depositors

Reserve Bank says new bank capital requirements will see interest rates paid to depositors 'fall slightly'

18th Dec 25, 8:30am

Reserve Bank says new bank capital requirements will see interest rates paid to depositors 'fall slightly'

How the Depositor Compensation Scheme addresses moral hazard

16th Jun 25, 12:08pm

How the Depositor Compensation Scheme addresses moral hazard

Who pays for the Depositor Compensation Scheme?

PIEs more prominent as RBNZ issues Depositor Compensation Scheme product hierarchy policy following consultation

9th Jun 25, 7:30am

PIEs more prominent as RBNZ issues Depositor Compensation Scheme product hierarchy policy following consultation

Why the Reserve Bank is developing a Depositor Compensation Scheme product hierarchy policy and what it would mean

30th Apr 25, 5:00am

4

Why the Reserve Bank is developing a Depositor Compensation Scheme product hierarchy policy and what it would mean

CEO 'very comfortable' Westpac NZ's not making 'inappropriate profits' from money customers 'inadvertently leave in the wrong account'

27th Mar 25, 12:00pm

1

CEO 'very comfortable' Westpac NZ's not making 'inappropriate profits' from money customers 'inadvertently leave in the wrong account'

Simon Jensen calls for a more internationally orthodox, and less conservative, approach to prudential regulation from the Reserve Bank

21st Mar 25, 9:20am

4

Simon Jensen calls for a more internationally orthodox, and less conservative, approach to prudential regulation from the Reserve Bank

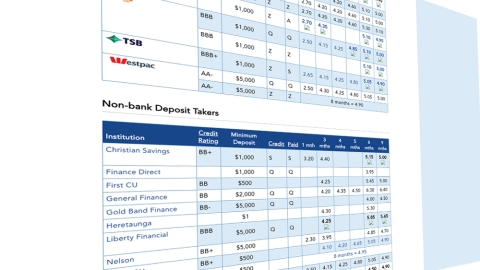

Non-bank deposit takers will be included in the Deposit Compensation Scheme starting in mid-2025. Our rate tables now identify these regulated financial institutions

13th Dec 24, 5:56am

11

Non-bank deposit takers will be included in the Deposit Compensation Scheme starting in mid-2025. Our rate tables now identify these regulated financial institutions

Whilst the push for greater bank competition is good news, it may also come with increased risk

28th Oct 24, 6:00am

22

Whilst the push for greater bank competition is good news, it may also come with increased risk

Deposit insurance expert Geof Mortlock details concerns about New Zealand's incoming depositor compensation scheme

24th May 24, 10:01am

12

Deposit insurance expert Geof Mortlock details concerns about New Zealand's incoming depositor compensation scheme

[updated]

Treasury says depositor compensation scheme fund to build up over 20 years, covering 0.8% of protected deposits

9th May 24, 10:00am

5

Treasury says depositor compensation scheme fund to build up over 20 years, covering 0.8% of protected deposits

RBNZ expects some deposit rate convergence across different types of deposit takers once compensation scheme launches

12th Mar 24, 3:02pm

35

RBNZ expects some deposit rate convergence across different types of deposit takers once compensation scheme launches

Reserve Bank to prepare and maintain a plan for dealing with every deposit taker in case it fails

4th Nov 23, 9:20am

15

Reserve Bank to prepare and maintain a plan for dealing with every deposit taker in case it fails

[updated]

RBNZ mulls giving non-bank deposit takers access to settlement accounts so they don't have to go through the big banks who get the financial benefit

19th Oct 23, 2:42pm

7

RBNZ mulls giving non-bank deposit takers access to settlement accounts so they don't have to go through the big banks who get the financial benefit

Reserve Bank may apply macro-prudential tools to non-bank deposit takers but isn't concerned about the growth of non-deposit taking lenders

16th Nov 22, 9:44am

Reserve Bank may apply macro-prudential tools to non-bank deposit takers but isn't concerned about the growth of non-deposit taking lenders