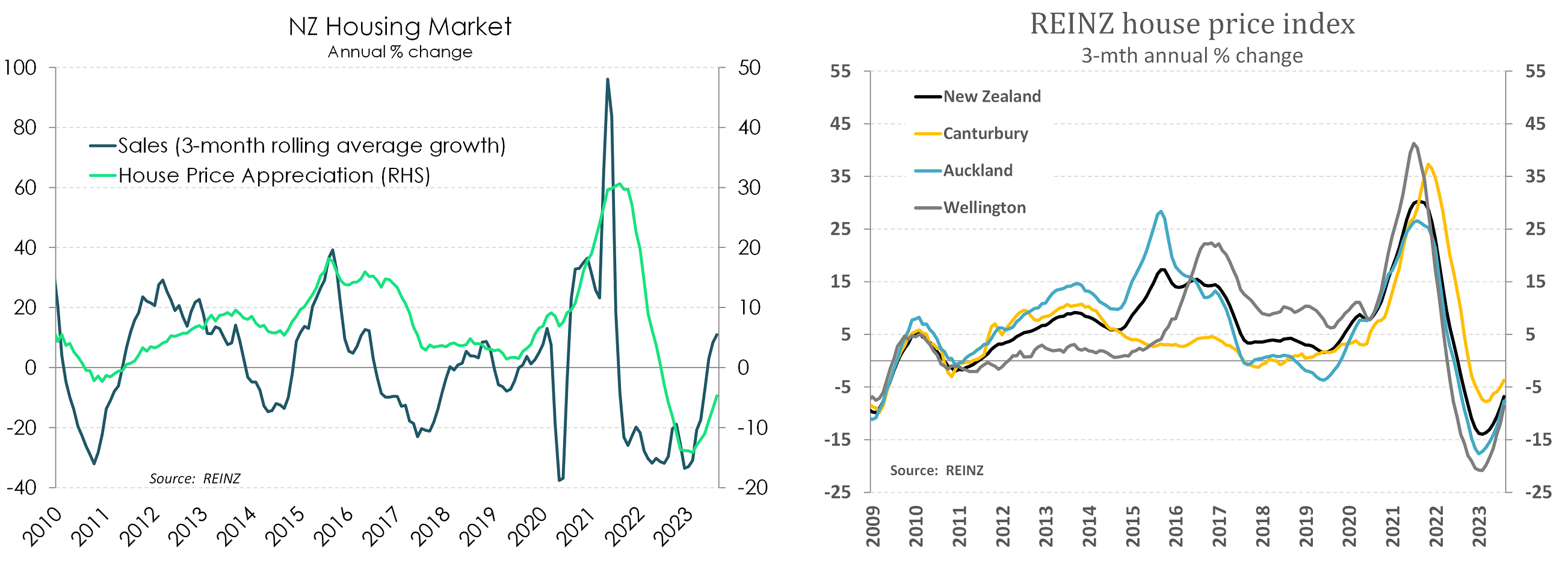

Economists see the latest housing market sales data from REINZ as suggesting that momentum is now building in the housing market and that's likely to continue throughout spring.

Among major bank economists, those at Westpac now are forecasting price rises of 8% next year, Kiwibank economists say 6%, ANZ economists forecast 3% in the second half of this year before moderating next year - but now concede "upside risks" to that forecast and ASB economists expect house prices to "continue ticking higher from here", but don’t expect them to claw back sufficient ground to reach their previous peak until early-to-mid-2025.

Kiiwibank chief economist Jarrod Kerr said the housing market looks to have found its footing and is going into the warmer months with a bit of a 'spring' in its step.

"Indeed, it’s the months of spring that will be the true litmus test for housing. And we’re expecting the buoyancy to continue. Because the surge in migration is providing additional demand to an already tight market." The 100,000 additional migrants will need "at least" 40,000 houses. "Houses we haven’t built."

Kerr said house prices are now at more sustainable levels.

"They’re not at affordable levels. But they are not as extreme as they once were. We think that the correction for past excesses has now run its course."

He said that housing policy "must focus" on supply, rather than restraining demand.

"All our housing market problems stem from a lack of supply. And our lack of supply is linked to a lack of infrastructure maintenance and investment. Investors are not the villains here. They’re just an easy target."

There are three drivers of the housing market, Kerr said.

"Firstly, falling mortgage rates will support confidence and activity next year. Although mortgage rates have risen recently, we expect to see falls in mortgage rates into next year.

"Secondly, the demand/supply imbalance will worsen. The surge in migration and the loss of dwellings at high risk of climate change will only exacerbate the housing shortage.

"And finally, the residential construction boom is cooling quickly. The number of dwellings coming to market will fall back from very high levels. The growth in demand, with a migration boom, will once again outstrip supply in coming years. All three drivers point to a strengthening housing market, and price gains. We are likely to see a continuation of monthly house price gains – albeit very modest gains – in the warmer months. We forecast annual gains creeping up to 2% by the first quarter of 2024, before hitting a high of 6% by the middle of next year."

ASB economist Nat Keall said given the rollercoaster ride NZ house prices have been on over the last couple of years, how the average homeowner feels will depend a lot on when they bought their property.

"The average buyer who bought close to the peak of the market, may still be feeling a bit anxious given where prices are still sitting relative to the size of many mortgages.

"...But given the enormous scale of the pandemic-era upswing in house prices, the average buyer who bought in 2020 or earlier has still experienced a substantial capital gain. After their gains over the past four or five months, prices are now back to where they were in early 2021, when rapid house price inflation was already underway.

"That may be cold comfort to a borrower battling sizable increases in mortgage rates in the years since, but for the economy writ large, it’s worth acknowledging the recent housing market downturn has only improved housing affordability to a very minor degree, particularly now that it already looks to be at an end.

"We expect house prices to continue ticking higher from here, but don’t expect house prices to claw back sufficient ground to reach their previous peak until early-to-mid-2025," Keall said.

Westpac senior economist Satish Ranchhod said the REINZ figures had given the Westpac economists confidence in forecasting that house prices will rise by "close to" 8% next year.

"October’s election remains an important wild card for the housing market. Right of centre parties (who are currently in opposition) have signalled that they would ease the regulations affecting property investors, such as restrictions on interest deductibility.

"We would expect that an easing of those policies would reinforce the pick-up in house prices," Ranchhod said.

ANZ economist Andre Castaing and senior economist Miles Workman said the August REINZ House Price Index (HPI) figures had "come in a little stronger than our expectation".

"Homes have been selling faster and sales are up. While we’re certainly not characterising the housing market as ‘strong’, [the] data provides further evidence that the cycle has turned," they said.

"All up, these data suggest momentum is building and that is likely to continue throughout the spring."

Volumes sold - REINZ

Select chart tabs

Median price - REINZ

Select chart tabs

77 Comments

"All our housing market problems stem from a lack of supply. And our lack of supply is linked to a lack of infrastructure maintenance and investment. Investors are not the villains here. They’re just an easy target."

Good grief. The biggest problem in our housing market is the 'price' of existing supply. And what is the root cause of this? The politico-housing complex's privilege of gaming the monetary system so that credit can be created and allocated to drive the Ponzi.

As Taleb says: "Never take advice from anyone in a tie. They'll bankrupt you. Don't ask a general for advice on war, and don't ask a broker for advice on money. Think about the derivatives mess—buying credit derivatives from these banks was like buying insurance for the Titanic from people who were on the Titanic!."

Further to the reference to Taleb, he's now saying not to get near real estate or new tech. OK, he's talking about 'investment' but we know in Nu' Zllun that buying a home is considered an investment or savings.

“More than $100 trillion in real estate valuation,” Taleb said. “But we’re not at 3% mortgages anymore. We’re at 7% and going north.”

Commercial landlords are already struggling, with even major corporations like Brookfield suffering mortgage defaults in recent months. Collectively, $1.5 trillion in mortgage debt is due within the next two years while rates are significantly higher than before. This creates a risky environment for real estate investors.

Taleb’s analogy about “a fragile bridge” perfectly captures the property market right now, which is why investors should proceed with caution in this sector.

https://finance.yahoo.com/news/whole-structure-needs-tumble-black-13300…

Good grief. The biggest problem in our housing market is the 'price' of existing supply. And what is the root cause of this? The politico-housing complex's privilege of gaming the monetary system so that credit can be created and allocated to drive the Ponzi.

Just as something comparable to think about, take vehicles. Used (not collectible) car prices are way up. The increase in price of this 'existing' supply, has been heavily impacted upon by the rather large increase in the price of new cars, which has been driven by political expediency to encourage the adoption of much more costly EV and hybrid vehicles. Most people can't afford these much more expensive new vehicles, so it has them fighting over a diminishing pool of available existing vehicles.

We have made dwelling generation a very expensive exercise in NZ (actually almost anywhere with high labour and regulation costs), and like cars, they're not heading back to be simpler and cheaper to make, anytime soon.

We can see when credit is constrained, the price for new homes doesn't drop, but construction levels fall, and demand pressure remains on existing housing stock.

Until you seriously address the volume and costs around new housing, nothing will change, and likely get worse.

second hand cars are also affected by migration and supply issues - we missed, what, almost a whole year's worth of supply in 2020-21 because we weren't worth shipping to?

and how many cars did 100k extra people bring in with them?

Looks like the housing market is firing up......

Market sentiment is strengthening - but not at the level it reached during 2020/21.

TTP

I hope like hell we never see that level of "sentiment" ever again, anyone who thinks that period of insanity was somehow beneficial to anyone but greedy specuvestors needs help.

And yet by the end of Covid housing demand and supply was the most balanced it's been for years, rents were stable... so what did they do, open the borders, let in 100,000 and now we're 30,000 houses short again. FFS.

Migration is the government's (regardless of who's in power) go to when the economy is hitting a rough patch. They don't have much interest in improving productivity, so flooding the country with people to pump up property and construction seems to be their only answer. Unfortunately, we've been having this same tired conversation for decades. Nothing ever changes.

I think Kris Faafoi kept the immigration taps turned firmly off for quite a long period of time. Wages rose which was as intended, but businesses found it increasingly difficult to find staff and this actually limited growth in the economy. Labour changed policy too late. Rather than maintaining a balanced approach to immigration they used the levers full off or full on. This seems to be a hallmark of their govt, they have no halfway point, no subtilty. I think they just like total control too much. They say they are tweaking the settings but actually do nothing much to change the settings then when the dam breaks they have no alternative but to reverse very quickly at full throttle.

If you look at the housing price graph does the up down zigzag thing happening suggest that the line is going to stabilise in a nice flat slightly upwards moving average? I'd be very surprised if it did.

Because the market is so overinflated, because affordability is so poor and because access to credit is limited we won’t see notable price increases.

You can only get so much blood from a stone.

Affordability is no better now that it was at the peak.

The root cause of the 'price' of existing supply is still scarcity though. Sure increasing mortgage terms and lowering interest rates allows people access to capital which they wouldn't otherwise have and thus allows them to take part in the contest. The fact remains though that if supply was adequate across the board, then there would be no need for the contest, and it is ultimately the contest which drives prices up.

Turning it into, allowing it to become a contest probably wasn't a very good idea. So many factors that have gone into creating this though and it would seem nobody really wants to understand any deeper or join the dots. We've become so beholden to it that it mustn't change.

It's a trippy paradox... Our culture/operating system obviously highly values monetary and material wealth, yet to create it, we are in reality placing a higher value on scarcity.

Blah blah blah…….

I’m over reading the spruiking from these self interested crooks.

Would be good to hear from someone without an obvious vested interest eg. Rodney Dickens, or a university academic

Hi HouseMouse,

University academics don’t have time to come here……

They’re fully occupied with their own vested interest of keeping their jobs - even though most of them now loath working for universities……

These days universities have become poverty-stricken, oppressed places. In other words, they're low-pay, low-morale ghettos - bashed around by marketing/commercial forces. In this sordid process, scholarship (i.e. excellence in teaching and research) is fast being displaced.

A great pity.

TTP

As someone who works as a part time lecturer- lot of truth in that!

Part time is great, wouldn’t like to do it full time.

Having said that, plenty of academics do write articles, and enjoy doing so.

ummm.. May be in NZ but not where I am across the ditch. Universities here are creaming it with revenues from overseas students. The last few years, universities in Aust have been invested in International ranking as a marketing tool (more research, more advance courses, online teachings etc..) . This is something NZ universities need to catch up on, and they are doing it - just a bit behind.

Also intellectual freedom is being utterly stifled by woke politics.

I’m over reading the spruiking from these self interested crooks. (27 upticks)

The denial of houses going up in price is just incredible !

I don't see any denial in the figures, just frustration in the presentation and the language being used to support an agenda. What looks like monthly fluctuation with low sales volumes is being sold as ;turning a corner' and return to a 'healthy' market.

My take is that the "crash" started due to limited access to credit, listing numbers stayed the same initially while demand fell off a cliff due to affordability. As such the supply/demand equation was skewed toward oversupply. Since then demand has stayed low while supply has dwindled due to unrealistic price expectations, with only motivated sellers transacting. We are now at a point with low supply and low demand.

Demand is likely to pick up a little at some point when those with the means to pay, but have been holding off until we reach what they perceive is 'the bottom' jump back in (which may be what we are seeing now) and maybe some additional upside relating to immigration (but I think this impacts rents more than anything). However this upturn in demand is going to be severely limited by the price of money, which is now significantly higher than it was at the start of the downturn.

The wild card here is supply. No real underlying causes for supply to decrease substantially that I have seen put forward. A lot of potential on the horizon for an increase; rising unemployment, more mortgages rolling over to higher rates, removal of bright line, banks forcing interest + capital...

In fact most of the bank economists are actively predicting that supply will increase and rates remain high, yet counter intuitively still picking prices to increase over the same period..

At 7%+ interest? Yeah nah.

How can we get the price of shitboxes up to $2m with an attitude like that?

By selling them to foreign buyers

How on earth could any self-respecting economist (Jerrod Kerr in this case) say that "all of our housing problems stem from a lack of supply"? What, demand doesn't matter?

We go on to read that according to Kerr, two of the three drivers of house prices are interest rates and the "demand/supply" imbalance (funny, I thought only supply was supposed to matter). Kerr then concedes that interest rates continue to rise and gives no evidence for his prediction that they will fall next year.

Is it any surprise that these bank economists continue to be wrong time after time?

How on earth could any self-respecting economist (Jerrod Kerr in this case) say that "all of our housing problems stem from a lack of supply"?

When your paycheck is dependent on people believing what you say.

He’s been pretty strong recently in saying the OCR will be cut from around May.

I doubt it, unless the economy is absolutely smashed.

I don't like the data but I can't help but think that 18 months of downward pressure has come to an end. I really hope this is a very brief, weak spirited up tick based on the Spring seasonal effect coupled to a change in government being widely anticipated.

I'd like to see a DTI come into effect to prevent this becoming a spark to the flame. This is particularly critical before poor economic data gives the RBNZ an appetite in the next year or two to reduce the OCR.

Oh come on. Just grab another bucket of popcorn. This is awesome.

The last moon landing was in 1972. Hopefully Nu'Zillun houses will all be there in 2025.

Same here. Whether it's the start of a climb back, a case of a holding pattern emerging, or a case of 'nothing goes to hell in a straight line' (and once the election hoopla subsides prices fall again) I don't know, but just anecdotally I'm seeing more 'sold' signs on properties near where I live, the smugness is returning to the comment on the big property investors Facebook group and so on.

I'm not a property investor, developer, agent or anything like that - for what it's worth I'd like to see prices decline further so I guess I have a vested interested in wanting to see a market decline.

That being said, I was chatting this am to an estate agent I know fairly well (and whose insight I do genuinely value/trust as he seems to say the same things privately as he says professionally) and his view is that the faster sales/more robust prices of late are primarily owing to there being few listings, outside of certain categories e.g. new townhouse shoebox builds here in central Chch, or the 3/4 bedroom 'cookie cutter' builds going up in the likes of Marshlands, Halswell, Lincoln etc.

That means when something desirable or not necessarily 'replicable' does pop up, there's interest and demand because there isn't a great deal of choice at the moment. E.g. a nice family-sized home in a desirable suburb like Burnside with good schools nearby will be packed with interest at open homes (another REA I know who is a right hooky character was boasting the other day of '50 groups through the first open home' at such a property) whereas a new build in a half-finished subdivision with no real amenities nearby will sit and languish.

Certainly I am looking every day as the dumbthoughts clan is expanding, and haven't seen anything much interesting that isn't a Williams corp shoebox or subdivision Stepford Wives build.

That fits with what I'm seeing in Auckland. My M-i-l has just sold a suburban house, and is looking to buy a replacement in a different suburb - there's plenty of competition for nice houses in the 1-1.5m sort of range, she's finding it difficult not to overpay. Those aren't FHB though, they're movers/upsizers who already have collateral. It's the FHB end of the market that is, one would expect, feeling the pinch from the interest rate surge. One wonders if there are many townhouse developers who are holding off bringing stock to market?

Interesting insights, thanks.

I think if you're an 'upsizer' (e.g. bigger house needed for more kids, moving into a nicer school zone, change of needs or whatever) then you can't necessarily sit around and wait for a great deal and that's where the action is, and as you rightly point out you're probably using some existing equity so more manageable.

If you're an FHB, then at the moment it's presumably cheaper to rent than buy so it might be easier to hold fire.

It all ultimately relies on the FHB though doesn't it? The ability to release capital for anyone in the market is 100% reliant on new capital coming in, and the yields don't stack up for investors.

Downward pressure at an end! Ummmmm just take a look at the mortgages about to roll over.

We aren’t even at the starting gates.

With average house price in Auckland around 1.1 million most of the population will just not be able to buy from scratch. If we wait maybe 5 years with 7% wage growth and 4% inflation and house price fall another 15% the games will be back on

National has a brilliant plan: Make NZders rent from overseas landlords.

NZders will still be paying a mortgage, just not their one.

Sheep to the meat works. Yum.

I think you'll find property investment still works when you can rent a 3 bedroom house out to two families .. plenty of large families buying averages house and crowding in, if you have four average wage earners, servicing the mortgage even at these rates is no problem.

Fark - why stop at 2 families in a 3 bedder - you could put a mezzanine in and get at least 20 people in there no worries. PS your greed is showing champ..

Like it or not, the market is rising. Barring a massive shock it will keep rising over the next couple of years. Anyone ready and able to buy should do so now.

I don't expect Sun Tzu would heed this advice.

See sales facts below please

" Investors are not the villains here. They’re just an easy target."

if you kill the chicken for meat, then don't expect eggs for dinner.

Of course, property investors, the unsung heroes of the housing market! They're like the Robin Hoods of real estate, taking from the tenants and giving to... well, their bank accounts. But hey, who needs affordable housing anyway, right? 😄🏠💰

Woah hold up, stop. Don't kill your chicken, I'll get my "friend" Bank to kill it and then I'll provide you the meat, unfeathered, $30/kg. Make that $40/kg. Boy do I feel good about myself. What were you saying about eggs? Sorry you can't afford them anymore because we killed all the chickens down the road too. Didn't want all the chickens killed? Don't care. You should work harder.

The graph above shows an increase in the rate of change of the HPI from about -15% to about -5%, so still negative growth. Pressure is really starting in the regions at present. I have been monitoring the amount of declared “motivated vendors” on the Realestate.co.nz in my area, used to be about 6 such declarations in about 500 listings, currently about 50 vendors declaring this out of the 450 listings. Getting the odd scarey sale now:

This sold for $850,000 last week, under its 2020 RV of $880,000 and a big drop from its purchase price in 2021 of $1,190,000.

South Wairarapa featuring now as biggest losers in both the QV HPI and the REINZ HPI.

So IT Guy, the six month lag is just starting here.

In Christchurch its boom time.. https://harcourts.net/nz/office/papanui/listing/pi82627-33-everest-stre… sold at 950k today, with a 2022 rating valuation of 810k. The other week https://www.realestate.co.nz/property/43-apsley-drive-avonhead-christch… sold at auction, for $1,120,000 with a rating valuation of 990k.. 2/35A Hackthorne Road, Cashmere, Canterbury 8022 sold for 710k, capital valuation 560k. Keep in mind, Christchurch values barely fell after covid induced interest rates, and are on the way up again now.. and almost no mortgagee sales..

Inflation is back on the rise in the US now. August CPI was up 3.7% from 3.2% in July (and 3% in June). The only thing lowering NZ's CPI was the tradeable component, now that will be going up instead. Lucky NZ only reports CPI quarterly instead of monthly so all this can be buried until after the election.

Yeah, It appears quite clear this "system" rewards property investment rather than productive and honest hard work.

Have watching my own home appreciate at a rate far exceeding I could ever earn in software development. (This is in spite of house price drops which I'm frankly surprised haven't fallen further)

So now we're seeing house prices begin another upward march off an already ridiculously high price base? Can someone please explain and enlighten me as to how this is a good thing for society?

I've talked to as many politicians as I could so far this election cycle to express my concern and frankly it appears none of them really give a hoot discouragingly.

I've talked to as many politicians as I could so far this election cycle to express my concern and frankly it appears none of them really give a hoot discouragingly.

Think about the counterintuitive. For ex, doubling down on the Ponzi means that people might actually spur investment for productive activity. And there could be an argument for that to happen. It's just that the ruling elite don't have the chops to explain it to us.

So pouring capital into the unproductive might spawn something productive ? Most of the Karen's and Bruce's involved in property do so because they are incredibly risk averse, they believe its a sure thing. They wouldn't have the intestinal fortitude to establish something productive.

If it's such a can't-miss bet, why aren't you doing it? I've built a few houses and I'm just about to build another one.

It's profitable, tax free and lots of fun.

All still going as predicted here, you have until the election to get into the market. August until October is the market bottom. If we get the predicted dry summer for a change with sunshine everyday the market will go ballistic.

That's the spirit!

Leverage to the max. The time low wage tenants are easily going to be able to coverall the costs of the very expensive debt.The banks will ignore everything, Tony the Comb has promised that rates will drop back, and there are future capital gains for Africa.

Damn the torpedo's...go go go!!!!!

I think the election boost started last month. This unseasonal untick cant be anything else, rates have gone up in the period. The narrative worked, National was getting back in and fixing everything.

If we get significant rate cuts before December without a crash the bottom has already happened. If rates keep creeping up well this boost will just look like noise.

suckers rally. first of many over the next 3 - 5 yrs. . . . . . be careful

Yawn.

Someone wake me up when interest rates start coming down.

The majority of the new 100000 migrants will not be willing or able to buy NZ houses at their market prices. the 40000 houses they require will increase demand in the existing rental market. I expect to see rent inflation more so than house price inflation in the coming 24 months. Particularly in Auckland. Most goods and services have risen by 20% since COVID so I don't see why accommodation will be an exception.

Despite this, I think some of the regions will lower due to a slower economy and loss of exports income. Time will tell. I predicted a rental spike early last year as PIs exited but I was wrong due to the strength of their fingernails.

I can see why people are voting National

Labour waste - $88k for staff hui. Crazy! Talk about an own goal.

Take your hui and put it up your gooey.

Its the last few weeks for Labour with their snouts in the trough, they already know they are the Christmas Ham this year.

Well, they did cancel because of cost, so not all bad.

But they need to be sharper than this if they want to claw back some ground.

Potential consequences of rising house prices from current price levels in most locations in NZ:

Rising unaffordability of housing will result in more renters. Some younger families may delay having children, some adult aged children who are working may stay at home longer (I know of quite a few of these)

Rising rents by private landlords will make rent unaffordable for lower income households.

Expect increase in numbers applying for social housing. More families in temporary housing such as motels until more permanent social housing becomes available (due to the shortage of social housing).

Expect an increase in government rental assistance (being paid by 'taxpayers') to be paid to private landlords.

Is this where taxpayers want the government to spend their money? Or are there other areas where this money could be spent to benefit the country?

Those vulnerable also include a mother of two kids on a single income facing rent rises.

'As a single mum, that's impossible': Rents rise as migration jumps | Stuff.co.nz

An article about housing with only 40 odd comments! It must be saying that housing values have stopped dropping or are on the rise!

House prices aren't increasing, you need to inflation adjust pricing.

In my opinion RBNZ will need to raise more to abate inflation anyway, at 6% inflation people are being very preemptive about the end of this tightening cycle.

My mortgage balance doesn't change with inflation. Therefore I am more interested in how house prices change in nominal rather than real terms. Inflation is good for leveraged asset owners even if the interest rates to counter it are not.

House prices in general shouldn't really be of any interest to someone owning their home for the long term, unless they're worried about what the bank might do in a negative equity situation or they want to jump onboard the lazy debt stacking equity release game.

Me, I'm focused on salary/wage inflation as that's what goes towards the increase in mortgage principal payments.

At this point I’d rather chance some rounds against Canelo than enter NZ’s real estate colloseum.😳🥊

NZ is nothing more than a property market wasting capital bidding up land prices.

Its no wonder we have such low productivity.

Existing mortgage in lending in 2017 was $240b. By 2023 it's now $340b.

Imagine if the Government borrowed an extra $100b or so.......oh wait! We're outraged when the Government does it, but when the retail banks do it no worries!!

If it's such a good deal, why aren't you piling into it?

I have access to REINZ stats. You need to look at 12 month trend in sales.

This does not support the positive spin i am afraid.

In the 12m to Dec 22, Auckland total sales were 29,433

In 12m to march 23 it was 27,028

in 12m to June 23 it was 26,471

In 12m to Aug 23 it was 25,968

in June-Aug 21 it was 12,886

In Jun-Aug 22 it was 6824

In Jun-Aug 23 it was 6543

By the way, in Auckland the total sales over $2.9m in Jan 19 - Aug 23 was 3352 out of 70,991 sales

That is 59 pcm (718 pa)

National project selling $20 billion worth for their tax revenue wheeze, over 4 years, which is about 240 pa.

Question not being posited by interviewers is, if you think Chinese will buy, have you had a look at state their market is in??

How does this match up with comments from B&T

"Economists say". Well thats says it all. Move onto the next article.

This is just perverse: we're turning on the immigration tap again to try and keep wages down and provide illusory growth - which is inflationary because of the artificial increase in demand for crumbling infrastructure that can't cope with who is here now..

Many more perversions of logic to come as desperate govts shunt reductions in living standards from one group to another over the years to come. They have no other tricks.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.