By Terry Baucher*

So, no Capital Gains Tax to rule them all, not even a wafer-thin mint partial extension of the existing bright-line test to cover all residential investment property/holiday homes. I’m almost certainly not the only one who didn’t see that coming.

The other big surprise for me is the decision to not prioritise any new environmental tax proposals for now. When introducing the TWG’s final report Michael Cullen made much of using the funds from these measures to help farmers transition to a lower-carbon economy. That appears to have fallen by the wayside for the moment.

The Tax Working Group made a dozen recommendations regarding environmental and ecological outcomes. One of these was to develop a framework for taxing “negative environmental externalities” (i.e. pollution).

The TWG report noted that the approximately $5 billion of environmental taxes raised in 2016 represented about 6.2% of tax revenue. According to the OECD, New Zealand ranked 30th of 33 OECD countries for environmental tax revenue as a share of total tax revenue in 2013.

Surprising and a little disappointing

Accordingly, given our dependence on the environment for our agricultural and tourism sectors, it’s surprising and a little disappointing that the TWG’s recommendation for developing a framework is simply rated “Consider for inclusion in the 2019/20 tax policy work programme.” Furthermore, the Government has decided not to advance any new environmental tax proposals other than those within the current tax policy work programme.

The other eleven environmental proposals covered Greenhouse gases, water abstraction and water pollution, solid waste and transport. All are within the current tax policy work programme, but critically the Government has ruled out both resource rentals for water and the introduction of input-based instruments such as a fertiliser tax in this term of Parliament. Unlike CGT these issues are not completely off the table.

Although property owners in particular will be relieved by Wednesday’s decision, there will be far more losers as a result because the TWG’s suggested options for recycling the revenue raised from a CGT through reductions in personal income tax are off the table entirely. This would appear to include any changes to tax rates and thresholds which might come out of any proposals made by the Welfare Expert Advisory Group.

However, given the current tax rates and thresholds have not been adjusted since 2010, the issue of personal income tax reductions is not going away. Today’s decision probably increases the pressure on the Government to make some changes in next month’s Budget.

So which TWG recommendations has the Government marked out as high priority? The most significant would be introducing measures to counter land-banking and land speculators. The TWG’s final report suggested residential vacant land taxes were best levied by local government. There are few other details so far apart from a direction for the Productivity Commission to include vacant land taxes into its enquiry into local government funding and financing.

The other high-priorities include the tax treatment of seismic strengthening work which frankly should already have been a priority; an interesting proposal from the New Zealand Superannuation Fund to develop a regime encouraging investment into nationally significant infrastructure projects; and a number of technical tax integrity items relating to loss-trading, and better tax collection.

Overall the TWG made 99 recommendations. Eleven have been deemed high priority for progression in the 2019/20 current tax policy work programme. The Government rejected 14 including CGT; another 14 such as the current rate of GST are current tax policy and will remain unchanged; work is already underway on considering 30 recommendations and the remaining 30 should be considered for inclusion in the tax policy work programme in due course. This last group includes business taxation changes aimed at reducing compliance and the TWG’s suggested changes for KiwiSaver. Given the well documented imbalance of tax treatment between residential property and KiwiSaver funds this is particularly disappointing.

'Not healthy for a democracy for interest groups to wield such influence they can effectively exempt themselves from tax'

Finally, a note on the politics of the decision. I do not believe it is healthy for a democracy for interest groups, whether property owners, business owners or multinationals, to wield such influence that they can effectively exempt themselves from tax.

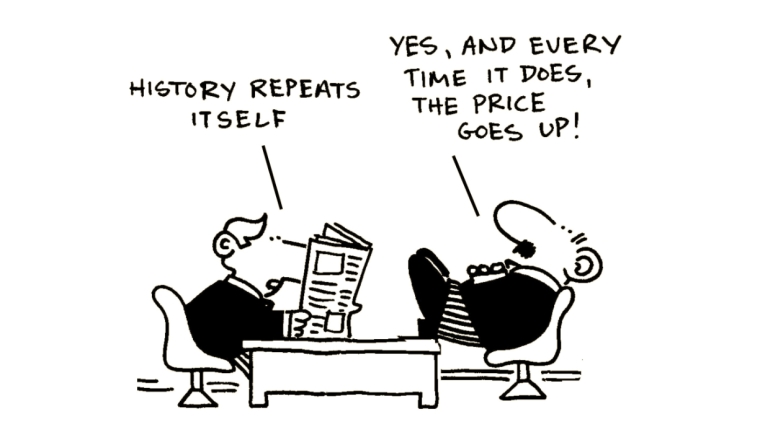

Over the past 50 years various working groups at regular intervals have reviewed the tax system, considered the merits or otherwise of a capital gains tax and then backed off. In between each review governments of both hues have steadily broadened the scope of taxation.

The Prime Minister may have said no this time, but the pressure for widening the scope of capital taxation still remains whether it’s from widening inequality or the continued tax-favoured status of property investment. We will therefore be relitigating the issue of capital taxation within 10 years.

*Terry Baucher is a tax consultant and director of Baucher Consulting Limited a specialist tax consultancy. He is the co-author with Deborah Russell MP of Tax and Fairness published in 2017 by Bridget Williams Books.

22 Comments

Re :

". I do not believe it is healthy for a democracy for interest groups.. to wield such influence... "

Would it be healthier for another interest group ( tax accountants ) to wield enough influence to be able to push through a new tax that benefits their profession more than anyone else ?

It is not all tax accountants. It is the The Big four accounting groups (you know, the same ones that run the tax evasions schemes, money laundering and gun running) who are the influential in the wrong way. These are also the same ones that the govt uses mostly when contracting out and the ones that make the most out of complicated tax systems (a cgt would have been a windfall for these guys)

The box standard mum and dad accountant genuinely want a simple and fair tax system. They want to focus on running the business, not worrying about tax affects in fine print. It's time cross party co-operation began on tax, but too many boof heads in parliament for that.

"Finally, a note on the politics of the decision. I do not believe it is healthy for a democracy for interest groups, whether property owners, business owners or multinationals, to wield such influence that they can effectively exempt themselves from tax. "

But that's what democracy is? It's hard to find anyone who votes for something or pushes for something other than to advantage themselves, look at how NZ First got elected particularly. Also, Terry wouldn't be complaining about if his viewpoint won out - that's democratic, but when the other side wins it's "influence."

This is why not everything should be governed by democracy and why democracy is not a panacea.

I think Terry is talking about big money influencing politics but that is not the case here. Its voter base that have influenced it (and political survival instinct), NZ first could well be sunk themselves if they didn't torpedo it. They are the big winners from this.

Same goes for the PM, she is at the height of her popularity but she won't risk her career on CGT. I think her political team were quite happy to drop it and rule it out to get her re-elected. If she really cared for it she could have made it a bottom line for the next coalition agreement but that would be a big risk and she cares more about self promotion than tax 'fairness' it seems.

One of the problems as I see it for Jacinda is that you can't keep bringing in the 'old guard'. John Key did exactly the same thing when appointing Dame Margaret to head ECan. It's the oft quoted Einstein point about us being unable to fix our problems with the same thinking that created them.

Jacinda needs to find innovative minds in her own generation. That will make the difference.

Thankfully no CGT .......... its an insidious form of resentment tax that is designed to lower us all to the level of the lowest common denominator , handicap and weaken us financially , and a massive disincentive to savings and investment .

You would not do anything to weaken or handicap the All Blacks or any successful Kiwi sporting team , so why do it to successful farmers and entrepreneurs ?

A justified resentment. My term deposit may not have the interest credited until maturity, yet is taxed regardless. An equity investment accumulates income which is cashed out on sale or used for gearing without cashing out, but is not taxed.

So how about we remove tax on interest income ...then maybe the savers wont be resentful?

Something needs to happen with our tax system, is remains an unfair system and is leading to more and more inequality.

Labor needs to win on it's own or will Nat step up and acknowledge we have a problem?

rastus. The preferential tax treatment of equity investment creates a sensible incentive that encourages business development. It's why proposals for higher taxes on selected non productive investment such as vacant land , have merit.

yes to a vacant land tax. But preferably, say yes to a deemed rate of return (as used by the AUS welfare system). This would bring speculative land etc down to a value where the deemed return is acceptable to the price paid. Much better than cgt tax, as (for one thing) no sale is required to achieve tax revenues.

As much as income tax is an insidious form of resentment tax from speculators who aren't skilled enough to earn a high salary, sure it is.

As John Key himself put it, if a person earns $100k of income from a salary they pay tax on it, and it's fair that a person earning $100k of income from selling a house pays tax on it just the same.

To pretend it's about something else is just being a silly-billy. John Key with his $50+ million doesn't envy your portfolio.

If the $100k earnt on the house is inflation, then taxing that is theft. The owner has garnered no real income from it, unlike the salaried person.

We need to sort out building material costs, and legal compliance costs. If the US can have cheap housing everywhere outside of NY/SF, so can we. It comes down to unnecessary costs place on the property market by local and central government.

Remember that people who will beeffected with the introduction of CGT are the people making the choice. Vested Interest. Am sure many Labour supporters will feel let down

90% of those surveyed were opposed to CGT applying to KiwiSaver. There are probably one or two labour supporters included in the sample. A consistent theme in polls was that CGT is a good idea except when it is applied to my capital.

Not talking about CGT as a whole but for speculators - though have BLT but is BLT effective.

I believe that a CGT applied to all assets ( including the family home ) to prevent market distortions at 3.5% would be acceptable. If the revenue from this was sensibly used to reduce tax rates and help build infrastructure everyone would win. Presented by the twg at 33% with no inflation allowance, lifestyle blocks over 4000sq m excluded along with a working from home or Airbnb situation it was totally unbelievable to me Cullen had the cheek to deliver such rubbish. The people have spoken, people are not that stupid !

Nobody is asking what, exactly, a tax on 'capital gain' represents?

If a house is sold for more digits that it did previously, it's still the same house, same street, same planet. No real gain in either energy or resources was had - indeed, the house is older and the planet more depleted.

So what is it the Govt were expecting to 'spend'? They could have created the digits themselves, and the change to the physical world would have altered not at all. So both parties, the taxed and the taxers, are fooling themselves.

The principle you are laying down applies across all forms of earned or unearned income. All forms of productive, or non productive work. Functionally there is no difference between money created from nothing.

Could we please have a grammarian explain the difference between affect and effect

The issue is, was, and always will be workability of proposals. There are endless issues in fair implementation, which Terry blithely ignores. CGT proposals are full of implementation issues and unintended consequences, but pollution and green house gas taxation is completely untenable. And cgt impact modelling looked tolerable until you look at the consequences of even moderate inflation. Essentially we were setting up for capital flight when we need to increase investment.

Wow, disillusioned with Miss A. I voted for her to make the hard decisions, not to do things that made re-election easier. She now looks to me like JK who campaigned on house prices in 2007 then did nothing on that (or anything else) for the next 3 terms.

“ I do not believe it is healthy for a democracy for interest groups, whether property owners, business owners or multinationals, to wield such influence that they can effectively exempt themselves from tax.”

I agree with Mr. Baucher and would add MPs to that list. The vast majority of MPs own multiple properties and are not unbiased in their vote on this issue. Those MPs have effectively exempted themselves from tax on their own properties by blocking the introduction of a capital gains tax in NZ. From the NZ Herald on 27/2/2019, "The 2018 Register of Pecuniary Interests, which lists all properties MPS have declared an interest in, shows three-quarters of National MPs have an interest in two or more properties. Among Labour MPs, the figure is two-thirds. Among the smaller parties, two-thirds of New Zealand First MPs have an interest in two or more properties but only one Green MP does. Act leader David Seymour owns no property." (https://www.nzherald.co.nz/nz/news/article.cfm?c_id=1&objectid=12207144)

"Not healthy for a democracy for interest groups to wield such influence they can effectively exempt themselves from tax"

I am neither a property owner nor a business owner, but a mid-twenties profressional. I donated $100 to the campaign to fight the capital gains tax. The conception held by Terry and too many on this website is that only greedy land owners would oppose the CGT. No. I oppose it on principle, and many other small donors did the same. You didn't get your way. Don't throw your toys out of the cot.

If you want to make the tax system fairer, start with lowering taxes on labour.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.