The world's gone super-cheesy but we can't quite produce enough cheese to take advantage - and that could cost us with lower milk prices to farmers this season than might have been the case.

This is according to Westpac senior agri economist Nathan Penny, who has reduced his pick of the farmgate milk price for the season that just started this month to $8.90 per kilogram of milk solids from a previous high-flying pick of $10. He has maintained a "positive" dairy outlook, however.

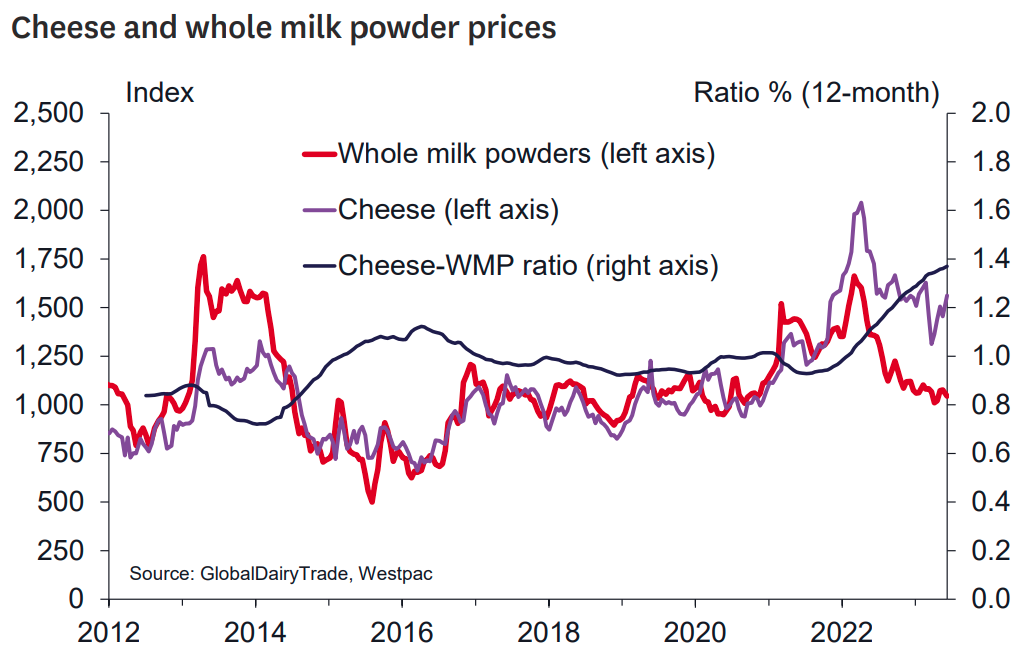

Penny, who has a good track record among economists when it comes to picking the milk price, says in a Westpac Dairy Update that global dairy consumers "have fallen in love" with cheese, with cheese prices "sizzling at or near record highs since late 2021".

"Unfortunately, New Zealand is not well placed (relatively) to take advantage of this trend and total dairy farmer incomes will be lower than they would ordinarily be," he says.

He does say, however, that he's expecting "significantly larger" Fonterra dividends on the back of higher profits in its cheese (and protein) businesses, "albeit these dividends won’t fully offset our lower milk price forecast".

Fonterra recently gave its first milk price forecast for the new season, picking a wide forecast range that had a midpoint price of $8. But it did lift its expected earnings forecast. Penny's pick of $10 for a price had been much the highest - and in fact the new price of $8.90 still is - but there have been previous seasons when he has produced outlying forecasts that have proven ultimately to be near the mark.

The update from Penny followed another GlobalDairyTrade auction early on Wednesday in which overall global dairy prices fell again - but cheese prices soared.

"...The world now definitely loves cheese. Indeed, reflecting this global love affair, since late 2021, global cheese prices have averaged 32% higher than the five-year average prior i.e., between November 2016 and October 2021," Penny said.

"Pinning down the exact genesis for the cheesy trend is a question for the marketing experts – however, we suspect it has something to do with Covid lockdowns, the ease of pizza deliveries during said lockdowns, and therefore a new-found love of cheese in the large fast-growing markets in Asia," Penny said.

But while increasing global consumption of dairy products is normally a good thing for New Zealand, we are not well-placed to benefit from higher cheese prices, at least in the short term because New Zealand dairy companies have limited (factory) capacity to produce more cheese. And while cheese production has expanded where possible, in the short term, these companies are stuck producing other less profitable products like whole milk powder (WMP).

Penny said despite sizzling cheese prices, New Zealand has been unable to materially increase cheese export volumes.

"Note we have been able to divert some WMP [Whole Milk Powder production to other products (like butter), but ideally we would be switching more WMP production into cheese."

Penny said some commentators have pointed to rising Chinese WMP production as a sign of increasing Chinese self-sufficiency and/ or notable strength in Chinese dairy production.

"In our view, China is filling the gap left by global dairy exporters. Indeed, if we could, we would be producing even more cheese and subsequently even less WMP, creating an even larger WMP gap for China to fill," he said.

"With cheese production capacity capped, New Zealand dairy export incomes are not optimal given the current mix of global dairy product prices. Translation: the total of the milk price plus the Fonterra dividend will not equal what the farmgate milk price would be given a normal mix of prices. As the chart below shows, cheese prices have never been this high relative to WMP before."

Penny noted that last month, Fonterra had said that it expects normalised earnings per share of 65-80 cents for the 2022/23 year. Assuming it pays 70% of its earnings as a dividend, this equates to a dividend of between 45.5 and 56 cents per share.

"We anticipate that Fonterra will continue to pay a similar dividend over 2023/24. Adding this together to our forecast milk price equates to between $9.355/kg to $9.46/kg. In other words, the healthy dividend does not fully offset our lower milk price forecast (as Fonterra cannot fully capitalise on very high cheese prices).

"A key question going forward is how long will cheese prices stay high? And secondly, how soon can Fonterra and other dairy companies start to produce more cheese?

"For now, we assume that the cheese price strength and relative WMP weakness persists over the year (on top of an underlying increase in global dairy prices). Essentially, it’s relatively difficult to build new capacity over this sort of short-term horizon. However, if New Zealand companies can produce significantly more cheese in the next 12 months, then cheese prices will fall and WMP prices will rise. In this case, the milk price will be higher and Fonterra dividends lower i.e. closer to our previous forecast."

Dairy prices

Select chart tabs

7 Comments

Research now saying cheese is a health food. 🤔

Research also says that cheese can be as addictive as cocaine. They may be right, I love the stuff!

Man 'addicted' to cheese spends £60k on cheddar - doctors say he is healthy

https://www.express.co.uk/news/uk/1777308/cheese-addict-spent-60k-on-ch…

My pick is that as the price rises, producers will switch over en masse

The westpac economist changed his forecast, oh what a surprise.

I'm no chartist but it actually looks like prices spiked in early-2022 and have been falling back again towards historic trend?

I thought we were replacing dairy farms with pine forests? You can probably soon expect your cheese to come from China like your fruit and meat.

Milk & Dairy Markets

There is simply too much cheese. USDA’s Dairy Market News reports that cheese production schedules are “steady to stronger” and, for some cheesemakers, “limited warehouse space is becoming a concern.” Meanwhile, there is plenty of milk, especially now that bottlers are slowing down intakes for summer break. Spot milk prices in the Upper Midwest ticked back down this week, with some sales as low as $12 under Class III. A few cheesemakers offered their workforce a long weekend, but others worked straight through the Memorial Day holiday. And, unlike earlier in the year, there are very few plants taking downtime for maintenance, so today’s steep discounts reflect a milk surplus that cannot be blamed on underutilized production capacity. By all accounts, the vats are full. USDA reports that some cheesemakers are turning away spot milk because they simply can’t hold anymore.The excess weighed heavily on the cheese markets. CME spot Cheddar blocks plummeted to $1.42 per pound on Wednesday, their lowest value since May 2020, at the height of the pandemic panic. Blocks made a partial recovery and closed today at $1.43, still down 4.75ȼ for the week. Barrels fared a little better. They closed today at $1.5125, up 2.25ȼ since last Friday. Those prices are probably low enough to attract a bit more export business, but demand is clearly not keeping pace with production. H/T AW

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.