A rapidly weakening outlook in the residential construction sector offers some signs that inflationary pressures in the economy may start to weaken in future - though they are still sky high for now, according to the latest ANZ Business Outlook Survey.

The latest survey shows that activity intentions in the commercial building sector remain firm - but the view towards residential construction has plummeted.

Meanwhile, however, in the general economy cost expectations, pricing expectations and inflation expectations remain in the stratosphere.

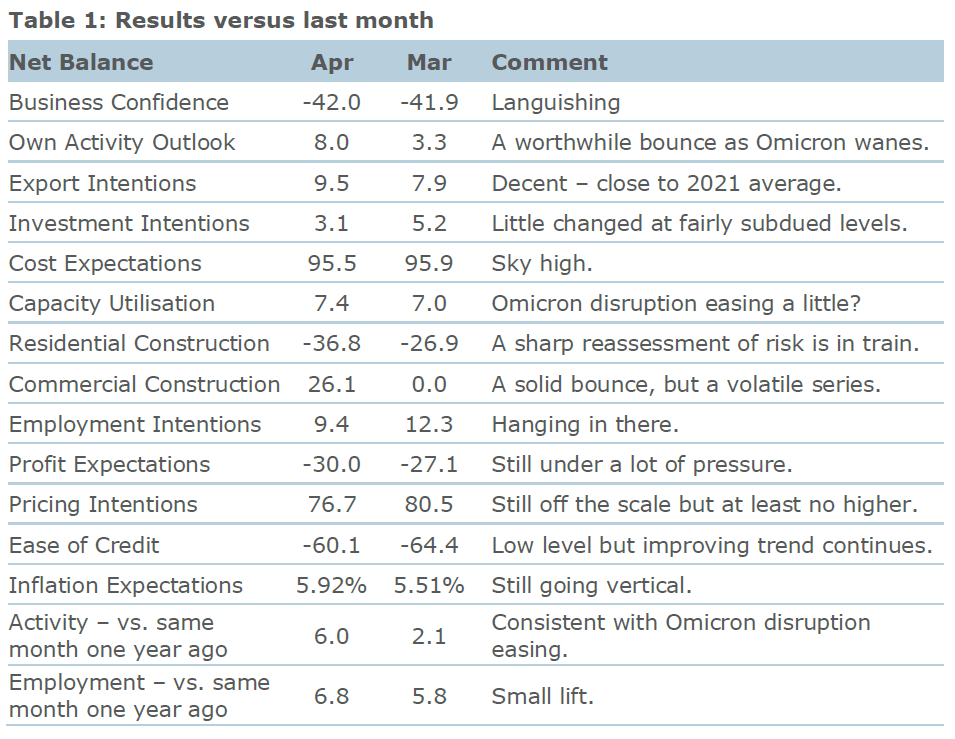

ANZ chief economist Sharon Zollner said business confidence remained very low in April, while the 'own activity' measure lifted a little as Omicron disruption waned.

"Inflation pressures remain intense, with inflation expectations sharply higher, though pricing intentions eased slightly. There are signs of easing inflation pressure in the construction sector,” Zollner said.

She said the Reserve Bank (RBNZ) would be pleased to see some of the heat coming out of the construction sector, "which has been a trailblazer for domestic inflation pressures for some time".

“Pricing intentions eased sharply for construction. Cost expectations also fell, but rose elsewhere, most dramatically for agriculture.

"The outlook for residential construction is weakening rapidly – the divergence between residential and commercial construction intentions is unprecedented."

Zollner said expectations of inflation in 12 months leapt from 5.5% to 5.9%, with the release of the March quarter data having had a clear impact [annual inflation came in at 6.9%].

“Pricing intentions are the best forward-looking indicator for inflation – these eased very slightly but remain sky high, and continue to suggest upside risk to our tentative forecast that CPI inflation may have peaked.

“Both actual and expected wage growth is highest for agriculture. Construction is the only sector for which wage settlements have been flat. Looking ahead, expected wage settlements over the next 12 months have increased for every sector except construction, where they are lower, and services, where they are flat.

“It’s worth nothing that inflation expectations were much higher for those who responded later in the month – indeed, almost full percent higher, at 6.6% versus 5.7%. Wage expectations were higher for the latter group and expected profitability was much lower.

“Firms remain somewhat wary of the outlook and continue to find the profitability picture hard going in an environment of rising costs and now, in some consumer-facing areas, the prospect of softer demand.

“However, on the plus side, activity levels appear to have picked up as the disruption to labour supply and activity from the Omicron outbreak has passed its peak.

“Overall, there was mildly encouraging news for the RBNZ in April’s ANZ Business Outlook survey. While inflation pressures remain extreme, and inflation expectations jumped further, there were some tentative signs of the acceleration in costs easing, at least in the construction sector, which has been leading the domestic cost and inflation charge for some time.

“But with plenty of wage and other cost inflation in the pipeline, it’ll be some time before the RBNZ can conclude that they’re getting ahead of the inflation game. We continue to expect another 50bp hike in May, and steady 25bp increases thereafter taking the OCR to a peak of 3.5%,” Zollner said.

Business confidence - General

Select chart tabs

25 Comments

"A rapidly weakening outlook in the residential construction sector offers some signs that inflationary pressures in the economy may start to weaken in future"

how long is a piece of string? Construction labour. Still a shortage of builders? Instead of saying come back in a year to eighteen months. it may reduce to nine months with a big qualification on building materials. Plasterboard appears to be the biggest bottleneck right now is not likely to change much for six months. I don't see the residential construction sector back to some semblance of normality for at least a year. Normality in my book is around six months from building consent to completion. Overall from drawings to submission for BC, 3 months.

Contribution to reducing inflation in this sector for at least a year, zero%

I fear you might be underestimating how rapidly and significantly expectations for future building have changed.

In jurisdictions that have their land use and housing policy &^*$ together, their supply and demand curves lie almost on top of each other so housing prices are stable and affordable.

Only in countries like NZ where our land and housing policies are dysfunctional do the supply and demand cycles become countercyclical. Either not enough supply to equal demand or just as demand drops off, the countercyclical supply starts to be delivered - creating the classic boom and bust cycle.

We are getting everything we planned to achieve.

Criminal negligence caused by greedy entitlement mentality?

Most people are only playing the hand they were dealt. It's the dealer's fault ie this country is being run on the same odds as a casino, where some win big and most lose in the short term. And in the long term, we all lose.

Leadership comes from the top down, but as H L Mencken noted, 'as democracy is perfected, over time, it will more and more reflect the true nature of its voters, to the point at some future date we will be Governed by morons.'

We must be close to that point now, both in our leadership, and how we vote.

Idiocracy in action, right here, right now.

The housing market is great at self regulating. Just when you think all the obvious indictors are for house price falls, something fundamental changes and that all goes out the door. Materials go up, new builds slow, prices go up.

Sorry...just about fell off my chair.

When you say 'housing market' what do you mean....prices?

Driving interest rates to zero has been the biggest influence in house price behaviour the last 30-40 years (In NZ....and the NZ housing market appears to be positively correlated to the US stock market....which also peaked end of last year). Will be interesting to see what happens now that it looks like the US 10 year treasury is breaking out of its 40 year downward trend - everything people thought they knew about investment, might suddenly be exposed as nothing more than an illusion.

Wolf Richter outlined the issue of housing and the interest rate sham y'day. I know it's Murica and "Nu Zillun is different", but it should resonate across the Anglosphere.

The Fed has caused this ridiculous housing bubble with its interest rate repression, including the massive purchases of mortgage-backed securities and Treasury securities.

And the Fed is now trying to undo some of it by pushing up long-term interest rates. It’s the Fed’s way – too little, too late – of trying to tamp down on the housing bubble and on the risks that the housing bubble, which is leveraged to the hilt, poses for the financial system.

So that boom is over. And the Fed has just now begun to push up interest rates, way too little and way too late, but it is finally plodding forward in order to deal with this rampant four-decade high inflation, after 13 years of rampant money-printing – an inflation of the magnitude the majority of Americans has never seen before

https://wolfstreet.com/2022/04/27/mortgage-volume-gets-crushed-by-spiki…

Agreed. While there's no doubt a price floor for things like a sheet of GIB, m2 of land or an hour's worth of Labour, the price of everything that goes into building a property from the land to the materials and Labour have all increased to meet the market. It's not that it takes 30% longer to manufacture GIB, scrape land or nail trusses, but prices have met what the market can afford to pay.

If less people can afford to build a new house for the current "price" of a new house, and suppliers cannot pass on reductions, then building effectively grinds to a halt. But these prices are not determined by cost + slim margin...well maybe at the retail end but certainly not manufacturing.

If I am wrong and they're not "rorting it", then clearly these manufacturers have no clue how to turn a profit during good times.

This is a country where people without degrees or post graduate education (tradies, RE’s etc) are wealthier than those with.

Any profession that is somehow housing market related have wages set by market demand. And market demand is skewed by a huge financial bubble. When the bubble bursts, the froth that bolstered the income, wages and profits at all levels is going to respond.

An OCR peak of 3.5% is incredibly optimistic in my view . I think that is where they like to think it will peak , just like I saw Orr predicting it would peak later this year also wishful thinking. The pipeline of costs onshore and offshore is much longer than that .

Fairlyfrank,

"An OCR peak of 3.5% is incredibly optimistic in my view". Well, you may be right, but a few of us still think that the adverse economic effects of an OCR over over 2% will make themselves felt so quickly across the economy that the RB will be forced, once again, to change course.

With an election looming in late '23, the government will put huge behind the scenes pressure on the Bank. If the OCR is anything like 3.50%, they are toast, though quite possibly they will be shown the door anyway.

You assume there'll be a choice.

The $NZ is going to tank and keep on tanking. 3.5% is the floor, not the ceiling. In a cycle of global inflation, we're in an almost uniquely weak position.

Yes, the value of the $NZD and where the financial reef fish take it will be of fundamental importance. I have been betting for quite some time that our very high external current account deficit is non sustainable. If the $NZD tanks then that will create considerable pressure to raise interest rates. The key uncertainty is when will the reef fish make a sustained move. In recent days they have been darting around but the trend has been away from the $NZ and towards the $US in particular. I see more divergence between the NZD and the AUD over coming months.

KeithW

Linklater the reserve bank can only change course if macro economic conditions allow it to , if events offshore continue to worsen, such as energy prices, federal interest rates , food prices ,continue to rise the nz dollar will tank increasing inflation accordingly. This scenario would force the reserve bank to act to achieve its inflation mandate, notably the housing market is not its concern , while it is obvious that increases in mortgage rates will squeeze the spending in the economy this will assist in bringing about the lower inflation they desire .

So what?

I have been forecasting this since the middle of last year.

HouseMouse way ahead of the pack, once again.

any one out there want to engage my services?

it is actually hilarious how far ahead of these clowns my thinking is.

What I take from this is that Monsieur HouseMouse is leading the clowns.

Didnt you wave the white flag last week and admit that you had the interest rate curve all wrong?

Where shall we start with my very good record HW2? (hey no one gets things perfect, most economists struggle to hit even a 30-40% Success rate).

Go ahead and mock me, but I've been much more switched on than most economists and most on this website :

- As Fritz, predicted a big housing correction in 2022-2023: looks like I'm right

- Mid/late last year, predicted 5-10% falls in house prices in 2022 as my central scenario, with my second scenario being 10-20%. Likely to be one of these.

Note: all economists predicting small gains at that time or very minor falls. Even in January T. Alexander was saying rises of 5%...

- From early/mid last year, was calling a residential construction sector slump in mid to late 2022. Now ANZ are saying that. T Alexander has been saying it from early this year. I was way ahead of these so-called experts.

- Sold my shares last October, seeing weakness on the way: looks a fairly good call right now, don't you think

Sure, the OCR will go north of 1.75%. But how far north? If it only went to 2.25%, then was cut, then the spirit of my forecast was right. Hey maybe the OCR WILL go to 3% I will be very wrong, for once. I'll be man enough to admit it.

I know you dislike me, and you hold that against all my opinions. But actually, I don't care.

H M,

- "Sold my shares last October, seeing weakness on the way: looks a fairly good call right now, don't you think". I don't know where you were invested, so it's difficult to comment on that. I have long concentrated my portfolio in good quality dividend paying companies, so have never contemplated a total sell down.

Instead, i have for some years, slowly taken profits and accumulated cash in anticipation of a significant fall. I have found over decades that dividends fall much less than share prices and this has so far served me well. I wish you luck with timing your re-entry into the market.

Leading clowns is a better strategy than following following them…and unfortunately we’ve got a society that for a large part love the circus.

I am a little surprised to not see more comment about commercial construction. The current and planned activity level in the commercial sector for warehouse facilities and related is remarkable, with the major commercial building companies committed right through into next year, and the banks shoveling out the money to support this building. At some time this too must turn.

KeithW

The demand for warehouse space could really turn on a dime. Rates for 40' container ex China main ports to East Coast Australia have fallen about USD 3000 from where they were earlier this year. The rates to NZ were closely matching Australia until recently. But now they have diverged. AU has more shipping lines calling ex China which makes it more competitive. But there was a divergence of rates on the way up so expect the same on the way down. These rates are a leading indicator of demand. The containers are mostly full of discretionary items. That then go to warehouses full of mostly discretionary items. Then into retail and online channels. Consumers will decide at the end of the day. Put money away for WHEN my mortgage interest rate doubles or by a new Flat Screen, Washing Machine, Sofa etc.

Likewise. I have no idea where growth in demand for commercial property is supposed to come from.

I think the peak in OCR may well be short.... the recession coming on the other side will be the deepest NZ has seen since possibly the war years. We make little but food and houses, no good if people cannot afford to buy either, Chinese tour buses are a rare sight these days.....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.