The latest ANZ Business Outlook survey for June is showing "renewed meaningful progress on bringing inflation pressures down", ANZ economists say.

And ANZ chief economist Sharon Zollner says while "there is still a long way" to go, she is optimistic that the Reserve Bank (RBNZ) will be in a position to cut the Official Cash Rate "considerably earlier" than August next year, as the RBNZ currently expects.

The ANZ economists' most recent estimate of when the OCR may be cut was February 2025, though they have not reiterated that particular forecast in the latest survey summary.

In terms of inflation indicators in the latest survey, Zollner said both cost expectations and pricing intentions "have now fallen off the plateau they were stuck on for eight to nine months".

"Inflation expectations also continue to steadily decline."

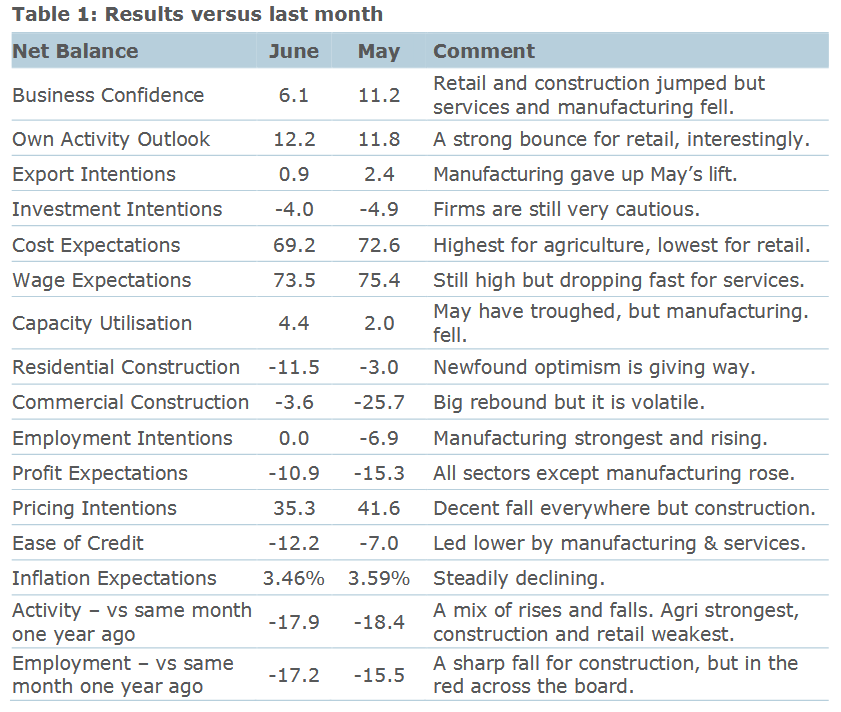

Pricing intentions fell 7 points to 35 and cost expectations fell from 73 to 69. Inflation expectations eased from 3.6% to 3.5%.

Zollner said average reported wage increases versus a year earlier rose, but expectations for wage settlements over the next 12 months fell by a similar margin.

In terms of 'headline' results in the survey, business confidence fell 5 points to +6 in June. Expected own activity was unchanged at +12, while past activity was flat at -18.

Zollner said the survey "remained weak" in the forward-looking activity indicators "with a marked decline in reported past activity”.

"Construction is experiencing the largest fall in activity versus a year earlier, followed by retail, but every sector except agriculture is reporting weaker activity than a year earlier."

While the GDP outcome for the first quarter of the year was a "barely respectable" 0.2% rise, the signals for June quarter GDP "are extremely weak".

"We have pencilled in a small decline at this early stage."

Westpac senior economist Michael Gordon, commenting on the survey results, said overall, the survey continued to suggest soft activity through the middle part of this year.

"We currently have a 0.1% decline pencilled in for June quarter GDP, but we’ll be reviewing this shortly. We note that the stronger-than-expected March quarter result was driven by volatile items that increase the odds of a weak result next time.

"The pricing measures will help to reassure the Reserve Bank that inflation is on the path back towards target. Even so, there is still some way to go, and the RBNZ will be wary of the risk of taking its foot off the brake too early," Gordon said.

Every third month the survey asks firms to rank their largest problems.

In the latest results inflationary problems (finding labour, high wages, high other costs, and regulation and paperwork) continue to decline in relative importance, ceding ground to the disinflationary problems of low turnover and competition, Zollner said.

“Interest rates have also grown as a problem.

"Low turnover is a particularly weighty issue for the retail and manufacturing sectors. The agriculture sector is by far the most concerned about non-wage costs and interest rates.

"The turnaround in labour shortages is evident across all sectors," Zollner said.

“The medicine is working. The economy is clearly weak, as the RBNZ intended, but more than that, we are finally seeing renewed meaningful progress on bringing inflation pressures down."

Earlier on Thursday the ANZ-Roy Morgan Consumer Confidence Survey was released, with the confidence measure easing 2 points in June. "At 83, confidence is miles below the 20-year average of 114," Zollner said of these results.

"Bringing it all together, consumer pessimism is consistent with the broader economic data that shows households are tightening their belts in the face of restrictive monetary conditions, a stagnant housing market, and a softening labour market."

Business confidence - General

Select chart tabs

26 Comments

Maybe they cut in November into a collapsing economy.

Looking at it in Hindsight, having to lift from 0.25 to 5.5 reeks of incompetence.

EDIT - just read this

Astonishing indifference to a failed institution

By Michael Reddell on June 27, 2024

Since taking office, the new government has replaced quite a number of chairs of government entities. I'm sure there are many others but NZTA, Health NZ, Pharmac, and the FMA are just the examples that spring to mind. It isn't uncommon for such changes to be made, and in many government entities board members can be replaced at will by the government of the day.

It isn't so for the Reserve Bank. Mostly, board members (including the chair) can only be replaced at the end of their terms. This is consistent with notions of the operational independence of the Reserve Bank, and much the same provisions apply to MPC members.

Surely the Governor General could remove anyone within the RB?

More smoke and mirrors from anz. Should read ‘new zealands largest mortgage provider wants rates cut to recharge their major business-line asap and will use any data possible to make this happen’…. Yawn

They are at the coalface and know how many businesses are now in the hospital wing.

Most of those businesses should never have been propped up for the last few years in the first place.

It is good to see some of the businesses competing with us close. They were always struggling.

There is only so much pie to share around and it is better without them nibbling the crumbs.

yeah - we are starting to get decent amount of enquiries about business productivity again.. in the boom businesses werent exactly queuing to improve themselves... now its back to reality

When you can patch over anything with free (or exceptionally cheap) money, it allows lots of zombies to shuffle along. Now that those days are over, businesses need to get serious and assess whether or not there is a realistic path to profitability for them.

In 99% of cases dealing with zombies is best done through a bullet in the head, not offering them a walker in case they get better. It didn't/hasn't worked in Japan and it won't work in the West.

Agree. Applies to business and a lot of leveraged individuals.

Great to get back to a real innovative economy.

Its crazy, where I live in the town centre there's like 7-8 bakeries and a bunch of other mediocre bottom-of-the-barrel stores which should not be able to exist. I'd be happy to see interest rates rise further just to see the scum shops close down.

These predictions are based on dream scenarios that we won't get anymore inflationary global shocks. Given what is unfolding geopolitically, we will be extremely lucky if we don't get anymore.

I would be 100 times more worried about impact on exports then inflation at this point.

What is your line of thinking here IT Guy?

Geopolitically, for us this means China, hard to see massive price increases coming from imports, but easy to see sanctions or events that impact our exports....

I guess we could see an oil price shock, again I think its impact on exports would be bigger then domestic inflation.

Russia cannot even defeat Ukraine, that war is not going to get bigger unless he wants his arse kicked. Poland would love to do some kicking though....

If the BRIC-Western relationship does break down the most likely we would get the perfect storm of energy price driven inflation, imported inflation and huge export revenue drop.

In that event you would be able to buy a street of houses in Auckland for a few bucks.

Another good point. BRICS countries are uniting to challenge the G7. BRICS countries control a huge amount of food, minerals and recourses. This could also cause inflation for the west if certain moves are made.

One example is if China makes a move on Taiwan and tries to blockade or quarantine its shipping and airfreight routes then that will cause another inflationary shock for the world.

Also, the war in Ukraine is set to get worse and possibly expand. Both sides can't afford to lose so expect more volatility ahead.

The biggest issue was demand spiked due to economonic stimuli everywhere all at once. Unlikely in the near term.

I wonder they thought about asking them (especially those that have had bumper profits over the last few years) if they had any guilt for the greedflation they have caused to ensure we are now in a significantly worse position now than we otherwise would be.

Well actually of course they wouldn't have - the survey is run by ANZ!

You don’t say Sharon?

Exactly, one of the chief 'crash the economy' proponents now having second thoughts.

Imagine what this country will look like if the RB does in fact sit on it's hands until August 2025.

A country with prices being controlled hopefully.

Lol, do you think we control prices? We are a tiny little price-taking island in the Pacific!

I shudder to think.. a mix of for lease signs and endless road cones.

There don't need to be so many for leases. Too many landlords hold out for top dollar and stay vacant for years due to pigheadedness.

We own our own building but if we didn't need it for our business I would have no trouble renting it. Just need to get ahead of the curve and offer the best value to rent it.

Tell me you’re a boomer without telling me you’re a boomer

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.