The Reserve Bank's forecasts for the Official Cash Rate are "too high and too hawkish", according to Kiwibank's chief economist Jarrod Kerr.

In Kiwibank's latest Our Take publication, Kerr forecasts that the RBNZ will cut the OCR (currently on 4.25%) to 3.00% in 2025. The RBNZ's currently forecasting it will drop the OCR to 3.5% by the end of next year.

Kerr says because of the the RBNZ's forecast OCR track there are not enough cuts being priced in by wholesale interest rate markets.

"We believe the RBNZ will be forced to lower their track (again), and deliver faster cuts," Kerr said.

Kerr's views contrast with those of Westpac chief economist Kelly Eckhold, who says there is a risk the RBNZ may actually cut the OCR too far next year and may need to start raising rates again in 2026.

Kerr says Kiwibank economists have been "fierce advocates" of lower rates.

"We believe rates were hiked too high, for too long, and we’re suffering the consequences," he says.

"The swift reversal of heavy-handed hikes is needed to limit the economic scarring, which is becoming more evident in labour market data, business failings and financial hardship. The spike in Kiwisaver hardship withdrawals, is one such development.

"The crystal ball is cloudy, but the direction of the Kiwi cash rate is crystal clear. We need to see rates pulled lower over 2025, if the current lift in confidence is going to translate into activity, and then investment and hiring intentions.

"The continued need for rate relief is obvious, to us. Taking off the handbrake and putting policy in neutral is now the game."

But it's the pace of getting back to 'neutral' that Kerr has disagreement with.

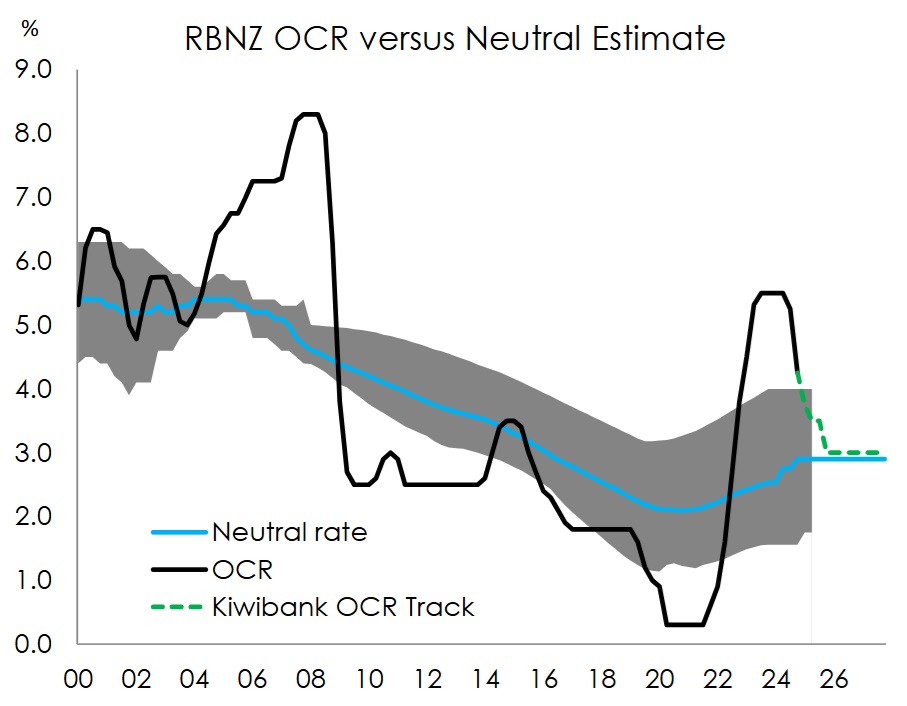

"The chart below highlights the RBNZ’s estimate of neutral. It’s the theoretical rate that neither hurts nor stimulates.

"It’s the Goldilocks rate that’s not too hot or too cold. And you only know where it is, when you’ve gone past it. But it provides good guidance on how far the RBNZ thinks they need to go to remove the restrictiveness of policy.

"That Goldilocks rate was revised higher, again, from 2.75% to 2.9%. And accordingly, our end point forecast is higher today. We have changed our call from a 2.5% endpoint to 3%. So the cash rate has another 125bps to go, with 50 in February a nice start to the new year. And we believe the RBNZ will cut to 3% next year."

But Kerr says what surprised the Kiwibank economists in the latest RBNZ Monetary Policy Statement was the time it takes to get monetary policy back to neutral.

"According to the RBNZ’s OCR track, the cash rate finishes 2025 at 3.5%. That’s just 75bps of cuts over the entire year, of which 50bps is delivered in February. And the final move to 3% does not happen until deep into 2027.

"It’s a strange track. There’s an argument that they should frontload cuts to 3.5%, which we agree with. But then they argue a need to keep the cash rate slightly restrictive over most of the forecast horizon.

"So frontload because the data has deteriorated, and inflation is back in its box. But then hold restrictive for an extended period to make sure inflation stays in its box. We’ll take the other side of this bet.

"We believe the RBNZ’s track, and market pricing, will prove to be too high and hawkish. The implied cash rate is likely to move towards 3% in 2025, and thoughts of rate hikes (priced into the curve from 2026 and beyond) will be postponed."

Kerr says the lowering of interest rates will provide much needed relief for indebted households and businesses.

"And it is the expectation of these rate cuts that has us in the more “optimistic” camp when thinking about economic growth, household wellbeing, business expansion, and the recovery of the housing market."

64 Comments

100%

In fact, the OCR needs to go 2 5% and I think it probably will. I think the economy is going to surprise the RBNZ on the downside

Especially with more geopolitical upsets in the first half of next year.

What are you thinking? Trump failing to solve Ukraine in 24 hours (lol), and conflict escalating?

I reckon trump will easily stop the war. Neither side has much motivation to keep fighting anymore.. so both will likely negotiate and will have to let russia keep most of what they have won. Hence why Russia is throwing everything at winning strategic ground asap.

Might not be 24 hours.. but negotiations will probably start and conclude within days or weeks.

Will Trump want his first big political achievement to be bending over for Putin?

He will be able to claim success for brokering ‘peace’

With the "X" megaphone ramming that 'fact' down everyone's throat (while ignoring any peace will be temporary).

Putin isn't settling for a temporary peace or "freeze" which then allows NATO to rearm and retrain Ukraine so this blows up all over again in five or ten years. Either it's a full diplomatic solution which meets Moscow's requirements, or Russia will force one via the battlefield.

Putin likes trump and will let trump take the credit. Putin will be let off as part of the deal and life will go back to normal.

Putin will do what he has done in the last few 'wars' and settle for the extra land they have so far. In 5 years he will do it all over again anyway and grab a bit more. It's not a rush for Russia.

With trump in charge ukraine won't be allowed to join nato.. so they will just have to wait for putins next invasion... Likely unsupported by the usa next time too.

"Putin likes trump"

To Russia Trump is a 'useful idiot'. An individual who was used to broaden the divisions in the American society and undermine the democratic system. Russia puts in a lot of effort into destabilising western nations because a weaker west is beneficial to Russia. Putin is the product of the Soviet empire and his attitude towards the west is not much different now that we are in the "Second Cold War".

And the US doesn't put a lot of effort into destabilizing other nations, under the pretense of bringing democracy to the rest of the world?

Mystery - your brain is a sponge for western propaganda. You need to open your minds eyes. Do some digging into the origins of the conflict. Because it wasn’t president Putin/Russia who started it.

" Blackbeard"

I've spent my childhood in Ukraine. I know the history of this conflict pretty well.

The simple truth Is, the west is better than Russia and Ukraine wants to gravitate towards the west rather than towards Russia. Russia doesn't like that

Yes, that’s because the west has continually treated Russia as the enemy in waiting. If the west changed their projection towards Russia, to promote a friendly relationship, then Ukraine wouldn’t have objections towards its neighbour. But this is a global power game, one country to rule them all. Sadly nuclear war is probably the only answer to change attitudes.

Again, do more research.

NATO and the US military industrial complex need an enemy. Their existence, careers and profits depend on it.

"the west has continually treated Russia as the enemy in waiting"

No. On the contrary, the west has been too lenient towards Russia during Putin's 20-ish years of rule (before the full-scale invasion of Ukraine).

The west was too kind to Russia even while Russia was invading Chechnya (Second Chechen war- as Putin came to power), then Georgia and Ukraine, etc. During Putin's rule the west(Europe) let itself relax/demilitarise relative to Russia which was ramping up its military. Instead, the west was reaching out to Russia, it helped Russia recover after the collapse of the USSR! More recently the west(EU) even let itself increasingly depend on Russia's energy supplies!(a stupid/naiive geo-economic move in my opinion).

The west failed to see Russia for what it is - a dangerous, authoritarian state that still has grievances against the west after losing the first Cold War and with it the territories which used to belong to Russia (then USSR), such as Ukraine.

Now that we might have entered into a second Cold War it might pay to think a bit harder about whose side you are on @Blackbeard.

"the west has continually treated Russia as the enemy in waiting"

I speak fluent Russian and watch some of Russia's propaganda channels now and then. You should hear the insane things that Russian state television airs. They (propagandists on national TV, not the government directly) openly say things such as 'Russia should destroy London' or should take back Alaska because it's Russian territory. It's really messed up. I think Russia threatens the west more than the west threatens Russia.

Not sure why you are telling such obvious, wild untruths given how extraordinarily careful Russian diplomacy is and how attentively Russia nurtures its relationships with the Global South nations and BRICS countries.

Putin will do what he has done in the last few 'wars' and settle for the extra land they have so far. In 5 years he will do it all over again anyway and grab a bit more.

This is an absurd counterfactual to what Putin, Shoigu, Peskov, Belousov, Mishustin, Zakahrova and others have actually been saying. Perhaps you should listen to their comments instead of to MSM talking heads? Russia, already covering eleven time zones, isn't interested in any more land. It is interested in removing the threat of NATO bases and strategic weapons from its doorstep, as well as eliminating all Banderists from Ukraine.

Tend to agree

How will Trump stop the war?

And what do you think those Russian troops will do to the people of Ukraine as they extract their revenge (think your wife, son, daughter, girlfriend etc) if they gain any sort of control.

Widespread butchery, rape, murder and pillage.

The naivety of those who live in peace.

Pillage and plunder is all mankind knows. We've been doing it for centuries to people and planet. We call it capitalism.

Note that four major regions of Ukraine have already voted to join Russia. It seems that the Russian speakers there were not fond of the Kiev government waging war, since 2014, against their own citizens in eastern Ukraine.

Do the RBNZ really care if we are in recession (they haven't so far) as long as the CPI read doesn't get too far below 2%?

My understanding is that there is an understanding that if the CPI is tamed and well within range that the OCR shouldn’t be kept unecessarily high if the economy is really struggling. I think this is both an informal thing as well as a semi-formal thing (broad references in the RBNZ’s framework)

certainly there is less official mandate since ‘sustainable employment’ was removed

I would guess that the RBNZ's view is that if the OCR is somewhere near neutral (~3%) then it is not unnecessarily high, so a few more cuts. Then they just watch and wait until they are very, very sure that inflation isn't going to pick up again. I would suspect that we would only get an OCR starting with a 2 is that if we start to get CPI readings closer to 1% than 2%

I think National have done their best to remove any informal thing. I think it was Bill English who specifically told them to target 2% rather than be within target, and Nicola Willis that removed the employment mandate and told them to concentrate on inflation only.

Personally I think they need to make a change. Either informally let them be anywhere within target and tell them the economy is more important than the 2% midpoint, or add the employment target back again but make sure it is a secondary goal that only applies when CPI is within target. But really this kind of thing should have been done before we had a problem, not wait until the obvious problem has occurred and then look reactionary / interfering.

I agree HM, it probably needs to go lower. 3% OCR will be about 4.75% mortgage rates, that is only 1% lower than now and unlikely to revive the economy.

It's never about the mortgage rates, it is about the level of debt we have taken on for housing. We shouldn't fiddle with the OCR to unnatural low levels again just to give relief to those who took on more debt than they could manage, the dead weight (harsh as it sounds) needs to be cleared. It will be hard for some, but it's not the job of the RBNZ to be a fail safe for poor choices.

Yes, that is a pretty compelling argument for the RBNZ to only look at CPI (their mandate) and forget about the short term economy.

Yes, but….. their ‘independence’ is exaggerated

The problem with this stance is that it completely ignores the devastation that is being wrought on our small business owners and entrepreneurs.

No.

- We didn’t defeat non tradable inflation. Just got lucky.

- we’re still emerging from the covid economy. Need headroom (or floor room?) to cut if things go bad.

- 2.5% is relatively low, historically speaking. We’re not returning to the post GFC zirp era.

Ok.

So where is economic recovery coming from? Given we have an austerity government.

Assuming austerity (not something I advocate), aren’t quite deep OCR cuts the only way out of the economic quagmire?

What I am saying should not be mistaken for support for the ponzi economy. I am simply addressing the unfortunate reality we face.

Or do you think sickly GDP growth and rising unemployment will simply be tolerated?

I don’t!

...the RBNZ needs to manage the sticky domestic inflation situation.

Also a wait and see approach is sensible in relation to what the FED does in the short/medium term (and any impact of the new US government policies).

Don't want to see the NZ$ dropping significantly to reignite imported (tradables) inflation, combined with the still high domestic inflation (non-tradables).

"...the RBNZ needs to manage the sticky domestic inflation situation."

The OCR is a woeful tool to use to do that.

I'd argue that the RBNZ, by raising the OCR, is a significant contributor to 'domestic inflation'. Further, quite a bit of 'domestic inflation' is down to how successive governments have structured the economy. If you really want to address 'domestic inflation' we need a massive tax system overhaul.

Unfortunately i can't see a tax overhaul in the next couple of years. So we are left with the ocr and Orr always using it to extremes.

Just an FYI: The OCR is set by a 'committee' of seven people - the Monetary Policy Committee.

Four members come from within the RBNZ and three are external appointments. They reach a 'consensus' but how individuals 'vote' is almost never described.

Just quietly, I'd like to see Jarod added to the committee and their 'deliberations' made public. Methinks there's far too much 'groupthink' in the current committee makeup.

"Also a wait and see approach is sensible in relation to what the FED does in the short/medium term (and any impact of the new US government policies)."

Here we go again.

If you believe our interest rates are beholden to what the FED does then please explain why many other central banks started making cuts way in advance of the FED.

Further, please explain why our RB (and many others) has dropped by so much more than the FED has at this time.

Might I also enquire as to how many other central banks you follow? Would it be just two? (Because that seems to where such ill-informed comments appear to come from - i.e. from an extremely low statistical sample.)

Just a further bit of critical information on the major difference that the FED rate and the OCR have on the respective economies ...

In the USA, most mortgages are fixed rate for 30 years. We don't have fixed rates for longer than 5 years in NZ - most mortgages are fixed for 2 years or less.

(And btw, when a 30 year fixed rate US mortgage is re-financed, the bank's break-fees are limited to about 3 months of interest on the basis the bank will re-lend the funds within 3 months.)

This difference is critical to understanding why raising the FED rate doesn't affect households as much in the USA - but how it cripples them in NZ.

And let's also not forget - it is the younger generations that have the biggest mortgages.

"when a 30 year fixed rate US mortgage is re-financed, the bank's break-fees are limited to about 3 months of interest on the basis the bank will re-lend the funds within 3 months"

Is there any reason why we can't have that in NZ? Is it to do with Fannie/Freddie or is it just a regulation the banks have to follow?

"Is there any reason why we can't have that in NZ?"

Government regulated it in the USA. So no, I can't see why our government couldn't do it in NZ. Do they need to? (I suspect they might but I've never looked into it outside the one time I've done it in NZ.)

"Is it to do with Fannie/Freddie ..."

Fannie and Freddie assist in making 30 year fixed rate mortgages possible - mainly by forcing banks to do likewise. One notes at this point that both Fannie and Freddie were set by their government. Our government meanwhile .... [crickets !!!]

Isn't this easily gamed? Borrow long (30 years!) on your (already paid off) home in the hope that interest rates go up and you can make a nice profit on it. If not then just break it and pay it back. Would have been quite a smart move 3 years ago.

Economists have become completely myopic in their commentary, focusing almost exclusively on the OCR and the Reserve Bank's role in setting it.

If the OCR was the only thing that mattered, we would have a centrally managed economy. As it so happens however, we don't, and there are myriad other factors which influence things like GDP growth, inflation, and interest rates.

What I think we're going to find is that our obsession with the OCR is putting the cart before the horse. Whatever the RBNZ does will be determined by events outside of its control. This may mean that the OCR is held high even as we enter recession, since the alternative would be far worse.

It's like trying to fly a highly complex plane by only bothering to operate one of the levers and (effectively) ignoring all the others.

And the politicians are perfectly happy with this, when inflation is a problem they get to point the finger at the RBNZ and wash their hands of it. When it comes back into band then they can say "look how much we did to help!"

Unfortunately it's 100% true. The rbnz and government find it far to convenient to point at each other to try to pass blame.

Did you mean bank economists have become completely myopic?

Why wouldn't they be? Monetary policy has a major influence on what banks do.

(To say nothing of the sad fact that they are - by a huge margin - the most often quoted in MSM and social media even though it should be obvious to everyone that they are employed - and guided - by huge money making machines. Non-bank economists barely get a look in.)

"We believe the RBNZ’s track, and market pricing, will prove to be too high and hawkish. The implied cash rate is likely to move towards 3% in 2025, and thoughts of rate hikes (priced into the curve from 2026 and beyond) will be postponed."

I agree. Our default economic growth policy (house prices to the moon) will need more stimulus than is currently being forecast.

Yep, and the OCR will need to go sub 3% to do this

We can pretend this time is different & prolong the eventuality, or just accept the fact that housing/construction is what will get us moving again & slash rates…not saying it’s a good thing…but pretty sure it’s the THE thing 🤷🏻♂️😂

Of course, nothing to do with the massive debt pile accumulated during the previous decade where the OCR was mostly 2.5 or lower. Lest we forget NZ has been in a debt bubble for over 15 years.

The pain felt by the debt-holders and their banks is a symptom of the malady, not the cause. Time the minority who hold the debt took their medicine - unfortunately that includes some FHB, but the majority of that minority are the investors who pushed debt levels up, aided and abetted by the banks under the RBNZ's lax watch.

You're forgetting that the biggest, richest, investors, the ones who started buying up big and leveraged in the 1990s and 2000s, don't care one whit about current interest rate pain. Their net worth is still through the roof on all the big city rentals they bought for $250K or less. Your comment is, knowingly or unknowingly, targeted towards the typically younger small fry who started out only in the last few years.

No, my main target is those 'investors' who leveraged up to buy - and who outnumbered FHB by almost 3x from 2015-2021. That does include the prior cohort you mention as well, but simply put: NZ had an extra 30% demand for mortgage debt over a long period of time, caused by lax oversight and encourage by politicians - most of whom had their snouts in the trough.

Yes but those who leveraged up are still away laughing, and will have exponential advantage financially moving forwards compared to any FHB bar those who have support form their parents to buy a house (such as the children of said investors). This is the precise reason why wealth accumulates in assets over generations and we need measures to lessen the impact of this. We cannot change the fact that many investors bought property before 2020, but we can look to the future and legislate a better path including a tax reform including LVT or a CGT that actually does something.

It started long before 2015. Go back to at least '99 when the marketing ramped up for residential investment property, negative gearing, tax free gains, land banking. Boomers jumped in first, then every man and his dog started piling in around '02/'03. Tax structuring really took off.

What was happening in the global background? Foreign developers and offshore money saw NZ as ripe for the picking. NZER'S are just guinea pigs and lemmings. Mainstream economists are clueless.

Clueless or by design?

If support of a currency that runs ongoing trade deficits is required then something has to attract demand for the currency.

What's nz collective LVR?

If possible to stratify the lvr data by demographics or ses, i'd be interested to see that.

Why should we even be listening what Kiwi bank is saying? Jarrod Kerr and his 'band of gypsies' (apologies to Jimi Hendrix) exhausted their credibility as economists eons ago. About time they replaced their crystal balls.

I beg to differ.

Like me (and not a few others here), they've been saying the RBNZ should have started cutting way back in November 2023. At the same time, they've been acknowledging the RBNZ is so moribund in their hawkish models that they won't. In terms of the mess NZ is in, and the enduring damage that the RBNZ has caused, KB's predictions have been way, way better than almost all other bank economists.

(Note: 'moribund in their hawkish models' are my words. Jarrod & Co have been far more polite than I could ever be in the face of such foolishness!)

"Vested interest says OCR is wrong as it doesn't benefit their profits"

One notes that even with a slowdown in spending it doesn't seem to have hurt the bank's profits either.

That's because the banks have first dibs on many households' discretionary dollar. Once the bank hoovers those up for itself, then naturally other spending in retail etc drops.

Are the bank's not a free market? Why are they so beholden to the OCR? If they want to sell more debt at 4.75% or whatever, why don't they just go ahead and do it?

Why are we still giving these false prophets airtime? You know they're not in it for you. Bank economists are here for one thing, and one thing only.

The blame game has really shifted gears - govt/RBNZ, banks/RBNZ, govt/banks, people/govt, people/people, employers/employees, residents/immigrants, investors/non investors... Y'all are being fooled and we keep feeding the machine.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.