The triple effects of weaker sale prices in China increased shipping costs and the NZD strengthening against the USD, caused At Wharf Gate (AWG) prices in New Zealand to fall by an average of 23 NZD between May and June. Softwood log inventory has dropped in China and daily log use has started to increase.

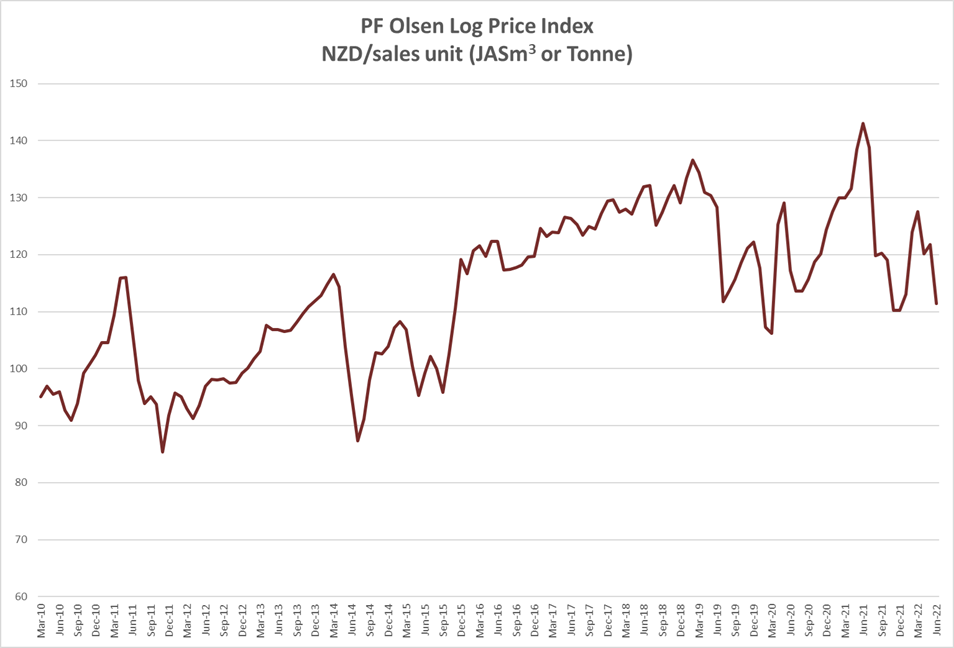

The PF Olsen Log Price Index decreased $11 in June to $111 which is $11 below the two-year average, $9 below the three year-average and $13 below the five-year average.

Domestic Log Market

Log pricing has been consistent through Quarter 2. High inflation will put pressure on log prices in Quarter 3. Forest owners have seen significant increases in costs from contractors due to fuel and wage increases.

The May Caixin China Manufacturing PMI increased to 49.1 from April’s 26 month low of 46.0. This also beat market forecasts of 48.0. While an increase is good news the PMI is still below 50 which indicates contraction, but the rate of contraction has at least slowed.

Some Chinese property developers are still struggling, and in a bid to attract buyers China Central Management has advertised it will accept wheat or garlic as part of the deposit on houses in the central province of Henan. Another developer Poly Real Estate said it would gift a 100kg pig to house purchasers on one of its residential projects.

Authorities in China have increased efforts to revive home sales by lowering mortgage rates and easing rules on home purchases. Property sales in May by the top 100 developers in China has fallen 59% from May last year.

Demand for sawn timber in India remains subdued due to ongoing shortages in container availability for exports. Liners are repositioning empty containers from Dubai and Singapore for export of Indian goods.

Kandla port will receive about three log ships from South America during July. Kandla green sawn timber price is hovering at INR 621 for South American and INR 671 for Australian origins.

Kandla may get 4 ship loads from South America, during August.

Tuticorin is facing a log shortage. A part bulk shipment is expected to arrive at Tuticorin port in early July, to discharge about 16,500 m3 from Uruguay. This may be enough for three to four months, as mills are not getting adequate sawn timber orders to operate throughout the week.

The price for sawn timber has dropped to INR 681 to 701 per CFT, cut from South African and USA logs, respectively.

Exchange rates

The NZD strengthened against the USD through May which increased the drop in June AWG prices. The NZD has weakened against the USD through June which is good for July AWG prices.

NZD: USD

|

CNY: USD

|

Ocean Freight

Shipping costs have dropped on average over 10 USD per JASm3 for log exporters to China from New Zealand over the last month. Vessel congestion in New Zealand has eased and this will also benefit AWG prices at some ports.

Source: TradingEconomics.com

The Baltic Dry Index (BDI) is a composite of three sub-indices, each covering a different carrier size: Capesize (40%), Panamax (30%), and Supramax (30%). It displays an index of the daily USD hire rates across 20 ocean shipping routes. Whilst most of the NZ log trade is shipped in handy size vessels, this segment is strongly influenced by the BDI.

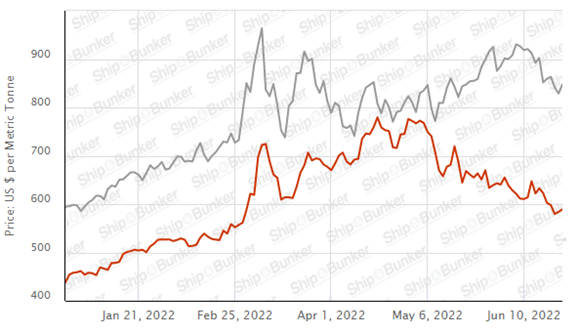

Singapore Bunker Price (IFO380) (red line) versus Brent Oil Price (grey line)

Source: Ship & Bunker

PF Olsen Log Price Index – June 2022

The PF Olsen Log Price Index decreased $11 in June to $111 which is $11 below the two-year average, $9 below the three year-average and $13 below the five-year average.

Basis of Index: This Index is based on prices in the table below weighted in proportions that represent a broad average of log grades produced from a typical pruned forest with an approximate mix of 40% domestic and 60% export supply.

Indicative Average Current Log Prices – June 2021

| Log Grade | $/tonne at mill | $/JAS m3 at wharf | ||||||||||

| Jun-22 | May-22 | Apr-22 | Mar-22 | Feb-22 | Dec-21 | Jun-22 | May-22 | Apr-22 | Mar-22 | Feb-22 | Dec-21 | |

| Pruned (P40) | 180-200 | 180-200 | 180-200 | 180-200 | 180-200 | 180-200 | 160-180 | 160-180 | 160-180 | 150-160 | 150-160 | 150-160 |

| Structural (S30) | 120-155 | 120-155 | 120-155 | 120-155 | 120-155 | 120-155 | ||||||

| Structural (S20) | 100-105 | 100-105 | 100-105 | 100-105 | 100-105 | 100-105 | ||||||

| Export A | 110 | 133 | 129 | 141 | 141 | 108 | ||||||

| Export K | 102 | 125 | 121 | 132 | 132 | 99 | ||||||

| Export KI | 94 | 117 | 113 | 125 | 125 | 90 | ||||||

| Export KIS | 86 | 109 | 105 | 117 | 117 | 82 | ||||||

| Pulp | 46 | 46 | 46 | 46 | 46 | 46 | ||||||

Note: Actual prices will vary according to regional supply/demand balances, varying cost structures and grade variation. These prices should be used as a guide only.

A longer series of these prices is available here.

Log Prices

Select chart tabs

This article is reproduced from PF Olsen's Wood Matters, with permission.

4 Comments

So when do we get to see lower log prices reflected in our lumber prices. Hope Bunnings buyers are onto it .

No labour for extra sawmill shifts. Structural timber mills are a poor investment - for example Prime Sawmill in Gisborne has had eight owners in 35 odd years and lost tens of millions of private and ratepayer money.

The IFO 380cst vs Brent Crude graph is somewhat deceptive when talking about NZ Logs.

This refers to the 3.5% Sulphur IFO (intermediate fuel oil) price whereas about 95% of handysize vessels are restricted to burning 0.5% Sulphur VLSFO (very low sulphur fuel oil). Only vessels which contain a sulphur scrubbing device can consume IFO and this is usually only found on SupraMax vessels or a few of the newer Handysize (later than 2019)

For reference current VLSFO fuel price is around USD 1,130/MT according to PLATTS Bunkerwire.

A mate ordered some 100&125mm posts. 3mths wait for 100mm and 5mth wait for 125 - direct from mill.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.