Summary of key points: -

- Three alternative scenarios for the US Dollar on Wednesday’s US election result

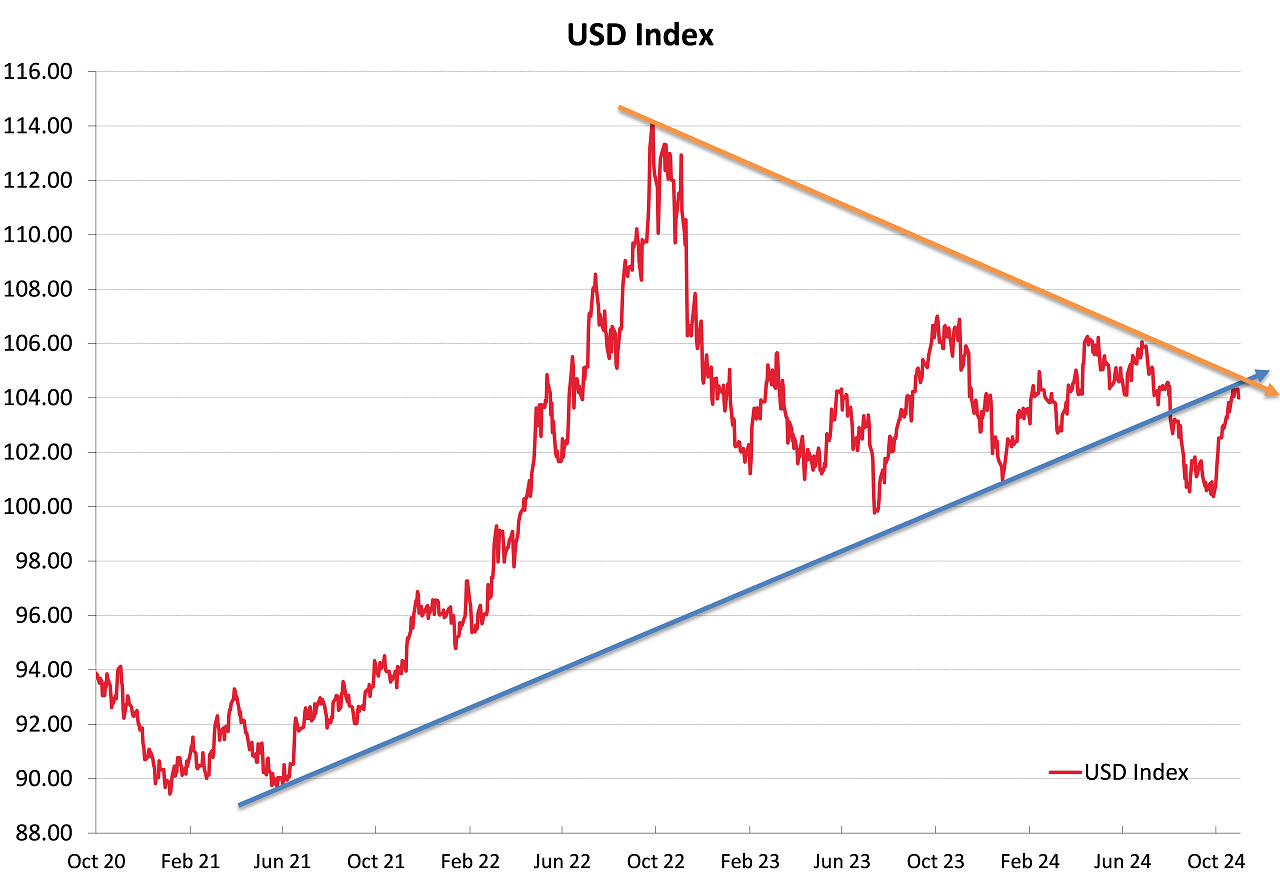

- US Dollar Dixy Index sitting at a critical juncture point on the charts

- Why do the financial markets react so willingly to distorted US jobs data?

- Interest rate cuts in Australia much further away

Three alternative scenarios for the US Dollar on Wednesday’s US election result

The permutations seem endless in respect assigning probabilities to the US Presidential Election outcome and what it all means for the US dollar, therefore in turn, the NZ dollar. What we do know is the US dollar has already appreciated 3.70% over the last month in the lead up to the election as currency speculators have laid down their bets that Donald Trump will win and that is positive for the US dollar. The Kiwi dollar is trading below 0.6000 at this time due to that speculative USD buying related to the expected election outcome.

What we do not know with any precision, is how much of the US dollar buying that could be expected after the election result on a Trump victory, has already taken place beforehand and therefore there is a reasonable chance that the US dollar will not appreciate that much after the election as the US Federal Reserve cut interest rates by 0.25% at every meeting over the next few months. Foreign exchange markets always build-in expected future conditions/events into the currency price today, therefore more often than not they react the opposite way to what most would expect when the actual result is known. A stronger US dollar on an expected Trump win this Wednesday is by no means guaranteed, given all the speculative market positioning already in place.

The three most likely scenarios after the election on Wednesday are seen as follows: -

- 50% probability: No clear result on the day with the vote so close in the key battleground states that contested vote counts and recounts are the order of the day. In an environment of typical American pandemonium, confusion and incompetency that could go on for weeks to sort the election result out, it is difficult to see the US dollar strengthening when all it means is uncertainty for the economy and uncertainty for financial/investment markets. The FX markets would be reluctant to add new speculative positions in this situation, any related USD buying or selling may delayed for weeks/months until the final result is confirmed.

- 25% probability: A clear-cut Trump victory, which may see a significant amount of immediate profit-taking by the FX punters who are already long the USD i.e. USD selling. However, history would tell us that higher inflation and trade wars from Trump’s import tariffs policy is a positive for the US dollar. The question is whether the master showman and salesman can pull it off.

- 25% probability: A clear-cut Harris victory for the Democrats, which provides a much clearer picture for consequential FX market reaction. The US dollar would weaken potentially right back on the USD Dixy Index to where it came from a month ago i.e. 100.50 (currently 104.24). The USD selling emanating from the fact that there will be no additional tariffs and no global trade wars under a Harris Presidency. The NZD/USD exchange rate would be propelled back above 0.6000 to well above 0.6200 in this scenario.

Local FX risk managers should not be making any hasty hedging decisions over the next few days ahead of the election result, hedge portfolios should already be positioned for all three scenarios.

Whatever the election outcome, financial markets will be in for a ride wild of volatility.

US Dollar Dixy Index sitting at a critical juncture point on the charts

Over the last month the US dollar has appreciated from 100.50 to 104.24 on the Dixy Index on the back of the FX “Trump Trade”. The currency speculators, in anticipation of a clear-cut Donald Trump victory in the US Presidential Election this Wednesday, have bought the USD in advance of the election date. However, it was the much stronger than expected September US Non-Farm Payrolls jobs increase of 254,000 released a month ago that was the initial catalyst for the USD buying. Increasing US 10-year bond yields from 3.80% a month ago to 4.38% today has added to that upwards momentum in the US dollar.

Currently priced at 104.24, the USD Dixy Index has reached a critical juncture point on the technical charts (see below). The USD uptrend line (blue) currently intercepts the downtrend line (orange) precisely at the current 104.24 level. Is it entirely coincidental that the crunch point for the US dollar on the charts comes bang on the Presidential Election risk event that (depending on the result) could send the US dollar further higher or sharply lower. The US dollar’s sideways shuffle movement between 100.00 and 107.00 over the last two years may well be on its last legs. A retreat lower from 104.24 over coming days would confirm that the downtrend is still in train. A Kamala Harris win on Wednesday is likely to push the US dollar out of the bottom end of the channel to below 100.00. A Donald Trump victory may already be largely priced-in to the USD at 104.24, however further medium-term USD gains should not be ruled out on a clear-cut Trump win.

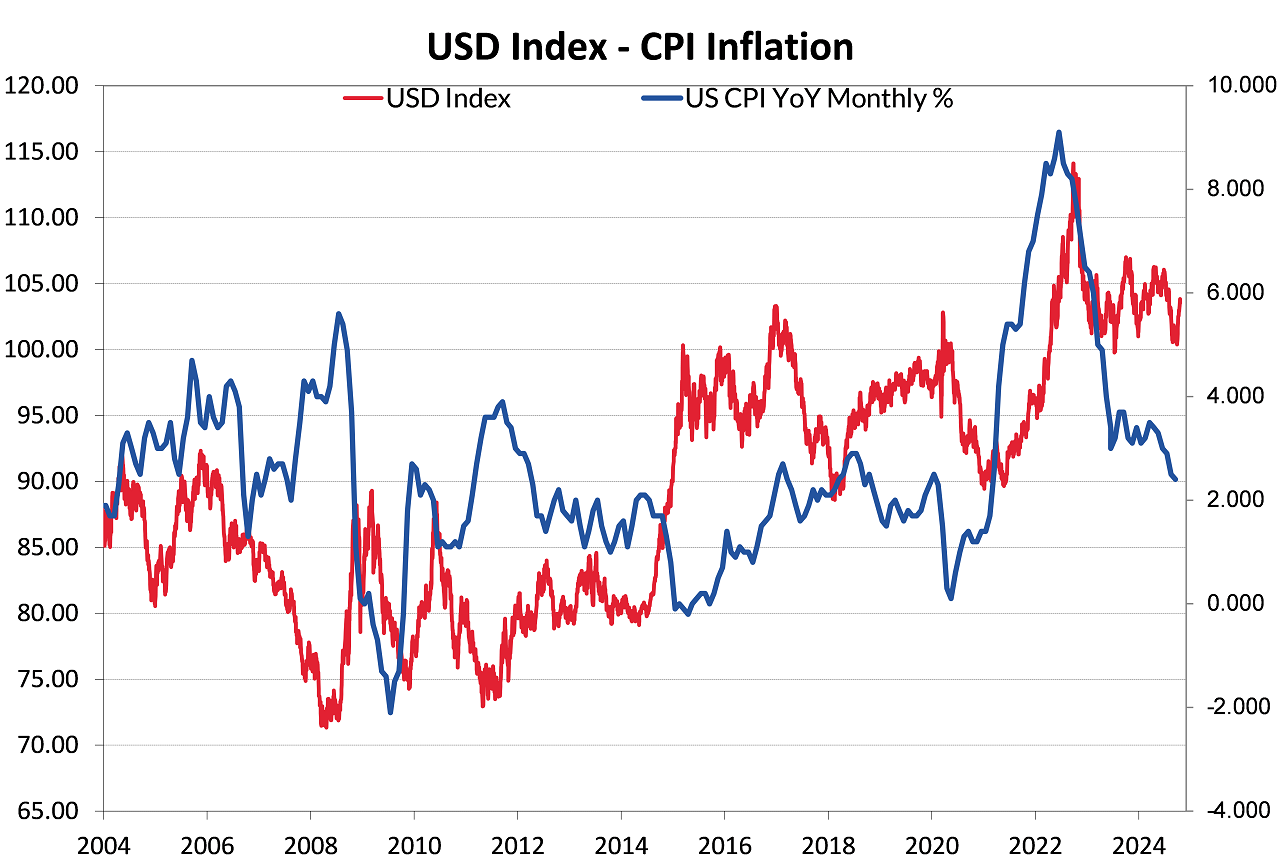

Whilst the FX and bond markets have worked themselves into a tizz in the lead up to the Presidential Election (stronger USD and sharply higher bond yields), the economic reality is that US inflation continues to decline to the Fed target rate of 2.00% per annum. For most of the last two years the FX and bond markets have displayed serious doubts about whether US inflation would continue to reduce. The inflation data over recent months should have totally squashed those doubts, therefore outside a clear cut Trump victory, the economics point to further US dollar depreciation below 100 on the Dixy Index.

Over the last 20 years, each time US annual inflation is at or below 2.00% the subsequent lower interest rates cause the US dollar value to be closer to 90.00 than 100.00 on the Dixy Index (refer chart below).

Why do the financial markets react so willingly to distorted US jobs data?

For many years, the monthly Non-Farm Payrolls measure of new jobs added in the US economy has been the preeminent signpost for the financial and investment markets in terms of economic growth, wages/inflation pressures and therefore interest rate direction. Over the last 12 months, massive subsequent revisions downwards to the numbers of jobs first reported and the volatility of outcomes from month to month have seriously dented the accuracy and credibility of the employment data.

Last Friday’s miniscule 12,000 increase in jobs for the month of October was clearly distorted by hurricanes and worker strikes (loss of 44,000 jobs). However, we have again seen large downwards revisions in prior months’ figures with September cut from 254,000 to 223,000 and August slashed from 159,000 to 78,000. Confident commentaries after the high September increase talked about a continuing “robust” US labour market. That is not the case as the latest data confirms. What job increases we have seen over the last 12 months is totally dominated by the healthcare and government sectors. Increased US Federal Government spending (debt financed) under Bidonomics policies has created most of those job increases. Similar to the recent September quarter’s GDP growth of 2.80%, most of the growth is coming from Government fiscal expansion. The US economy, is to a considerable degree, living in a “Fool’s Paradise” of Government borrowing to pay the grocery bills. Grant and Jacinda could tell you all about that!

The second monthly measure of employment in the US economy is the household survey that the unemployment rate is calculated from. The October household measure recorded 368,00 fewer jobs and the labour force contracting by 220,000. The US labour market is weakening; however, the markets seem reluctant to accept that.

Give the evidence of a softer underbelly to US employment trends, it is very perplexing and surprising that the sell-off in US 10-year bond yields, on the distorted September jobs increase a month ago, has continued over recent days. In propelling bond yields up to 4.38% the bond market is either expecting rising inflation (not the case) or larger US Government fiscal deficits and greater supply of new bonds in the future to fund the shortfall (highly likely). The current pricing seems more related to a Trump Presidency delivering higher inflation and larger fiscal deficits from tax rate cuts. The higher bond yields effectively tighten US monetary policy when the Fed are busy loosening policy. Something has to give!

Interest rate cuts in Australia much further away

Whilst the official Australian CPI inflation reading last week for the September quarter confirmed a sharp decline in the annual rate from 3.80% to 2.80%, the reality is that inflation is still 3.80% if you remove the temporary Government electricity price subsidy that distorts the figures. The Reserve Bank of Australia have removed the electricity subsidy from their inflation forecasts.

If it was not for this latest bout of “Trump Trade” US dollar appreciation, the Australian dollar would be over 0.7000 to the USD today, based on the shift in the timing of market interest rate pricing for cuts from December to April 2025. Australian jobs growth remains unbelievably strong, iron prices have lifted on Chinese economic stimulus and the gold price is through the roof. The lucky country looks pretty lucky at this time and the Aussie dollar would normally be soaring higher on favourable interest rate differentials and sound economic performance.

If Kamala Harris does win the US Presidential Election, the Australian dollar still appears to be the standout currency that has all the ingredients to make major gains against the weakening US dollar.

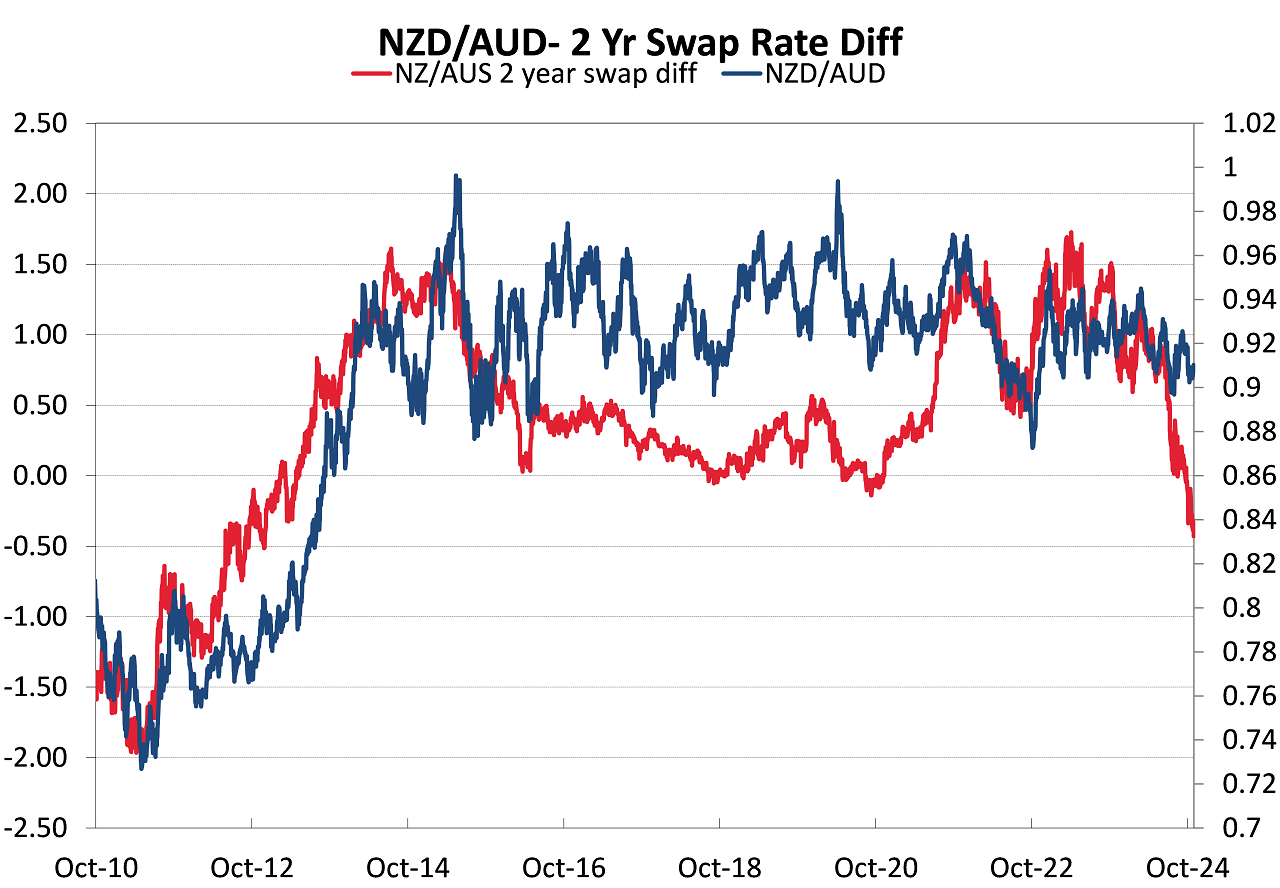

With the Reserve Bank of New Zealand cutting our interest rates again on 27 November and the Aussies not cutting until April/May 2025, the NZD/AUD cross-rate appears destined to move below 0.9000 over coming months. The interest rate differential between the two countries have moved demonstrably in favour of the AUD outperforming the NZD against the USD, therefore a lower NZD/AUD cross-rate (refer chart below).

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.