Log prices are increasing in China as log demand remains steady and buyers react to tightening supplies. Inventory of New Zealand pine in China has dropped by 0.5m m3 in the last month. AWG prices increased slightly in July, and larger AGW price increases are expected for August. New Zealand suppliers need to be cautious they don’t increase log production too much and oversupply China. A small increase in shipping costs will partially offset the AWG gains from CFR log price increases in China.

Domestic Log Market

New dwelling building consents in New Zealand continue its downward trend this year. Indeed there has been a downward trend since the peak of March 2022.

This is not a good sign for mills who already report lower demand for the sawn timber they produce.

Export Log Markets

Export AWG prices

AWG prices in the North Island only increased marginally as competition for logs had kept the prices artificially higher than market fundamentals. Log sellers in the South Island received about an average 15 NZD increase in AWG prices in July. This reduced the AWG price differential between North Island and South Island ports back to normal levels.

China

China softwood log inventory has decreased slightly to about 3.7 m3 with radiata stocks dropping about 0.5m m3 over the last month to 2.6m m3. Port off-take has remained steady ranging around 70-75k m3 per day while supply volume has reduced significantly. Log shipments from New Zealand was about 1.4m m3 which is well down on previous highs of 2m m3 a month.

In July the CFR price for A grade radiata logs in China increased to 110 USD per JASm3, and the market expects August sales will range around 115-120 USD per JASm3. Domestic wholesale log prices in China increased through July as buyers react to tightening supplies.

Many of the larger forest owners in New Zealand have removed the production restrictions they had placed on their crews. This will increase volume to China. Countering this increase, many smaller forest owners are still not willing to start harvesting at the current price level, so as harvest crews complete jobs, their next job is unlikely to start. Winter is also not a good time to start a new harvest block with increased roading costs.

The China Caixin Manufacturing PMI unexpectedly fell 0.4 points to 50.5 in June. Manufacturing conditions picked up for the second month in a row, but at slower levels then in May. Any PMI number above 50 signals manufacturing growth.

Prices for green sawn timber in Kandla are stable at 511 INR per ft3 for timber from South American logs and 551 INR per ft3 for timber from Australian logs. Kandla is expecting four log shipments from South America and four shipments from Australia during August.

The market in Kandla is waiting to hear MPI NZ decision regarding issue of phytosanitary certificates for India bound shipments without fumigation at origin, for which Indian Plant Quarantine has given a temporary window till 31st August 2023.

Tuticorin is receiving pine logs in containers from South Africa and USA at CIF 91 to 113 USD per metric tonne. Green sawntimber is sold around 600 INR per CFT.

Exchange rates

The NZD was quite volatile against the USD in July hitting a peak of 0.64, but has dropped back more recently to 0.615 to be closer to the end of June rate of 0.609.

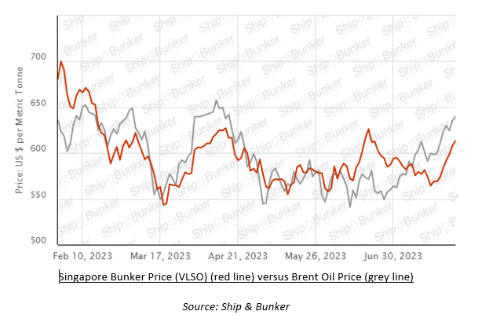

Ocean freight

Freight rates from New Zealand to China have increased by about 2 USD per JASm3. This will partially offset the AWG price increases resulting from the increased CFR log prices in China.

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI.

PF Olsen Log Price Index - July 2023

The July PF Olsen Log Price Index remains at $108. The index is currently $11 below the two-year and $14 below the five-year average.

Indicative Average Current Log Prices – July 2023

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Jul-23 | Jun-23 | May-23 | Apr-23 | Mar-23 | Feb-23 | Jul-23 | Jun-23 | May-23 | Apr-23 | Mar-23 | Feb-23 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 150-160 | 150-160 | 160-170 | 180-200 | 200-222 | 190-205 |

| Structural (S30) | 120-145 | 120-145 | 120-150 | 120-150 | 120-150 | 120-150 | ||||||

| Structural (S20) | 93-100 | 93-100 | 98-105 | 98-105 | 98-105 | 98-105 | ||||||

| Export A | 105 | 105 | 110 | 133 | 158 | 140 | ||||||

| Export K | 96 | 96 | 101 | 124 | 149 | 131 | ||||||

| Export KI | 89 | 89 | 94 | 115 | 130 | 121 | ||||||

| Export KIS | 80 | 80 | 85 | 107 | 131 | 113 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.