May At Wharf Gate (AWG) log prices remained flat with very little market movement. Log Inventory has started to reduce in China. Modest price increases are expected for June log sales, but this is unlikely to translate to increased AWG prices in New Zealand as shipping costs remain high and the NZD has recently strengthened against the USD.

Domestic demand for sawn timber remains very low and many sawmills now plan to reduce production of structural lumber to match orders.

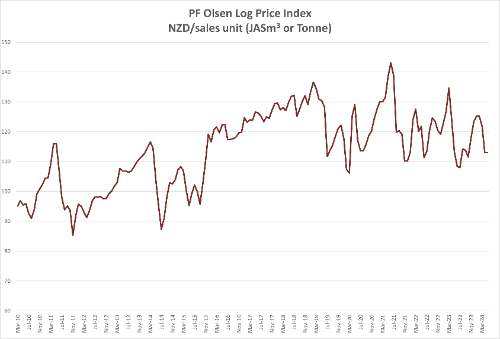

The PF Olsen Log Price Index remains at $113. This is $6 below the two-year average, and $7 below the three and five-year averages.

Domestic Log Market

Domestic demand for sawn timber is poor and slipping. Construction activity remains very low in New Zealand. Some sawmills are offering significant discounts to move product, as mills compete for market share. This is at a time when the costs of production have increased, so many mills are getting squeezed in the middle.

Sales of clear boards into Europe are relatively strong, but high shipping costs and a stronger NZD will reduce the returns from these sales. Sales of sawn timber into Asia are steady, but there is some price pressure developing.

Export Log Markets

China

China log inventory has reduced with softwood levels (which is mainly New Zealand radiata pine) at about 3.2m m3. Daily off-take remains at 70-75k per day.

The sale price for A grade pine logs in China during May has been around 116 USD. Exporters expect log prices will increase in June.

The China Caixin Manufacturing PMI increased in April to 51.4 from 51.1 in March. (Any number above 50 signals manufacturing growth). New export orders grew at the fastest rate in three and half years.

China has announced wide ranging measures to assist its ailing property sector. He Lifeng (vice premier and the Communist Party’s top economic official) wants municipal governments to buy unsold homes and convert them into affordable social housing. To facilitate this, in a coordinated move the People’s Bank of China (PBOC) announced it will establish a nationwide program to provide 300 billion yuan (41.5b USD) in loans to fund this state purchase of unsold homes. Central government will also encourage commercial banks to support local state-owned enterprises to buy unsold homes in an effort to raise the potential capital input to 69b USD. While share prices have been increasing any increase in construction will likely be muted. It does signal that China still wants to rescue what was once the engine room of its GDP growth. While the China government does not want to return to the speculation driven excessive construction they do seem to want sustainable construction activity.

As mentioned in previous articles New Zealand forest owners and log exporters will need to adjust supply to match this lower demand base. This will be especially important during the New Zealand summer when drier ground conditions facilitate increased harvesting levels.

Demand in Gandhidham for green sawn timber is steady with prices remaining at INR 571 and INR 601 per ft3 from timber from South America and Australian pine logs respectively.

The market anticipates three log vessels loaded from New Zealand in June to arrive in July along with two vessels from Australia and two shipments from Uruguay.

New Zealand log supply is replacing some Uruguayan supply that has reduced due to flooding caused by record rain levels. Uruguay volume has maintained higher sale prices (144 per JASm3 USD for A long) while some New Zealand exporters lost their nerve and discounted price, so the sale price is now in the range 136-140 USD per m3 for A long. Australian volume is selling in the same range as the New Zealand supply. It appears Uruguayan suppliers are rewarded for being consistent suppliers. Also, a part of the Indian market has now adapted and got used to the Uruguayan logs and is competing for a share of the reduced supply.

In Tuticorin, some containers are arriving from USA, Australia, and New Zealand while South Africa has also resumed supply. The sawn timber price is steady at about 651 INR per ft3.

India is waiting for the general election result for the lower house of the Parliament on June 4. Once this result is declared more new projects can be implemented, increasing wood demand. Countering this though is the monsoon usually starts in June which may dampen demand until September.

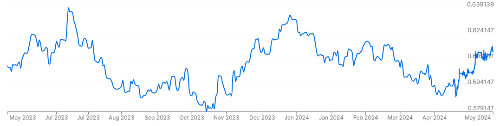

Exchange rates

The NZD has continued to strengthen against the USD during May. In isolation this FX effect would reduce the June AWG prices received by New Zealand forest owners by about 5 NZD.

NZD:USD

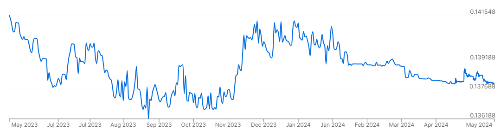

CNY:USD

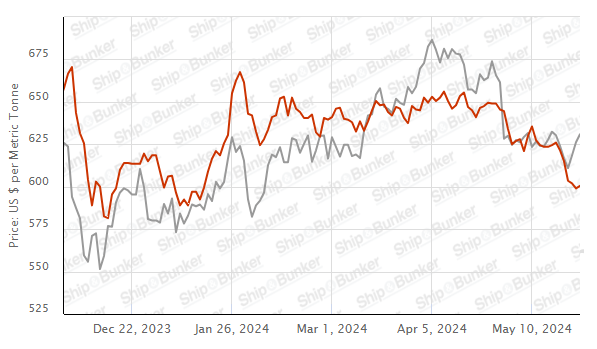

Ocean Freight

Ocean freight remains high with shipping from the South Island now above 40 USD per JASm3. The slower New Zealand economy means less vessels are bringing goods to New Zealand that log exporters can then load out from New Zealand.

The BDI below is a composite composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI.

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – May

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent

a broad average of log grades produced from a typical pruned forest with an

approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – May 2024

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| May-24 | Apr-24 | Mar-24 | Feb-24 | Jan-24 | Dec-23 | May-24 | Apr-24 | Mar-24 | Feb-24 | Jan-24 | Dec-23 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 170 | 170 | 185 | 196 | 196 | 190 |

| Structural (S30) | 120-145 | 120-145 | 120-145 | 122-145 | 122-145 | 120-145 | ||||||

| Structural (S20) | 93-100 | 93-100 | 93-100 | 94-100 | 94-100 | 93-100 | ||||||

| Export A | 108 | 108 | 128 | 135 | 135 | 134 | ||||||

| Export K | 99 | 99 | 119 | 126 | 126 | 125 | ||||||

| Export KI | 90 | 90 | 110 | 117 | 117 | 116 | ||||||

| Export KIS | 81 | 81 | 101 | 108 | 108 | 107 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.