Fixed home loan interest rates are taking another step lower with the latest move by ANZ, the nation's largest mortgage lender.

To be fair the dip is not large. But it is significant because it restarts the stalled cutting momentum. And two of its new rates are now market leading.

At 6.35% ANZ offer's the lowest one year rate for any bank. And at 5.79% it has the lowest two year rate, a position Westpac had on its own until now.

It is almost certain other banks will follow ANZ down, and possibly even drive rates slightly lower for the bragging rights.

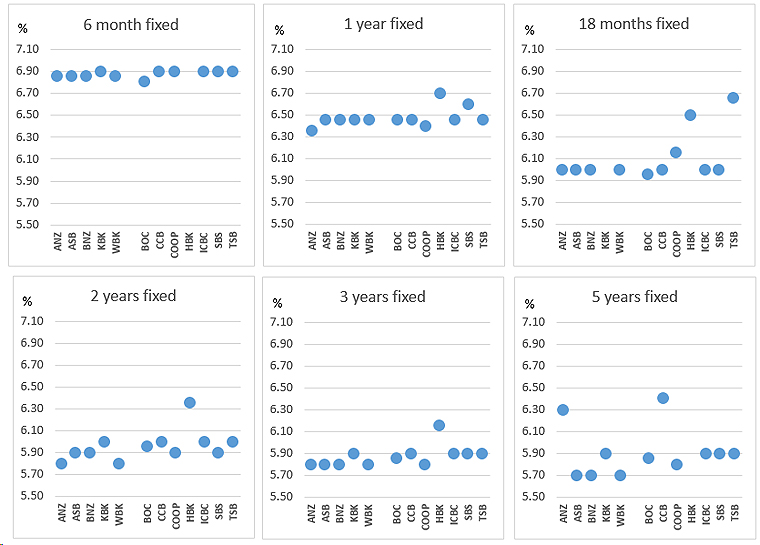

At each fixed term, the above dot plot shows who has the lowest offer, and how your current bank compares.

It also helps you assess the rate benefits you give up for going shorter.

Now, the lowest carded rates for each fixed term are:

6 months = Bank of China at 6.80%

1 year = ANZ at 6.35%

18 months = Bank of China at 5.95%

2 years = ANZ and Westpac at 5.79%

3 years = a range of main banks and the Cooperative Bank at 5.79%

4 years = BNZ and Westpac at 5.69%

5 years = ASB, BNZ and Westpac at 5.69%

It is probably worth noting that missing from this list is Kiwibank, the institution the Commerce Commission singled out to be the disrupter.

ANZ has cut all its term deposit rates for terms of six months and longer at the same time.

Almost all banks will have some flexibility in their rate offers. So the carded rates are just the start. Negotiate. How flexible they may be will depend on the strength of your financials. And don't forget, banks have savvy tools at hand to 'know' the likely valuation of your property, so if the loan-to-value ratio (LVR) is near 80% you may not find them very accommodating for a lower rate. With falling house prices, the point where low equity premiums start applying is shifting around as well. See this.

And the carded rates we report here can be different to the rates banks might offer in their banking app. We would like readers to reveal what their banking app shows as the potential offer rates. Please add that market intelligence in the comment section below.

A quick check of the wholesale swap rate chart below gives a clear understanding of where funding costs are heading.

One useful way to make sense of the changed home loan rates is to use our full-function mortgage calculator which is below. Term deposit rates can be assessed using this calculator.

And if you already have a fixed term mortgage that is not up for renewal at this time, our break fee calculator may help you assess your options. Break fees will be minimal in a rising market. But they become important in a falling market, like now. Don't forget, when you sign up for a fixed rate you are signing a contract. You have been given the right to break it in legislation but the bank has the right to reclaim its costs when you do so. This is NOT evidence of banks making it hard to switch (as some borrowers, and sadly some journalists seem to think).

Here is the updated snapshot of the lowest advertised fixed-term mortgage rates on offer from the key retail banks at the moment.

| Fixed, below 80% LVR | 6 mths | 1 yr | 18 mth | 2 yrs | 3 yrs | 4 yrs | 5 yrs |

| as at September 12, 2024 | % | % | % | % | % | % | % |

| ANZ | 6.85 -0.04 |

6.35 -0.10 |

5.99 | 5.79 -0.20 |

5.79 -0.10 |

6.29 -0.45 |

6.29 -0.45 |

|

6.85 | 6.45 | 5.99 | 5.89 | 5.79 | 5.79 | 5.69 |

|

6.85 | 6.45 | 5.99 | 5.89 | 5.79 | 5.69 | 5.69 |

|

6.89 | 6.45 | 5.99 | 5.89 | 5.89 | 5.89 | |

|

6.85 | 6.45 | 5.99 | 5.79 | 5.79 | 5.69 | 5.69 |

| Bank of China | 6.80 | 6.45 | 5.95 | 5.95 | 5.85 | 5.85 | 5.85 |

| China Construction Bank | 6.89 | 6.45 | 5.99 | 5.99 | 5.89 | 6.40 | 6.40 |

| Co-operative Bank | 6.89 | 6.39 | 6.15 -0.04 |

5.89 -0.10 |

5.79 -0.20 |

5.79 -0.20 |

5.79 -0.20 |

| Heartland Bank | 6.69 | 6.49 | 6.35 | 6.15 | |||

| ICBC | 6.89 | 6.45 | 5.99 | 5.99 | 5.89 | 5.89 | 5.89 |

|

6.89 | 6.59 | 5.99 | 5.89 | 5.89 | 5.89 | 5.89 |

|

6.89 | 6.45 | 6.65 | 5.99 | 5.89 | 5.89 | 5.89 |

Fixed mortgage rates

Select chart tabs

Daily swap rates

Select chart tabs

Comprehensive Mortgage Calculator

26 Comments

Down go interest rates, up go house prices

The excess houses on the market need to be sold first before there is any upward movement in prices. It's still a buyers market.

If sellers collectively hold firm, the market can still rise even on low sales volume.

that is a big if.

If they get to 2% maybe. But until then, NZ property = total rip off.

10% by Xmas!

Actual rates being offered as of now:

- 6m - 6.79%

- 12m - 6.19%

- 18m - 5.85%

Did they change today?

6m dropped from 6.85% for me

Lucky you just locked mine in last week at 6.85. Congrats

Have you drawn it down yet?

I have the same offered now.

The longer terms are

2yr 5.79

3yr 5.65

4yr 5.59

5yr 5.59.

no discount off carded special rate for 2 yrs

Waiting for Kiwibank the supposed disrupter to do some disrupting

LoL, don't hold your breath for that one.

For ANZ staff and those with private banker access:

6 month: 6.69%

1 year: 5.99%

18 months: 5.79%

Anz online renew, 6.79,6.19,5.85,5.79.

Wonder if after the next 25bps OCR reduction we will see another 100bps taken off market rates. One can only hope...

No, it'll a be pretty linear response now, the pivot from the RBNZ to cuts was a significant event, now that we know the direction for rates is down for the foreseeable future it's just a question of how fast.

This is definitely not how swaps evolve, and not how mortgage and savings rates are set by the market.

I should have written /sarc

They would have to indicate a faster ocr reduction path than last time. The 6 month rate will possibly move the most as the rate ocr will have been reduced so the month without the cut will drop out. The longer the term the less significant this will be.

ASB Premium Banking

6 Months: 6.79%

12 Months: 6.19%

18 Months: 5.85%

That's competition for you, exactly the same as ANZ.

Fix for 6mths or 12mths??

Run the numbers for yourself and see! It's quite fascinating.

On the current online ANZ rates I've got, to be better off over 12 months doing two 6 month fixes (vs 12 month now), the second 6 month rate has to be 5.59% or better. I'm going out on a limb to say that's not going to happen by March, for that particular rate.

Looking instead at doing a 6 month then 12 month, to be better off than the current 18 month offer, the 12 month rate in March needs to beat about 5.25%. It's almost like they planned that 5.79% 18 month rate to be tricky to outgamble.

In a couple of months the 6month rate should drop given the OCR likely to drop. Floating is an option if you can get a discount. I get 1% from asb and 0.74% from anz.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.