At Wharf Gate Prices (AWG) prices for export logs reduced an average of -NZ$2 per JASm3 across ports in New Zealand in October. The CFR log sale price in China has reduced as the CNY weakens against the USD. The weaker NZD against the USD had countered this lower sale price when determining AWG prices in New Zealand. The NZD has stabilised against the USD, while the CNY has continued to weaken against the USD. This variation in currency performance against the USD will likely cause some short-term AWG log price pain for New Zealand forest owners. While log demand is down in China, reduced log supply is maintaining a balance between supply and demand.

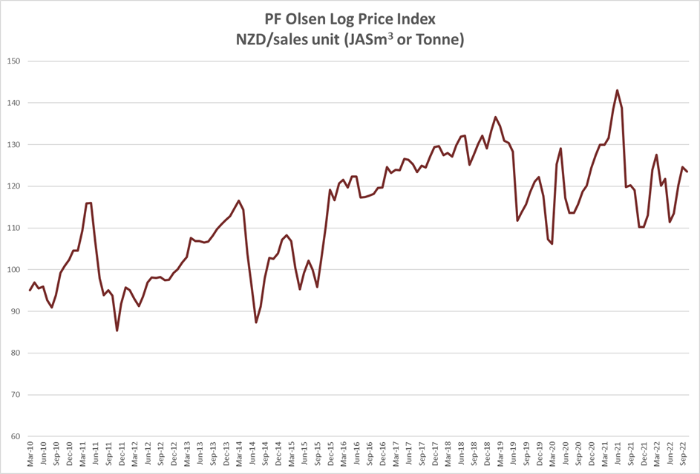

The PF Olsen Log Price Index decreased $2 in October to $123 which equals the two-year and five-year averages. The October index is $5 above the one-year average, so continues to show that log prices this year have been well below average.

Domestic Log Market

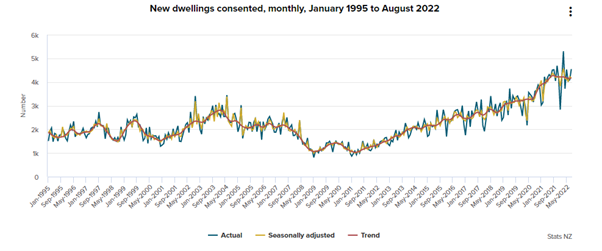

In August 2022, 5457 new dwelling were consented. This comprised of 48% townhouses/flats/apartments and units, 42% stand-alone dwellings, and 10% retirement village units. The number of new dwellings consented to the end of August YTD is up 8.9% from the same period last year.

The annual value of non-residential building work was up 14% year-on-year ended August 2022.

Auckland and Waikato continue to dominate the construction industry with 52% of the national consents this year coming from those two regions. Canterbury consents are also strong with 17% of the national consents. Canterbury consents had the biggest increase of major areas, up 23% year-on-year to the end of August. While West Coast consents are only 3% of Canterbury’s consents, they are up 58%!

Export Log Market

China

China softwood log inventory remains below the 4 mln m3 despite China having the Golden Week holiday at the start of October. There is also a lot less spruce in China as arrivals from Europe has dropped dramatically. This inventory is now less than 500k m3. Daily port log volume off-take has not fully rebounded since the Golden Week and is only about 60k per day. (It was 70k per day before the holiday period).

There is still a wide range of CFR sale prices in China depending upon vessel timing and sales strategies. The current sale prices for A grade logs range between 128-134 USD per JASm3. This is about a 10 USD drop over the last month.

The September Caixin China Manufacturing PMI declined further to 48.1 from 49.5 the previous month. Output fell for the first time in four months and new orders shrank the most since April. Of more concern is that export sales declined at the steepest rate in four months. Market sentiment is at its lowest point since November 2019.

While log demand is down in China the reduced log supply is maintaining the supply demand balance.

High unemployment rates as well as low productivity means housing affordability will be a significant issue. Homebuyers have also lost confidence in the completion of new real estate projects and are refraining from buying new properties. Housing prices are falling in more than half of China’s cities. A survey by the People’s Bank of China in the second quarter of 2022 showed that only 16.2 per cent of households expect an increase in house prices. New home sales are also plummeting, dropping 23 per cent year-on-year as of August. A drop in pre-sales is important because they currently account for 86 per cent of Chinese developers’ funding.

Policymakers attempt to restore the confidence of homebuyers by financing developers with guarantees or have state-owned developers take over the assets of private developers. The structural changes to the Chinese real estate market are resulting in a larger market share for state-owned developers (deeper pockets and access to better funding) at the expense of private companies. it is estimated that only about 25% of private property developers will remain. This means the developers will tend to have healthier balance-sheets, be more stable and operate with smaller profit margins. Urbanisation of the population as well as upgrading housing standards means log demand will continue and should stabilise with less property speculation.

India

Economic activity started slowing in India in the middle of October as preparations commenced for Diwali on the 24th of October. Many sawmill workers in Gandhidham are travelling to their home villages in Eastern India and will return to work about mid-November.

Sawn timber prices are down in Gandhidham. Green sawn timber from South American and Australian logs sells for about 511 and 581 INR per CFT respectively. European kiln dried sawn timber sells for about 601 INR per CFT. This is about a 7% price drop over the last month.

Log vessel arrivals at nearby Kandla Port are reducing drastically. The market expects only one or two arrivals from South America in November and maybe two vessels from Australia. The port will also receive 40k m3 of SYP logs as underdeck cargo from the USA in November.

There may be more arrivals in December if the demand increases.

Indian Plant Quarantine has allowed imports without Fumigation, from Methyl-bromide phased-out countries, without payment of four times relaxation fee of 800 INR per metric tonne.

Importers need to pay the normal one-time inspection fee of 200 INR per tonne, arrange an on- arrival methyl-bromide fumigation and then clear the logs arriving from methyl-bromide phased out countries, as per the list updated by Indian Plant Quarantine, from time to time.

If MPI New Zealand gets exemption from Indian Plant Quarantine for under deck logs, then Indian Plant Quarantine may allow import of NZ pine logs as underdeck cargo, without fumigation, by passing necessary orders, from 1 January 2023 onwards.

If Indian Plant Quarantine allows, then New Zealand log suppliers can resume shipments from 1 January 2023. This will be beneficial to both exporters of New Zealand logs and Indian log buyers.

Exchange rates

While there is still some fluctuation the NZD has stabilised against the USD. The CNY however, has continued to weaken against the USD. This further reduces the purchasing power of the Chinese log buyers. This variation in currency performance against the USD will likely cause some short-term AWG log price pain for New Zealand forest owners.

NZD:USD

CNY:USD

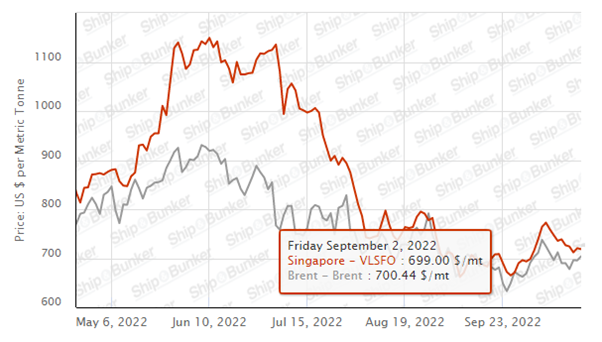

Ocean freight

Shipping costs have further stabilised with low to mid 40’s USD per JASm3 being the average shipping rate from North Island ports to China.

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capsize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in Handysize vessels, this segment is strongly influenced by the BDI. The BDI has risen slightly in September from a two year low.

Source: TradingEconomics.com

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index - October 2022

The PF Olsen Log Price Index decreased $2 in October to $123 which equals the two-year and five-year averages. The October index is $5 above the one-year average, so continues to show that log prices this year have been well below average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – October 2022

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Oct-22 | Sep-22 | Aug-22 | Jul-22 | Jun-22 | May-22 | Oct-22 | Sep-22 | Aug-22 | Jul-22 | Jun-22 | May-22 | |

| Pruned (P40) | 175-200 | 175-200 | 175-200 | 175-200 | 180-200 | 180-200 | 190-200 | 190-200 | 150-170 | 150-170 | 160-180 | 160-180 |

| Structural (S30) | 120-150 | 120-150 | 120-150 | 120-150 | 120-155 | 120-155 | ||||||

| Structural (S20) | 98-105 | 98-105 | 98-105 | 98-105 | 100-105 | 100-105 | ||||||

| Export A | 133 | 135 | 128 | 115 | 110 | 133 | ||||||

| Export K | 124 | 126 | 119 | 107 | 102 | 125 | ||||||

| Export KI | 116 | 118 | 110 | 100 | 94 | 117 | ||||||

| Export KIS | 110 | 112 | 101 | 93 | 86 | 109 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.