Summary of key points: -

- Kiwi dollar falls three cents in ten days

- Lower New Zealand inflation – good luck, or good management?

- Aussie economy and currency show their resilience

Kiwi dollar falls three cents in ten days

The Kiwi dollar has reversed dramatically downwards over the last two weeks, from a high of 0.6360 on 30th September to a low of 0.6055 on 10th October.

The first two cents of the sharp decline were directly related to a stronger US dollar on the world stage, initially an escalation in the Middle-East war and then a blockbuster jobs number for September in the US economy which pulled back the speed/extent of US interest rate cuts over coming months. The last once cent drop in the Kiwi over this last week from 0.6160 to the 0.6055 low, stemmed from the Reserve Bank of New Zealand’s (“RBNZ”) 0.50% OCR cut and accompanying dovish tone in the statement on Wednesday 9th October. The 0.50% cut was widely expected and fully priced-in to both interest rate and FX markets ahead of the RBNZ decision, so it was a little surprising to see the NZ dollar sold down one cent in response. It has since recovered to 0.6120 by Friday 11th October. The New Zealand specific related selling of the Kiwi dollar ahead of, and after the OCR cut was evidenced by the NZD/AUD cross-rate falling away from above 0.9200 on 30 September to below 0.9020 on 9th October. The Kiwi significantly underperforming the Aussie dollar against the USD. No surprises there, as we are aggressively cutting interest rates, and the Aussies are holding their rates stable. Local AUD exporters with orders for new hedging placed at 0.9050 and 0.9025 spot entry levels have been rewarded for their patience.

There was no forward guidance from the RBNZ on further interest rate reductions, however many are expecting another 0.50% reduction in the OCR to 4.25% at the 27 November RBNZ Monetary Policy Statement. The RBNZ see the New Zealand economy as weak with spare capacity and the global economy not much better. Their commentary on the US and Chinese economies appeared somewhat out of date. We have seen a massive Chinese monetary stimulus in recent weeks and therefore the comment “economic growth in the United States and China is expected to slow” may prove to be wide of the mark with both the US and China slashing interest rates.

The question for local interest rate markets and the Kiwi dollar is whether the RBNZ will deliver future OCR interest rate cuts in accordance with the current forward pricing which has the OCR reducing to below 3.00% over coming months? As always, that depends on the upcoming economic data. Will the New Zealand economy continue to weaken, which appears to be where the RBNZ are coming from? Or will the prospect of lower interest rates and improving export commodity prices lift activity levels in the final months of 2024 and into 2025? Continuing weaker data results will see earlier and larger cuts by the RBNZ and therefore individual NZD depreciation over and above what the USD is doing against the major currencies. Some improvement in the data may lead to NZ interest rates reducing at a slower pace than US interest rates, and therefore neutral to positive for the Kiwi dollar on its own account.

Evidence so far is that the Kiwi dollar is holding above 0.6000 on this latest bout of US dollar strength from the Middle East and a rouge-looking jobs number. A return to the NZD uptrend (based on USD selling) is expected as the Fed will still be sticking to their plan of progressively cutting their interest rates. The surprise to everyone is that Israel has not yet retaliated to the Iranian missile attack. Rest assured, the reprisals will come, so further bouts of USD strength cannot be ruled out over coming weeks/months.

Lower New Zealand inflation – good luck, or good management?

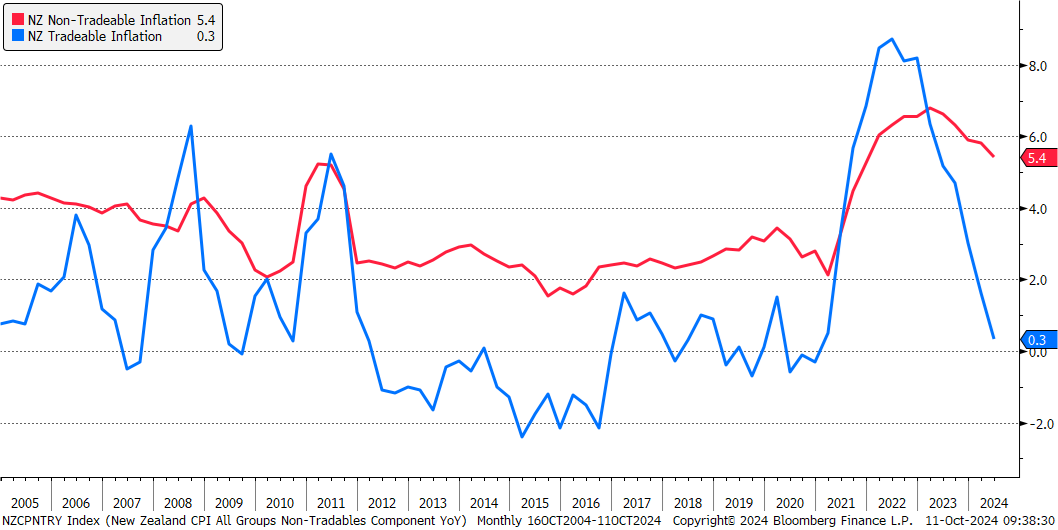

The first piece of economic data to answer the question on the Kiwi’s future direction from local factors will be this week’s CPI inflation figures for the September quarter. Consensus forecasts range from +0.70% to +1.00% for the quarter, the likely outcome is +0.90%. The annual rate for tradable inflation is likely to decrease to below 0.00%, aided by a 20% drop in crude oil prices over the quarter. It is always tradable inflation (imported goods) moving up and down that drives the overall inflation rate in New Zealand. As the chart below confirms, over the last 20 years domestic/non-tradable inflation has been remarkably stable, averaging at over 3.00% per annum increases. Low overall inflation rates from 2013 to 2019 were achieved by low or negative tradable inflation, which in turn, was caused by importing deflation on goods from China and technology/communication prices tumbling. Covid-related supply disruptions and strong consumer demand from 0.00% interest rates in 2020 and 2021 were behind the spike higher in tradable inflation in 2022. Likewise, it is again cheaper product prices out of China and lower oil prices that have sent tradable inflation to 0.00% in 2024. Inflation is falling rapidly, however it seems to be due to more good luck from offshore developments, than good monetary management here in New Zealand. Consumer demand has off course weakened off this year due to the higher interest rates, however the majority of the reduction in tradable inflation comes from supply side changes, not the demand side.

The continuing volatility in imported tradable inflation (up and down) causes monetary policy to swing from loose to tight to loosen again, causing more volatility in economic growth than would otherwise be the case if domestic/non-tradable inflation was more under control at lower levels. It also causes more volatility in interest rates and exchange rates, contributing to the boom/bust mentality and patterns that has become a feature of the New Zealand economy for many years.

Whilst there was a lot of hoopla and self-congratulatory back-slapping last week with the 0.50% OCR cut implemented on the success of reducing overall inflation much earlier than everyone thought, the reality is that the New Zealand economy still has a major problem with sticky/high non-tradable inflation from the public sector and non-competitive sectors of the economy. The September quarter’s non-tradable inflation increases for rents, house build costs, rates, electricity, medical costs, telecommunications and insurance will be a salient reminder that we do not have appropriate control over inflation as many would like us to believe. We just got lucky!

Looking ahead, there is a real risk that the offshore forces on inflation could turn against us again with increasing oil prices and commodity prices. As the Chinese Yuan strengthens against the weaker USD, Chinese manufacturing goods exporters will not be in the same position to discount their USD selling prices to our importers. In this situation tradable inflation starts to move up again and overall inflation increases. Without addressing and rectifying the underlying root causes of the consistent domestic/non-tradable price increases, New Zealand will always have a higher vulnerability and volatility with inflation control within the 1.00% to 3.00% limits.

The chart below aptly displays the larger volatile swings in tradable inflation compared to the consistent and stubbornly high non-tradable inflation over a 20-year period.

Aussie economy and currency show their resilience

Whilst the Kiwi dollar tumbled three cents in ten days, the Australian dollar was more resilient against the bout of recent USD gains. The AUD/USD exchange rate pulled back from 0.6900 to 0.6700, however has since regained some composure to 0.6750. The clear difference between NZ and Aussie is that the market sentiment has firmed up in Australia that they will not be cutting interest rates until well into 2025. Only two weeks ago, both the interest rate markets, and the Aussie economist fraternity were convinced the Reserve Bank of Australia (“RBA”) would be forced to U-turn and cut interest rates before Christmas. The view on that has changed abruptly.

Over recent weeks, the economic data releases in Australia have not exactly supported a weaker economy and less pressure on inflation: -

- The Westpac-Melbourne Institute Consumer Sentiment index jumped 6.20% month-on-month to a 2-1/2 year high of 89.8 in October, a sharp turnaround from a 0.5% fall in the previous month.

- The ANZ-Indeed Australian Job Ads rose by 1.6% month-on-month in September, reversing a downwardly revised 1.8% fall a month earlier and marking the first rise in eight months.

- Retail sales were stronger than expected for August, a 0.70% lift compared to prior consensus forecasts of no change.

Another strong employment increase for the month of September (released Thursday 17th October), on top of five consecutive months of increases between 35,000 and 47,000 new jobs, will be another good reason why the RBA cannot cut interest rates anytime soon.

On top of the more positive domestic economic data, the Chinese monetary stimulus has reversed the trend of iron ore prices (Australia’s largest export). Iron ore prices have moved up from a low of US$91.30/tonne in early September to US$106.40/tonne today. Copper commodity prices have also reversed out of their previous downtrend. The Chinese are even buying Australian lobsters again after a prolonged trade ban.

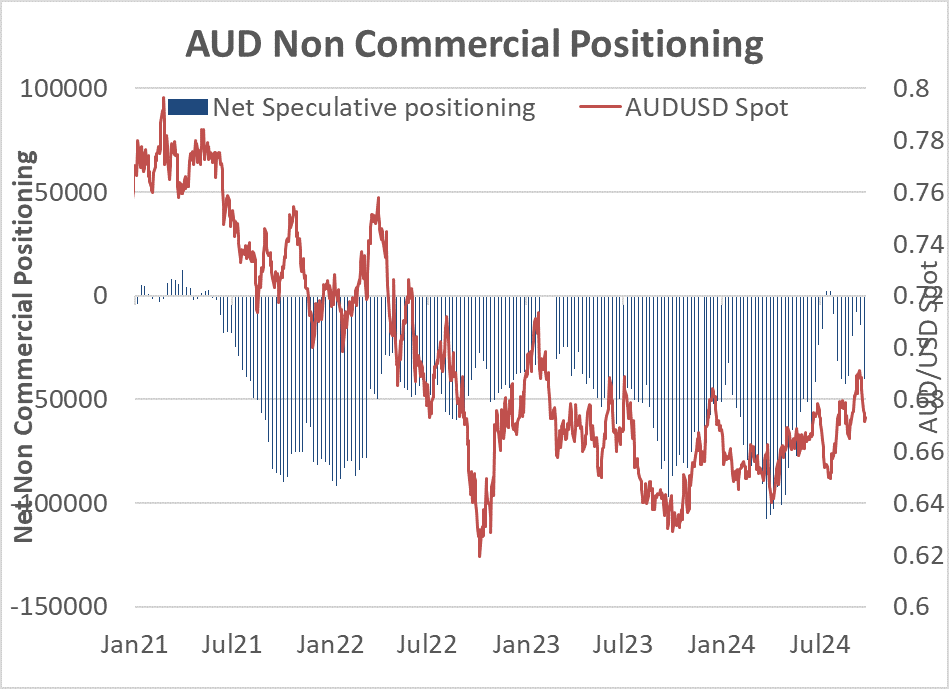

The recent closing up of the interest rate differential between the USD and the AUD has negated the rationale for currency speculators to short-sell the AUD and pick up the free forward points advantage. AUD short-sold speculative positions have reduced dramatically, paving the way for further Australian dollar gains against the USD. The gap in the two-year interest rate between the AUD and USD has closed from Australian rates being 1.00% below US rates just six months ago to near zero today.

All the economic and commodity price signs point to a quick recovery of the recent Aussie dollar losses and further appreciation of the AUD to above 0.7000 against the USD.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

14 Comments

Looking ahead, there is a real risk that the offshore forces on inflation could turn against us again with increasing oil prices and commodity prices

Yes, this does not bode well and this appears to be manifesting itself in longer term bond yields. The risks are certainly mounting.

" ... and this appears to be manifesting itself in longer term bond yields."

It is? Seems like normal to me. For example, if you overlay the post GFC 10 year US Treasury yield over what's happening now it looks about the same. I haven't done this for NZ govt bonds for a while. Is it different this time?

The first paragraph in the section titled "Lower New Zealand inflation – good luck, or good management?" contains some absolute gems. Seems Roger is thinking along the lines JFoe, myself and other.

"Inflation is falling rapidly, however it seems to be due to more good luck from offshore developments, than good monetary management here in New Zealand. "

Just about says it all really. NZ Inc. really needs a government with some gumption to address why all of NZ Inc. must suffer so much simply because oil prices are used to ramp up the returns for the owners of existing assets. (If you don't understand the 2nd half of that sentence, you haven't been paying attention.)

Answer is?

What are a couple of big policy changes that NZ should make - its a serious question.

Need to be able to sell them to the people (or at least enough voters to pressure change) so I would think that cause and effect need to be easy to associate

And that doesnt necessarily mean they need to be popular

Both Jfoe and I have proposed a system largely based on what's already in place, with a few tweaks.

It has numerous precedents in the 'producer boards' that used to operate in our primary sector to smooth the prices that our farmers get from selling produce overseas. And a few still exist.

In effect, the fuel taxes levied on all types of fuel are redirected (in part) to a fund. The fund invests the money. When we get an oil shock, the fund steps in and keeps the price stable, or rising gently, by cashing up some of the fund to reduce the fuel taxes government would otherwise have received. This keeps government revenue stable and keeps the money separate to government so they can't go off and spend it. We already have a similar scheme to handle natural disasters that's been around since 1945: Natural Hazards Commission

Sound like a plan?

Another aspect is reducing our demand for imported energy by producing much, much more of our own. Ya' know, like electrifying everything that we can and producing far, far more electricity than we currently do. This is obviously going to take time as it requires a change in government, splitting the gentailers into pure generators and pure retailers, asking some greenies to compromise, maybe encouraging solar on every rooftop, R&D into tidal, etc. etc.

Sound like another plan?

Note the first plan can be done quickly (6 months?) but the latter will be never ending. And eventually the former plan will get much smaller in size if the latter plan is gone at hell for leather.

Thanks

No problem. Pleased to have an opportunity to get this stuff out.

Any and all thoughts - for and against - would be much appreciated.

I fully agree!

Roger is right - we have yet again (or still) failed to deal with the cost drivers in our local economy

We might just get lucky again though as the deflationary pressures in China are strong - their local economy is relatively weak for known reasons but their production has remained relatively robust - so lots of things to sell and plenty in the stockpile

At the same time countries are making trade harder - tariffs new rules etc etc. One winner from this process is likely to be us - if you consider more and cheaper goods from China a win.

One side issue/caveat though - they currently have a surplus of milk in China and as they reduce their herd size probably a surplus of beef so more pressure on exports and our BOP (= upward pressure on interest rates?)

One would argue that the RBNZ sets the OCR on the Non-tradable inflation only to create some sense of consistent monetary policies. The NZ economy would most likely avoid those boom - bust cycles if the RBNZ would do so.

Sadly, this won't work. An oil-shock hammers all parts of NZ Inc. and inflation goes off on a tear.

Are you saying that the price of a thing that provides two-thirds of your energy might be a critical input cost for domestic prices? Wash your mouth out!

The incessant 'uncompetitive public sector' nonsense makes these articles hard to read to be honest. The country needs to use a decent chunk of its resources meeting the universal needs of the country. Constantly arguing for a greater share of those resources to be under private for-profit management gets a bit tiresome - not least because the evidence suggests that the promised benefits almost always fail to materialise. Unless we're talking about the benefits for rentiers of course.

The point on nontradable inflation is a bit odd. Our country runs on a model whereby house prices go up 5% a year, which enables private sector lending to expand by 4%, which supports profits and wages to increase by about 3%... all of this means that, unsurprisingly, domestic domestic prices go up by about 3% too.

You're welcome Roger. Now forgive me while I return to my current uncompetitive contract (as opposed to my last contract where I did the same thing but was apparently competitive because I was working for shareholders).

Touché! A hit. A most palpable hit. (Apologies to Shakespeare.)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.