Summary of key points: -

- Kiwi dollar follows the Aussie lower

- NZD/USD rate overshoots to the downside

- US employment data a very mixed bag

Kiwi dollar follows the Aussie lower

Risk sensitive currencies such as the NZ dollar and the Australia dollar have been hit hard over this last week as financial and investment markets react to the spreading of the Omicron Covid variant and a more hawkish tone on monetary policy from the US Federal Reserve.

It is too early to tell what the impact will be on the global economy from this latest Covid mutation; however, markets are jittery and fragile as they move towards the end of a tumultuous year. The Kiwi dollar has disappointed and under-performed over recent weeks, in much the same way that our All Blacks rugby team and Black Caps cricket team have fallen short of increasingly higher expectations recently.

Last Friday’s sell-off in the NZD/USD rate to 0.6750 (below the previous low points over the last six months of just above 0.6800) has not been due to a stronger US dollar on global FX markets or some negative NZ economic news (as some media reports have suggested).

The latest bout of selling has more to do with the Kiwi dollar closely following the Aussie dollar in the currency markets and the AUD has been slammed down to 0.7000 against the USD after breaking below key chart support levels.

The foreign exchange markets in pricing the AUD lower (contrary to what has been the view of this column) are reflecting the large current divergence between the central banks of the US and Australia.

The US Federal Reserve is looking to accelerate their tapering back of QE, whilst the Reserve Bank of Australia (“RBA”) is staunchly defending their stance not to increase interest rates off zero until 2024.

The battle between the RBA and the local Australian interest rate markets on the extent and timing of their interest rate increases will be determined by how soon a rapidly tightening labour market in Australia starts to push up wages.

The RBA has made it very clear that they do not see higher inflation as a problem until it is more permanently embedded through higher wage costs causing the price increases.

To date they have not witnessed this occurring, however it cannot be too far away. The demand for labour in Australia is already hotting up with job adverts increasing 6.2% in October as they emerged from their Covid lockdowns. The November job adverts figures are due for release on Monday 6th December with another strong increase likely to bring some support to the AUD exchange rate. Australian employment numbers for the month of November on Thursday 16th December will also be scrutinised by the FX markets as evidence of stronger labour market conditions and thus pressure on the RBA to relent on their stance.

The RBA review their interest rate settings on Tuesday 7th December and their commentary will be examined for any hints of recognising the emergence of a stronger labour market.

Whilst the Australian dollar has depreciated further than anticipated over recent weeks, it does appear to be now heavily oversold at 0.7000 against the USD, on two counts: -

- Short-sold AUD speculative positions seem more certain to be unwound (requiring AUD buying) before the end of the year as the punters are now sitting on even larger FX gains.

- Australian economic data from employment to GDP growth to massive Balance of Payments surpluses all stand as AUD positives that support a significant rebound in the AUD value over coming months.

Similar FX market and economic analysis can be put forward for the NZ dollar being oversold against the USD at 0.6750 as well, namely: -

- The FX markets in selling the Kiwi dollar after the RBNZ were more caution on the NZ economic outlook in their 24th November statement, have arguably over-reacted as the RBNZ are still going to increase interest rates next year more aggressively than any other central bank in the world. Outside of other influences this would normally be sending the Kiwi dollar higher.

- The FX markets have for the meantime chosen to ignore the increases in dairy export commodity prices which will deliver a strong growth impulse to the NZ economy. History tells us that the divergence between the NZD/USD exchange rate and whole milk powder commodity prices never lasts too long. Therefore, at some point not far away, FX traders and investors will recognise that the NZ dollar is under-valued vis-à-vis the higher dairy prices.

NZD/USD rate overshoots to the downside

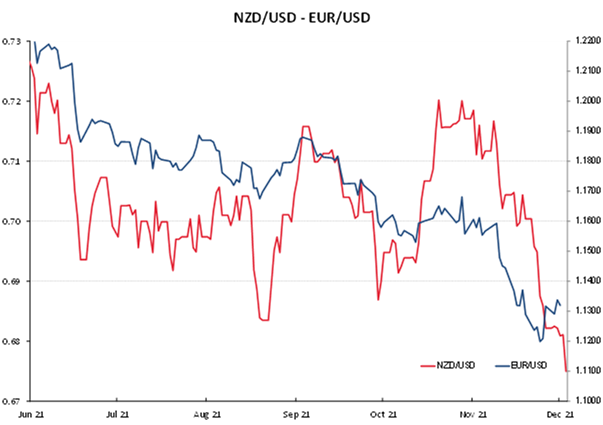

The chart below confirms that the sinking of the NZD/USD rate below 0.6800 to 0.6750 has nothing to do with a stronger USD on global currency markets.

Over the last week the EUR/USD rate has recovered from rates below $1.1200 to stabilise at $1.1300 (blue line, right-hand axis). Through October and most of November the NZD/USD rate outperformed the EUR/USD rate when the forex markets incorrectly expected a super-hawkish RBNZ. They were wrong, and the Kiwi plummeted from above 0.7100 to 0.6900.

The continuation of that fall to 0.6800 was a catch-up on the stronger USD at the time. However, the NZD/USD rate has now over-shot the EUR/USD rate on the downside at 0.6750. That position will not to be sustainable if and when the EUR/USD rate heads the other way, back up to $1.1500 (weaker USD).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.