Summary of key points: -

- What the US Presidential Election outcome means for the US Dollar

- Why wouldn’t Kiwi spirits be lifting?

- Oil prices and the USD – why have they diverged?

What the US Presidential Election outcome means for the US Dollar

With the US Presidential Election Day now only days away on Tuesday 5th November and 26 out of 50 states already voting by postal ballot, it is time to examine some scenarios of the potential outcomes and discuss what it means for the direction of the US dollar currency value: -

Scenario 1: Clear-cut victory for Republican Donald Trump

During the election campaign Trump has been reluctant to talk about the economy, favouring illegal immigration as his primary rallying call. He criticises the Democrats for high inflation, conveniently forgetting that inflation has tumbled from 8.00% to 2.00% over the last 18 months in the US. However, a Trump win would, according to the titans of Wall Steet, deliver stronger economic growth as corporate and personal income tax rates are cut. Just how the US Government can cut taxes when their internal Government budget deficit and Government debt levels are already at record high and crippling levels is beyond belief. Trump will also increase tariffs on imported goods by 10%, 20%, 100% or 500%, depending on what day it is and where he is holding a rally! According to the real estate tycoon, who supposedly knows something about economics, the income into the Government from the tariff increases will offset the tax cuts.

The foreign exchange markets are poised to buy the US dollar against other major currencies on a Trump victory as they see a stronger US dollar emanating from higher inflation (due to tariffs on imported goods) forcing higher interest rates and they also see retaliatory trade wars. The US dollar appreciates when there is uncertainty in the world’s trading environment caused by tariffs and counter-tariff measures. Under Trump, the US would be ripping up free trade agreements and adopting an isolationist economic policy of “America First”. Trump wants to impose tariffs on imported goods as he sees it bringing manufacturing and jobs back to the US from China/Asia. The evidence from the 2017 to 2020 period of Trump’s first term as President, was that higher import tariffs did not cause manufacturing in the US to increase, it actually contracted as manufacturing plants in the US import component parts from all over the world and they become uncompetitive due to the tariff/cost increases on those component parts. The Trump tariff policy is fundamentally flawed, as the increased consumer goods prices to US households does a lot more damage to the economy than any perceived gains in US manufacturing jobs.

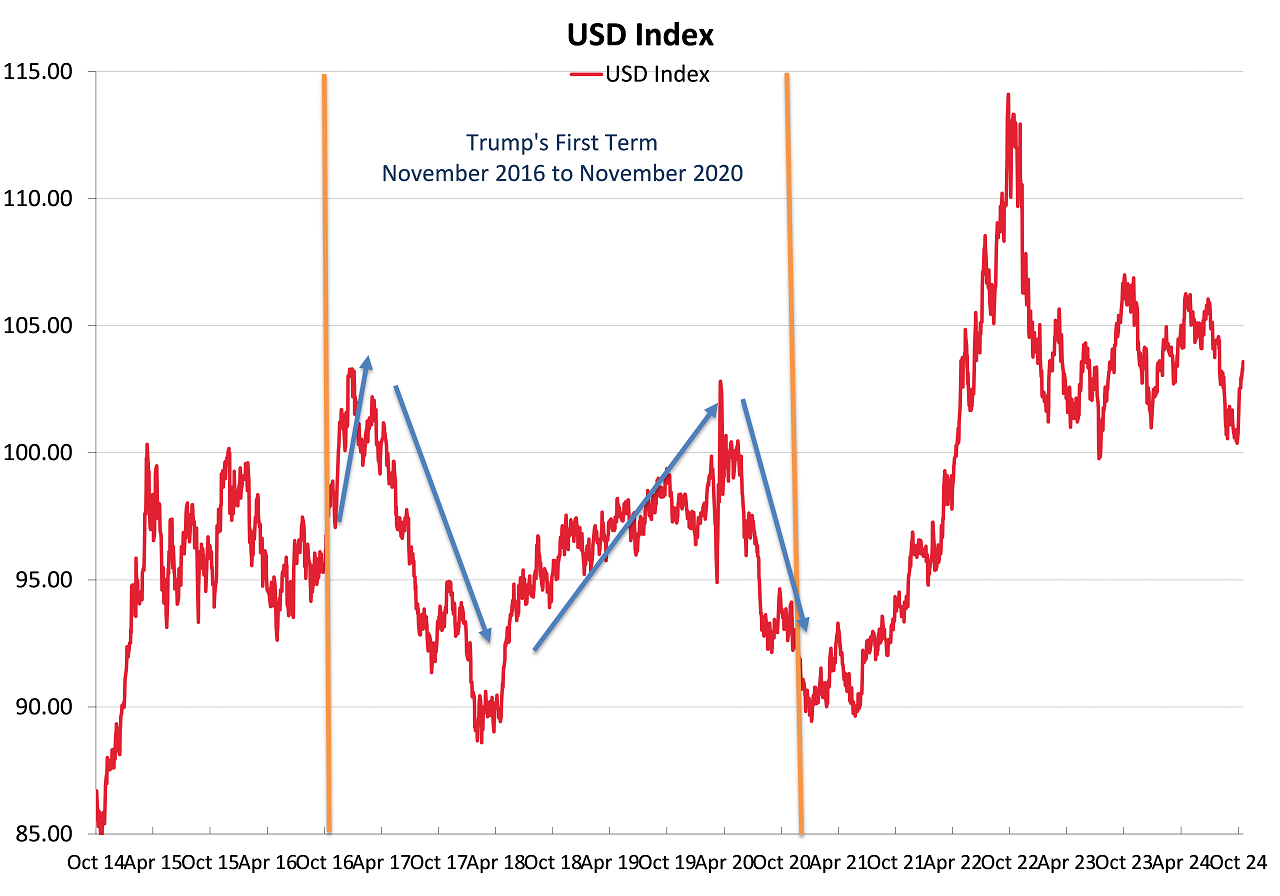

The historical evidence that the US appreciates under a Trump Presidency is not all that convincing. As the chart below of the USD Dixy Index displays, after some initial USD gains in late 2016 after Trump was elected the US dollar depreciated through 2017 as the US economy underperformed others. The US dollar recorded gains from 90 on the Index to above 100 through the year of 2018 as US interest rates increased. However, the USD fell away again in early 2020 as the Covid pandemic hit the world and the Fed slashed US interest rates.

The end result for the US dollar’s performance through the first Trump Presidential term of November 2016 to November 2020 was a complete mixed bag of two time periods of USD gains and two time periods of USD losses.

Whilst FX risk managers should expect immediate USD appreciation (the NZD/USD exchange rate forced below 0.6000) under the scenario of a clear-cut Trump win, to USD gains may be relatively short-lived. Foreign investors into the US economy, like the Chinese and Japanese sovereign wealth funds holding US Treasury Bonds, are more likely to be selling out of US assets as the US turns it back on the rest of the world.

Scenario 2: Clear-cut victory for Democrat Kamala Harris

A Harris victory on 5th November would not be so positive for the US dollar value as all those currency market punters sitting on long-USD positions in expectation of a Trump victory are forced to sell their USD’s. Under a Harris Presidency the import tariffs would not be increased, therefore avoiding a global trade war. Corporates and fund managers around the world who had positioned for a stronger USD on the possibility of trade wars would rapidly unwind their positions, selling the USD in doing so. The Harris Democrat administration would be expected to continue all the Government spending programmes put in place under the Bidonomics economic policy regime, therefore no respite for the ever increasing fiscal/budget deficit and Government debt levels. The absence of tax cuts would be net negative for US economic growth, allowing earlier/larger US interest rate reductions by the Fed in early 2025, which in turn is bad news for the US dollar.

It pays not to read too much into the performance of the US dollar through the 2020 to 2024 years of the Joe Bidon Presidency. The strong gains from 90 to 115 on the USD Index in 2021 and 2022 coming directly from the Fed rapidly increasing US interest rates as they realised the inflation increases at the time were not “transitory”. The US dollar has traded in a 100 to 106 range over the last two years, as up until very recently the financial markets were not convinced that US inflation would reduce to 2.00% and stay there.

Through the months of September and October the gap in the polls between Trump and Harris in both the national poll and the seven key battleground/swing state polls for the electoral college votes has barely changed. Harris still holds tiny gains of less than 1% in Wisconsin, Michigan, Nevada and Pennsylvania, whilst Trump is ahead in North Carolina, Georgia and Arizona.

Over the last two weeks of the campaign, expect to see the Harris team roll out the Obama Royalty pairing to garner last-minute support in the key states. Trump is using billionaire Elon Musk for support. Elon is offering Pennsylvanian voters $100 each if they sign a pro-Trump petition for free-speech and the right to bear arms (US citizens already have this??). Unfortunately, Elon is something of a weird individual like Trump, he is not a great orator and clearly has not informed Trump that more than half of Tesla’s cars built globally are manufactured in Shanghai!

A clear-cut Harris win on 5th November would likely send the US dollar value below 100 on its Index, pushing the NZD/USD exchange rate up to the 0.6300/0.6400 region.

Scenario 3: No winner can be announced on the night as ballot boxes are missing!

Such a scenario should not be discounted, as only in America can bureaucratic incompetency disrupt the democratic process and lead to utter pandemonium. It would be difficult to see the US dollar appreciating in the markets on such a “unknown result” and the uncertainty that would result.

Whatever the result, the outcome for the currency markets is binary on 5th November. With that particular “event risk” over, the markets will quickly move on to the next piece of economic data and how that impacts the Fed, interest rates and the USD value. There is some interesting timing ahead of us, the next two important US economic data releases are the PCE inflation figures for September on Thursday 31st October and Non-Farm Payrolls jobs numbers for October on Friday 1st November. Soft results for both data sets would send the USD lower.

Why wouldn’t Kiwi spirits be lifting?

In economic and business terms, the “mood of the nation” could not be described as buoyant at the moment. However, consumer and business confidence is improving on the expectation of rapid interest rate cuts by the RBNZ.

In stark contrast, what is very buoyant for the general spirit and mood of all Kiwis is our success in the sporting arenas of the world: -

- Team Emirates New Zealand has successfully defended the America’s Cup yachting challenge in Barcelona, showcasing our technology, tenacity and tactical sailing nous.

- The White Ferns Woman’s cricket team won the ICC Woman’s World T20 final against the old foe, South Africa, tonight in the UAE.

- The Black Caps Men’s cricket team secured an historic test victory against India in Bengaluru.

- Kiwi Formula 1 racing car driver, Liam Lawson has started for the Red Bull junior team VCARB in Austin, Texas on Monday morning, New Zealand time.

With all this, and if the All Blacks smack Ireland, England and France on their rugby northern tour, Kiwi spirits should be sufficiently lifted to go into 2025 with renewed economic optimism. Coupled with rising rural incomes from higher export commodity prices, the chances of an export-led recovery in our economy in 2025 certainly start to increase.

Oil prices and the USD – why have they diverged?

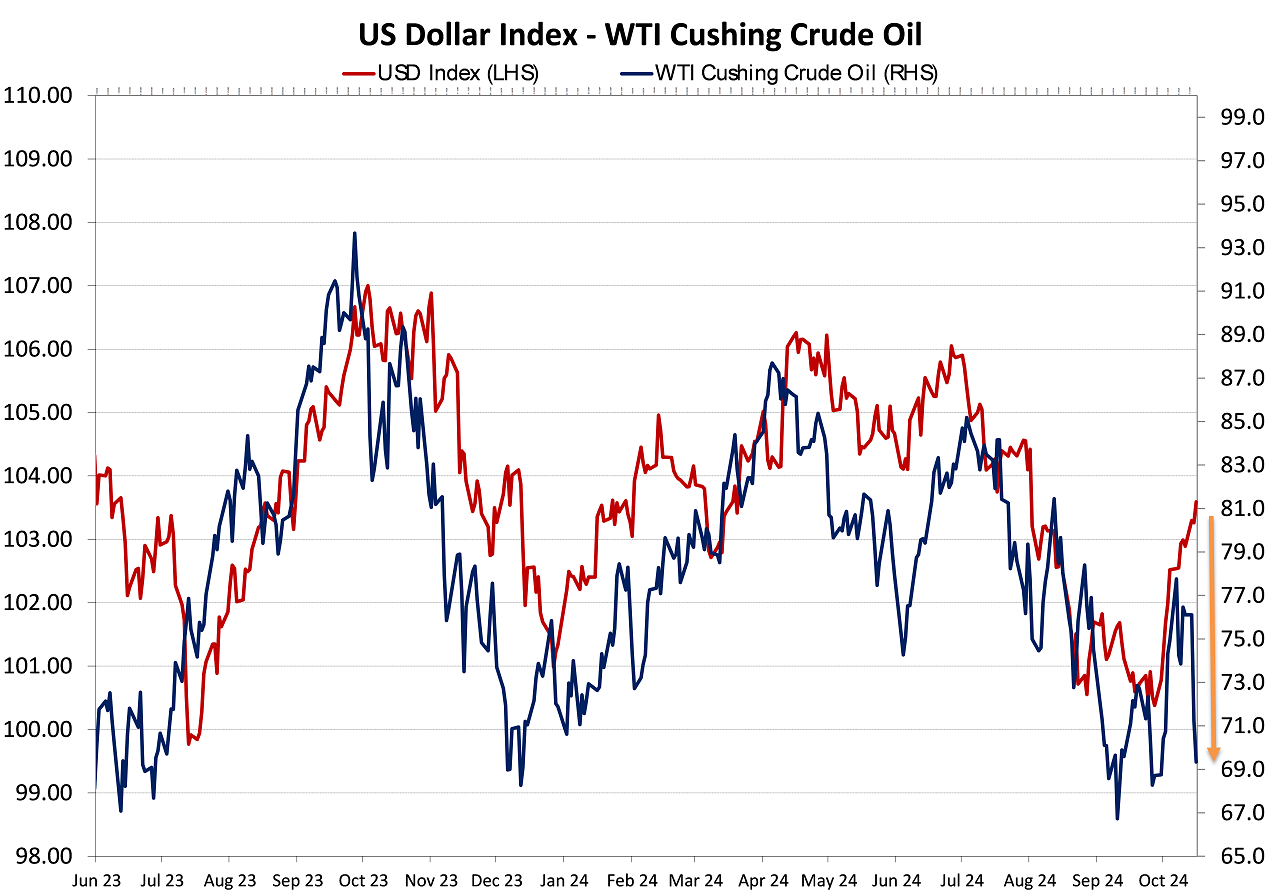

Over recent years the USD Currency Index has moved in tandem with oil prices (WTI – refer chart below). The rationale for the close correlation between the USD and oil stems from: -

- Lower oil price leads to lower US inflation, lower interest rates and thus a lower USD.

- Higher oil prices is typically the result of escalated Middle East war tensions and the disruptions to global oil supplies coming from that. Increased global geo-political risks always produce US dollar appreciation as funds seek a safe haven.

Oil prices jumped up from US$68/barrel to US$78/barrel over the first week of October when Iran fired their missiles at Israel. The USD Index followed oil prices higher.

Very surprisingly, Israel has not really retaliated (yet!) and oil prices over the last two weeks have retuned back down to US$69/barrel.

Given the tight correlation, it is odd that the US dollar has not followed oil prices lower. The close proximity of the US Presidential Election and the recent boomer US jobs number have the FX markets attention right now, outweighing prospects of lower US inflation and interest rates due to lower oil prices.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

Really good analysis. Nobody other commentator has covered the U.S. dollar possibilities so comprehensively.

I don't see the sport success making things buoyant for all kiwis. Very briefly perhaps.

For those struggling there is no rub from this success - for many just resentment.

And the Silver Ferns thrashed the Ockers

Sport is the opiate of the masses, a very useful distraction from what is really important

Kerr misses the obvious under Trump. Civil unrest. Pitting US citizens against each other will have consequences.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.