At Wharf Gate (AWG) log prices were stable in February. Log demand in China increased very slowly after the Chinese New Year. CFR log prices have held steady, while log inventory increased during the holiday period. Shipping costs have increased through February and the CFR log prices in China won’t be able to increase to compensate. This means AWG log prices in New Zealand will be under pressure in March.

Domestic log prices are stable with log pricing set for Quarter 1.

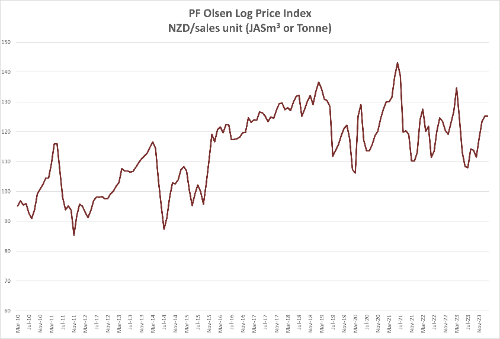

The PF Olsen Log Price Index remained at $125. The index is currently $6 above the two-year average, and $4 above the three-year and five-year averages.

Domestic Log Market

Domestic log prices are stable as most log pricing was set at the start of Quarter 1.

The NZ Reserve Bank has kept the official cash rate at 5.5%. This was expected by the market, but the Reserve Bank softened its stance slightly with new indications it may cut interest rates sooner than expected. “Core inflation and most measures of inflation expectations have declined, and the risks to the inflation outlook have become more balanced.” A rate cut sooner than expected would be welcome news to the sawmilling industry.

Export Log Markets

China

China softwood log inventory increased to 3m m3 over the Lunar New Year Holiday period. Activity has started back very slowly since the holiday period and log use is still below 10k m3 per day heading to the end of February. Even when daily off-take gets back to 50k this still means there is two months of inventory in China.

The sale price for A grade pine logs in China remained stable in February with a slight increase to be in the 128-132 USD range.

The China Caixin Manufacturing PMI remained at 50.8 in January. (Any number above 50 signals manufacturing growth). This is the first time since May 2021 the index has remained in the expansion zone for three straight months. The market is waiting to see how log demand will recover after the holiday period but early indications are that the construction activity will remain very slow.

India

A recent amendment to section 43B(h) of the Indian Income-tax Act is putting some temporary sales and collection issues among Micro or Small enterprises (MSE) in India. Buyers need to pay back a MSE unit, within the credit period agreed upon. Otherwise, bills will be disallowed and treated as income and income tax levied.

This may be a transitional glitch, but in the longer term this section can improve cash flows to importers.

Kandla Port is likely to receive five log vessels from South America and one log vessel from Australia, in March. The CFR price for A grade is in the range 144 to 152 USD per JASm3.

Green sawn timber prices have increased by about 20 INR per CFT over February South American sawn timber is selling for 561 INR per CFT and Australian radiata pine sawn timber is sold at 591 INR per CFT.

Tuticorin continues to face log supply shortages, due to adverse weather in the USA and higher liner freight rates. The price for green sawn timber remains around 650 INR per CFT.

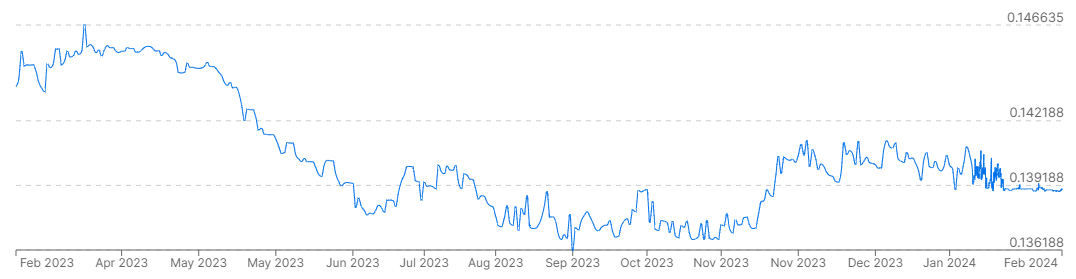

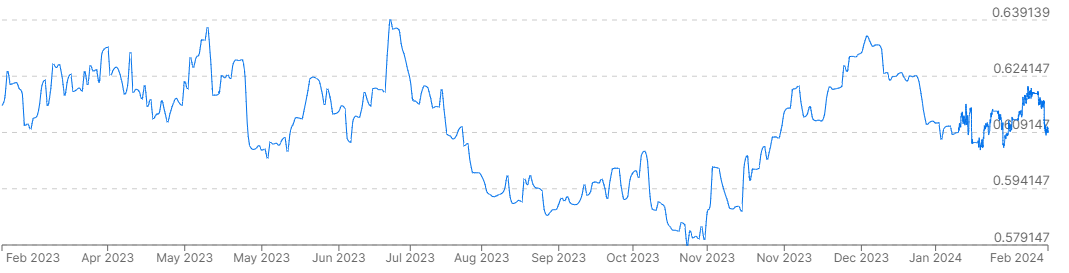

Exchange rates

The NZD has weakened against the USD through February and this will offset some of the increased freight costs during AWG calculations.

NZD:USD

Ocean Freight

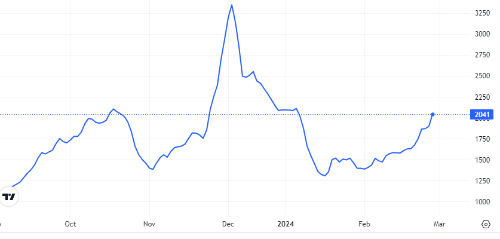

Freight costs have increased by about 6-8 USD per JASm3 with average shipping costs now above the mid 30’s USD per JASm3 to ship logs from the North Island of New Zealand to China.

The Baltic Dry Index (BDI( below is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI.

The Baltic Dry Index has increased 25% over the last month.

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – February 2024

The PF Olsen Log Price Index remained at $125. The index is currently $6 above the two-year average, and $4 above the three-year and five-year averages.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent

a broad average of log grades produced from a typical pruned forest with an

approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – February 2024

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Feb-24 | Jan-24 | Dec-23 | Nov-23 | Oct-23 | Sep-23 | Feb-24 | Jan-24 | Dec-23 | Nov-23 | Oct-23 | Sep-23 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 196 | 196 | 190 | 180 | 180 | 180 |

| Structural (S30) | 122-145 | 122-145 | 120-145 | 120-145 | 120-145 | 120-145 | ||||||

| Structural (S20) | 94-100 | 94-100 | 93-100 | 93-100 | 93-100 | 93-100 | ||||||

| Export A | 135 | 135 | 134 | 125 | 119 | 119 | ||||||

| Export K | 126 | 126 | 125 | 116 | 110 | 110 | ||||||

| Export KI | 117 | 117 | 116 | 107 | 101 | 101 | ||||||

| Export KIS | 108 | 108 | 107 | 98 | 92 | 92 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.