By Amanda Morrall (email)

1) Negotiate

I can't say I wasn't warned. It's been a full week since I took delivery of my magnificent puppy Mazzy and already she's burning through my hard earned cash.

After quickly outfoxing me with my make-shift crate, a clumsy barricade I fashioned by rearranging the furniture, I caved in and bought her her own cell. It's for my own good, and hers, I'm assured. As I was a bit desperate to put an end to the piddling, I didn't have the luxury of waiting for a cheap second to appear on TradeMe. Instead, I went for the average priced buy-me option of NZ$79. Of course, no sooner had I pushed the confirm button then the exact same crate was offered to me for NZ$65.

At the risk of getting a bad TradeMe rating, worse arguably than a credit downgrade (I do more business with fellow NZrds than the banks), I followed through on my purchase. I did however read the fineprint before turning up to collect my Made-for-$5 in China, Sold-for-$80 in NZ crate and discovered that I had a five-day refund option. The Chinese family operating this TradeMe bazaar of crates and a million other imported curiosities from China was based out of a cement bunker in industrial Albany. They didn't appear to rolling in profit but I figured it didn't hurt to ask for a discount. I got it for $70.

The moral of this story? Well apart from the blatantly obvious truth about cats and dogs being costly, and never being in a hurry to buy, or sell, if you can avoid it, it's the ask and receive savings trick.

Sure you might get a few of those withering "What a preposterous and pathetic suggestion my dear girl or boy" looks. But more often than not, I have found you get a discount.

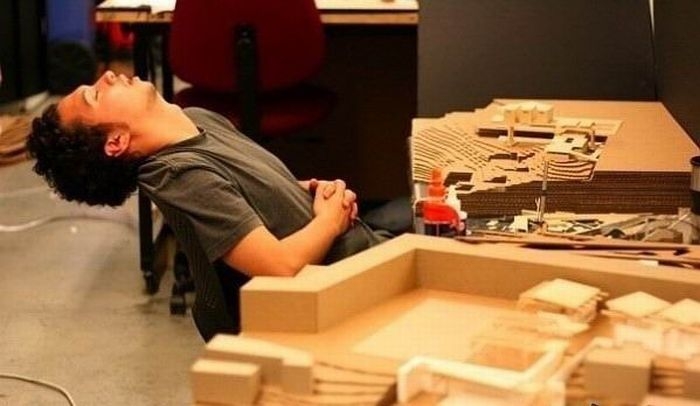

2) Wake up sleepy head

Personal finance, I have discovered, is this crazy free-market jungle place of ideas, blogs and soft-sell internet purchases. The handle these bloggers give themselves cracks me up. Fatguyskinnywallet.com takes the cake. This guy is on a mission to lose weight and fatten his bank account instead. Wealthpilgrim.com, freefrombroke.com, sustainablepersonalfinance.com, bucksomeboomer.com, couplemoney.com, investorzblog.com, littlehouseinthevalley.com, sooverdebt.com., the list goes on and on.

A few are selling their wares, others aren't selling anything. They're sharing their knowledge. Nothing wrong with that.

Here the millionairenurse.com discusses how he's managed to turn his insomniac tendencies into hours of productivity. Lethargy, I would argue is almost as bad as debt, for those who want to get ahead.

3) Snowball myth or math

The snowball method for debt reduction is an interesting one. Essentially, it's a psychological weapon to attack debt. Adherents (debt laden-folks going in circles or spiralling in the red) are encouraged to tackle their smallest debt first before working up to the bigger high-interest bearing beasts. The idea is that by starting off modestly, you'll build up the confidence necessary to knock-off the big bastards later on.

Personally, I believe it makes most sense to target the most expensive debt, then work your way down the list. However, it's not a one size fits all formula in personal finance. Each individual is unique in how they view and manage their debt. Stick to what works and don't relapse. thedebtmyth.com takes a similar view in this blog analysing the math behind the snowballing method. Some cool apps to check out as well.

BTW, I am looking to review personal finance apps for New Zealanders so please email me your suggestions if you have any: amanda.morrall@interest.co.nz

4) Social networking and productivity

I'm a social media convert. I used to think it was a waste of time or else an outlet for individuals who couldn't or preferred not to engage with people the old fashioned way; talking.

Life is oh so humbling. Sorry Bernard for mocking you.

Some interesting findings in this ManPower report on how New Zealand employers view social networking in terms of a productivity tool and booster. I still have some doubts about how Facebook improves productivity but I expect I'll be proven wrong, again.

5) Wither the homegrown talent?

I like to fancy myself "foreign talent.'' It sounds so self important and exotic. Really, I'm just a hack from Canada lucky to wash up on your beautiful shores. Journalists are a dime a dozen.

Engineers on the other hand, now there's a professional you can feel proud of, and better yet highly desired.

In the same whitepaper as above released by ManPower, New Zealand employers questioned about hiring outlooks and sources, report that 39% of new recruits will be from abroad. Engineers are at the top of the labour food chain, followed closely by technicians and software experts.

The primary countries of origin for foreign talent scouted by New Zealand employers are the U.K., South Africa, India and Australia.

Some other juicy tidbits in this report as well.

My question? Wither the local talent? Presumably in OZ?

To read other Take Fives click here or follow Amanda on Twitter @amandamorrall

11 Comments

The following video has no relevance to personal finance however I did go thru a fair number of these in my former life as a ballerina...

Shows how those torturous but beautiful looking pink shoes are made:

Wither the homegrown talent?

Australia, mostly, but also elsewhere.

Anywhere but New Zealand.

Why would they still be wasting their time here?

Amalgam. Why so negative????

I think opportunity is ripe in NZ. Granted you need a bit of gusto to make a proper go of it.

"Why so negative"?

You know what? I'm not even going to make any pointed remarks regarding disingenuousness and naievete.

Despite the four question marks, you claim to be a journalist, right?

How about you go interview some of NZ's successful entrepreneurs, as well as the not so successful ones.

Then do some comprehensive digging into their backgrounds.

After you've done that there will be no more "just get in there and roll up your sleeves and be a winner!" Ra! Ra! nonsense.

No more "You don't need cash, you just need gumption!" fantasy twaddle.

North America has venture capitalists who kickstart those with good ideas but without the essential financial wherewithall to make them fly.

New Zealand does not.

New Zealand is the "No Can Do" country.

Now prove me wrong.

Sorry, I know when to pick my battles. Suggest you go have a chat with Bill Buckley instead. Seriously.

Failing that, I guess you should follow the herd and move to Australia. Canada's a nice alternative to the U.S but perhaps we are too nice and naive. At least our economy isn't floundering, so bad.

http://www.interest.co.nz/personal-finance/55581/kiwi-entrepreneurs-enc…

Why are almost all of NZ's most successful entrepreneurs sucessful overseas?

It's because getting anything truely viable off the ground is all but impossible for those who don't already have some serious seed money.

So those with a will cross the Tasman, or head to 'Mother England', or even the USA, where there's at least the possibility of finding someone willing to invest in something that isn't related to dairy farming, or houses.

Where there is no commitment by government or business to encourage, assist and support startups, there will be almost no startups.

All we get instead is a bunch of debt-ridden small "businesses" such as takeaway bars and wheel balancing outfits lurching from one insolvency crisis to another.

The next IBM, or Google, or Microsoft, or Intel, or whoever? Not here. Not in NZ.

Guess Bill is the exception. He did all his capital raising on his own. Even his father turned him down but he persisted. He started with $12K. Sure, he's no IBM but he's pretty damn successful.

When I asked what the biggest obstacle to success was: I put your question to him about lack of capital.

Watch the video. He says it's lack of confidence that is holding would-be entrepreneurs back, not capital.

Last year's global winner was an orphan who started with $15K now runs a $450 million business.

I'm not trying to trivialise your concerns but attitude counts for a lot!

Peace out Amalgam. I don't want to argue.

Amanda confidence doesn't pay bills. You are right that people need to have a go some times but amalgam is also right that you can't start a business on high hopes. And when did your mate start his successful business on $12k? That doesn't go very far at all now!! Attitude will only get one so far even a good attitude. When you read all the stuff written by the business success stories and about them they always acknowledge how good luck played a huge part. A few days ago I was reading about the 2 Steves at Apple computers and how they started in a garage but they would have fizzled out very fast if it weren't for the VC money and supervision they got soon after. You can start in a garage here but you will always be on your own.

Lucky Basket: Great handle. I'm not suggesting confidence is everything but if you have a self defeating attitude you're dead in the water. I pay my own bills...I don't pray for them to be paid every night. I had my first job at 14 and I've worked steadily even since.

I'm quite confident that the abundance of great people and opportunities that keep flowing my way isn't due to luck but having a good attitude, a positive mindset, and always being grateful. Compassion also goes a long way.

Spot on Amanda. I am priviledged to know a group of very motivated young farmers who, despite all the negative comments that abound around young farmers not being able to get in to farm ownership, firmly believe that their goal is reachable. I see good attitude, belief in onesself, sharing of experiences and compassion in spades, in these young men and women. They are also keen to learn - and participate in the DairyNZ Biz Start and Biz Grow programmes. Building networks with likeminded peers is also beneficial.

You're right Ivan. Consumers have more power than they realise.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.