The country's biggest bank says its customers' card spending growth has fallen under 1% y/y in June, suggesting sales volumes are still falling.

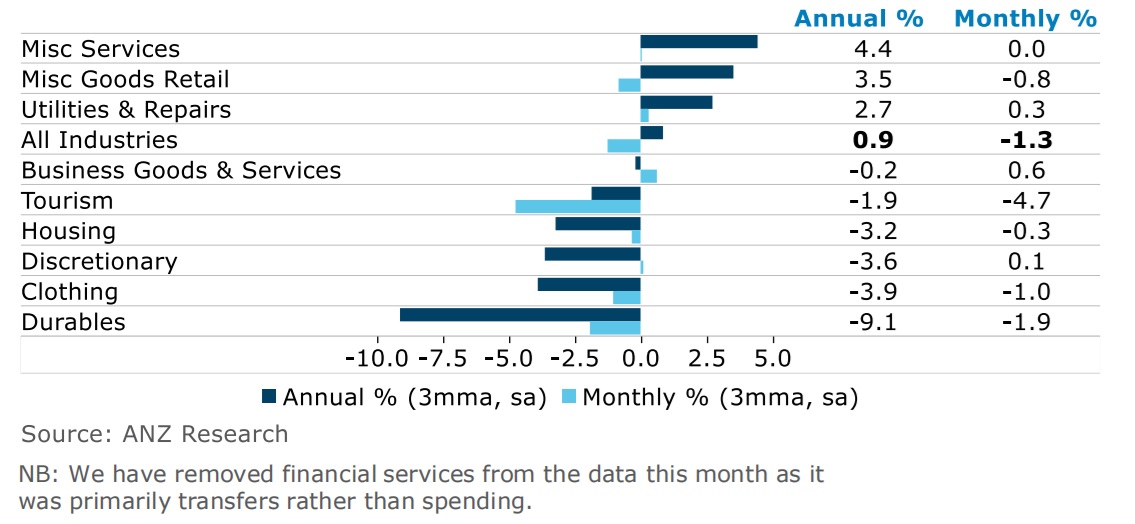

A detailed data pack for June compiled by ANZ chief economist Sharon Zollner highlights that spending on durables, discretionary spending categories, clothing and categories related to the housing market is particularly weak at the moment.

Monthly electronic card transactions data released by Statistics NZ on Friday showed that in June spending declined for the fifth month in a row.

The ANZ data puts a granular perspective on the extent of, and the nature of this shrinking spending by the Kiwi consumer.

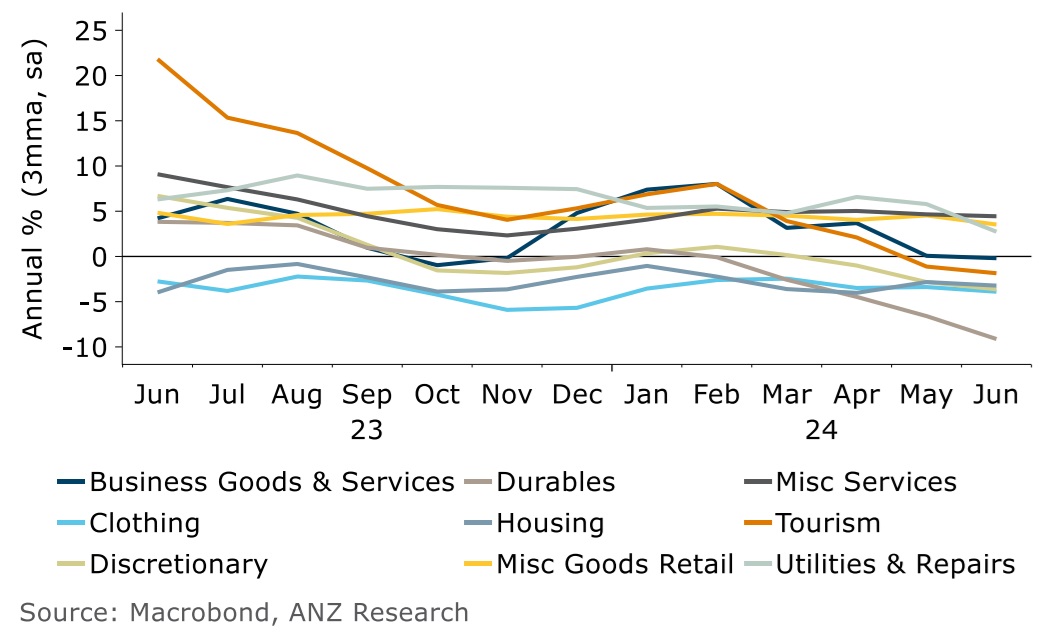

Zollner said tourism-related spending saw a particularly sharp fall in June (seasonally adjusted) with spend lower than a year earlier.

Meanwhile spending on miscellaneous services, miscellaneous goods and utilities/repairs are the only categories where annual growth remains positive.

She said the year-on-year decline in durables spending "continues to deepen", with the only categories not in the red year-on-year being miscellaneous services, miscellaneous goods (supermarkets are in this category), and utilities & repairs.

"The contributions of each category to total card spending growth in the past year shows growth being held up by miscellaneous goods (which includes both buy-now-pay-later payments and supermarkets).

"The waning growth impact of the tourism recovery is notable," Zollner said.

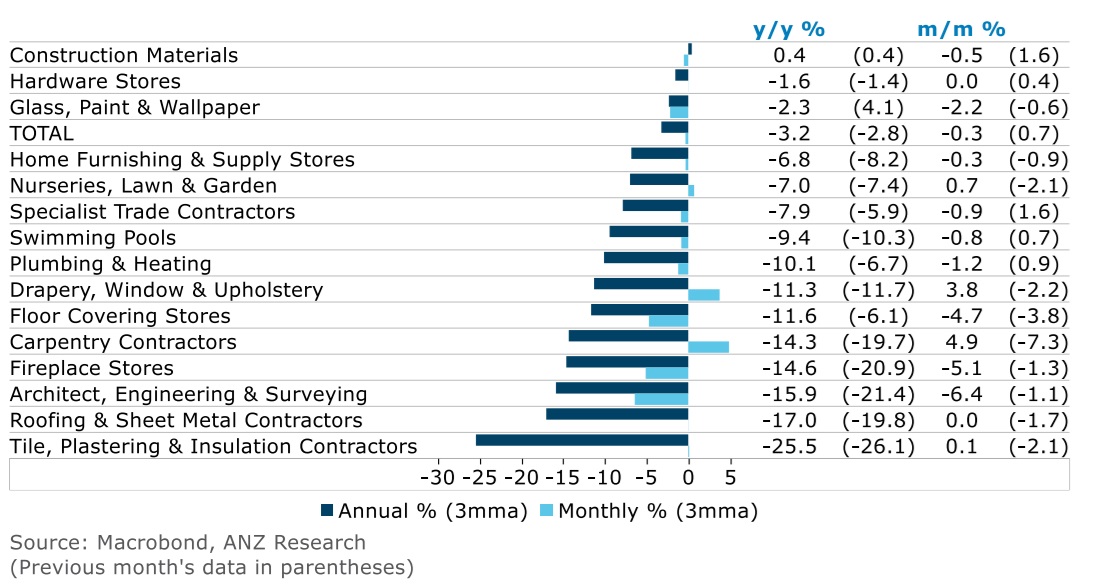

In terms of housing-related spending, Zollner said this is down 3.2% year-on-year.

"Pretty much every category is down on a year earlier. Falls could be a mix of lower sales volumes and price reductions.

"Sharply weaker construction activity is clearly having a big impact on this category," Zollner said.

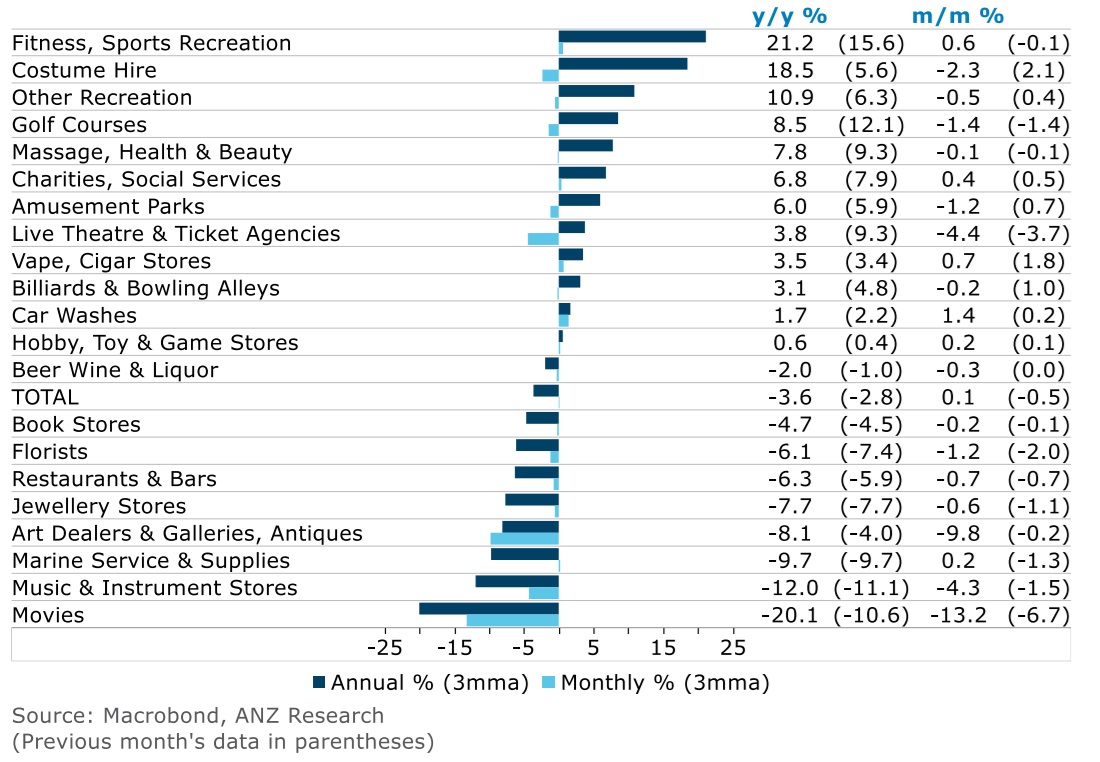

When it comes to treating ourselves, well the ANZ data is showing that spending across a range of discretionary spending types continues to sink overall, down 3.6% year-on-year.

"Restaurants & bars is by far the largest category in this group and the fall versus a year ago continues to deepen, with turnover now running at -6.3%," Zollner said.

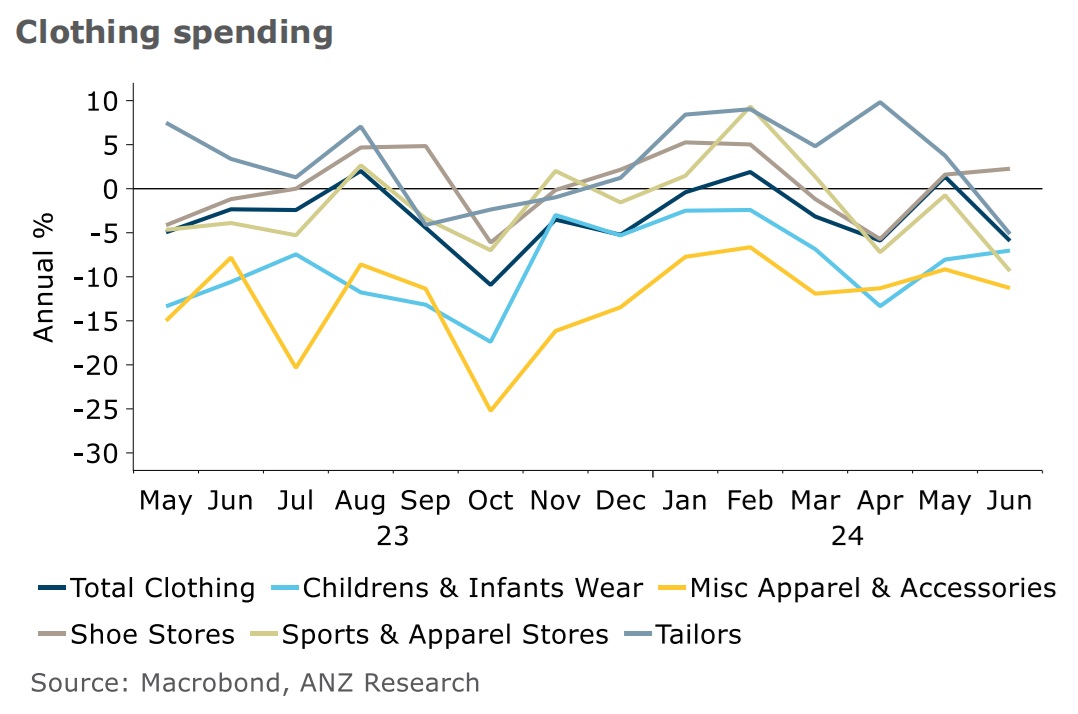

And meanwhile, the clothing retail trade, as Zollner puts it, continues to go "through the wringer".

"The clothing retail sector continues to do it really tough, with turnover down around 4% year-on-year in nominal terms.

"Most clothing store types have spent the majority of the past year experiencing lower revenue than in the same month a year earlier."

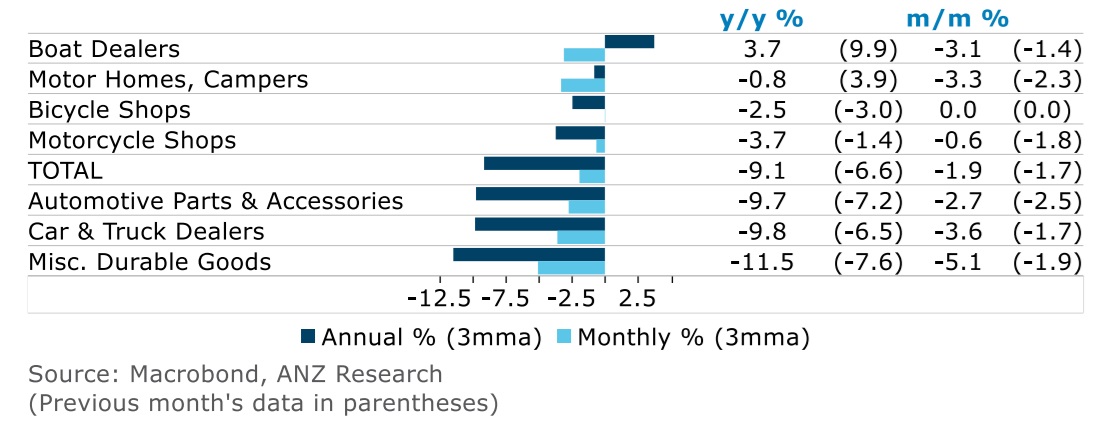

Zollner said durables spending remains under pressure due to a soft housing market, high interest rates and a weakening labour market.

Spending versus a year earlier dropped from -6.6% in May to -9.1% in June.

"If it has wheels, it’s hard to sell currently," Zollner said

13 Comments

terrain pull up!

terrain pull up!

Thank god the rent collectors are still buying boats.

that is an interesting stat - given marine supplies have gone backwards

Do these stats include offshore online shopping - thats where an increasing proportion of our "discretionary spending" now goes

This is all very interesting. It would be interesting to know the size of the used / second-hand market in NZ for all kinds of things. It's starting to boom in China and has been booming in Japan for 20+ years.

"At present, the penetration rate of China's secondhand goods market only stands at 5 percent, while in some developed countries, the figure can reach about 20 percent,"

https://www.chinadaily.com.cn/a/202312/27/WS658b79d7a31040ac301a9b3f.ht…

Intrigued by costume hire numbers and the deeper meaning there

There's an increasing need for Spruikers to have a few different costumes in rotation 🤡

The data and graphs are incredibly sobering - thanks interest.co.nz for such a good article.

But I do think this is a good thing - it shows that the New Zealand of today aren't blind fools, and instead are focusing on paying down debt, and cutting spending. I remember 2008 when Alan Bollard was begging kiwis to reduce spending but nobody really cared.

Only problem is that spending they are cutting is someone else's income

Unemployment numbers in six months 😬

Next problem for RBNZ will be reversing thier behavour, how to make them open wallets again. It has taken 2 and a half years for them to finally stop spending on movies and takeaways, could take the same length of time for them to feel confident to open wallets

Paying down debt - or Interest expenses?

Fantastic

The only power we have left as citizens of NZ.

The power to stop this over charging by most business in NZ is to stop spending and bring them back to some normal.

To much cartel behaviour in NZ

Isn't the whole idea of raising interest rates to make people poorer? to make them spend less? to make prices fall..? It seems to be working. However, tradesmen at 14.3 to 25.5 might be looking harder at crossing the ditch now..

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.