While headline inflation continues to decline, economists are worried prices are still climbing in the most visible and persistent parts of the economy.

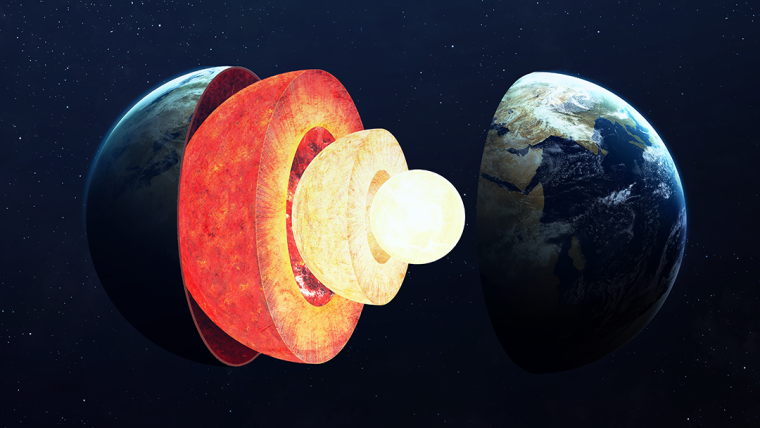

Brad Olsen, Infometrics chief executive, said there was still an intensely hot core of inflation among everyday items such as food, energy, and rental costs that shape expectations.

International oil prices have flowed through to lower transport costs but household living costs are continuing to rise at a significant pace.

Non-tradable or domestic inflation was running at 6.6% in the June quarter, on an annual basis. That’s above the Reserve Bank’s forecast of 6.3% and ANZ’s 6.4%.

The annual rate of inflation dropped to 6% in the June quarter from 6.7% in the March quarter. It peaked at 7.3% in June 2022.

Henry Russell and Miles Workman, economists at ANZ, said the price pressure was spread broadly across sectors and wasn’t due to idiosyncratic movements in one or two components.

The falling headline rate was due to cheaper imported goods, lower shipping costs, and a much weaker international oil price. All things the central bank has little-to-no control over.

“Overall, today’s data suggest that underlying inflation is proving persistent, which will be a big worry for the RBNZ,” Russell said in a note.

“Monetary policy is working to cool inflation pressures, but there’s a long way to go, and it’s not clear that progress is fast enough”.

Most core inflation measures are showing some evidence of moderation, but not the Reserve Bank’s own ‘sectoral factor model’ flagship which has been stuck at 5.8% for the past three quarters.

There were other concerning trends under the hood as well. Almost 85% of all items included in the index were running above the 2% target, even as the proportion running above 5% fell.

“That suggests extreme inflation is now fading, but at the same time, inflation could be normalising above the RBNZ's target midpoint of 2%,” Russell said.

“It’s a long way back to target and that challenge will become increasingly evident once the low-hanging fruit of base-effects has all been gathered”.

Strong wages support inflation

Kiwibank economists said the world war on inflation was being won, but the domestic battle was still being hard fought.

Mary Jo Vergara, a senior Kiwibank economist, said half of all NZ’s inflation had been imported and that element was fading fast.

It fell to 5.2% in the June quarter, down from 6.4% in March and a peak of 8.7%.

But getting back to 2% required bringing down “stickier, demand-driven” domestic inflation, which was made more difficult by the steady increase in wages.

Multiple economists said non-tradable inflation was unlikely to drop back into the target range without some weakening of the labour market.

Most now expect the Reserve Bank to lift the Official Cash Rate (OCR) another 25 basis points to 5.75%, if not further.

Only two components of the entire consumer price index (CPI), transport and communication, declined across the quarter, with the rest of the headline fall being due to base-effects.

Kim Mundy, a senior economist at ASB, said the June quarter included some inflationary impacts from Cyclone Gabrielle and the Auckland flooding.

For example, dwelling maintenance services rose 1.7% and insurance premiums lifted 3.1% during the quarter.

“The extent to which the RBNZ expects these price rises to be temporary will be an important consideration in terms of the policy implications,” she said in a note.

But there are future inflation pressures on the horizon as well. The September quarter will include impacts from tax changes, such as the discounted fuel tax and council rate hikes.

No-one expects inflation to pick up pace again, but its descent will slow as the easy parts are picked off first and tougher battles are fought.

Watch, worry, and wait

Craig Ebert, a senior economist at BNZ, said the 6% CPI would help to dampen inflation expectations and keep indexed prices from increasing too fast.

Elsewhere, he saw encouraging signs that inflation was being squeezed out of the economy despite what might be a disappointing quarter for some.

“If we didn’t know better, we would have viewed today’s CPI report as keeping a degree of pressure on the RBNZ. But … there are already strong disinflationary forces running through significant parts of the NZ economy,” he wrote in a note.

Export commodity prices were falling which would have a negative impact on the economy, and therefore inflation.

Gross domestic product has been flat, if not falling, and business surveys show it has been easier to find available staff. Capacity constraints are easing more generally, as well.

Ebert said global inflation was going through a similar process to inflation in New Zealand.

“Clearly moderating in a headline sense but running into degrees of stickiness with respect to core inflation (underpinned by resilient labour markets).”

“Looking at the latest consensus forecasts, they expect CPI inflation, across the world, to slow to 5.3% in calendar 2023, then 3.6% in 2024.”

BNZ has forecast an annual inflation rate of 5.9% in the September quarter and 4.7% in the December quarter, while the RBNZ has guessed it will be 5.7% and 4.9%.

At its last policy meeting, the central bank said it was expecting headline inflation to fall from its peak and bring expectations down with it.

But Ebert said it was less definitive in its comments about core inflation, saying only that it was expected to decline when capacity constraints ease.

“This suggests a degree of tolerance, at least timewise, to witness core inflation falling. With so many leading indicators pointing downward, we need to trust the lags in bringing inflation to heel,” he said.

Financial markets were pricing in a decent chance of another increase to the OCR in November, but were little changed by the CPI data release on Wednesday.

41 Comments

'Core of inflation is hot'... as a direct result, interest rates will remain hot for the foreseeable future..

Import more and more wannabe kiwis. They must work to solve the staff shortages but not buy anything or rent.

.

I'm not so sure that tradables, like food commodities, will stay low given the intense heat and drought in the Northern Hemisphere. Oil has moved back up $5/bbl since the end of July.

RBNZ cannot lean on tradable inflation.

91 is heading towards $3 a litre in many parts of Auckland.

.. just given Suzuki Swift a make over. It’ll last another 5 years or more.

Honda Jazz 2002, 200800km. Waiting for the pain to hit and someone to offload a Corolla cheap.

“Buy the cheapest car your ego can afford.”

Great taste in cars - I love mine.

Great cars.

In the last quarter, higher wages added $500 million to business costs - this is about average for the last 5 years.

Guess what else has added another $500 million? Yep, interest rates. In fact, the high cost of borrowing is now by far the biggest pressure on the prices that are actually pushing up inflation (fruit, vegetables, rent etc).

So, to all the lazy ass bank economists who are talking about sticky wages: Look at the bloody data and get over your 'workers must be punished whilst we watch' fetish.

Less than 40% of properties have a mortgage. That's a small group wearing it.

It’s hardly ‘small’.

Households overall are net winners from higher interest rates. Savers are now getting paid more in interest than mortgagors are paying out.

Jfoe..

I'd suggest the real returns on savings is not much different now than it was... ( Before financial repression style rates post GFC)

$100000at 5% is$5000/yr less 30%tax gives $3500 net .. say inflation is5% ...that 100000 losses $5000 in value SO... Net return is negative $1500 ......Hardly a winner...!!! In fact a big loser.

Home owners , over time, tread water with gains in property prices, that is essentially a function of monetary inflation. Ie. Property is a better store of value than money ( term deposits etc )

Real estate has no par value - zero is certainly a possibility.

Disagree...as long as we need a "a roof over our heads"... real estate has a par value.

It will never ever go to zero... Nuclear wars ..etc aside

except those who have less savings than mortgage debt

That stat always surprises me. Does it include state houses in the denominator?

The driver is business lending costs. Last bit of money I got from the bank was at 8.5%.

Increased mortgage costs will stop spending, slowing inflation.Apart from that they aren't worth mentioning.

So the squeeze goes on business. Funding costs are up, people spending less, margins eroded.

Yes and a big part of the rest appears to be coming from the Crown splashing borrowed cash around and also driving up costs for businesses and especially primary producers who are already under the pump from the weather. So no respite coming any time soon

Sorry, but that's plain wrong. The Crown has taxed as much as it has spent over the last 6 months. The fiscal brakes are well and truly on. In fact, that's a major reason we are in recession.

No the Crown has not taxed as much as it has spent - spending is outrunning tax take

They publish the data so we don't have to debate it - google RBNZ D10 and look at govt cash influence by month.

Jfoe,

Does the RBNZ d10 account for all of the govt income/spending over those 6 mths ?

The govt financial statements seem to show a different view ?? Ie. Spending more than it is taxing

https://www.treasury.govt.nz/publications/financial-statements-governme…

What are your thoughts on higher wages relative to leaner profit times?

I have said before that while wage rises are good when the going is good (economy-wise), when times get tough they aren’t so good as employers may have to shed more staff than they might otherwise had to.

Well said, when the market cools and you’re left with multiple staff on high wages, those quiet weeks really hurt.

This is a result of out of control government spends, excessive freebies, and failure of RBNZ in taking preemptive actions when this government's intentions were loud and clear with flooding the economy with excessive and free cash.

Agreed, gotta stop giving out $17bn a year to bludging boomers regardless of how much wealth they’ve amassed by riding the greatest tax free capital gainz in the world

Don't worry, it'll tick up by another $500m or so in the next 12 months, like it has since the mid 2000's.

We can build 1 new hospital with $500m. Yet each year super increases by that amount. At the moment we're at 34 hospitals per year. Cruel irony, is the non-means tested super is going to those who will likely need the hospitals the most, and they'll no doubt complain about the quality of care.

So you reckon the Government shouldn't have lashed out with huge liquidity when Covid hit, and the RBNZ shouldn't have slashed interest rates to the bone as well? Probably right. But that's an easy call in hindsight.

What would you be saying if Covid had actually been another variant of Marburg Virus (who knew at the time) and 90% of New Zealanders that caught it subsequently died, and the Government/RBNZ had failed to take the actions they did?

The problem we have now is correcting the policy mistakes made over decades by successive administrations of all ideologies across the world, not just here. And until those have been fixed, then expect more of what we've had in the last 2 years, as Inflation keep rearing its destructive head. The bigger problem comes after that - a Deflationary Depression. But that's for another day.

Oh come on. We knew the fatality rate of Covid 8 weeks after it broke out. Central banks eased for 18 months.

Cutting interest rates was never going to fix a health issue. The stupid part was never recognising that covid measures never created a demand deficit, that lower borrowing costs would have fixed. In fact it was the opposite.

No we didn't, and then it evolved. The Delta variant didn't hit NZ in numbers, but India shows what is was capable of. There is no reliable date 8 weeks into a new virus, no matter how you wish it were so, because 8 weeks in no-one can know what it will do, how much it can mutate, and how contagious it is.

Multiple economists said non-tradable inflation was unlikely to drop back into the target range without some weakening of the labour market.

Bernanke found it wasn't wages and tight labor. It sure wasn't QE. So where did the "inflation" come from? It was the most obvious explanation here confirmed unnecessarily by econometrics. SUPPLY SHOCK. Shocking. https://buff.ly/3CEKlPB Link

Government is to blame for energy and rental costs.

We have an oligopoly power market milking consumers with oligopoly profits. NZ is simply too small for a fully competitive market. A NZ INC system optimal system would be much better. NZD has been relatively weak as well keeping fossil fuels up in price.

Government is letting a flood of immigrants through the border as well when we still have a massive shortage of housing.

Not to mention local government with its 10% odd rates increases. So much for it being part of government trying to keep inflation in the 1-3% band.

NZ is simply badly managed.

And don't forget, Labour banned the sale of Low User Power Plans. So thanks, Megan Woods.

No they didn't. They increased the maximum charge daily charge that could be applied to low user plans - no company was forced to change anything, they were just allowed to.

Plus, the gentailers pinkie swore that they wouldn't increased their profits as a result.

Inflation doesn't just tank overnight like these pundits seem to hope it will. Core inflation is lingering around but headline inflation is heading in the right direction. Construction materials will see a decent price decline in the coming months as demand falls in the residential sector.

Unfortunately we have a supermarket cartel in this country so they'll keep cranking food prices for as long as they can get away with it. But all in all, I think we'll continue with a gradual inflation decline.

What was the inflation rate in the 80's when the interest rates were so high. And what were the other contributing factors to that?

Energy underpins everything. The core inflation driver is a lack of energy supply caused by a long running war on fossil fuels and the inability of wind and solar to replace them. Taxing the former to subsidize the letter compounds the problem.

Inflation can be solved by increasing energy supply or cutting demand. Cutting demand means destroying wealth and quality of life with those at the bottom bearing the brunt of it.

Fuel excise tax was increased on the 1st July, raising the petrol cost by 29c a litre or about 12%.

Coincidentally, the NZ election occurs a week prior to release of the September inflation figures.

Inflation figures for the September quarter are looking to be very bad.

RBNZ toolbox’s blunt tools are proving inadequate to bring inflation into target zone. They simply aren’t made for pandemics, food supply issues and floods yet they keep on the same old path wrecking productivity and living standards. A good place to start is draining the bureaucratic swamp.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.