Many in the New Zealand forest industry have a “wait and see” approach to their business.

Saw millers are waiting to see if local demand for sawn timber will recover closer to earlier forecasts. Exporters of New Zealand logs to China are waiting to see how the Chinese mills ramp up production after the Lunar New Year holiday, with many ports in China holding high log inventory as mills ran down inventories before the holidays.

China softwood log inventory is estimated at 4.3-4.5M m3. There is an increase in softwood supply from places such as Southern USA, Brazil and Uruguay. These logs are predominantly used in the construction industry where the timber is used for concrete form work and are sold at a discount to New Zealand radiata logs.

At Wharf Gate (AWG) prices received for export logs in March were virtually unchanged from February apart from an increase in the lower grade industrial logs. Some mills increased their purchases of the lower grade logs to mix with the higher grades and reduce their overall cost of log supply. This is most likely only a temporary effect, as mills will have a lot of stock from which to choose after the Chinese New Year holiday period.

The market outlook for China remains steady, while the India demand outlook is mixed with the construction market slow, but with packaging still in strong demand. There are currently less log suppliers shipping to India and demand is still expected to lift in Quarter 3.

Exporters of logs and lumber from New Zealand face increased shipping costs as ship owners seem to be holding back from releasing ships to the market to reduce supply and increase price. Log exporters to China face shipping costs of mid USD 30’s per JASm3.

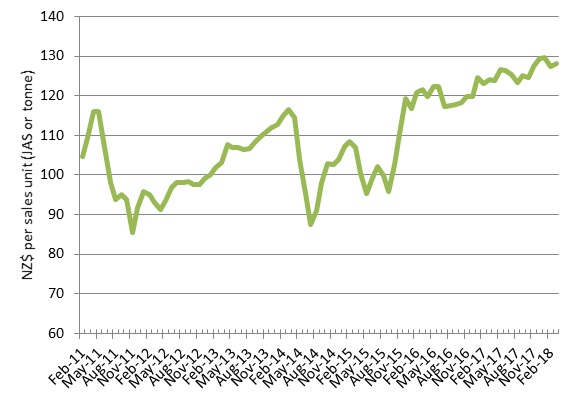

Due to the increase in price for the lower grade industrial export logs, the PF Olsen Log Price Index increased by $1 to $128. (See PF Olsen Log Price Index below). The average sale price is currently $11 above the three-year average.

Domestic Log Market

Pruned

The domestic demand for pruned lumber is steady after a quiet start to 2018. The lower pruned grades continue to be in more demand than the higher pruned grades. Exports sales are still strong, but all the mills would rather supply lumber to the domestic market for better margins. Log supply was very tight in some regions throughout February do to severe weather events.

Unpruned

Sawmills producing unpruned lumber continue to report that sales of construction lumber while similar to last year are well down on forecast. There is no one reason for this but seems to be a combination of reduced construction due to labour constraints and market wariness. Anecdotally we hear of tradesmen with less forward orders than usual. The domestic demand for industrial lumber to be used for pellets and packaging is strong, with good demand forecast.

The export markets remain strong, so volume is redirected to first Australia then further afield. Fortunately, the Scandinavian supply of lumber into Australia has reduced. All the mills however, would rather supply lumber to the domestic market for better margins.

China

There has been virtually no data out of China over the last two weeks. Visitors to China report eerily quiet scenes at ports across China with high inventories. Total softwood inventory in China is estimated at 4.3-4.5M m3. Log exporters are not concerned about this increase in stock levels over the Chinese New Year period, and demand is expected to ramp up quickly as workers return to the mills. Most exporters increased prices for log sales in China by one USD per JASm3 for February and again in March.

We note that coal stocks in China are also relatively high, and this is a function of the holiday period and the crackdown of the China government on improving processing efficiency, and environmental performance. Similar to improvements outlined in previous Wood Matters about the wood processing industry, the Chinese government has a target to cut ineffective coal capacity by 150 million mt in 2018.

India

A few suppliers of logs to India have instead supplied China over the last six weeks as demand is still sluggish. Log suppliers expect demand to lift in Quarter 3. Suppliers to this market will likely face proportionally higher shipping cost increases than supply to China.

Scion Log-Price Outlook

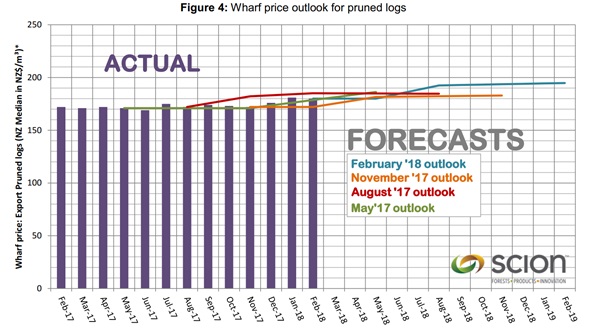

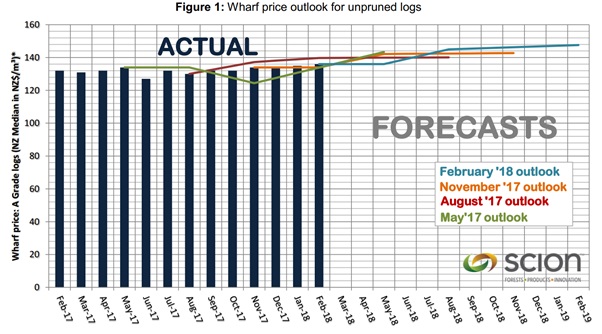

In February Carel Bezuidenhout of Scion undertook his regular survey of forest industry participants to update the Scion Price Outlook. The results are graphed below and show a generally positive outlook.

Pruned logs

Unpruned logs

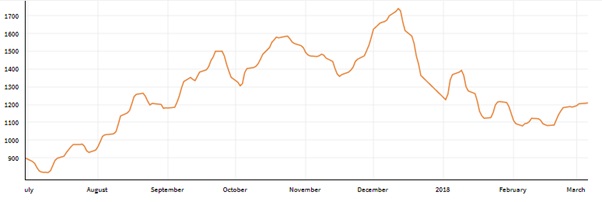

Ocean Freight

Ocean freight prices have increased in the last couple of weeks as ship owners demand higher prices. Market commentators believe ship owners are holding vessels back to reduce ocean freight capacity. There is often an increase in ocean freight demand after the Chinese New Year period. Log exports are reporting shipping costs to China in the mid USD30’s. The chart below of fuel bunker prices does show an increase in fuel costs in the last couple of weeks.

Singapore Bunker Price (red line) versus Brent Oil Price (blue line)

Source: Ship & Bunker

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays the average USD hire paid per day across 20 ocean shipping routes.

Baltic Dry Index over last year.

Source: Lloyds, BDI.

Foreign Exchange

In the first week and half in March the NZD has appreciated from 0.7261 against the USD at the start of March to 0.7288. Log buyers and sellers at NZ ports wait to see the strength of the NZD relative to the USD towards the end of March when prices are set for April log deliveries.

PF Olsen Log Price Index to March 2018

Due to the increase in price for the lower grade industrial export logs, the PF Olsen Log Price Index increased by $1 to $128. The index is currently $6 higher than the two-year average, $11 above the three-year average, and $16 higher than the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – March 2018

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||

| Mar-18 | Feb-18 | Dec-17 | Nov-17 | Oct-17 | Mar-18 | Feb-18 | Dec-17 | Nov-17 | Oct-17 | |

| Pruned (P40) | 182 | 182 | 182 | 182 | 182 | 185 | 185 | 181 | 180 | 179 |

| Structural (S30) | 128 | 128 | 124 | 120 | 120 | |||||

| Structural (S20) | 112 | 112 | 110 | 109 | 109 | |||||

| Export A | 142 | 142 | 148 | 144 | 137 | |||||

| Export K | 135 | 135 | 140 | 136 | 131 | |||||

| Export KI | 128 | 123 | 130 | 127 | 122 | |||||

| Pulp | 47 | 47 | 47 | 47 | 47 | |||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only..

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.