarter has upset the seasonal adjustment factors that Statistics NZ apply and is causing some weird and unexplainable outcomes.

The 25.4% increase in the accommodation/food services sector and 14.0% increase in transport is more explained as the opening up of the Trans-Tasman travel bubble in the quarter prompted a flurry of increased activity. However, that is clearly a one-off boost that may not repeat for a while with the delta strain spread in both Australia and New Zealand.

Net result is that you should not read too much into these historical GDP figures.

Instead of religiously following their 18th August hawkish monetary policy stance, the RBNZ would be well advised to take stock of the current situation and risks facing the NZ economy. In particular, their reconsideration should include: -

- The plight/difficulties of small business from successive lockdowns. Business failure rates are climbing and a sudden reversal from a super-loose to much tighter monetary policy is the last thing they need.

- What if by December we are still well below target population vaccination rates, another delta outbreak occurs, and the only Government response is to lock Auckland down again?

- The export economy is already struggling to increase output with labour shortages and shipping/freight disruptions. The last thing they need is the RBNZ causing the NZ dollar to appreciate at a time when commodity prices could be going the other way as China slows.

Not that the NZ interest rate market is reflecting it, however, there has to be a growing probability that the RBNZ will be forced to revise their planned rapid increases in the OCR. If and when they do that, the Kiwi dollar will weaken on its own account.

2. Pivotal decision for the Fed this week

The US Federal Reserve’s 12 voting members on the FOMC committee appear to be split down the middle at 6:6 on whether to taper their QE/money printing stimulus levels sooner rather than later when they meet this week on the 22nd.

The EUR/USD rate has been oscillating above and below $1.1800 of late, depending on whether the US economic data has been stronger (pointing to an earlier taper) or weaker than expected. The USD weakened back to $1.1900 following the poor August jobs number, however, it has recovered to $1.1720 over recent days following much stronger than expected August retail sales numbers.

These latest USD gains explain the lower NZD/USD rate to 0.7030. The September jobs increase should be another large one (similar to the July number) as many employments/welfare benefits ran out in early December and people were forced to go back to work. There is plenty of work going around in the US economy with job vacancies (openings) standing at a record high 11 million.

The chances are that the USD bulls will be somewhat disappointed with the non-committed outcome on tapering at this week’s Fed meeting. However, a strong September jobs number on 8th October should cause another bout of USD gains to $1.1600. Local USD exporters seeking to top-up hedging percentages may get another bite of the cherry in the 0.6900’s when this occurs.

3. Hard landing for the Chinese economy?

Industrial production and other Chinese economic data released over recent weeks has confirmed a marked slowdown in economic activity.

Crackdowns and intervention by the Government authorities in the tech and steel sectors started the change. However, the loss of confidence has now spread into the construction/property sector with the colossus Evergrande empire buckling under the strain of US$300 billion of debt.

A potential collapse of this company and the resultant risk of contagion impacts elsewhere raises the spectre of a credit shock/debt crisis in China reverberating across global financial/investment markets. The NZD/USD exchange rate is always vulnerable to falling global equity markets and a developing credit crisis in China is lifting the “risk-off” investor sentiment.

However, as we have seen many times before the Chinese authorities are well versed in papering over the property value/debt cracks to stabilise matters.

Expect to see a rescue package for Evergrande, as well as a loosening of monetary policy with a 0.50% cut to their officially fixed interest rates (currently around 4.00%).

A weaker Yuan exchange rate value against the USD would be part of a looser monetary policy setting from the PBOC.

The NZD and AUD follow the USD/CNY exchange rate closely, so another reason why we can see one last push lower in both currencies by one and two cents over coming weeks.

By November, global FX markets should have fully priced-in USD gains from Fed tapering and 2022 interest rate increases, so thereafter the US dollar weakens on the US of A’s dual deficit problem.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

9 Comments

I think RBNZ should be ready to cut the OCR more than anything else rather than to buy Aussie banks' narrative or making decisions without deep dive into some of the questionable numbers behind the June quarter's performance.

If the current numbers aren't strong enough to raise the OCR, then they literally never will be. Implicitly, Roger is arguing for a BoJ/ECB type 'new normal'. There will never be better numbers than these, and there will always be a crisis somewhere.

He's also probably wrong about Evergrande. There's no sign that the government plans to bail them out. They might compensate customers who have paid for apartments that will now never be built, they're easing liquidity to help out banks who are threatened by counterparty contagion, but the company and its bondholders will be left clutching thin air. There is no incentive to bail out Evergrande directly rather than bailing out the most deserving of their creditors.

Brisket - Xi knows that the Chinese hate losing money so letting Evergrande fail will produce social unrest but a bailout sends the wrong signals TBTF - so something that rescues individuals deposits on part or unbuilt apartments may be a suitable course whilst allowing the big corporates and major investors to bear losses. Accepting a total failure will also have a domino effect on other companies bonds and those holders of Evergrande Bonds, its a tricky situation and a mistep will have major implications and not good ones.

I think the reassertion of moral hazard is part of the plan. China’s property bubble has been extraordinary, even compared to our own. We saw earlier in the year that Xi was prepared to nuke a whole industry (after-school tutoring) because of its pernicious social effects; I think this is comparable but trickier. Unlike our own government, Xi can see that housing bubbles necessarily lead to inequality and social unrest, and that the damage from popping it will only get worse the longer it is delayed. The public never abandon a bubble by choice; if Evergrande and one or two other companies go under, if they have a few quarters of negative GDP growth, they will have got off lightly.

I don't think the views are not opposite, that the economy is "on fire", is that is it over valued, and based on inflation no real growth.

The June quarter GDP is just an illusion. There is nothing but govt hot air to underwrite these numbers & regardless of whether you agree or not, it really doesn't matter. Events are about to overtake once again. Mr Xi has had enough of rich Chinese entrepreneurs telling him how to run his country. He will teach them. Chinese property has been a ponzi for years, especially in Tier 1 cities, & like we've (or I've) seen before, both here & elsewhere, it's the big time property types who get hit hard & first. It's how the cycle works. The unknown factor is Xi himself & his powerful (immediate) underlings. They have levers most of us don't, so we can only watch on. Real life is way more exciting than anything you can watch on television.

The New Zealand economy is housing with some bits tacked on the side.

Can't goose it forever.

Yeah don’t worry China can control everything

Have economists now erased from there models the nature of unstable complex systems? Whenever attempts are made to mess with volatility or free motion of markets things end badly. As Taleb says the longer you do it the more likely explosion is. Commentators show that they have swallowed the narrative that 2000 and 2008 cannot happen again despite the utterly dark nature of shadow credit risk in China

Deleveraging and counter party risk are huge unknown

Roger, I am coming round to you!

Great piece today.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.