According to RBNZ data (S40), Kiwi households store $175.3 bln of their cash resources in banks. That is held in savings and other at-call demand deposits which pay minimal interest, in chequing/transaction accounts which typically pay zero interest, and in term deposits, which these days pay a low interest return.

These household deposits, when combined with similar deposits of businesses, make up about two thirds of the funding of our retail banks. The balance is supplied by other wholesale lenders who provide a quarter of the funding, and by shareholders who have the least skin in the game, supplying only 8% of the funding required. To them, however, go all the profits of banking - and in the year to September 2018, those amounted to $5.5 bln, after tax. To most independent observers, it seems a wildly unbalanced funding structure, built on leverage.

But it is what it is, and while the RBNZ is making moves require shareholders to invest properly in their enterprise, it would be wise for investors and savers who hold some of their liquid wealth in banks to understand how they are exposed by this unbalanced relationship.

The RBNZ Dashboard allows us to drill into the key data, by bank. Here is the top level data as at September 2018:

| Net loans | All other | Total assets | Customer | Debt | All other | Shareholder | ||

| September 2018 | & advances | Assets | assets | deposits | securities | liabilities | investment | |

| $bln | $bln | $bln | $bln | $bln | $bln | $bln | ||

| ANZ | 126.5 | 32.5 | 159.0 | 104.1 | 26.6 | 15.3 | 13.1 | |

| ASB | 83.8 | 12.0 | 95.8 | 61.5 | 23.2 | 3.1 | 8.0 | |

| BNZ | 83.2 | 16.8 | 100.0 | 61.3 | 25.4 | 5.9 | 7.4 | |

| Kiwibank | 18.8 | 2.1 | 20.9 | 16.4 | 2.4 | 0.6 | 1.5 | |

| Westpac | 80.4 | 9.5 | 89.9 | 62.0 | 17.6 | 3.1 | 7.3 | |

| -------- | -------- | -------- | -------- | -------- | -------- | -------- | ||

| Main banks | 392.6 | 72.9 | 465.6 | 305.2 | 95.1 | 28.0 | 37.3 | |

| Cooperative Bank | 2.4 | 0.3 | 2.7 | 2.2 | 0.0 | 0.2 | 0.2 | |

| Heartland Bank | 4.1 | 0.5 | 4.6 | 3.0 | 0.2 | 0.8 | 0.6 | |

| Rabobank | 10.4 | 1.4 | 11.8 | 4.2 | 0.0 | 6.0 | 1.6 | |

| SBS Bank | 3.8 | 0.7 | 4.6 | 3.4 | 0.3 | 0.6 | 0.3 | |

| TSB | 5.6 | 2.0 | 7.5 | 6.8 | 0.0 | 0.0 | 0.6 | |

| -------- | -------- | -------- | -------- | -------- | -------- | -------- | ||

| Challenger banks | 26.2 | 4.9 | 31.2 | 19.6 | 0.6 | 7.7 | 3.3 | |

| ====== | ====== | ====== | ====== | ====== | ====== | ====== | ||

| All retail banks | 418.9 | 77.8 | $496.7 | 324.8 | 95.7 | 35.7 | 40.6 |

The four Australian banks supply 89% of the loans and advances to New Zealand borrowers, and hold 89% of customer deposits. They supply 89% of the shareholder investment in our retail banking system. They dominate by any definition. The RBNZ has a number of requirements to ensure that Australian domination doesn't result in any problems that their parents may encounter by infecting New Zealand. But whatever they require, it will probably be inadequate in a major Australian banking crisis. And there is always suspicion that the actions of both the bank head office policies, and even Australian regulator requirements, both work against RBNZ objectives to some degree.

So, investors in bank offers and depositors in bank accounts should use this information to ensure they deal with these banks knowing their financial strengths, or otherwise.

The same data, but presented as a percent of total bank assets is a starting point:

| Net loans | All other | Total assets | Customer | Debt | All other | Shareholder | ||

| September 2018 | & advances | Assets | assets | deposits | securities | liabilities | investment | |

| % | % | % | % | % | % | % | ||

| ANZ | 79.5% | 20.5% | 100% | 65.4% | 16.7% | 9.6% | 8.2% | |

| ASB | 87.5% | 12.5% | 100% | 64.2% | 24.2% | 3.3% | 8.3% | |

| BNZ | 83.2% | 16.8% | 100% | 61.3% | 25.4% | 5.9% | 7.4% | |

| Kiwibank | 90.0% | 10.0% | 100% | 78.5% | 11.4% | 2.9% | 7.2% | |

| Westpac | 89.4% | 10.6% | 100% | 68.9% | 19.6% | 3.4% | 8.1% | |

| -------- | -------- | -------- | -------- | -------- | -------- | -------- | ||

| Main banks | 84.3% | 15.7% | 100% | 65.6% | 20.4% | 6.0% | 8.0% | |

| Cooperative Bank | 88.7% | 11.3% | 100% | 83.5% | 1.7% | 7.9% | 6.9% | |

| Heartland Bank | 88.9% | 11.1% | 100% | 64.8% | 4.2% | 17.1% | 13.9% | |

| Rabobank | 88.0% | 12.0% | 100% | 35.5% | 0.0% | 51.3% | 13.2% | |

| SBS Bank | 84.1% | 15.9% | 100% | 73.8% | 6.3% | 13.0% | 6.9% | |

| TSB | 73.8% | 26.2% | 100% | 90.4% | 0.5% | 0.6% | 8.5% | |

| -------- | -------- | -------- | -------- | -------- | -------- | -------- | ||

| Challenger banks | 84.2% | 15.8% | 100% | 62.9% | 1.8% | 24.6% | 10.7% | |

| ====== | ====== | ====== | ====== | ====== | ====== | ====== | ||

| All retail banks | 84.3% | 15.7% | 100% | 65.4% | 19.3% | 7.2% | 8.2% |

Some items stand out when looked at this way. First is the high level of "other assets" at ANZ, which relates to high levels of derivatives funding. You can inspect more about this by reviewing the R5 and R6 elements in the RBNZ Dashboard (and it should be noted they are largely offset by R11 and R12. In stress however, you might be sceptical about the 'asset' value because certainly the 'liability' value will always hold). TSB's large "Other asset" position is quite different, a $1.8 bln investment in Government, local authority, SOE and other corporate bonds, fairly evenly distributed. (Note 6.)

ASB and BNZ have relatively large exposures to wholesale funding.

Another item worth noting is the relatively low level of shareholder support by some New Zealand-owned banks (especially Kiwibank) - and the relatively higher level by others.

Of course, in any financial business, the real value and the real exposure is in their dominating loan books. Most of the rest is mere detail.

And here things get interesting. Almost 59% of all lending is for housing, and all but three banks have 60% plus of their loans in the residential housing market. Only BNZ among the main banks can't be called a mortgage bank. Rabobank (rural) and Heartland Bank (asset funding) aren't either.

| September 2018 | Credit rating |

Housing loans | of all Loans |

Risk weighted housing loans |

net risk weight |

| $ bln | % | $ bln | % | ||

| ANZ | AA- | 75.8 | 60.0% | 17.0 | 22.4% |

| ASB | AA- | 54.6 | 65.2% | 17.6 | 32.2% |

| BNZ | AA- | 39.7 | 47.8% | 12.6 | 31.7% |

| Kiwibank | A | 16.7 | 88.7% | 6.6 | 39.7% |

| Westpac | AA- | 48.7 | 60.6% | 15.9 | 32.7% |

| -------- | -------- | -------- | -------- | ||

| Main banks | 235.6 | 60.0% | 69.7 | 29.6% | |

| Cooperative Bank | BBB | 2.2 | 92.4% | 0.8 | 37.0% |

| Heartland Bank | BBB | 0.5 | 12.3% | 0.6 | 124.6% |

| Rabobank | A | 0.0 | 0.3% | 0.0 | 36.3% |

| SBS Bank | BBB | 3.0 | 78.0% | 1.1 | 37.8% |

| TSB | A- | 4.6 | 82.8% | 1.7 | 37.7% |

| -------- | -------- | -------- | -------- | ||

| Challenger banks | 10.3 | 39.4% | 4.3 | 41.8% | |

| ====== | ====== | ====== | ====== | ||

| All retail banks | $245.9 | 58.7% | $74.0 | 30.1% |

The overall system exposure to housing risks is clear in this data. Also clear is that that most banks regard that risk as low. BIS and RBNZ rules allow the main banks to assign risk weightings to their loan portfolio based on their own definitions and, surprise, they judge their own portfolios as low-risk. And this self-judgment allows them to hold less capital against these housing loans. In the ten years plus that this risk-weighting system has been in place, the main banks have taken a generic 50% risk weighting under previous rules to down as low as just 22.4% risk weighting (ANZ). To their chagrin, the smaller banks are not permitted to use this self-assessment process and need to hold higher levels of capital. It is a situation that the RBNZ has finally realised is flawed and is moving to rectify. But weaning banks off low risk-weights for housing won't be easy and they will resist staunchly.

If you are depositor however, you may wish to know who has gamed the risk-weighting system the most.

And you may also wish to know where the current non-performing housing loans are.

| September 2018 | Top 5 credit exposures to non-bank counterparties / CET1 |

non performing housing loans |

non performing share |

Housing loan market share |

| % | $ mln | % | % | |

| ANZ | 51.3% | 185.9 | 46.1% | 30.8% |

| ASB | 16.5% | 84.3 | 20.9% | 22.2% |

| BNZ | 42.2% | 33.3 | 8.3% | 16.2% |

| Kiwibank | 6.4% | 15.2 | 3.8% | 6.8% |

| Westpac | 56.4% | 66.7 | 16.5% | 19.8% |

| -------- | -------- | -------- | ||

| All main banks | 385.4 | 95.5% | 95.8% | |

| Cooperative Bank | 9.7% | 4.0 | 1.0% | 0.9% |

| Heartland Bank | 23.8% | 0.2 | 0.0% | 0.2% |

| Rabobank | 20.6% | 0.0 | 0.0% | 0.0% |

| SBS Bank | 43.3% | 6.4 | 1.6% | 1.2% |

| TSB | 41.7% | 7.6 | 1.9% | 1.9% |

| -------- | -------- | -------- | ||

| Challenger banks | 18.2 | 4.5% | 4.2% | |

| ====== | ====== | ====== | ||

| All retail banks | $403.6 | 100% | 100% |

The main banks have 95%+ of the mortgage market but there is a wide dispersion in where the non-performing loans reside. (See RBNZ's G5 definition. This is the total of both impaired loans, plus loans 90 days past due "not not [yet] impaired".) Maybe some banks are stricter with the definitions than others, but the wide dispersion may raise eyebrows. And to be fair, the numbers and values are not large - in the table above they are in $ millions, not $ billions as in the first tables.

The second column in the previous table does not relate to housing loans at all. Rather is records how much of a bank's common equity tier one capital (CET1) is exposed to their five largest borrowers. Away from housing loans, a few large corporate loan wipeouts (more than just 'failures') could quickly put their capital at risk and push them below their regulatory minimums. This is detail any depositor should be aware of. (see RBNZ Dashboard item V1. For those fascinated by interbank relationship conspiracies, V3 may also catch your attention. Personally, I am not one of them.)

79 Comments

Too many numbers and tables for me, just put the banks in order of least risky to most risky, that is a format I can understand.I have everything shared in TD's between the ASB and the BNZ currently.

Agreed ... in layman's terms.

interesting comment, that is the what most kiwis would say unfortunately

what do you mean there is risk are not banks safe?

why would there be any risk with a bank.?

I remember back in the 80s when the BNZ almost went bust and a friend told me to get my money out before it become public, and I was young and naïve and said its fine its owned by the government wont go under.

was i so wrong it came very very close. next minute sold and boy did I learn a valuable lesson without losing my money thankfully

Sorry, investing due diligence is real work. I can't do that for you. If you need someone else to do it, you will need to engage a financial advisor who understands your personal situation and your view and tolerance of risk.

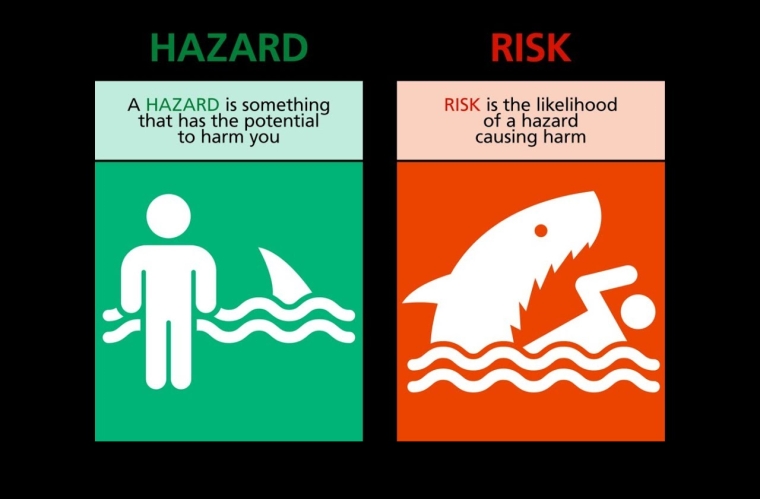

What we can do is point out where you can go to get solid information, and lead you to some of it. We can also point to some potential hazards. After that it is over to you.

I think that if you are going to get in the water, you owe it to yourself to do some work assessing the risks for your situation.

The credit ratings are probably good enough for the layman. Here is a guide:

https://www.rbnz.govt.nz/-/media/ReserveBank/Files/regulation-and-super…

Yes, oh Yes....credit ratings will do the job similar to when they were valuing mortgage bonds AAA as defaults in those bonds were skyrocketing, fearful of loosing the rating to competitors if they valued the bonds junk...GFC followed.

Carlos67,

I have spent quite a lot of time looking at th RB’s Dashboard and as requested,I have given feedback on it. There are over 100 metrics in the Dashboard,but they simply do not allow you to assess the relative strengths of the banks. For most,only the big 4 banks are important. I would like to see the leverage ratio added in,though this can be calculated from the existing figures.

My own TDS are split over 4 institutions,only 1 of which is a top 4 bank. I also have cash in Government bonds. In due course,I think some level of Deposit Insurance will be introduced.

We record the Leverage Ratio here, by bank, quarterly, since March 2008.

Carlos's comment and David's reply reminds me of a south park clip:

https://www.youtube.com/watch?v=TGwZVGKG30s

I'm fine with certain things being complex but money and banking should be simple. To whose benifit is it that it is complex? Is our current system an improvement from the system that we used to have and which seemingly most people still think we do?

Lol. Glad the SouthPark scene didn’t operate in the 80s, when saving a series of TDs for a first house, with interest rates of 10- 14% - & all of it came back!

Daddy will you buy me a New Years Honour...pretty please...I wannabe a wannabe just like you...Pick me...pick me??.

https://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=12…

Lots of numbers indeed, used to confuse the public when the reality is that all it is is simple double entry book keeping, the observer believes that the banks have 2/3 of their loans covered by deposits...The reality however is that a deposit is merely an entry added to a banks ledger, as a deposit the minute that a loan is written. And money gets created out of nothing. Our household debt burden grew by 6% last year.. Approximately $12 billion.. our economy growth is slowing because the debt is not growing fast enough to keep it growing. In fact with debt growth at equilibrium with last year GDP is about to stall and the quality of the banks’ loan books will soon look less stable.

And that is where the central banks lost control of the creation of money. 97% owned is worth watching

as is this post from DFA specifically about NZ bail-in.

https://youtu.be/Zs_ptT7ktn0

But doesn’t the lending come under capital adequacy regulations? What they’re actually doing is allocating a portion of their capital/deposits to the loan, the capital that is surplus to the regulatory requirements.

Yes it does appear to be a double entry (money is deposited into a loan account but nobody’s bank accounts are reduced or frozen) but it’s not some credit double down. It’s literally borrowing the “use” of money that somebody else has stored in the bank, and depositors allow this in return for a share of the returns.

With all due respect to Carlos,he sums up the financial literacy of Kiwis, and indeed his own in two lines.

David, thanks for article.As you state it requires 'work'.

Ahhhh... details!

David,

How does the 'Shareholder Investment' fluctuate with share price? If ANZ share price does down 25% will their shareholder investment go down in proportion (unless they issue more shares) or is the figure reflecting the capital from the share purchase price at time of buying and in-turn a 25% drop in share price will not change this figure?

Just trying to work out what a change in share price might mean for the banks ability to issue credit.

100% great work thanks.

Has nothing to do with the share price (or the price you paid for your shares). Maybe my terminology of "Shareholder Investment" is wrong. It really is the balance sheet item "Shareholders equity" and that has little to do with the daily market price for their shares.

Thanks for the prompt reply.

I wish they would put this series broken down by bank into the Dashboard;

So do I !

I understand it is coming 'sometime' however. I think the issue is that they started sourcing this data with the agreement that it would be consolidated only (on the basis that it contains commercially senstive detail). But now the Dashboard is released, the RBNZ want to extend it to things like C32 but they need the data suppliers' agreement to modify the original deal. Might be a while yet, I suspect, because they will need everyone to consent.

David, would I be correct to calculate ANZ's ratio of "non-performing house loans" to "total loans" by dividing $185.9 Million by $75'800 Million = 0.3% ?

Yes. And you can get it is a bit more detail from the Dashboard, in G5, H5, J5, K5 and L5, for each type of lending.

Thank you DC

I take it the Non-Performing Loans data only covers mortgages that have had missed payments within a certain time frame or are impaired, not other Non-Performing Loans such as Interest Only Mortgages?

Apparently there is no definitive definition of a nonperforming loan. Usually it is a loan that is behind in its interest payments by a certain number of days.

That is right. Nonperforming loans are not a specific 'thing' on their own. They are the sum of two 'things'. Firstly, Impaired Loans, for which there is a defined standard. And Past Due loans, for which there is another standard.

Impaired loans: "A loan or advance is impaired when one or more events occur that cause a lender to believe they will not receive all of the future principal and interest repayments that have been contractually agreed with the borrower. These events could include: the borrower entering significant financial difficulty or bankruptcy; the borrower failing to make repayments as required and the loan becoming past due; the contractual agreement between the lender and borrower being restructured or amended; the borrower breaching covenants or other terms and conditions that have been contractually agreed with the lender."

90 Day Past Due loans: "A loan or advance is past due when the borrower fails to make a payment (of principal and/or interest) when that payment was contractually due. When a borrower has failed to make repayments on a loan for 90 or more days, that loan is 90 days past due."

Aussie Building Permits Plunge After Prices Plummet Most In 35 Years

https://www.zerohedge.com/news/2019-01-08/aussie-building-permits-plung…

Another risk tactic is todeposit some funds in your Australian bank account and benefit from the Aus Govt guarantee. Easy enough for kiwis to open an Aus account. Spreads the risk.

not that easy now to do it from NZ with the aml, you find its far easier to do on a holiday though as you need to complete this step now

Will complete their identity check within 12 months. Note, you won’t be able to make withdrawals until you have completed this check.

Yes,next holiday/visit to Aus. Passport over the counter & account can be opened.

Plus then use a no fees debit card on future visits avoiding fx charges.

Australia has very recently legislated the bank "Bail-in" if a bank goes under, just like New Zealand did under John Key. That protects the tax payer but not the depositors, which is good for the country but bad for term deposit holders and savers. So the "government guarantee" in Australia is now effectively zero.

So is this no longer the case?:

"The Australian Government has guaranteed deposits up to $250,000 in Authorised Deposit-taking Institutions (ADIs) such as your bank, building society or credit union. This means that this money is guaranteed if anything happens to the ADI."

https://www.moneysmart.gov.au/managing-your-money/banking

No such thing as a guarantee now, Mortgage Belt. The politicians know their banks are at risk with the lax lending rules and housing price declines, along with the fallout from the Royal Commission, so they either know full well of the risks or their pollies are stupid. A bit of both I think. I will try and find the video.

Tainuibabe,

Are you sure? I have just checked and as of Oct. the deposit insurance was in place. I think a move like that would have been big news.

Its something that has been talked about on the Martin North/DFA videos a bit. Its not exactly crystal clear exactly what can be bailed-in or the trigger conditions.

https://www.youtube.com/channel/UCKWDscRjYFTD1KHsmow4-bQ/search?query=b…

take your pic of videos and you'll have to decide for yourself whether there any fire, or is it all just a smokescreen.

I am very sure. There is a video of the legislation passed on YouTube and one politician was fighting it because it was sneaked in. And as he was trying to have his case heard, you can watch the politicians leaving the chamber as he starts to speak. It was publicised but not covered widely in the media. It literally has only been voted in about 4-5 months ago! On another note, I wouldn't expect that the Australian Deposit Guarantee would extend to non-Australian citizens anyway. Why would the oz government pay out for New Zealand deposit holders with Australian Tax Payers Funds? It is a grey area.

Tainuibabe,

Are you sure? I have just checked and as of Oct. the deposit insurance was in place. I think a move like that would have been big news.

This notion of the consumers evaluating bank risks is wrong. Banking in todays credit and electronic environment is an essential service not an investment option. What alternatives does Joe Bloggs have...the mattress, gold, bitcoin? Regulation is weak, the RBNZ just realized we're exposed to the Australian parent companies, pull the other. They are culpuable as are the govt and need to ensure the money men are looking after the consumers interests. A deposit guarantee scheme needs to replace the crappy OBR and they need much higher capital ratios asap, tighter lending rules and the self assessment rubbish stopped. Have we forgotten the gfc, what caused it and the lack of regulation. Promises not delivered. It is what is is mentality gets us here time and again.

Information asymmetry?

The other alternative is to put everything into the house. Literally. Less likelihood of fraud (other than divorce).

I am doing exactly this. Everything, all short term savings once it reaches a few thousand dollars in my Kiwibank savings account is withdrawn and used to pay for my renovations. No more bank borrowing for me, now that I am freehold! I bank with one of the Big 4, have done for about 30 years... hell I even used to work for the bank for a long time, but I now only use this bank as a transactional account to pay my bills, but literally everything else is transferred out to Kiwibank as this bank is less risky and more likely to be bailed out by our Labour Government if they hit the wall. Our government will not bail out any Australian Bank with taxpayer funds and I fully agree that we shouldn't! I agree with John Key and the bail in laws he introduced, because those big banks can leave New Zealand dirt poor if they collapse. It is very much a "buyer beware/investor beware scenario. Also, no risk of a divorce for me and then loosing half my assets, done that before, never again lol. Single, happy and without any debt.

Too right. I've raised the point before that us wage slaves have to supply a bank account to receive our wages. No more brown paper envelopes with cash every pay day. Yet the belief is that when your employer deposits your wages into your bank account, then it's your cash sitting in the bank. OBR says no?

I meant repaying your mortgage.

But re cash savings - physical cash will soon be outlawed. Some businesses are now refusing paper cash already.

I think that you will find that it isn't true that you NEED a bank account to receive your salary. This came up at work a few months ago and our Finance Manager said that if an employee requests their wages to be paid in cash, then the payroll department/employer must comply by law. Ask your HR/Payroll department about the legislation.

You are correct about the OBR too, once your salary is in the bank, it can be used as a bail-in and frozen for a period of time until the bank can be re-floated or sold off. Like I said in the last post, legally you can request your salary to be paid in cash in an envelope and your employer must do so if you put it in writing.

Although I suspect if you do that your employer might start looking at you sideways and wonder if you have a screw loose..

Exactly. It’s a joke that the RBNZ basically wash their hands of doing their job to protect the financial system and leave it up to depositors to assess the stability of banks. Assuming the average depositor has the information and knowledge to assess the credit worthiness of financial institutions is laughable.

I agree the tax payer shouldn’t foot the bill if banks go under, but neither should depositors as there is no practical alternative. Shareholders reap the rewards when a bank is profitable and should cover losses on the downside

Our RBNZ is doing everything possible to educate us investors, bank customers, mortgagee's etc of the risks, but they can't do the work for you. We all have a responsibility to educate ourselves on how the financial system works, but lets face it, most New Zealanders are very naieve because a major bank failure or bank run hasn't happened in their lifetime, but it sure has happened throughout history and certainly happened to our grand parents! There have been numerous bank runs and collapses overseas just in the past 10 years alone and they are still happening. We live in an interconnected financial worldwide web where one bank collapse can, and does trigger other bank failures. The risk is greater now, because the banks are becoming scared of lending to each other, as happened prior to Lehmans bank collapsing, which triggered the GFC. Have you noticed how mich harder it is now to get Credit? This is one of the reasons why.

In a bank collapse, shareholders are hit first. The shares are devalued to almost nothing, dividends stop, then if there is still a shortfall, depositors are next, followed by the general transactors who just use the bank for their salary cheques. Customers who have taken a haircut or had funds frozez can be given shares instead of their money back (you usually don't get to choose your option), but by this time the bank shares have plummeted to almost zero and aren't worth anything anyway. I can't make this shit up, it is a function of the OBR legislation and you can find it easily on the RBNZ website, along with other interesting financial charts. Make it your priority to learn about it, so you don't loose your wealth if the worst case scenario happens!

@Bluff When did the RBNZ discover there is a connection between the NZ and Aus parent bank? I'm curious because I went and saw a 'personal banker' at the ANZ to ask just that question and he suggested I write to the ANZ head office in Auckland. So much for personal service. As TD's come due I'm slowly removing our money from the ANZ to Kiwibank, and that resolves the issue of whether there is a connection or not.

requiring banks to hold T1 of 16%, which is what this long article is about. Reducing share dividends to 2% per which is also what this article is about fails to model what happens next in the banking system.

It almost assumes that a company that is a publicly run share holder business is one no longer.

That management and owners of the business wont make decisions after T1 is raised and the bank is told to reduce it dividend.

Im hearing nationalisation of the banks here people.

becuase the whole banking business would change as management say well the RBNZ might as well run the banks and the company is delisted and the capital returned to share holders in a buy bank instead of dividends as share holders dump the shares and move to high performing stocks.

You cant get away from the fact that these businesses are not SOE nor are they government owned.

Think bank management will just sit there and say OH OK we arnt a public company in business after all.

We are a government controlled business and we will do what ever we are told and our shareholders dont matter.

The logic for this is? well ..........

It all sounds good and logical.......but........it isnt.....

Banks have not seemed to have behaved particularly like private capitalist entities in recent times. Too ready to ask governments for taxpayer bailouts when their risky behaviour goes wrong. Regulation requiring them to operate in more responsible and safe manners is hardly less worrisome in such conditions than regulation requiring restaurants to work safely with food.

NZ banks? hardly... the fact are the facts...Nationalise the banks then and be done with it.

accountingsoftw,

That would cost far too much and is quite unnecessary. We need them to significantly increase the capital-more skin in the game-for shareholders,to divest themselves of all non-commercial banking activities,to cease all on-essential derivative trading and go back to being boring old commercial entities.

You can't nationalise a bank if your country doesn't own it in the first place.

They've behaved exactly like private capitalist entities with the power to hold entire nations to ransom. It was forewarned 100+ years ago when the Federal Reserve took control. Every capitalist entity wants to make the rules, only some actually gain the power to.

If one or more of the big 4 Australian banks got into real trouble in Australia because of their housing market decline/crash, and need a bailout or bail-in, how would that impact those banks here ? In reality, how separate are they in a crisis like that?

Voiceofreason,

I posed that question to the RB several years ago and have a copy of their reply. It states that the assets of the NZ subsidiary would be ring-fenced.

This is correct.

It would definately affect our banks as their parent banks are Australian owned. Our banks are already required to re-pat large sums and profits to send back offshore. This isn't new, it has been happening for years. Some of the money was kindly gifted back recently, as was reported in the banks latest financial profit report.

How about we try a little social experiment? Let's take all our cash out of the bank and see how safe the banks are. If they really want/need your money then demand they pay you more for it. Of course those that have their short and curly's locked up with a mortgage won't be allowed to. Whose money is it?

Sorry Meh, what does that prove ? No bank in the world would be "safe" if they lost their depositors - banking is just supply and demand for money with a margin in the middle - yes, withdraw your cash and demand higher rates, but understand your just asking the borrowers to pay you more

Taking into acount Grant A's response above, that would constitute a "run" on the bank, and there are laws to enable them to limit and stop it. Whose money is it? If you've deposited it in a bank account - it is the bank's money, not yours any longer. And if the bank gets into trouble it will be gone because you are just an unsecured creditor. If you don't like that then ask the Government what they are going to do about it.

The government has already given you the answer. It is called the OBR policy. They can't legislate the banks anyway because New Zealand doesn't own them. They may however, help out Kiwibank if this happens, and this was noted in a Credit Review of all the banks, a couple of years ago, which resulted in Kiwibank receiving a better rating than those pesky ozzie owned banks who have had two major credit risk downgrades already.

OMG so no one here can actually put the banks in order of risk so whats the point of all the numbers ? Seriously you want me to go away and do my own due diligence on all the banks ? Unless you can provide a conclusion or analyse the numbers its pointless putting them up because they mean nothing to Joe Public like me. I can never remember any of the major banks getting into trouble. The only memory I have was the likes of Country wide or was it Marac that someone started a rumor on and there was a bank run on them.

Carlos - there was one, the BNZ which effectively went belly up as a result of the cowboy days of the 80's that saw it bailed out by the Govt and then onsold to NAB the current Aussie owners. So it can happen, but we shouldn't be comparing too much to the 80's in NZ which was amateur hour where a Muldoon hugely controlled economy was suddenly freed up and turned into a free for all that taught the naive NZ population and finance industry a hell of alot of lessons (well for the last 30 odd years anyway).

The BNZ almost collapsed as Jim Bolger took the helm. Fay Richwhite, Brierley and co were responsible for the near collapse which resulted in the big government bailout, as the BNZ was our Government owned bank and the only one that our government banked with. I remember it well, because I started working for the BNZ about 8 months before it was sold off to NAB. Ever heard of the "Winebox Enquiry" that Winston Peters exposed? History that I will never forget.

There are legal (and practical) reasons DC and co can't give personalised financial advice. There are also several types of risk.. which ones are you worried about the most?

There is only one risk really worth worrying about for a depositor - and that's the OBR hazard imposed by the RBNZ - when a bank is put under statutory management and the bank's depositors are required to relinquish a portion of their funds to make the bank solvent (with covered bonds exempt from this hazard). The RBNZ dashboard is extremely unlikely to provide any way at all for depositors to evaluate that risk in advance. In the case of one of the Australian banks getting into difficulty, it is likely their NZ subsidiary will be sacrificial - especially with the RBNZ OBR in place.

Largely agree that the risk is anything that would trigger an OBR, as being the primary concern of any depositor. But at this point there would be so many things going wrong for the bank that the RBNZ and Government should be facing some very hard questions about regulation and oversight, because the OBR trigger would suggest significant problems with the bank's stability. The banks and Government should also realise that in this event the public would be expecting that at least a few would be going to prison for criminally negligent or fraudulent behaviour.

One of the most significant learnings from the GFC was that no one went to prison, despite much of what was going on appeared at least to be fraudulent, or criminally negligent.

Iceland jailed the bankers and changed legislation and are better off for it today. They recovered much more quickly compared to countries that slapped them with a wet bus ticket.

Clearly its a waste of time perusing this on here. Just look at their credit ratings instead, this is quick and easy to find.

Indeed! I have never known rating agencies to get things drastically wrong.

Like AAA rated MBS's in the USA during the mid 2000s? Solid as a rock those things..

Zigackly. Wassisname is ferpectly right!

Wassisname is certainly "right" in some aspects. I figured you might have been being sarcastic, but you forgot the /s :)

I think you guys are missing the point, at least the rating agencies put their balls on the line and give each of the banks a rating. I asked someone, anyone to rate the banks in order here and all I got was no can do. Presumably the rating agencies are looking at similar information as above, unless your suggesting they pull the ratings out of a hat. Their "Educated guess" is going to be as good as any.

Just don’t have a bank account. Problem solved.

All of the data on the RBNZ website can be exported into an Excel spreadsheet and you can use formula's and graphs to work with the data, which can give you a pretty good snapshot of each bank. But it takes time and dedication to do this. If you are into this sort of thing as a hobby, the data is a dream for some.

This video by Ray Dalio, called "How the Economic Machine works in 30 minutes" is a great video and a good start. It is well worth watching if you are wanting to understand more about how financial markets work.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.