Thousands of New Zealanders are playing a minuscule role in the 'David and Goliath' GameStop movement.

Around 10% of all trades (by value) made via Sharesies over the past two weeks involve GameStop shares.

Sharesies co-founder Leighton Roberts told interest.co.nz around 9000 users of the share-trading platform made $20 million of trades over a fortnight, with activity spiking over the past two days.

He said the median value of a GameStop trade had been US$180.

Hatch general manager Kristen Lunman couldn’t provide similar data but said about 2% of Hatch users own GameStop shares.

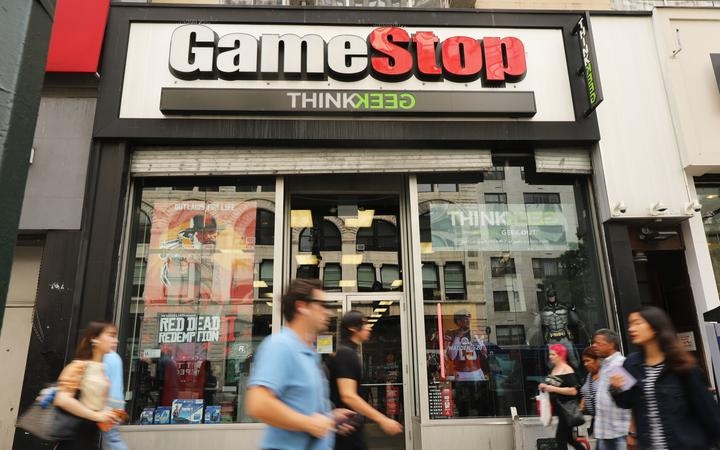

Retail share traders have swooped in to boost the price of GameStop shares in an effort to squeeze Wall Street hedge funds that were short selling shares in the video game retailer.

The movement, which is as political as it is financial, was roused on the online forum Reddit. It’s been endorsed by the likes of Tesla CEO Elon Musk and former Democrat US presidential candidate, Senator Bernie Sanders.

Roberts and Lunman said they weren’t restricting Sharesies and Hatch users from partaking in volatile share-trading as the US platform Robinhood controversially has.

Both were focused on providing users with educational material and leaving them to make their own decisions.

They said problems people have had making trades are a result of the brokerage infrastructure being overwhelmed.

“Generally, Sharesies won’t stop you from placing orders for these volatile investments, but you should know that these orders might be delayed or rejected by the exchange,” Sharesies said on its website.

“If your order is rejected, you’ll be able to place a new order when the exchange accepts them again. There’s no knowing when that order might be filled, or at what price.

“We believe that everyone should have access to investing.”

Roberts said Sharesies was considering sending additional educational material to high-risk users who are losing a lot of money regularly.

Lunman said Hatch isn’t set-up to cater to day traders.

“This [the GameStop movement] isn’t something you want to be a part of. Don’t do weird stuff,” she said.

The Financial Markets Authority (FMA) said it was following the GameStop case “with interest, as many regulators no doubt are”.

“We have welcomed the new wave of retail investors to the capital markets, however we have expressed our concerns about investors potentially spreading misinformation on social forums and following the herd into high-risk investments,” the FMA said.

“Investors need to think carefully about their capacity for loss when considering high-risk investments, such as shares in an individual company, especially in volatile markets.

“We reminded investors in December that they need be aware of their obligations in relation to market manipulation, both information-based and trade-based. We have more information for investors about market manipulation on our website.

“We won’t speculate on whether the GameStop scenario involves market manipulation.”

Here's a Yahoo chart showing how the GameStop share price and share trading volumes have spiked on the New York Stock Exchange over the past month:

And here's a chart showing the volatility over the past five days:

56 Comments

The old farts, govt, and banks will want Sharesies gone. They want the kids focused on signing on to mortgages for overpriced slums.

The Coming Revolt of the Middle Class

That's how Neofeudal systems collapse: the tax donkeys and debt-serfs finally rebel and start demanding the $50 trillion river of capital take a new course.

Yes, told less colourfully by Elizabeth Warren in a 2007 lecture, The Coming Collapse of the Middle Class;

Very odd to see Kristen Lunman, GM of Hatch (apparently) venture an opinion on whether this is a good investment or not? Typically platforms don't comment (as you saw with others above) because if it's interpreted as financial advice, as it might easily be in this scenario, they could be held responsible under the Financial Advisors Act.

I was thinking the same thing. Sloppy

But she's right on the comment "dont do weird stuff" - Millenials need to understand this isnt Pokemon Go or the latest tik tok viral video ie the latest trend for everyone to follow. This is real money and there is the potential for a lot of people to lose a lot of money.

'real money'? This isn't mum n dad punting a million on the unearned capital gains of an Auckland do up. The average trade is $180

It appears there is a hunt on for other excessively short positions. The hunter is being hunted!

I'm not sure if I'd advise that as an investment strategy but it beats a casino for fun.

The Sharemarket, clearly just another thing thats broken. Things are getting crazy out there now, looking like desperation stuff.

Those jokers absolutely deserves it. When you treat the stock market like a casino, the result you get is just that- like a casino.

I wrote a warning sometime ago here on this and courted a long list of mockery- see who has the last laugh.

Saying that, the IQ of this country needs to improve and Dunning - Kruger was absolutely right about their obsevations.

The peak of mount stupid....

The peak of mount stupid

Who? The speculators or Sharesies?

I don't think you get it. People are speculating and making or losing money. Nothing to do with being 'stupid.' The average NZer will read Ashley Church in Granny Herald and believe that house prices double every 7-10 years? Is it 'stupid' that people carry these beliefs?

It was an reference to the Dunning-Krugar curve rather than a comment on the traders. I will try and be clearer next time. I find it an amusing term. Hope all your valves are ok.

If the kids are speculating and know that they can lose, that is not a reflection of Dunning Krueger. In fact, the idea of 'you can't go wrong with bricks and mortar' is far more applicable to the DK bias.

Again. I wasnt commenting on the kids/traders. I was expressing amusement at the phrase peak of mount stupid which appears on the DK graphs. I'm loving and admiring the kids and for some fun thinking of joining them.

JC...Exactly. As a complete guess (made solely with logic and a good sense of intuition) I would say the average kid who has bought GameStop in the last five days is infinitely smarter (and financially literate) than the average investor who has bought in the NZ property market recently.

There is absolutely nothing wrong with +EV gambling (in the share market, casino or anywhere else) as long as you adhere to the Kelly Criterion and (the majority of) your gambles are indeed +EV. Day trading and shorting stocks as well as casino gambling can be (very) profitable for a small minority.

And yes, one of the best illustrations of the DK effect would be the average NZ property (speculator) investor.

You can imagine all the tut-tutting from the old farts, Granny Herald, and even younger, 'hipper' leaders like Ardern and Robertson. Of course, none of them really understand what's going on. Their opposition will be because they believe the kids are 'not playing by the rules', when in fact, the rules are set out to benefit the rich, themselves, and to some extent the old farts (who just blindly accept the manipulation because Wall Street are the 'experts').

The reality is that the kids are the most 'free market' actors in this game. They know they stand to lose 100% and are not going to get bailed out but the hedgies and investment banks (and the old farts to some extent) will should SHTF for them.

JC.... and the most disgraceful part is the fact that these kids are risking their own money while (almost 100% ) of the worthless fund mangers have no skin in the game ie they have absolutely none of their own money at risk. Fund managers are on a complete freeroll where if they profit they gain by way of commissions and fees but when they take losses it is their clients who take the hit. They play dice games with other peoples money.

“Is it 'stupid' that people carry these beliefs?”: those beliefs have made people a lot of money so not really. Throwing a ton of money on a stock that is overvalued and only rising because of a reddit page does sound quite stupid though (although if you happen to get your money out at the right time it could pay off big time).

“Is it 'stupid' that people carry these beliefs?”: those beliefs have made people a lot of money so not really.

You're missing the point. People like Church look at the a predetermined time in the past and claim 'look, house prices in NZ double every 7-10 years.' People look at the connection and believe there is some kind of 'proof' that supports this relationship. People are making judgements based on a cursory observation. Nothing more, nothing less. In the case of the Redditers, this is completely different and most (if not all) will realize they can lose their investment.

Those jokers absolutely deserves it

Who? The punters or the hedgies? Some of the former have made a motza. The latter have been taken a hit.

No fingers in this pie but I like the cut of these Redditor kids. Had a look at their forum post for this and there doesn't seem to be anything nasty about them like name calling, bullying or political arguments. Just in it together, ride or die to the end. Quite endearing really.

Hard to feel sorry for the hedge fund caught with their pants around their ankles or trading platform that's now subject to a class action lawsuit for restricting trade when they had a vested interest and will probably be taken to the cleaners (Citadel, the fund being pinched, is also an investor in RobinHood.)

I agree - I"ve been on the Reddit/WSB site for a lot of the day. Felt like history being made - a movie for sure.

The mighty power of a like-minded collective combined with a dollop of YOLO. Fascinating story.

It's not about the money - it's about sending a message

It’s interesting because it’s an example of open source due diligence- someone worked out that the institutional short sellers had been (illegally) selling way way more than the shares on offer; and that mathematically they would be forced to cover if enough people bought. Like VW in 2009, but instead of large funds it was a mob of end users calling the shots. Since then it has become ‘occupy Wall Street 2.0’ it seems

Not only has it exposed the dodgy antics of the hedge funds but also how captured/conflicted the mainstream financial media are to them (looking at you CNBC)

Exactly and these young investors are buying and HOLDING. In other words, the apes are holding all of their bananas - I really need to get off Reddit (and I'm a retiree).

To close their 'short positions' hedge funds need to Buy GameStop Stock, which will push the price up higher. Also consider shorts were over 100% of GameStop stock lol. Further consider 'meme-stock-traders' AREN'T selling.

No liquidity means the shorts probably have more pain ahead of them.. unless people get bored and wonder off. I'm not buying GameStop, but it's funny! I chucked a few hundred at BlackBerry's dip today because it's considered a meme stock, but has good fundamentals IMO.

Thought: Perhaps GameStop will issue more shares?

Other hedge funds will be piling , taking out competing hedgefunds, sharks circling.

Will laugh if the shorts use bailout money to fund margin-calls, then find themselves in a worse position. To quote Voldemort; "They never learn". Though he's one to talk.

Yep, that's Elizabeth Warren's point too;

https://www.boston.com/news/politics/2021/01/28/elizabeth-warren-gamest…

Nar can't do it, buying BlackBerry's dip is where I draw the line. Wish GameStop holders all the best. See how the end-of-month ?? margin calls go tomorrow/today??

Colbert @ 6:46

https://www.youtube.com/watch?v=4lTbWQ8zD3w

There's a bunch of disaffected GME investors who are turning away from Wall St altogether and moving into Crypto.

I'm feeling euphoric. Think I'll blow a few hundred dollars and put some more squeeze on the hedge funds short position and buy some. Whoopi

Or there is potential for a lot of people to lose a little bit of money and have a great impact and screw with a hedge fund. Kind of like a givealittle focused on messjng with 'the man'. I don't really see it as something can be sustained u less there is eventually a lot of organisation behind it but it's a great watch. And maybe some will also make some money.

You have to admit this is quite fascinating. :) BBC GameStop: Global watchdogs sound alarm as shares frenzy grows. "Regulators have fired warning shots over frenzied share dealing in GameShop and other firms fuelled by social media chat on sites like Reddit and Facebook." https://www.bbc.com/news/business-55842994

If anything this movement has highlighted how the system is rigged for the big players. As if the algorithms and high frequency tradingand bail-outs weren't enough. Big hedge funds find themselves overexposed on the shorts, a group of retail investors on reddit band together and hatch a cunning plan to trigger a short squeeze, get overwhelming support from all over the world. Now all the stops are coming out to try and force the price down so these corrupt hedge funds can exit their bad positions - platform RobinHood initially preventing customers from buying the stock (but allowing them to sell hmm) then backing down and allowing customers to purchase... 1 stock. Sharesies were getting a pounding on social media at one point, I'm guessing they were caught up in the halts somehow.

If any regulation comes of this, it should be a) on short sellers and b) looking at the conflict of interest in companies like Citadel that have a finger in hedge funds AND platforms. One rule for all, they shouldn't be bent when required for the bigger players.

It's rigged - any regulation that comes out of this will be to protect the big boys.

Which inevitably will generate a huge public move into decentralised crypto products of all shapes and sizes.

Yes, I don't see crypto as a currency, but blockchain makes for excellent share trading, essentially an individual corporate stock exchange.

Great to see some equity in the equity markets.

Who is Sharesies using to clear trades? My observation is that Sharesies order flow is being sold before trades clear, if this is the case then they really need to explain themselves

You should visit Sharesies website and find out for yourself. Sharesies uses DriveWealth. Ask them.

Just watched an interview on Fox with Doubleline CEO Jeffrey Gundlach.Made plenty of sense to me.

One thing he said''The little guy is tired of seeing the elitists catered to""

Underlines speculative focus of cash looking for a thing but yield.

Some shorts have felt the pain and covered (puked)

Total short interest has fallen from 146% to 121%

https://www.highshortinterest.com/nyse/

I wonder how they estimate this. I think the organisations with short positions only have to formally report once every two weeks.

Great Interview - wouldn't post if I didn't think so:

https://youtu.be/jPkP4xiaQAY

We're looking at the long term consequences of centralised planning by central banks, combined with stimulus which is needed now, combined with a destroyed middle class by what's happened in the pandemic

Truer words never spoken.

The post comments are illuminating.

It's not "just a bunch of kids who are bored", it's a bunch of people who are pissed. But I guess that's hard to see the difference from the penthouse

I'd be okay with losing $500 to stick it to a hedge fund.

I'm long on it, I just really like the stock

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.