Chinese log buyers continue to struggle with credit issues and log demand in New Zealand is reducing as construction activity declines due to high inflation and interest costs. AWG (At Wharf Gate) prices dropped 5-10 NZD per JASm3 with the larger drops at South Island ports. Some mills and forest owners have already pre-empted Quarter 3 pricing and reduced prices for domestic logs to preserve supply chains. There is general agreement we are at the bottom of this export price cycle, but few are bold enough to make predictions about the rate of recovery. Harvest volumes are reducing significantly in New Zealand which will help with the supply/demand balance.

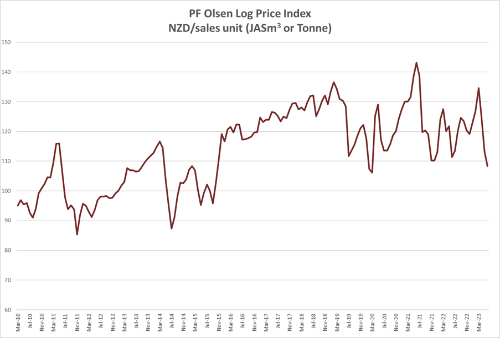

The June PF Olsen Log Price Index decreased $5 to $103. The index is the lowest since March 2020 when markets were impacted by COVID-19 lockdowns. The index is currently $12 below the two-year average and $15 below the five-year average.

Domestic Log Market

There is strong demand and enquiries for clearwood timber from Europe and the USA. There has been reduced supply of clear boards with Pan Pac Forest Product’s Whirinaki mill in Napier being inoperable since Cyclone Gabrielle in February. Sales of the mid to lower grades produced by these mills cutting pruned logs are more of a challenge. There are high stocks of premium decking around New Zealand, and timber prices in Asia are falling although lower prices are offset partially by lower freight costs.

Production of structural timber is well ahead of sales with mills now looking at difficult decisions on how to reduce timber production. Australia is also not a lucrative market as they can buy cheaper product from the Baltic countries.

Export Log Market

China

China softwood log inventory has increased slightly to about 4m m3 with radiata accounting for about 3.15 m3. Port off-take has remained steady ranging round 70-75k m3 per day. Supply volume from New Zealand will drop significantly over the next couple of months as many forest owners in New Zealand have stopped or slowed down harvest operations. Many ports in New Zealand have now restricted log deliveries to four days a week, as there is insufficient supply to justify remaining open all week. As predicted last month, there hasn’t yet been any log imports from Australia.

The CFR price for A grade radiata logs in China has bottomed at 105 USD per JASm3, and log exporters are currently offering sales at 110 USD for A grade. Domestic wholesale log prices in China have now stabilised.

The local Masson pine mentioned in last's month report is mainly produced in the southwestern provinces of Guanxi, Yunnan and Sichuan. When pine logs from New Zealand cost more than 120 USD then this local pine will have a market share of 30-40%

These forests are untended so generally produce small size logs. This supply doesn’t impact major destinations of pine from New Zealand such as Lanshan, Taicang and Zhenjiang.

Between January and May this year China imported 15% (7.8m m3) more sawntimber than the same period last year. This sawntimber is mostly used in construction.

The China Caixin manufacturing PMI unexpectedly rose to 50.9 in May from 49.5 in April. Output rose the most in 11 months, new order growth was at a two year-high, and foreign sales continued to increase.

India

Electric supply was out for two weeks in Kandla after India was hit by Cyclone Biparjoy. Logs stored in the open got drenched and most will require two to three weeks of drying before they are suitable for production to resume.

There is already about 180,000 m3 of unsold logs at customs bonded warehouse and some are under auction for duty not paid.

Exchange rates

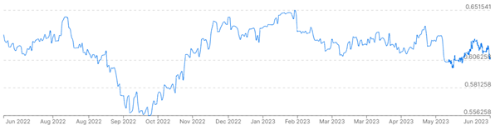

The NZD strengthened slightly against the USD in they first half of June, but has weakened in the second half. The CNY has weakened against the USD reducing the buying power of Chinese log buyers.

NZD:USD

CNY:USD

Currency graphs source: XE

Ocean freight

Freight costs have dropped due to a drop in global freight demand and the cost is now mid 20s USD per JASm3 for a two port load from the North Island of New Zealand to China.

The Baltic Dry Index is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI.

Source: TradingEconomics.com

Singapore Bunker Price (VLSO) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - June 2023

The June PF Olsen Log Price Index decreased $5 to $103. The index is the lowest since March 2020 when markets were impacted by COVID-19 lockdowns. The index is currently $12 below the two-year average and $15 below the five-year average.

Please note these are AWG prices at North Island ports and that South Island prices are commonly lower due to higher port and shipping costs.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – June 2023

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Jun-23 | May-23 | Apr-23 | Mar-23 | Feb-23 | Dec-22 | Jun-23 | May-23 | Apr-23 | Mar-23 | Feb-23 | Dec-22 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 175-200 | 150-160 | 160-170 | 180-200 | 200-222 | 190-205 | 175-190 |

| Structural (S30) | 120-145 | 120-150 | 120-150 | 120-150 | 120-150 | 120-150 | ||||||

| Structural (S20) | 93-100 | 98-105 | 98-105 | 98-105 | 98-105 | 98-105 | ||||||

| Export A | 105 | 110 | 133 | 158 | 140 | 125 | ||||||

| Export K | 96 | 101 | 124 | 149 | 131 | 115 | ||||||

| Export KI | 89 | 94 | 115 | 130 | 121 | 106 | ||||||

| Export KIS | 80 | 85 | 107 | 131 | 113 | 100 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

5 Comments

Monthly Reports – June 2023

https://www.laurieforestry.co.nz/news/monthly-reports-june-2023-6/

"Many ports in New Zealand have now restricted log deliveries to four days". Seems to ignore the ports bulging with Turangi logs - around 200k/month - logging contractors around the country being put to the sword in a sustained downturn, to save Turangi's sapstain.

Have they managed to save timber from Turangi? I was there shortly after the cyclone. In discussion with a truckee he pointed to logs atop each other and with the wet weather they didnt look good. He said they were turning worthless very quickly.

Pruned goes off very quickly, especially if snapped off. If tree retains rootball can still recover export sawlog for some time. Hangs on longer in winter too.

What I saw they were all snapped off. 30 year old trees. Many hundreds of acres. Pretty shocking sight.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.