By Michael Coote*

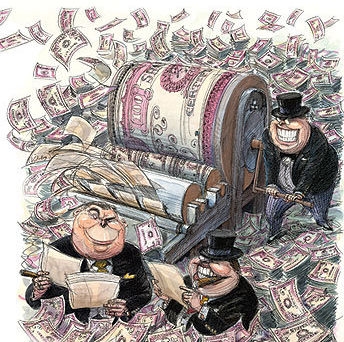

Paradoxically, risky assets like corporate bonds and shares can really take off like a rocket under a QE regime. (If you missed part one explaining how quantitative easing works, click here).

Paradoxically, risky assets like corporate bonds and shares can really take off like a rocket under a QE regime. (If you missed part one explaining how quantitative easing works, click here).

The reason for this ability for corporate securities to increase in value under QE rests on the special combination of effective lower bound (ELB), which ensures cash holdings are not remunerative, with QE’s twofold impacts of sucking government bonds out of private investment portfolios and substituting freshly prestigitated cash in their place.

Having sold their government bonds to the central bank, private investors then find that their portfolios have an overweight to cash that is paying them next-to-nothing.

As government bonds have become scarcer thanks to central bank buying, their yields fall and their prices rise, making it uneconomic for portfolio investors to buy more from the dwindling stocks available.

Accordingly, these investors turn to corporate bonds and shares as securities to buy with their unremunerative surplus cash in a “search for yield”, and their demand for these corporate securities pushes up prices in the marketplace.

A self-fulfilling prophecy arises, in which investor demand for corporate securities under the impetus of portfolio substitution creates profits that draw in other investors trying to earn more return on their portfolios.

The ECB tries to get too clever by half

Under the Maastricht Treaty, the European Central Bank (ECB) is not permitted to do QE, so has to dream up another way of getting much the same money-printing results as central banks like the US Federal Reserve, the Bank of England, and the Bank of Japan, for whom QE is an allowed activity.

The ECB’s answer is long-term refinancing operations (LTROs).

Two massive LTRO tranches were issued by the ECB, one in December of last year and the other in February of this year, in which over a trillion freshly printed euros were injected into the balance sheets of ailing European commercial banks under the guise of asset swaps.

In return for the new euros charged at an interest rate payment of 1% per annum, the commercial banks swapped their debt assets with the ECB on the understanding that the transaction would be reversed again within three years at most.

In other words, the swaps are supposed to be unwound, with the ECB getting back its printed euros plus 1% per annum interest, and the banks taking by return their debt assets the ECB had received as security.

At first the ruse succeeded, and there was a big share market rally that ran from December through to March based on cheap euro-denominated credit and portfolio substitution effects, but across April it has dawned that the LTROs don’t really fix anything permanently in the crisis-riddled eurozone, and in fact could make matters far worse as European commercial banks use the printed euros to buy the higher-yielding sovereign bonds of their home countries, including the PIIGS (Portugal, Ireland, Italy, Spain, and Greece).

What appears to be happening, in other words, is that the LTROS are funding convergence of sovereign debt crises and commercial bank insolvency onto the banks’ balance sheets.

About the only positive result could be that if countries like Greece exited the euro, then at least their commercial banking systems would be holding most of their governments’ debts, which would ease the breakup of the currency union during the course of the huge devaluations that would have to follow.

The being game played out by central banks with QE and LTROs is stumbling towards crisis point, and we could well see before the year is out the portfolio substitution effect goes into reverse as investors prefer to hold cash paying zero nominal interest rates and negative real interest rates to chancing their arm on riskier corporate shares and bonds.

*Michael Coote is a freelance financial journalist whose publication list includes interest.co.nz, the National Business Review, New Zealand Investor, The Press, and the New Zealand Centre for Political Research.

19 Comments

Michael, Very good article thanks; although in this and your previous article I believe you have missed what now could be the main reasons for QE in the UK, the US, Japan and Switzerland. Rather than just stimulating their economies by putting money in, they are managing down their exchange rates to boost competitiveness; and/or funding their fiscal debts without having to sell assets or mortgage themselves to foreigners. New Zealand should in my opinion learn from each, and could easily copy them. You said in the first article that you would not do QE until interest rates were near zero, or it would be inflationary. It seems to me that if say NZ created NZ$ to pay back the debt of say Mighty River Power that is held offshore, the increase in liquidity, and so any inflationary impact, happens offshore. Similarly any government debt held by foreigners could be bought back, and the increase in liquidity would be offshore. Or rather than issue new government debt offshore, print some money. Apart from reducing our debt costs, this would help reduce the exchange rate to a more competitive level; and so bring the current account deficit back to balance for the first time in forty years.

Am I missing something?

Yes Stephen you are missing something....our govt is managed by the banks...policy development must fit with banking demands.....You also miss the fact that once the idiots in the Beehive smell the crisp new money they will want more of it...and then more...You give MRP as an example target to waste the ink on but why stop at that debt when one more click on the Print button will repay all that foreign govt debt...hey presto no debt...doh.

I think we may well be better governed by the banks...close down Parliament..fire the swine....the banks will have a vested interest in making sure they don't stuff up again...end the ruse...give banks the power to impose taxes...make the theft legal...

Wolly,

Thanks. Understanding your response is a mix of reality and facetiousness, taking the Banks' possible concerns; they clearly are massively profiting from the current arrangements, with no doubt many margins at both ends of foreign transactions in arranging our debt. Even though we certainly wish to have solid banks, we clearly shouldn't feel any obligation to sustain the current multi margin process just for their benefit, and at massive cost to us. Much as I may not always like politicians, I wouldn't let the banks an inch closer to the decision process than they already are- indeed as you say they are probably already pulling the strings, or the current paradigm that we are operating under doesn't make any sense.

Controlled money printing to repay a fair amount of that debt (or at least enough to properly position the exchange rate) will not only effectively write the debt off, but also slim those margins, without otherwise threatening the fundamental soundness of the banks. The main banks in the US, UK and Swizerland have not been affected by money priinting- in fact it has significantly helped their balance sheets. Only the European method is killing their Spanish and Italian banks; but noone would advocate that here.

The moral hazard in giving politicians free access to the money press I accept is the main real concern.

To fix that I would change the charter or target of the Resrve Bank to be to have a current account surplus of 0-3% of GDP; and leave money printing to them. Separately I would suggest a very strong focus anyway on government spending by department and main cost area, as a percentage of GDP, benchmarked against the past, annd other countries with similar government systems.

In other words, the central bankers and govt's has destroyed all respect for money. Creating it out of thin air, in order to benefit themselves. Creating a double standard whereby some labour all day, and save in order to put food on the table, while others create it out of thin air, with no 'work' involved to fulfill their own ambitions.

What a joke, get physical assets before this whole mess explodes.

You had some respect for the currency skudiv!...wow.....they don't.....

Yes there is a storm coming.

....... I reckon there's an opportunity for someone to sell alotta fall-out shelters , tin hats , and baked beans around here .......

You guys waxing hickeysterically are such a laugh !

.... Bernard would be so proud , his mind de-programming has worked a treat .......

The above poster has no cred.

Claimed the USA had 'heaps of oil', but absolutely ignored my direct question re EROEI of said plays.

The need to self-delude is strong in that one.

Totally....vested interest IMHO....Lets examine GBH's motives in sprucing things up he has no where else to go so its full speed ahead and damn the torpedoes. He I believe he said he got handed a decent redundancy package from his printing job....something shock horror leftie unions fought for...but anyway. He then has invested it with GSach or some equally shonky organisation in what amounts to high interest (read risk) funds so he can get the income he wants. Beyond that he has no hope of getting employment again at his age and skill set....so all he could do is road sweep, pull carrots or sponge off the Govn when it goes pear shaped. Specifially the NZ Govn of course, he will feel the need to do this once things implode but since he lives abroad and pays no NZ taxes he will have to fly home as where he lives doesnt offer WINZ I believe.......

Am I way off the mark GBH?

regards

For once steven , you are 100 % correct ! .........indeed you are " way off the mark " ....

....... oooooh looky , the world didn't end overnight ....... US GDP looking stronger , Apple's profit surged , oil still freely flowing , no " rioting in the streets "......

....... forgive my positivity , but I see no alarming shortages of anything ( commonsense excepted ) .......... oooooops !

"What a joke, get physical assets before this whole mess explodes."

Yes, indeed... those who carry debt, risk having their backs broken on the rack of increasing interest rates. There seem to be many variations on the theme of "hidden interest rates" (such as bonds of a variety of different forms...), but I can't see any way past the certainty of a longterm increase in interest rates, probably lasting 20 years (and including some years of 15% minimum rates - possibly even hyperinflation...).

It will be better to live in a debt-free caravan than a 50% equity property that has a meagre $100,000 owing. If you're stretched to service debt at the current levels, imagine what you will lose in 5 years time. I'm pinning my hopes on Lotto.

I am sure there are lessons to learn from what countries like Brasil have been through.

Interest rates won't rise, as this would bring on default earlier than otherwise. Try my modification of the Quantity Theory of Money, which allows for interest. (M.V)+I=P.Q. You can only put the interest rates up in the early stages, at the later stage the burden of interest payments consume a greater part of the money supply. This of course also lowers velocity and eventually sends you into a downward spiral that ends in default or hyperinflation. But the hyperinflation doesn't come with high interest rates, it doesn't need to as the damage of interest has already been done.

Well Im totally the opposite view, except backs will be broken....

No inflkation initially....those carrying debt will see minimal interest rates for 5 or so years, as we see massive deflation from a secoond Great Depression....in their assets and thier wages...ie the net effect is they will be left with huge neg equity but wages will be as bady hit....especially when you consider that the un-empolyment rate will be twice maybe three times what we have now and the tax rates that will be needed to cover that will be significant.....so the burdens will be heavy.

NB 20 years of inflation at 15% isnt a sustainable/credible view...the entire system would tip over long before that IMHO.

"better to live in a debt-free" with that I will agree 100%.....funny that two totally opposing views see the same outcome...

regards

"NB 20 years of inflation at 15% isnt a sustainable/credible view".

I agree with you there. I did not intend to imply 20 years at 15%, I meant that we will experience a protracted period (couple of decades maybe?) of high interest rates, and that these will reach a peak of 15% (or perhaps even a short term hyperinflation cycle like Brasil if things are mismanaged). I don't expect a peak of 24% as we saw in the 80's, but do expect to see 15%, probably for a couple of years at least, with an underlying rate approaching 10% for the rest of that 20 year period.

If you look at the graph here:

http://www.tradingeconomics.com/new-zealand/interest-rate

and plug in the earliest starting date (1985) you will get some idea of what I mean. If the graph allowed it, it would be nice to roll the date back to 1975 to get a better idea of the 20 year pulse I am expecting to see repeated.

Yes explain how the bent sorry system works to a manual laborer who works long hours an barely saves a penny at the end of the week and you will have the poor blighter on the floor weeping like a baby.

or rioting in the streets........

regards

... or no rioting in the streets ...... just the usual activities of transportation , street cleaning , and prostitution ....... all normal , business as usual ...

"all normal, business as usual"

but only "business as usual" if you don't measure exactly who is on your streets.

Some people do not care if those people on the streets are the same ones who built our country, or merely a new underclass of imports who are brought in to live a "bottom dollar" lifestyle and form a finacial foundation for the traders and taxers who clip the ticket on human endeavour.

Interesting piece on Austerity.......and on how saving $1 is actually only really gaining you 40cents of reduced deficit.

http://krugman.blogs.nytimes.com/2012/04/24/austerity-and-growth-again-…

These were good articles. We should have more of this fellow.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.