UPDATED: We now know the Reserve Bank of New Zealand did not intervene in the currency markets in June, following the monthly release of its operations over the month.

Every month, the central bank releases its foreign exchange market actions for the prior month , outlining the net amount of New Zealand dollars it bought or sold, its capacity to intervene, and its total foreign currency assets and liabilities.

Although it's rare to hear about the Reserve Bank 'intervening' in the currency markets, the central bank is constantly involved in buying and selling New Zealand dollars, with figures showing in most months single digit net positive or negative purchases of New Zealand dollars (in NZ$ millions).

These small actions are merely undertaken to manage the RBNZ's positions - it has to look after its books like anyone else. It's when these monthly figures start rising into the hundreds of millions, or even billions, that we know the Reserve Bank has purposely entered the market to either drive the currency one way or another, make a whole load of money for the government, or acted to put itself in a better position for future intervention.

For example, the June figures show the RBNZ bought a net NZ$2 million over the month - a mere drop in the ocean in terms of the New Zealand dollar market. Figures for July are due to be released on August 30.

A look at the policy

The current policy allowing the Reserve Bank of New Zealand to intervene in the foreign currency markets was enacted in 2004, giving it the powers to use intervention in non-crisis periods to help it better operate under its Policy Targets Agreement with the Crown.

With the current political toing and froing over whether the Reserve Bank should be made to intervene more regularly in the currency markets to keep the New Zealand dollar at a more ‘suitable’ level for exporters, this article seeks to look at just what the Reserve Bank’s current currency intervention policy is, and examine the big purchases or sales of New Zealand dollars it has made since 2007.

The go-to piece on the RBNZ’s current policy was written by the Reserve Bank's Kelly Eckhold and Chris Hunt in 2005, called, unsurprisingly, The Reserve Bank’s new foreign exchange intervention policy.

The Reserve Bank’s number one objective is price stability. It was handed its new intervention allowance on condition that intervention was conducted in-line with its Policy Targets Agreement with the Minister of Finance.

The policy holds that the Reserve Bank would intervene in non-crisis periods to help take the top or bottom off an exchange rate cycle, determined primarily by the Trade-Weighted Index, or TWI. On top of that, if the TWI was at unjustified levels, the Bank has a set of criteria to assess before acting in the currency markets to drive the NZ dollar up or down:

Specifically, before intervening the Bank will need to be satisfied that all of the following criteria are met:

• the exchange rate must be exceptionally high or low;

• the exchange rate must be unjustified by economic fundamentals;

• intervention must be consistent with the PTA; and

• conditions in markets must be opportune and allow intervention a reasonable chance of success

In their article, Eckhold and Hunt acknowledge the Reserve Bank is likely to intervene only relatively rarely. The policy was not enacted to give the Reserve Bank power to try and act against market fundamentals - meaning it does not have the mandate to try and change the direction of the New Zealand dollar when it believes it is not nearing a peak or trough:

Intervention near the peaks of the exchange rate cycle will leave the Bank with an open (unhedged) net ‘long’ foreign currency position, while intervention at troughs will result in an open net ‘short’ foreign currency position.

Open foreign currency positions will be closed when the exchange rate nears the middle of the normal cyclical range – that is, when the exchange rate is near its long term equilibrium value. For example, if the Bank had a net long foreign currency position, it would look to buy back New Zealand dollars at that point.

Intervention is thought to work best in situations where it provides a signal to markets about future monetary policy settings or the level of the equilibrium exchange rate. The signal might relate to information the central bank has but market participants do not. The act of intervention may convey a message about monetary policy settings or the exchange rate that gives market participants greater confidence to trade in ways that will encourage the exchange rate to revert towards more justified levels.

Another reason why intervention might have an impact on the exchange rate in some cases is the idea that exchange rates are partly determined by the underlying structure of the financial markets.

For example, simple technical trading rules that try to take advantage of the continuation of short term trends in financial prices are used widely in the markets.

If exchange rates are at times partially determined by trend following behaviour rather than fundamentals, then it is possible intervention could have an impact on exchange rates if intervention disrupts the signals that trend followers look for. A relatively modest transaction by the central bank at the right time may be sufficient to slow or even prevent further movements of the exchange rate away from equilibrium. It might also be the case that intervention could encourage short term traders to jump in behind the Bank reinforcing the efficacy of the initial intervention transaction.

However, all of these mechanisms are subtle drivers of markets. We do not expect that intervention will be effective enough to offset the impact of fundamentals. This view is consistent with the experience of other central banks who have tried to intervene against fundamental trends and have been unsuccessful (e.g the Bank of England’s attempt to defend the pound in 1992).

Non-crisis intervention

The policy from 2004 is different from earlier laws allowing the RBNZ to partake in 'crisis intervention'. The Reserve Bank had always been able to intervene in the foreign exchange markets at times of significant crisis, to ensure, for example, there was a ready supply of New Zealand dollars on the market. Crisis intervention would see the Bank advising the Minister of Finance on the policy, which the Minister himself/herself would give the go ahead for.

The Bank’s new intervention policy from 2004 onward allowed the Bank to ‘act alone’ in the currency markets – without the directive of the Minister of Finance – in order to help it conduct monetary policy in line with it Policy Targets Agreement with the Crown:

The reason why FX intervention for monetary policy purposes has been set up differently from crisis intervention reflects an effort to manage some of the risks that can be inherent with intervention in non-crisis situations. In particular, as the Bank has sole responsibility for the timing of intervention and the subsequent squaring out of intervention positions, there is little scope for the Bank to be forced to abandon its strategy early under pressure from the Government. This would help to manage some of the financial risks inherent in intervening at cyclical extremes, as it gives the Bank the ability to hold positions for the time that will generally be required to exit at a profit (once the exchange rate reverts to more average levels).

Another reason for maintaining operational independence around FX intervention concerns the potential for intervention policy to conflict with monetary policy if decisions to intervene did not rest solely with the Bank. Because the Bank has control of intervention decisions, there is little scope for conflicts between intervention policy and price stability to arise, given that the Reserve Bank Act clearly defines a single objective: price stability.

Finally, before we take a look at the major moves, how do we know the Bank has actually intervened?:

Often, intervention will be very open and public. In these cases the Bank will issue a press release shortly after having intervened, noting it has intervened and the rationale for the intervention. Sometimes, though, the Bank may wish to intervene covertly, which will mean that there will be no comment from the Bank at the time of intervention. The policy regarding commentary is that the Bank will comment on intervention if it thinks such commentary is useful in enhancing the effectiveness of the operation. Otherwise it will not make on-the-record comments to anyone in response to questions regarding intervention.

Regardless of whether intervention is open or covert, intervention will be apparent after the fact. Each month the Bank and the Crown publish data on the status of the Bank’s balance sheet and the foreign exchange transactions the Bank has made with the markets. This information will clearly indicate when intervention has occurred within a month or two of intervention actually having occurred.

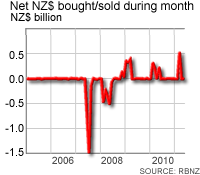

Which brings us to that data published monthly on the Reserve Bank’s website:

The big buys and sells

Mid 2007

In the three months of June (sold net NZ$736 million), July (NZ$1.489 billion) and August (NZ$138 million) 2007 the Reserve Bank sold a net NZ$2.363 billion dollars as it flooded the market with New Zealand dollars and bought up foreign exchange. This was the first time the RBNZ had intervened in the foreign exchange market since the New Zealand dollar was floated in 1985.

In the months leading up to the intervention, governor Alan Bollard had said a number of times that the New Zealand dollar as at 'exceptional and unjustified' levels.

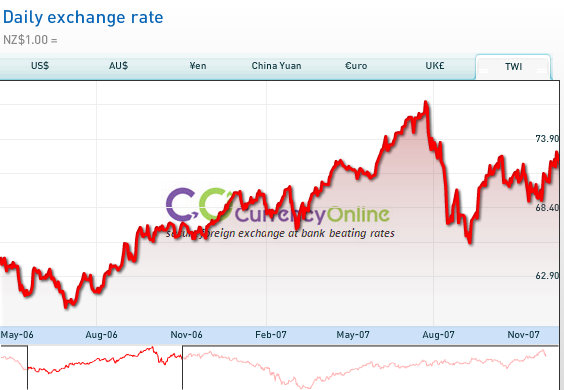

The New Zealand dollar measured by the TWI had been rising constantly from a cyclical low of 60.5 in June 2006, and hit as high as 76.9 in July 2007 - the mid-point of the Reserve Bank's first proper intervention action since the powers it acquired in 2004.

From the chart below you can see that from mid July 2007, the TWI fell away following the RBNZ's action. But having picked a peak in the TWI, the fall bottomed out only months later in September 2007, with the TWI reaching as low as 65.6 before it began rising again through late September and October 2007.

On June 11, 2007, the RBNZ issued a short press release on the intervention:

The Reserve Bank confirmed it has intervened today in the foreign exchange market to sell New Zealand dollars.

Reserve Bank Governor Alan Bollard said: “As stated in our June Monetary Policy Statement, we regard current levels of the exchange rate as exceptional and unjustified in terms of the economic fundamentals.

“This action does not prejudge the future direction of monetary policy, which as always will remain dependent on emerging economic trends.

“The action is consistent with clause 4(b) of the Policy Targets Agreement, which requires monetary policy to avoid unnecessary instability in the exchange rate.”

Until recently, this has been an unusual period of strong international liquidity, low risk premia, falling yen and US dollar, and strong demand for commodity currencies. Like the Australian dollar, the Canadian dollar, and other currencies, the New Zealand dollar has traded at two-decade highs. This has put pressure on some parts of our export sector, focused media attention on the NZ/US exchange rate, and made our monetary policy decisions harder.

Since balance date, there have been changes. Developments in the US subprime mortgage market have seen global investors become more risk-averse, seeking ‘safer havens’, with resulting pressures on global liquidity.

Along with other markets, the New Zealand dollar has come off its highs.

This year the Reserve Bank intervened to sell the New Zealand dollar as it continued to be at unjustified and exceptionally high levels. The Bank has also developed its foreign reserves policy further. The Bank has now sold New Zealand dollars in order to hold some of its foreign reserves on an unhedged basis. This ‘passive intervention’ is to give us better insurance in the event of a New Zealand dollar crisis. In addition, under certain defined conditions, we may carry out limited ‘active intervention’ to help stabilise currency peaks and troughs. This is similar to the Reserve Bank of Australia’s approach.

Early 2008

The Reserve Bank's next significant currency action was during the five months of February (sold a net NZ$472 million), March (NZ$240 million), April (NZ$352 million), May (NZ$511 million) and June (NZ$69 million) 2008, when it sold a net NZ$1.644 billion.

The rise of the New Zealand dollar since bottoming in September 2007 saw the Reserve Bank intervene by once again selling New Zealand dollars half a year after its last action. From its low of 65.6 in Sept 07, the TWI rose to a peak of 74.2 in February 2008 - the month the RBNZ began its five month sale of New Zealand dollars - before falling away.

By this time, the New Zealand economy had entered into recession while global markets were becoming overstretched and more wary of the state of particularly the US banking sector. As the New Zealand and global economies tanked, the NZ dollar also began a year-long march downward.

Despite what happened after this 'intervention', the Reserve Bank made no mention of this sell-off of New Zealand dollars as an intervention attempt to try and drive the currency down. In the Bank's 2007/08 annual report, it said the Bank had been building up its foreign reserve capacity through the year to better be able to intervene in the currency markets:

There were three material changes to the Bank’s foreign reserves intervention capacity during 2007/08. First, the Bank built up its absolute level of foreign currency available for foreign reserves intervention from $6 billion to $10.5 billion.

Secondly, in July 2007 the Bank announced it would hold part of its foreign exchange reserves on an unhedged basis, that is, with a net open position, which gives rise to foreign exchange rate risk. As unhedged reserves can be cashed up more readily than hedged reserves, this provides additional insurance against prolonged exchange rate weakness if reserves are required to be used in a crisis. The level of unhedged foreign reserves is likely to vary relative to hedged foreign reserves over the exchange rate cycle.

The Bank’s net open foreign exchange position has grown from $0.7 billion at 30 June 2007 to $4.4 billion at 30 June 2008.

Finally, the Bank diversified the currencies in which it holds its foreign reserves. The Bank added British pounds, Canadian dollars and Australian dollars to the Bank’s reserves currencies, and scaled back the proportion of reserves held in US dollars, euros and Japanese yen. The Bank’s net income can be expected to vary more in future due to volatility in exchange rates and interest rates. However, the Bank’s net open foreign exchange position is expected to be profitable, on average, over the long term.

The build up in the RBNZ's foreign currency intervention position over the 2007/08 year can be seen in the chart above.

Late 08, early 09

Following the collapse of US investment bank Lehman Brothers in September 2008, the Reserve Bank bought New Zealand dollars over the five months of November (bought a net NZ$131 million) and December (NZ$53 million) 2008, and January (NZ$357 million), February (NZ$327 million), and March (NZ$393 million) 2009, when it bought a net NZ$1.261 billion.

You can see from the chart above, there was a brief spike in the TWI over January 2009 (to as high as 58.6) before it fell away again to a low of 51.1 in early March 2009. The New Zealand dollar began rising again in March 2009.

Again, there was no media release from the RBNZ that it had intervened to support the New Zealand dollar. Instead, in his governor's statement in the RBNZ's 2008/09 annual report, Bollard said:

We began the year with a large foreign exchange exposure, partly due to our intervention in 2007 when we signaled that the exchange rate was then over-valued. We have unwound some of this exposure over the past year.

In that annual report, the RBNZ board made this comment about the RBNZ's foreign currency position:

As described above, the Bank’s balance sheet has expanded over recent years, in part to ensure appropriate financial system liquidity during the current period of international financial distress. This balance sheet expansion has led to greater risks for the Bank to manage with regard to its own exposures.

In addition, the Bank’s change in 2007-08 to adopting, as its neutral position, an exposed foreign exchange position on its balance sheet (to give it greater ability to respond to foreign exchange market volatility) and its starting position in July 2008 of a greater than neutral foreign exchange position following the interventions of 2007-08, has led to heightened financial exposures.

Over 2008-09, these positions have resulted in a net favourable financial outcome for the Bank.

Given its heightened financial exposures, the Bank and the Board have reviewed the desired equity position for the institution and reviewed the nature of the Bank’s dividend policy. With agreement of the Minister of Finance, a new dividend policy has been adopted that essentially distributes gains realised in New Zealand dollars over and above those required to ensure that the Bank retains a sound equity position. The Board is comfortable with the Bank’s planned equity position and with the new dividend policy.

On its foreign reserve position at the end of the 2008/09 year, the annual report included these comments:

Overall returns from foreign reserves have been relatively strong this year, largely because the weaker New Zealand dollar increases the New Zealand dollar value of our foreign currency investments, while the value of the New Zealand dollar liabilities funding those assets has remained unchanged.

To some extent, these foreign exchange gains have been offset by higher ongoing carrying costs of holding reserves, reflecting the move from higher-yielding bank paper to lower-yielding but more liquid government/supranational investments. Foreign reserves profitability relative to benchmark has been strong this year as the New Zealand dollar has fallen while the Bank was holding an open foreign exchange position larger than the SDR 1000 million benchmark position, meeting our key performance indicator on the returns on foreign reserves. The Bank moved to reduce the size of its foreign exchange position and realise some gains last year, once the New Zealand exchange rate fell to lower levels.

Early 2010

From March 2009, the New Zealand dollar began its long upward cycle.

The Reserve Bank bought large amounts of New Zealand dollars in the four months of February (bought NZ$320 million), March (NZ$199 million), April (NZ$1 million) and May (NZ$299 million) 2010, buying a net NZ$749 million during the period.

The RBNZ's 2009/10 annual report provides a more comprehensive account of the bank's foreign exchange transactions than the previous reports:

The Bank’s foreign currency operations have also tended to revert towards more normal levels as offshore market conditions improved over 2009-10.

• The asset composition of our foreign currency asset portfolio has remained stable and is still dominated by liquid holdings of government securities and the short-term debt of AAA-rated near-government and supranational entities.

• The overall level of foreign reserves has remained broadly unchanged. (Graph 4).

• However, we changed the balance between hedged and un-hedged reserves over the year, moving to a greater proportion of hedged reserves.

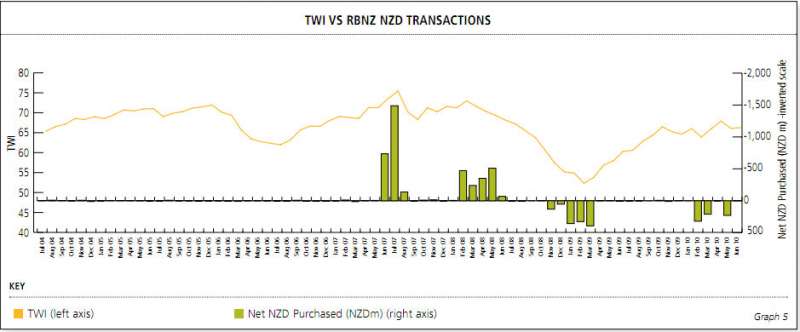

• Consistent with this shift, we bought New Zealand dollars and sold un-hedged foreign reserves, thus reducing our open FX position back towards our medium-term benchmark level of SDR 1000 million (approx NZD 2200 million). (Graphs 4 and 5).

• This reflected our judgment that FX markets had improved and that the worst of the global financial crisis was likely behind us.

The Bank’s foreign reserves function recorded a financial loss over the year, reflecting a couple of key factors:

• Revaluation losses on the Bank’s stock of long-term foreign currency-denominated loans that finance its hedged foreign reserves. During the global financial crisis, long-term foreign currency financing became much more difficult to obtain.

This meant that entities like the Bank that had prepositioned for market disruption by previously borrowing long-term FX received windfall gains as new borrowing costs rose in the more difficult financing conditions during the crisis. In 2009-10, funding conditions improved as borrowing costs fell, resulting in previous windfall gains being reversed and revaluation losses being recorded on the Bank’s long-term FX loans in the current financial year.

• Revaluation losses on the Bank’s stock of un-hedged reserves as the NZD exchange rate recovered from its crisis-induced depressed levels. The higher NZD exchange rate this year partially reversed some of the gains on un-hedged reserves that had resulted as the exchange rate depreciated in late 2008-early 2009.

These more recent revaluation losses reflect the inherent volatility that the Bank faces on its un-hedged reserves.

In aggregate, the magnitude of the revaluation losses on foreign reserves this year is within the range of what might be expected, given the structure of the Bank’s balance sheet. The Bank is adequately capitalised to manage this variability. While the Bank has recorded a loss this year relative to its internal benchmark for foreign reserves, in aggregate the Bank remains well ahead of its benchmark over the last few years.

And here are the two charts that accompany that commentary:

A look at the chart below shows the TWI trending upward throughout 2010.

Second Canterbury earthquake

Which brings us to early 2011.

You can see in the RBNZ's 'Graph 4' above that its unhedged level of foreign currencies has been returning to its benchmark of 1,000 SDRs or NZ$2.2 billion.

The latest 'intervention' we know about is a net purchase of NZ$525 million during the month of March 2011. This followed the devastating Christchurch earthquake on February 22 which shook domestic confidence. The RBNZ responded by cutting the Official Cash Rate by 50 basis points on March 10. The TWI hit its most recent low of 63.4 on March 17. Since then it has shot up to as high as 75 on August 1.

This article will be updated later today following the RBNZ's June figures on currency market actions, and with what to possible expect from the bank in the future.

No chart with that title exists.

This article was first published in our email for paid subscribers this morning. See here for more details and to subscribe.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.