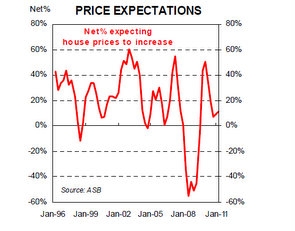

A net 11% of respondents in an ASB survey on housing confidence expected house prices to rise in the next 12 months, up from a net 9% who expected higher prices when surveyed three months earlier.

ASB cited the March 10 post-quake emergency cut in the Official Cash Rate for the improvement in confidence and for an increase in expectations of continued low interest rates.

The ASB Housing Confidence Index climbed two percentage points over the three months to the end of April, with a net 29% saying that now is a good time to buy a house.

"While more people now expect house prices to rise over the next year, that sentiment remains modest by past standards,” said ASB Chief Economist Nick Tuffley.

“House price expectations remain highest in Auckland, in keeping with recent housing market data which shows stronger activity in this region compared to the rest of the country.”

There was a sharp drop in housing confidence and price expectations in Christchurch over March.

"While there was a considerable rebound in April, housing confidence in the region is still softer than overall confidence in New Zealand. Meanwhile, house price expectations are more resilient, with a net 9% of respondents in Christchurch expecting a rise in house prices over the quarter – only slightly lower than the nationwide average of 11%," ASB said.

The survey found a net 35% of respondents saw interest rates rising over the next year, down from a net 55% in the January quarter who saw rising interest rates.

"This is unsurprising in light of the 50 basis point decrease in the OCR in March, and the resultant lower mortgage interest rates, which have increased the appeal of housing as an investment, despite the tax changes that came into effect on 1 April," Tuffley said.

ASB's forecast

ASB said recent market data had also shown tentative signs of an improvement in housing market activity, including a drop in the median days to sell to 45 days, although it remained above the long term average of 38 days.

“Despite renewed interest in housing, it appears buyers are still in no rush to purchase,” he said.

“We expect house prices to grow modestly at a rate of around 3 percent over the coming year. A combination of a contained level of housing inventory, positive population growth and the recent drop in interest rates will underpin a gradual recovery in underlying housing demand over the coming years."

See the full survey results here.

Housing confidence

Select chart tabs

76 Comments

Is this more reliable than a Treasury prediction?

How is the structure of your happiness frame-work , this morning ? Feel OK , or a tadge blue ? .... Call up the Treasury , they care for you !

Probably better than a BH prediction as well :)

The best time to by is always if you can. this will never change.

President of Property

I'd add , "...and can afford to hold it..." POP. So it's not about 'supply and demand' really, is it? It's about the ability to pay, and hold.....and, as far as your..."never change" comment...

"..people become net sellers of real estate after the age of 65, while net buying of real estate is most pronounced between the ages of 25 and 35 – when young people typically leave home and form new households....What have not been recognized to date are the grave impacts of the growing age imbalance in the housing market. If the elderly are more often home sellers, and are more numerous than the young who are buyers, a market shift could come on quickly after 2010, causing housing prices to fall. Even if prices remain flat, without the investment incentive young households will likely slow their entry into home ownership, worsening the imbalance between sellers and buyers. Once past the tipping point, market adjustments will cascade in virtually every community, as the ratio of seniors to working age adults will increase for the greater part of two decades."

http://www.informaworld.com/smpp/content~content=a789053981~db=all~jumptype=rss

RWC - wait 9 months (and a further 25 years) - sorted.

Joe public is obviously voting with his Cq book.

Sentiment turning more positive.

It would be easy to test whether the expectations data bear any relation to the actual outcomes. So why doesn't the ASB do this?

Could it be that this is just another piece of market hype to drum up some business? The housing loan approvals numbers are not too flash.

The margin for error is 50%...

They point to Bollard's compliance with the govts directive received, from the banks, to cut the ocr and go cheaper for longer, as the reason for an upswing in confidence...so can we look forward to when Bollard, is allowed to raise the ocr belatedly to catch up with inflation and the resultant downturn in confidence...being pointed to by the very same banks as the cause!!!

Not on your bloody life...nosireeee....that eventuality will have its very own colour of bullshit.

Right...the only way to avoid that diet is to eat animals...like you AL...steak for tonight is it?

Quiet AL....or the IRD will demand you pay tax on wild game...it's one that Helen and her control freak mates missed on account of being alseep for most of the nine long painful Labour years....

I just gotta walk down to the creekbed and the Fallow deer are everywhere.

Didn't Herr Helen & the Control Freak Rainbow Party attempt to shut down " backyard " animal killing enterprises , under the guise of " the good of the public health " ......

...... How quickly we forget all the crap they foisted upon us , all in the name of improving us , the public , to act in a manner deemed fit & appropriate by them , the Labour Party ..... They know best .... They know all .

Remember when Goofy tried to legalise sex between " consenting " children , as young as 13 .... . All in order to save the police the bother of nabbing the randy little oinks . ...... No unforseen consequences on the horizon from that legislation , Goofy ?

Amazing how people like Nicholas A comes up with some angle to suggest there will be a price crash.

Talk about spruickers being in denial, what about gloomers in denial also?

Time for both to move on.

Yes - getting more and more desperate by the week.

Nope.....you move on when the risk has passed...it has not....if anything its getting worse. If you want to live in denial how about not bothering to read such posts...then you can be happy....not knowing anything....just like crossing the road in rush hour, close your eyes and step out...you might make it, or you might get hit by a 7 tinne bus....your call.

regards

You must be so risk averse that when you think the 'risk has passed' we will be on the verge of another correction.

Enjoy life on the sidelines - buy high sell low!

.... and there's absolutely no point in doing anything at all , so long as the risk of peak oil exists , IMHO ..... and then there's climate change , too .......

regards

"A fool and his money are easily parted" as my grandparents, who lived through the Great Depression liked to say. They used to tell me how hard it was.....and then in my late teens I travelled the world and saw that much of the developing world still lived like this....Ive remembered this over my life.....and I have little debt....it removes flexibility, it constrains you....it puts you at risk....your choice as a grownup.

So what Im doing is looking at each risk and its impact.....and whats worse they are all here at once....or I could do like some and gamble....now I dont mind a considered risk, but a blind risk where I dont know the likelihood of it happening or how bad is not a game i'll willingly play...

regards

When I see competent ppl saying things like "we can see a real recovery" and not " we are on a 3rd depression death watch" I might consider the risk has passed....until then I will sit on the side lines and await opportunities...

regards

And dont forget the baby boomers - and greece - and ireland and.....and.....iran.....and......all that.....

Yep....so to sum up we see lots of risks and the big risk is any one of these could trigger several others or all of them....as Automaticearth is saying we could see drops of 90% in housing in a credit crunch because no credit is available, rad up on the GD. Now when my kids were < 10 they didnt understand about possibilities they did something and didnt get hurt well there was no risk of injury they just proved it!....but now they are older they understand something might or might not get hurt....some grownups it seems still think like < 10 year olds.

regards

I was gonna stay in bed all day , because of gloom from all the looming risk ; from depleted oil reserves , US debt levels , Iran / Libya , a new credit crunch , Ireland , being less smart than a 10 y.o. , global warming , KFC's new bun-less burger , Greece , a concatication of several risks together , Swine Flew , SARS , ....

... And then I thought , 'ang on a mo' , Gummy , a fragment of sky-lab or a small meteor could whack you where you ripose ....... there is that risk ! .... Get up , and keep moving .

No risk of nothing if you keep moving , dodging and weaving , even death can't getcha .......

Yup , no risk at all ......IMHO

regards

Um, just looking at that graph, am I the only one to see something significantly wrong with it?

The graph is labelled "net percentage expecting house prices to increase". It therefore must have bounds of 0% and 100%, yet the ASB graph goes below zero. What a laugh.

No, it shows at one stage more ppl expected house prices to drop than climb....it says NET so take one from other and whats left is the point on the graph for that time period.

As we can see the net is 10%....so 45% / 55% = 10% or another way just under half of ppl think house prices can still drop.....

regards

That makes martinv right, then? If 10 people are asked " Do you think house prices go higher", and 10 say 'No'. The net is 0%. If just one says' 'yes' the net is 10%. How can it go below 0%? To take the two opinions apart, the graph should be "What will house prices do" not "Will they go up"?

Scary that people can't understand this concept. Fairly basic maths - if 5 expect increase and 5 decrease then net is 0%.

That's not what the graph is details in the body, is it! It is "Will house prices increase". Your 5-5=0 is applicable to "What will house prices do". At best it should have below the X line " Prices expected to decrease" or maybe that is just implied.

No the artical says a NET % amount of ppl think it will increase....so more ppl think it will increase than decrease.....10% more.

regards

Hehe, not 10% more, 10 percentage points more. :-)

From the graph as it is now, "NET % amount of ppl think it will increase", if we see 60% on the graph, we can conclude that 80% of people think prices will go up, 20% of people think prices will go down. Therefore there are 300% more people who think prices will go up than there are people who think prices will go down. Such a large ratio is not intuitively obvious from the graph which shows 60%, but that's by the by.

My partner looked at the graph too, and came to the conclusion that it all makes good sense until you start to analyse it.. :)

No I dont believe it does make him right, but it depends on how the Q is asked.... I would ask "do you expect house prices to rise or fall in the coming year"....so I ask 100 people, 45 say drop, 55 say rise, this gives you the NET 10% rise.

It doesnt cover/display how many ppl say no change of course.....

So we need to see the actual Q....but wording it my way explains the -ve % we can see in the graphs at times.

regards

I think it should be labelled something along the lines of expected house price changes.

Incidentally the way they have labelled it, they get to sub-consciously tie the idea of house prices with 'increasing'. One could equally produce the inveted graph labelled along the lines of "net % who think prices will go lower", but that would be pessimistic.

A bit like how a year on year reduction is referred to in the media as a growth rate that's negative. :-) They still call it growth.

Whoa.. if the graph is as you say it is (it may well be), then that takes a bit of gettings ones head around. The use of the word 'net' in the title is of course the clue that something is not straight forward.

So presumably, of all the people asked, nobody said prices would stay the same, and nobody said they didn't have a comment. Or perhaps if they did say either of those they were not included in the data for the graph. Say 100 people are asked:

20 say prices will go down, 30 say prices will go up, 50 either don't know or say prices will stay the same. Would that end up as %10 (30-20), or would it be 20% (the 50 don't knows or the sames will be removed from the sample)?

Another way of misinterpreting it which crossed my mind is this. 47.4% said prices would fall, 52.6% said they would rise. Then there are 11% more people who said prices will rise than ones who said they would fall. By your initial calculation however a split of 47.4 and 52.6 would be shown as 5.2%.

so ASB have reverted to the good ole' 3%!!!

Rodney Dickens has written about the magical 3%. A nice safe middling number. Worth reading Dickens on the consensusing approach of economists too. They like consensus because its safe, if they all stick together then one or more of them don't look bloody stupid.

You could say thats wise, you could also say its cowardly herd behaviour and offers little or nothing to the debate.

Maybe 3% in Kaitaia (wherever that is)

Another 8-10% here in Central Auck this year!

yeah maybe SK - plenty of people with more money than sense throwing it away because a property has "double grammar zoning" - good on them!

I'd pick flat for the rest of Auckland though, and down everywhere else

You picked flat last year also - and were wrong.

because real national house prices dropped significantly?

If want to live in herne bay, westmere and mt eden get your cash ready - you might as well pay it out now - it sure isnt going to get any cheaper.

If you dont want to live there - easy life - nothing wrong with avondale and te atatu.

Which fundamentals have shifted so radically to cause people to believe that houses are a good investment now?

The income/price ratio is still highly unfavourable.

There are still more sellers than buyers, and that's excluding the coming vast bulge of retiring boomers.

None of the other usual economic indicators (employment, interest rates, CPI, etc) are good for property investment.

The near-exodus to Australia continues to increase.

The nation's public and private debt spirals ever higher.

How can low-paid people in shaky employment borrowing lots of money to buy overpriced houses in a property market that has yet to fully (and hugely) correct downwards be considered a good idea?

Only desperately spruiking RE agents such as SK could say you can't lose with houses right now, because everyone else knows much better than that.

"How can low-paid people in shaky employment borrowing lots of money to buy overpriced houses in a property market that has yet to fully (and hugely) correct downwards be considered a good idea?" - Now THERE'S an excellent question!

I'm not a RE agent (praise allah.)

Nearly all of the negatives you mention have been neg yes - and have now turned positive - you would have to read wider than this website to gain that information.

I'm not going to go thru them one by one.

Nearly all of the negatives you mention have been neg yes - and have now turned positive...

Uh, they have?

Perhaps on planet Spruiker, but not in the real world.

Prices are still too high, even after the recent mild correction.

Incomes are still too low, especially in relation to property asking prices.

The cost-of-living continues to increase, with no sign of slowing. (Bought fuel, lately?)

Employment indicators are still shaky.

Migration to Australia is increasing.

Houses aren't selling now, and that glut of retiring baby-boomer property looms very ominously.

Private debt remains far too high, while public debt skyrockets. (Gee, thanks Double Dipton!)

The NZ economy is very shaky. Few jobs are safe. Incomes are pathetic, even at the "higher" end of the scale. The price of almost everything is too high. A huge chunk of the population is facing retirement, a retirement they plan to fund by selling their property. Much of the nation's youth is bleeding out to Australia, where incomes are in the realm of grown ups.

You can try to dismiss the facts as "doom and gloomerism", but they are still the facts, and they are quite bleak...especially for you property selling dribblers.

There was a ball and charity auction reported in a provincial city of little ole Aotearoa a week or so ago, $200 a ticket and on the night people paid over $100,000. Now that's not bad for a bit of pocket money to give away in anyone's books. To my knowledge there was no big benefactor who substantially contributed, just ordinary successful Kiwis digging into their pockets for a good cause and having some fun doing that.

Also, the local Presbyterian Church is undertaking a $3 mill.development, has raised $2 million from the parishoners (over and above the normal giving) and has a $1mill loan.

The facts are not all doom and gloom it would seem.

And lots of people getting their RWC tickets delivered at present, know of people who have paid thousands without blinking an eyelid, just got 2 for a semi-final myself.

"And lots of people getting their RWC tickets delivered at present, know of people who have paid thousands without blinking an eyelid, just got 2 for a semi-final myself."

Crikey - no wonder this country has so much personal debt! Load up the credit card with more ultra expensive 'necessities' like tickets to a rugby game!

to a third rate "World" competition

Simpleton, who said anything about loading up credit cards? What about paying for things out of a healthy cash flow, or can't you envisage that numerous people might have that situation? Personally I never have other than a zero balance month on month for any of my credit cards. ( I'm told banks refer to people like that as 'freeloaders'). A relative who is in ANZ Head office management, says around 50% of customers are like that, so don't assume everyone is loading up debt!

As "Anon good nurse" points out, there are not many positive indicators for house prices at the moment.

As long as the economic recovery is agriculture-centred and patchy in other sectors, there is not going to be much confidence about. And confidence is an important driver of the market.

There are also a couple of uncomfortable fundamentals:

1) Even with mortgage rates at historically low levels, the housing market is currently eking out only marginal gains. With more home-owners on floating rates, any increase in the OCR will feed straight through into higher mortgages. This will put an immediate dampener on the housing market.

2) On the demand side, increasing migration to Australia is sucking a large number of middle-class buyers out of the NZ market. They are being replaced by mostly poorer immigrants coming in - Indian students are the largest single demographic group and they won't be buying into middle-class property any time soon.

These two factors would suggest continuing stagnation, or perhaps a gentle decline.

But In Oz, "THE lies being told about the property market drive us crazy. So it's time for the truth, the whole truth and nothing but the truth....Residential property values are falling right across the country and those falls will pick up as the year goes on...."

http://www.heraldsun.com.au/ipad/koch-beware-of-property-porkies/story-fn6bn9st-1226064745905

There are numerous positives - keep hiding under your interest.co.nz rock.

You were all proven wrong last year - and will be proven so again this year!

Mate - WHAT positives? You haven't responded to even a single point made about how the fundamentals are all completely negative for property! You just keep on with the same tired old "THINK POSITIVE AND EVERYTHING WILL BE OK!!!!!" crap.

The property bubble is finished.

SK. Here's a little something I learned years ago about all markets. "By the time you read about it in the papers ~ it's too late". The Aussie now have it 'in the papers' re the fall in property prices, and ours ( aren't a lot of them 'theirs' as well, just like 'our' banks?) won't be too far behind. But you're right. Reading interest.co.nz does put one ahead of the game!

Interesting article in yesterday's Business Spectator that the Aussie banks risk crushing the " house of cards " which they helped create . They gotta tread carefully , to not create a downward spiral , a'la the USA .

...... As much as we wish to catch Australia , the bigger part of the economy , the huge piece which is not directly connected to mining , is struggling .

And the mining industry is euphoric . They're bubbling with enthusiasm , the good times are back , and will last forever , due to Asia's voracious demand ..... Nothing can go wrong , this time is different .

[ ... but with all due respect , St Nick , reading interest.co.nz just connects one with alot of maniac depressives , just alike the head gloomsteriser , " chicken-little " Hickey ... ]

Quite roght, Roger! But I guess there are 'gloomster' who hope for another path forward for New Zealand, and 'gloomsters" who hope for things to stay the same or, worse, go back to a path that lead to where we are today :) Having an economy that is ' not as bad as some other people's' is not much of a success story, to me.

Know wotcha mean , St. Nick , it's not exactly a measure of high success to be the kid in the playground who has less shit in his pants than the other kids ...

.... It still stinks .

It would be nice and beneficial if NZ could finally get away from an economy based entirely upon farming and house trading.

I almost cant be bothered.

Look at the immigration figures - ie dont just read the articles on this site.

Look the building figures for the last 5 years - and consents going forward.

Look at the leaky houses.

Look at the employment and wage trends.

Look at the price of building materials.

1) Immigration is falling; worse - emmigration is rising!

2)Building figure and consent are down. Builders aren't going to build what they can't sell - especially to a poulation that's shrinking and getting poorer by the day!

3)Leaky houses will drag down the average price, as those with them, sell them, to get rid of them. That's lower prices - eveywhere!

4)Employment is down, unemployment is up - wages in real terms are falling with the increase of the cost of daily items

5) Building materials are doing what? Going up with the wave of new projects! The sellers of materials have to try to recoup their costs in a lower volume of sales; an apparent 'price rise' at best.

Think about where you are going to get a builder from.

Think about all the Chinese money looking to park their cash in hard assets.

Think about what asset class does well in a high inflation environment.

Think about the QV noted 8.4% increase in central auckland prices last year.

Think about low interest rates until Chchrebuild is underway (a long time)

We don't need builders if the population can't afford to buy their products.

If I was Chinese, I'd be parking' my cash in a market that's already gone down, if I wanted property! Say, the US, the UK, Spain, Portugal, Ireland...I'd be spoilt for choice with my yuan!

The best asset in an inflationary environment is...cash ( you get to buy, instantly, whatever it is you want when you need to, or spot the inflationary trend as entrenched). The worst is....debt...your stuck with it, as your income won't keep up with your repayments that will rise..

Auckland median ( ?) price is up because the higher prices properties are selling. That affects any average you want to analyse.

But...yes...interest rates are low...and going lower...as the economy here, reflecting all my above points...is knackered!

Todays nbr.co.nz

Prices up, sales down, rents rising in Auckland property market

Get yourself a new hobby.

I am not paying to see that.

Why would you branch out to other media outlets - when you have it all right here?

"The best asset in an inflationary environment is...cash "

This really is the last nail in your coffin of zero credibility.

Inflation will lead to higher interest rates...much higher...as they are artificially low right now. I believe we have further to 'go down' in this cycle before they bounce...and when they do...watch out!...cash is going to be worth a huge amount more...both in return and purchasing power...as those with assets that are leveraged, have to sell, as they can't meet, say, the mortgage payments at +10%. Then those with cash, still earning a measily +9% ( less tax, of course) get to buy assets at desperation sale prices.

"3)Leaky houses will drag down the average price, as those with them, sell them, to get rid of them. That's lower prices - eveywhere!"

This is your second best piece of uninformed nonsense that gives away your complete lack of basic knowledge.

Pss! Your desperation is showing!

This is why I cant be bothered.

Simple supply and demand theory is beyond you.

Tata.

Supply - lots of leaky houses ( is it 10,000 of them? I forget the number, but it's a lot). Demand for them ? Little ! Result : Lower prices....Why pay $500k for a 'good one' if you can pay $100k for a leaky? Sure; You may want a project, but at some stage someone wanting a house will pay...$100k...leaving the $500k one, unsold. What do they do in that case? Lower their price to sell against the glut of other leakies coming on for sale.

Don't go , SK , the gloomsterisers need someone positive to pick on ......

...... Gummy cannae withstand the tide of woe & despair alone .

Quick , grab the Anti-Hickeystamines , depression is taking over ..... we're sinking fast .....

........ arrrrrrrrrrrrgggggggggghhhhhhhhhhhhhhhhhhh !

THE lies being told about the property market drive us crazy. So it's time for the truth, the whole truth and nothing but the truth

You know on the issue of leaky homes, I'm surprised that some enterprising individual hasn't turned them into a business by buying them cheap (cost of the land surely - I'm mean the house is no good?) fixing them up and flicking them on.

They are - and doubling their money.

However the real money is in the litigation/building surveyor/repair industry where you pay a 'surveying' firm of 'experts' a huge amount of money to write a report demonstrating all the ways a building doesn't comply with todays building standards (which is usually because they were built yesterday to yesterdays standards). Then lawyers use this to try and bully money out of anyone involved in the project, councils (ratepayers), previous owners etc. with the threat of expensive court action (this is a delicate issue as the settlement figure must be less than the cost of defending an innocent party in court, or they won't settle). Then 'leaky building experts' do repairs at around 4x the rate the the same work would normally cost - incidentally the same 'experts' that started the process. Whether or not the building leaks in all of this is completely irrelevant - hence the budget allowing $1.5 Billion to pay for $375M of repairs to 'leaky' schools of with maybe $37.5M is for 'leaky' schools that actually leak.

SK,

surely even you can see this is purely interest rate driven. The Christchurch is like the GFC, it actually HELPED the housing market from imploding. What will the akld median look like with mortgages rates at 7%, 8% and 10%. We aint a good proposition at the moment for oseas investors so we can expect rates to rise regardless of Bollard's preference for Akld proeprty speculators over common sense. Property at the very least is a medium term investment, so these prices need to be sustainable at long term int rates of 8% + another 2%. Quite simply they arent.

yep Jimmy its a dead cat bounce, prompted by massive OCR cuts and the tax cuts

No more tax cuts and only one way for the OCR from here - up...well it could still go down but that would mean the already shaky NZ economy had weakened further in which case there wouldn't be much demand for housing anyway.... so either way its bad news for property

what's your take on the Melbourne market Jimmy? by all accounts it's dipping...so Australia isn't "different" after all!

This relates to Australia, which has seen prices go on up and up since 2007 until this year, whereas that hasn't happened in NZ. Australia would need quite a correction just to get back to the 2007 prices

So a survey says that some number is up by 2%. Did anyone else do statistics at school?

Surely this small % change is well within the margin of error and therefore _absolutely_ meaningless.

Again, yet more bull-crap from the property spruikers! They sure seem desperate!

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.