Summary of key points: -

- The US dollar has further to fall as the Fed commence the interest rate cutting cycle

- Time for the Aussie dollar to shine?

- Are green shots emerging for the NZ economy?

The US dollar has further to fall as the Fed commence the interest rate cutting cycle

Confirmation that the US Federal Reserve are set to commence a cycle of significant interest rate reductions came in the form of a simple statement from Chair Jerome Powell “The time has come for policy to adjust”, speaking at the central banker’s jamboree in Jackson Hole, Wyoming last Friday. The keynote address from Mr Powell provided a clear direction of travel, however the timing of and pace of interest rate cuts, as always, depends on the incoming data, the evolving outlook, and the balance of risks.

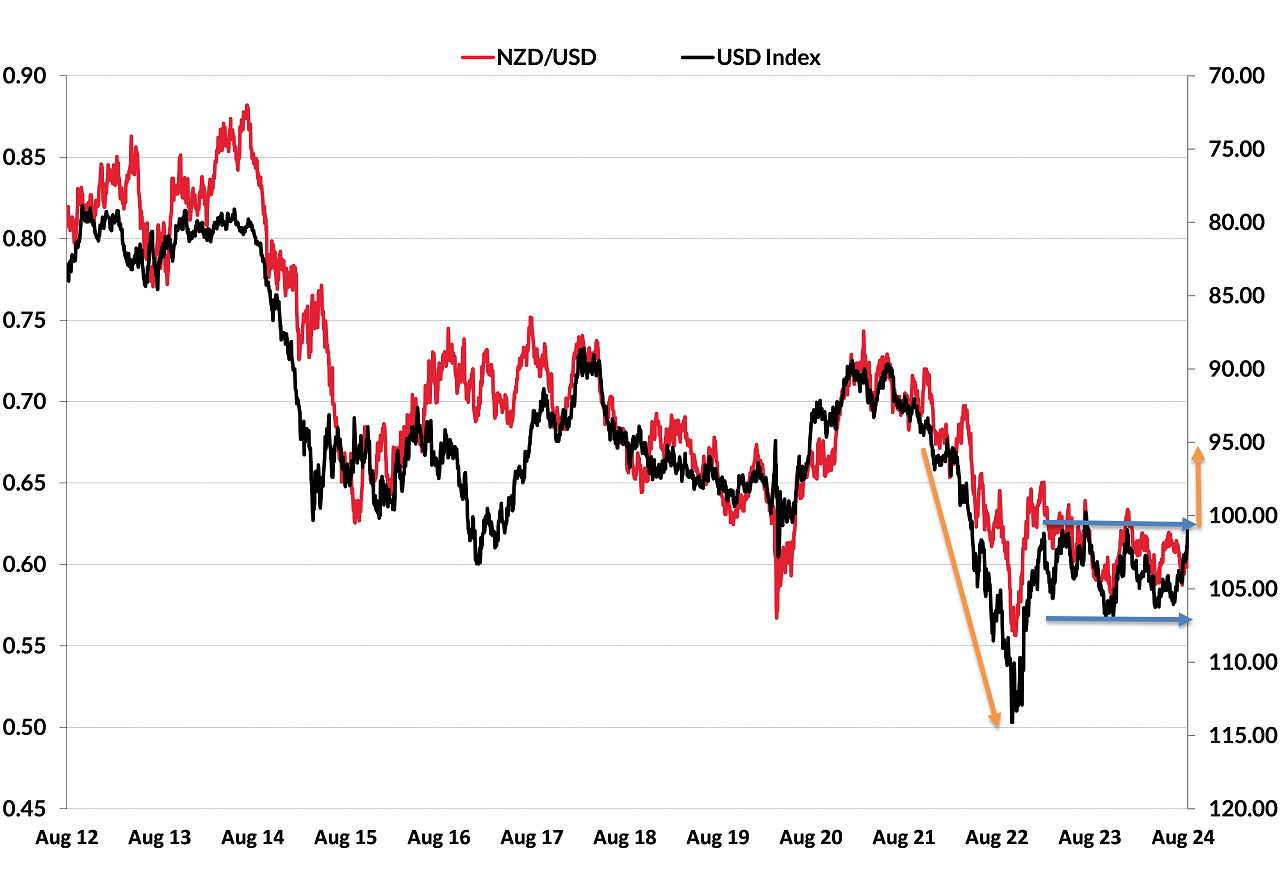

The reaction by the financial and investment markets to the confirmation was instantaneous with the equity markets higher, bond yields down and the US dollar value down in global currency markets. Over this last week the USD Dixy Index has depreciated further, tumbling from 102.30 to close at 100.60, its lowest levels since April 2022. The NZD/USD rate accordingly propelled upwards another cent from 0.6140 to 0.6240. When the Fed started to tighten monetary policy in early 2022 to combat their rising inflation the USD Dixy Index was sitting at 96.00. Over the course of the following nine months to September 2022, as the Fed Funds interest rate was shoved up to 5.50%, the US dollar appreciated by 19% to a high of 114.00. The NZD/USD exchange rate was driven lower by the stronger USD from 0.6700 to a low of 0.5600 over that nine-month period in 2022.

The reversal of the US dollar’s fortunes over the last 24 months has been much more protracted and uneven as the US economy held up better than expected in 2023 and inflation/jobs data was higher than forecast over the first three months of 2024. For most of the last two years the US dollar has traded up and down within a 101.00 to 106.00 channel on the Dixy Index as currency markets priced-in and then priced-out the timing and extent of the inevitable interest rate cuts. As a result, the NZD/USD rate traded within a 0.5900 to 0.6300 sideways channel. The equation has now been settled with the Fed on track to cut their 5.50% interest rates to 3.50% over the next 12 months. As a consequence of the Fed’s confirmation, the USD has dropped out of the bottom of the 101.00 to 106.00 channel. The USD has already depreciated 12% from its 114.00 high, however it has much further to go as global funds previously parked in the higher-yielding US dollar, return to their home currencies. A return of the USD Dixy Index to where it started from at 96.00 in early 2022 would see the highly correlated NZD/USD exchange rate another four cents higher to above 0.6600.

Several local economic commentators have been predicting a lower NZ dollar exchange rate to well below 0.6000 against the USD, due to New Zealand’s woeful economic performance and the RBNZ cutting our interest rates. Such forecasts have not been fulfilled as the forecasters fail to take into account what actually drives the NZD/USD exchange rates, which is the USD side of the currency pair. Since the RBNZ Monetary Policy Statement on 14 August the Kiwi dollar has appreciated from 0.6075 to 0.6240, all due to the US dollar depreciating against all currencies.

Softer than expected US GDP growth and PCE inflation figures, being released this Thursday night and Friday night respectively, look set to push the US dollar lower again to below 100 on the Dixy Index. The US interest rate markets are now pricing a 30% chance of a 0.50% first cut in interest rates when the Fed meets on 18 September. External forces are also pushing the USD value lower. The Bank of Japan are increasing interest rates at the same time as the Fed are cutting rates. Further appreciation of the Japanese Yen towards 130.00 (currently 144.40) seems highly likely, contributing to continuing USD weakness over coming months.

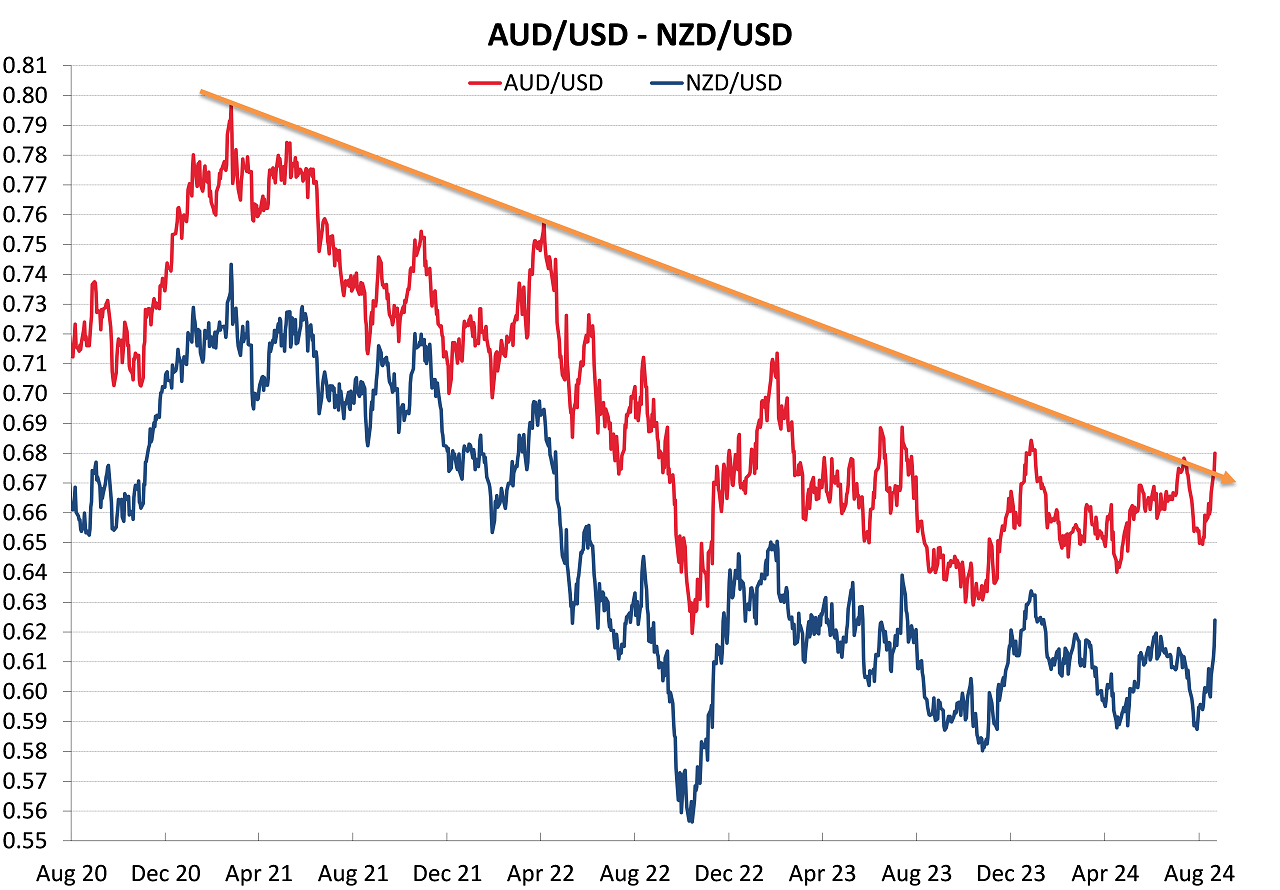

After the dominating USD Index influence over the NZD/USD exchange rate, the second major driver of direction is the AUD/USD exchange rate. The fact the NZD/AUD cross rate is today at 0.9175 (roughly its average level over the last 10 years) confirms just how highly corelated NZD/USD movements are to AUD/USD movements. The prime reason why the Kiwi dollar has been stuck in a sideways shuffle between 0.5900 and 0.6300 over the last two years is largely due to the Aussie dollar being unable to appreciate against the US dollar as Australian interest rates at 4.35% were 1.00% below those of the US. One can debate the success of the Reserve Bank of Australia’s (“RBA”) experimental monetary policy stance of not increasing their interest rates to higher levels to preserve jobs in their economy. Employment growth in Australia has been strong this year, so some success on that front. However, the big cost of the RBA’s approach has been their inflation rate remaining higher for a much longer period. As a consequence of the higher inflation and stronger labour market, the RBA will not be cutting their interest rates until at least February 2025. The interest rate differential to the US that has kept the Australian dollar at low levels over the last 24 months has now changed dramatically. Based on the AUD:USD interest rate gap closing up from 1.00% two months ago to zero today, the AUD/USD exchange looks destined to make further gains from the current 0.6800 level to above 0.7000 over coming weeks. The Aussie dollar has also broken above the downtrend line it has remained below since early 2021, another signal that further AUD gains are likely (refer to the chart below).

The risk to the view that the Australian dollar is poised to make strong gains, in a weaker US dollar environment, centres on iron ore prices. Iron ore prices have been falling to below US$100/per tonne as steel production in China slows down as they are overstocked. Further falls in iron ore prices to below US$90/per tonne would certainly hold the Aussie dollar back from making the gains the changing interest rate differential justifies.

Australian economic data to watch out for this week includes the Monthly CPI Indicator for July on Wednesday 28th August and Retail Sales for July on Friday 30th August.

Are green shots emerging for the NZ economy?

Amidst the doom and gloom cloud hanging over the recessionary New Zealand economy, several positive developments over this last week point to improvement ahead and perhaps we are not doing as badly as most project: -

- Whole milk powder dairy commodity prices jumped 7.20% higher to US$3,482/MT at last week’s GDT auction, resulting in Fonterra lifting their milk price for this season to $8.50/kg milk solids.

- Job adverts increased in July by 3.00% month-on-month, the first increase in five months.

- Credit rating agency, Fitch affirmed New Zealand’s AA+ sovereign credit rating, providing a vote of confidence in the Government’s fiscal plan. The risk of a credit rating downgrade pushing the NZ dollar lower was never considered to be very high, as our export commodity prices (logs and lamb excepted) remain at elevated levels. If our export prices were plummeting a credit rating downgrade would be more likely. That is not the case.

Interest rate reductions in New Zealand coming much earlier than generally expected has certainly lifted the spirits of late. How soon that transfers into stronger business investment and GDP growth remains to be seen. However, there are positive signs of an export-led economic recovery in 2025.

Daily exchange rates

Select chart tabs

*Roger J Kerr is Executive Chairman of Barrington Treasury Services NZ Limited. He has written commentaries on the NZ dollar since 1981.

5 Comments

Looks like both the AUD and the NZD have both broken out of the channel. This just gives even more room here for bigger rate cuts. Could see a 50bps cut coming up next for us. My prediction is for a 50bps cut in October now and if the FED drops in September its a given.

Thank you Roger Kerr for the excellent analysis.

Numerous cuts expected and will need to take place to settle the overballoned markets... 50bps cut first, easily, followed by subsequent 50 and 100bps cuts w/out questions. Buckle up, folks!

Is this good or bad?

Good for importers, bad for exporters, i get that.

more room for rate cuts? i assume that's good.

What about the stability of the economy?

Job adverts increased in July by 3.00% month-on-month, the first increase in five months.

No green shoots in the job market I'm afraid. June was a shocker for job adverts, and July was actually much worse.

June had 18 working days (2 public holidays) and July had 23 working days, so July was 28% (working days) longer, a whole five day working week longer than June.

3% more job ads in a 28% longer month represents withering job adverts.

TradeMe Jobs for example is currently showing 9,487 jobs, down by 55% from their 22,000 peak a couple of years ago.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.