By Bernard Hickey

This week's near 10% slump on global stock markets is all about fear the world's largest economies, the United States and the Eurozone, are about to slide back into recession.

Some of the more excited commentators are even saying this 'triple-dip' recession will turn into another Great Depression. I'm not so sure about that. I think we're headed for something that some people are calling 'The Great Repression'.

Here's how it works. Governments in America, Europe and Japan are heavily indebted, as are many households. The pressure of all this debt is weighing on spending in these economies. Many governments and households are trying to dig themselves out from under this debt.

There are three ways to do it.

The first way is to simply stop spending and repay the debt as quickly as possibly. Many households are doing this anyway and some governments are being forced to do that by taxpayers worried about how these high debts will be repaid in the future by their children. In those markets such as Portugal, Italy, Greece, Spain and Italy where governments aren't trusted or don't control their central banks, they are being forced to do it by markets.

But there is a problem with quickly repaying debt. It makes sense when it's just one household doing it, but when most households slash spending and governments both cut spending and increase taxes at the same time it can create a type of negative feedback loop. Some people refer to this 'paradox of thrift' phenomenon as a debt spiral. Households and governments reduce spending, which reduces jobs, which reduces incomes and taxes, which in turn increase the burden of the debt as a percentage of income because incomes have fallen.

The second way is for the debt to be restructured and for investors and bank shareholders to take losses in 'haircuts'. That largely hasn't happened as banks and their shareholders have been bailed out by governments and taxpayers because of the fear that financial collapses like Lehman Brothers would cause a Depression.

There is a third way for any country to dig itself out from under debt. It can inflate its way out while suppressing interest rates.

It's clear now that this what America and Europe are doing. They are turning Japanese. The Japanese government and its central bank have been holding interest rates down since the early 1990s to try to keep Japan from sliding into a depression. The Bank of Japan has set short term rates at nearly 0% for almost 20 years, while the state-owned Post Office and pension funds have been forced to buy government bonds with the savings from an ageing population, keeping long term rates low too.

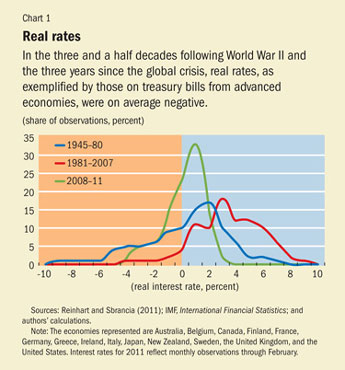

Acclaimed US economist Carmen Reinhart has written extensively about this strategy of 'financial repression'. She says this tactic was used in the 1940s to help keep interest rates low while inflation was allowed to rise above those interest rates. This reduced the real value of the debt and allowed the US government to dig itself out from under its debt load from the Depression and World War Two. Savers were encouraged or forced to buy low interest rate war bonds. Term deposit rates were regulated at low levels.

Fast forward 60 years and the world finds itself in a very similar position.

Fast forward 60 years and the world finds itself in a very similar position.

The US Federal Reserve has held its cash rate at nearly 0% for nearly three years. It has also printed more than US$1.45 trillion to buy US Treasury bonds and mortgage bonds, both of which have repressed long term interest rates.

Meanwhile inflation has crept up well above interest rates in both America and in New Zealand.

It's clear now that governments and central banks around the world are comfortable with a moderate inflation and don't want to (or can't) put up interest rates because they fear turning long term recession into depression. It does mean interest rates stay lower for longer and stay below inflation. This makes floating mortgage rates more attractive than fixed rates.

These low rates will help avoid a disorderly collapse, but it does mean savers are being punished for the past sins of borrowers and the developed world faces a grinding, Japanese-style recovery.

Welcome to The Great Repression.

87 Comments

But then we savers say "get stuffed" and we stop adding to our savings and we divert our capital away from investing in anything the thieving govt can manipulate. On top of which a whole generation grows up learning the foolishness of saving. Try telling kids they should put their pennies away for a rainy day...harrrrrrrrrrhahahahahaaaa.

Wolly, without borrowers, savers would earn nothing, so maybe if a few more savers got out there and took a few risks and tried to make some real money, then the economy would be more productive!

I remember listening to an analyst 20 years ago who reckoned that with all the savings building up in the global econnomy (pension funds, sovereign wealth funds etc) that returns on cash investments would dwindle as the world was flooded with those seeking low risk returns. I guess that's sort of true, except China has all the cash and the rest of the world is flooded with debt!!

Chris_J: Borrowers, debtors, and debtor governments have had it that way for 60 years. And now you want more? Really? When will it be the turn of the savers and lenders. Answer that.

If only we suffered a Japanese style lost decade. From what I've read, the economic disaster experienced by Japan has largely been a myth.

"Certainly anyone who visits Japan these days is struck by the obvious affluence even among average citizens. The cars on the roads, for instance, are generally much larger and better equipped than in the 1980s (indeed state of the art navigation devices, for instance, are more or less standard on many models). Overseas vacation travel has more than doubled since the 1980s. The Japanese boast the world's most advanced cell phones, and the biggest and best high-definition television screens. Japan's already long life expectancy has increased by nearly two years. Its Internet connections are some of the world's fastest -- something like ten times faster on average than American speeds."

http://www.theatlantic.com/international/archive/2011/02/the-myth-of-japans-lost-decades/71741/

Why the disconnect between the reality and the famous "Lost Decade" designation, subsequent to the crash of the Bubble Economy in the late 1980s?

"If we believe the evidence of our eyes, we necessarily must look again at those economic growth figures. Preposterous though it may seem to an unacclimatized Western observer, it appears that Japanese officials have been deliberately understating the nation's growth."

When you consider the protectionist rhetoric coming that some in the U.S. policy community made against Japan, the above makes a great deal of sense.

"Trade protectionism is flaring up again in the US Congress. In the 1980s, a litany of sanctions bills targeting Japan were introduced to Capitol Hill, including the so-called Gephardt clause sponsored by Democrat Richard Gephardt, which called for a 20% surcharge on Japanese products imported into the US. The so-called Gephardt clause led to the enactment in 1988 of "Super 301" clause, the much-toughened version of 301 Section of the Trade Act of 1974."

Japanese life expectancy will go down now, thanks to Fukushima!

Why ?

Fukushima continues to leak high levels of radiation -- see http://www.fairewinds.com/updates

So will ours when we import their highly radioactive second hand cars.

thieving govt can change the rule's when ever they like, and well do so, to manipulate any and all situation's. how do you think we have ended up at this stage.

We could blame the indi'scriminate u'se of apo'strophe's'....

I see Italy gets mentioned twice in the list of untrusted governments! Hahaha very funny Bernard, but watch your back and steer clear of men in sharp suits.

Japan has had a lot of deflation, which actually punishes borrowers and rewards savers. Most people are better off with deflation. Things get cheaper. But Japan has a culture and a constitution of putting the needs of others before yourself. We have more of a greed based culture and would be lucky to see deflation here.

Interest rates will be flatlining or decreasing for a while yet. Any increase of OCR will instantly kill any 'recovery'.

Looking into current developments on many fronts – the world will never recover again, simply because among the powerful in societies ethic and moral requirements and standards don’t prevail.

Walter , those places in the world with an entrepreneural spirit will thrive again . Those places with intelligent , hard working people , and with politicians of commonsense ..... they will recover , and go on to new levels of technological , medical , and educational prowess ............

.... despite that , you'll choose to continue living in Kaikoura ?

Bernard is only repeating what Olly Newland warned about many months ago. Both only differ as to the extent of the inflationary pressures.

Either way the answer is the same.

Investors in hard assets will be rewarded, while the whingers and whiners will be punished as they pay more and more rent for smaller and smaller boxes.

"Hyper Inflation Anyone?

Olly Newland April 2011

Hyper inflation could be just around the corner- as I suggested in a previous column of mine.

Money will be used to light fires if this comes to pass. Only hard assets will be worth something and as the article states property and commodities will be the main beneficiaries.

Income producing property, gold, antiques and art will be in great demand. Should inflation come are you prepared?? Have you got some income producing property? If not why not?"

Read the rest here:

http://www.ollynewland.co.nz/hyper-inflation-anyone/617/#more-617

Actually, No, Big Daddy. Financial Repression limits the amount of disposable income increases ( if any at all!), and any that occur are eaten up by the price rises of consumerables - food, energy etc. That leaves those in debt and credit ,alike, with less to spend on other items ie; assets. As the need to 'eat' and 'drive' becomes paramount, assets are sold down to meet the bills. Lower asset price of all kinds to come, sir. "Inflation in all you need; deflation in all you own" ( NB: Property is the BIG loser in the asset sell-down stakes. It has discressionary traits. A cheaper alternative is always available. It's just a matter of where, and at what price. The Japanese example Bernard aludes to, has demonstrated that well. That's why their property market has fallen continuously for 20 years, and theirs, and ours, is likely to continue to do so.)

Agree. I found a chart that listed the eventual spending percentages for the average German family during the Weimar hyperinflation. It was something to the effect of over 90% for food and fuel (including heating fuel), and less than 5% for rent. While real estate might "keep up" with inflation, it will fare poorly compared to more portable or immediately necessary "assets" like food. If you want a return on investment, it may very well be the best investment to stockpile food, while it is still relatively cheap. If banks "succeed" with their "QE to infinity" it virtually guarantees that food will be much, much, more expensive.

The only "upside" of hyperinflation is the fast devaluation of the debt attached to any property. However, this is more than offset by your increase in personal living expenses. I recommend doing a google search for "Penniless Billionaires," a book with a some cogent vignettes, available for your perusal online.

Your rent might be $500 a week, but if hyperinflation comes, $500 might not buy you a loaf of bread. So you raise your rent to $1000 a week, and quickly your mortgage evaporates. Have you really won anything? A home is a shelter, a cave. It falls in priority if someone needs to eat. OLLY COMPLETELY MISSES THIS POINT!!!! FOLLOW HIS ADVICE AT YOUR PERIL!!!!

There are only TWO SCENARIOS that explain how the next several years play out. Either way, property is stuffed, relatively speaking:

1) Deflation- in a deflationary Depression (where money is more scarce and valuable), 2 families move-in together to save money, and move down a notch as far as neighborhoods go, but they survive together. Property in the upper-middle class neighborhoods suffers drastically, as "nice" homes go abandoned for cheaper rents in lower-cost neighborhoods. Supply and demand says property values crash. Investors lose.

2) Inflationary Depression, resulting in eventual hyperinflation- this is the worse scenario of the two. It seems that Olly calls real estate "protection" from this eventually, which makes Olly a damn fool for not having done his homework. Has he ever lived through a hyperinflation? If he had, he wouldn't be throwing around his huckster theories, and peppering them with 2 dollar words like "hyperinflation" because he is worse than a clown, a pure FOOL. He would have more respect for the devastation that becomes of people personally during such an event. Olly would show a greater sense of awe and respect for the significance of hyperinflation, of which he has ABSOLUTELY FCUKING NONE, ONVIOUSLY!!!! Has he even read the stories of those who have lived through hyperinflaton? He's not old enough to remember the last Depression, or lived through recent hyperinflations in places like Zimbabwe, Hungary, Argentina, etc. That makes him a CHILD in this regard, a BIGGER FOOL. And now he touts "hyperinflation" like an expert. WHAT A FOOL!!! Hyperinflation is the WORST outcome for ANY country's currency, as well as YOUR pocketbook!!! It destroys purchasing power, and throws all valuations into chaos, especially for those businesses trying to buy stock and supplies to sell, say, for example, groceries....knowing that the replacement cost of those canned goods you just sold at your New World store now cost more than what you just sold them for!!!!

WAKE UP!!!

Hat's off to Bernard for bringing Rogoff and Reinhart into the picture, a couple of people who have really done their homework, unlike ass-clowns like Olly. I say let that monkey throw shite at the other monkey from Barfoot and Thompson, so we can all watch. No wait! They are throwing it at us, as a team! Buy into their logic at your own risk!!! They totally miss the much larger picture, and this is not a time to be making long-term decisions on short-term figures. It's like 2 blind people feeling an elephant and describing to you what an elephant is. I suggest a study of history, so you can be aware of what's coming, a prepare yourself accordingly. This is not a good a time for the world, and things are probably going to get a lot worse in coming years.

As Rogoff and Reinhart say, this is "the Great Contraction." I agree, and it will only show up in 2 ways, listed above. BOTH are bad for real estate. A better investment is precious metals, food, and firewood, using history as a guide. I WANT TO BE WRONG ON THIS.

I invite any cogent argument that is NOT a stupid, simple-minded jab by someone with room-temperature IQ. Seems a bit hard to find these days.

Hmmm.....Olly New..... some people lost their shirt

following such people in the 1987 market crash.

Hyper-inflation, no....fraid not....

Yes Im prepared, for deflation/stagnation....those gambling PIs like yourself will I suppose be on welfare.....maybe sweeping the streets.....

regards

Gummie's Theorem of the Day ( for what it's worth ) , is that we need to dis-band the Euro , and go back to individual country's currencies being freely floating ....... a tadge more ability for each nation to pursue policies to suit a necessary path ( i.e. a greasey slippery devaluing one for Greece , ........ )

...... and that will force up the German currency , keeping them more honest than the Euro , which aides them in a mercantilist approach to enrich themselves , at the expense of the rest of Europe .

Lest we forget China , of course , they need to be forced to either fully float the renimbi , or to be excluded from world trade . The track that their and the German goverments are pursuing is shoring up a mass of saving for themselves , leaving other nations with a pile of debts .

.......... or we could just sit under the old coconut palm , gazing forlornly at the azure blue ocean , and contemplate what might have been if politicians and central bankers had spines instead of jelly-backs , and brains instead of heads full of gummy bears ............

GBH's favourite bank? a GS comment,

"Our inflation forecasts have not changed much, but our conviction has increased that the large—and now growing—output gap will result in significant renewed disinflation. Nominal wages are growing at a 2% rate, unit labor costs are roughly flat, and the temporary inflation impulse from higher commodity prices and the supply chain disruptions in the auto sector is waning. We expect the year-on-year rate of core inflation to fall from a peak of around 2% in late 2011 to 1¼% in late 2012."

I will repeat it, DISINFLATION, with core inflation well below 3%. So jsut why with the US in at beats the doldumrs do some see hyper-inflation?

regards

That about sums it up GBH.

The bills just keep coming.

I doubt if there is much time/ options for repression – the depression scenario will probably catch up under the current worldwide fast accumulating and accelerating of events - forcing governments in trying to maintain the value of money. The bills just keep coming. Anyway a hopeless situation.

Looking into current developments on many fronts – the world will never recover again, simply because among the powerful in societies ethic and moral requirements and standards don’t prevail.

Well if you want to know what deflation does to stock markets, check out what has happened to the Nikkei index in Japan. At it's peak in 1990, it stood just shy of 40,000. Today it's just shy of 10,000. Not withstanding the odd cycle of incresing share values during this time it has been in steady decline (particularly 1990-1994) for 20 years.

Check this table and grah out here.

Spot on, Dabid B. Oh, and their property market..of course ( massively down from their '89 highs and 60% quite common)! And in case people still think that property is an asset that will' hold its own'; check out the other 'financial repression' early-starter candidates...at about 0%...The States; The UK...and what happened, and is happening, to their property markets. And let's not forget; It hasn't been 'all bad' for Japan. Until only a few month ago, even after 20 years of deflation, they were still the No. 2 economy on the planet.

Excellent point Nicholas. And what I should have added is that Bernard and the Labour Party's brilliant solution to our economic woes and future challenges is a CGT. To be brought in during a deflationary market that could quite possibly last for decades.

So Bernard and the Labour Party will borrow to bring that tax in, and then borrow a whole lot more when it fails to raise the revenue they expect it to, but they have committed themselves to spending that money on more and more welfare for their mates, and social values.

DB - actually, it's you who continue in cloud-cuckoo land.

The mass aren't going to understand what's happening to them - a combination of cranial rates of uptake, and spin from your kind.

They therefore have to be herded, behaviour-wise, and from that point of view, the CGT makes entire sense.

Neither your, nor their, approach has a snowball's chance in hell of propping up the house of cards, though.

Compared to the 500-plus young folk the other night - seriously contemplating the planet they'll inherit, including what kind of fiscal interchange might work - you sound like a dinosaur, just pre K-T.

good luck

pre K-T ....... ?... from before Kelly Tarlton , or pre Kel Tremain ??? .....

CGT, indeed....however therefore there should be no pain in introducing it, should there.

;]

Taxes will be going up to cover welfare etc etc...or we have to take on more debt...and clearly there is a limit to that amount of debt we will be alowed....so that swings back to raising tax....

regards

Hello DB : Some folk reckon that the chink in the Japanese psyche is their inability to admit failure , the " loss of face " factor . And as such , successive Japanese governments have propped up the giant insolvent banks , rather than accept the short term pain of nationalising them , and regurgitating them later , onto the market , as slimmed down enterprises with new management .

.... had they done so , they wouldn't have endured 2 decades of recession .

And what lesson did Timmy Geither & Helicopter Ben learn from this , to cure the USA's financial mess ...... not a helluva lot it seems ......

[ .... is the NZX top 50 index at a higher level now , than is was prior to the 1987 crash ? .... hint , the answer rhymes with " snow " ]

Hey, Gummy, good to see you back. Where have you been? All good with you I hope?

Cheers DB : It's the monsoon season , so I've been in my newly acquired swamp for 4 weeks , planting coconut palm seedlings ....... as any good Kiwi lad would do . Luckily no leeches , but a zillion cane toads around .

...... still holding the faith that the spirit of capitalism and entrepreneurship will triumph over the incompetentcies of banks , central bankers , politicians , and steven , who appear hell bent on destroying it .

The fall of societies.

Roger, as much as I like to see advantages of free markets, democratic processes, entrepreneurial spirits = drivers of economies to succeed, societies have been simply taken hostage by greed, corruption and other unethical behaviours by the powerful.

The fall of societies is only a matter of time and unfortunately cannot be avoided, but is leading into consequences of unprecedented scale.

I can place my phrase below 50% of the time on issues discussed on that blog or on any economic, political and financial subjects.

Looking into current developments on many fronts – the world will never recover again, simply because among the powerful in societies ethic and moral requirements and standards don’t prevail.

aaaaahhhhhh.... bufotoxins

Wouldn't dream of chewing or cooking one of the slimey little critters ..... for one thing , the locals are very superstitious , and believe the toads to be the re-incarnation of their long dead ancestors ( must've been more than a few real estate agents and used car salemen in the family ! ) ........

...... Ingerophrynus philippinicus ( Family : Bufonidae manilowdicus ) .

Roger, KW – your response doesn’t contribute to a valuable debate – but I understand the situation isn’t easy to comprehend, especially for people, who so far aren’t affected. Have a nice tomorrow - casu venit societas.

I only understand , Walter , that those good folk who dare to dream , and to take risks ..... may succeed , and find amazing fun & wealth for themselves ........

..... but those who cling to their government welfare " entitlements " , ... they'll waste their lives on whinging about their " rights " , and slagging off at the noveau riche .......

Gummy divides people up into their reaction upon staring at the night sky ...... some of us see great wonder , and can imagine awesome abundance , and incredible new worlds ......... and some guys just notice that the roof needs painting ......

..... you're a dab hand with a brush , so I've heard , Kunzie !

Roger - why does a person, with a positive attitude to life, who is 40 years successful with a business, has a good life- style, never made far reaching negative experience - changes he’s view towards massive, multiplied world problems and a negative outlook for societies ? Think about !!!

..and yes Kaikoura has fantastic night's sky and the roof doesn't need painting.

Umm , have we shifted tack , and you're talking about Wolly , now ?

Roger – I know a number of people having experienced success in life and business, talking along the same line like Wolly, me and some others. Only facing today’s grim reality, talking about new ideas, adapting to the situation lead to solutions. Making things better then they are ( see bank economists), can put one in a bad business/ life position.

Fair point GBH. Dreamers and Strivers are valuable. Its just a pity so many very good minds are wasting away in the financial sector.

I like your style :) And good to have you back - with Christov also absent for a while, the place was getting a little depressing.

Dr. Gummy had better prescribe a full course of Anti-Hickeystamines for you , m'dear .

.......... At interest.co.nz , the daily dose of gloomsterisationalysing can be a tadge palling , without guys 'like Christov , Wolly & steven to give one a fullsome belly-laugh .

Bless the good folks of Oxford : For they need all the laughs that they can get ! ....... [ but they do have the best butchers shop in all of Canterbury , to their credit ! ]

C'mon, there aren't that many unhappy people in Oxford I bet! There are many worse places to live I reckon - for my part I spent most of the day planting fruit trees and blueberry bushes while looking at the beautiful mountain views on a perfect, sunny day. That's definitely no reason to cry (except now I'm gonna have to work late tonight but on the positive side, all that digging might bring on labour!).

With all due respect , Elley , all your digging will not bring on labour , absolutely nothing will , now .......... Goff , Klinger & Cunny are totally buggered , nothing will bring on Labour .

You're hilarious, so glad you're back (I almost got worried you'd decided to leave us for good)!

Thanks (or Sorry) Walter.

I tend to your view of the world... you know this. The idea of unregulated capitalism is nonsensical to me. Truth is I don't have much to suggest... Slot the occasional link in, and try and make sense of it all. Roger puts an interesting view point to me, in that I consider him to be a liberal first and foremost - (which I understand to mean that one should be free to do whatever one likes.... as long as it doesn't cause harm), yet is probably considered 'right wing'. I think I'm probably left leaning - but what fascinates me is how these positions seem to join up and become irrelevant... if only people would stop shouting at one another...

"Tekapo'ed" was also a great concept of his - one I have affinity with...

A link I did offer that you might enjoy... The Political Compass.... still got my score somewhere....

... the problem is that the regulators are only human ....... and as such , prone to manipulation by vested interests ( lobbyists in Washington USA have succeeded in accumulating $US 1000 billion in annual tax exemptions ! ) ......

Glass Seagull was excellent banking regulation , until some crack-pots got into Bill Clinton's ear ( Monica Lewinsky had her tongue in the other one ) , and he decided to undo it , and her bra strap ...... those crackpots , ummm , Jamie Dimon & JPMorgan spring to mind .....

..... but you're right , KW John , un-fetid capitalism stinks , there has to be some sensible rules to play by ......

yeah gumbo i've always been fascinated by the way that pollies can be bought off so cheaply compared to what is gained from their assistance. i thought capitalists knew how to value things? does all this disprove capitalism, or prove that mp's know nothing about business?

The lobbyists' success in Washington demonstrates that the sharper minds gravitate towards the private sector , and that the dullards head into public " service " ......

Barney Frank ( USA ) is proof positive that most politicians could not even run a bath !

...... would anyone in a Kiwi business have forked out as much to re-claim Kiwi-Rail , as Michael Cullen did , for this " premium asset " , as he called it , ....... ha de ha haaaaaaa . What a boof-head ! ... Paul Little ( ex CEO of Toll Holdings ) must still be regaling his cobbers in the pub , with anecdotes of the day that Sir Michael came a knocking , with a brief-case $NZ 600 million thick .......

Welcome back....

Free markets are also prone to manipulation of vested interests, we have seen that for decades.....regulators can do a decent job where there is the political will to do so...but right now its probably too late to do much but hang on....

regards

Gee, I just wish I was on a salary commensurate with the....uh....lofty group of ppl you have put me in the same sentence with.

Again wrong, I dont wish to see Capitalism destroyed, merely its excesses curtailed...and moved to a cost our planet can meet.

regards

Yes but also in a structured society..their is also a hidden elite, they look after each other and as they have their children they are also looked after..They require a high standard of living as their numbers expotentilay increase..This standard of living generaly comes from the poorer less organised classes.Untill the inevetable finally happens.If resources are squeezed..

What a complete load of twaddle!!

Europe 'living in fantasy' over crisis

http://news.bbc.co.uk/today/hi/today/newsid_9550000/9550990.stm

http://www.tullettprebon.com/Documents/strategyinsights/Tim_Morgan_Report_007.pdf

http://www.postcarbon.org/article/435259-managing-contraction-redefining-progress-end-of

Only a crisis—actual or perceived—produces real change. When the crisis occurs, the actions that are taken depend upon the ideas that are lying around. That, I believe, is our basic function: to develop alternatives to existing policies, to keep them alive and available until the politically impossible becomes politically inevitable.

Friedman

"So far, we are on course for full-force collision. The fundamental problems with our monetary and financial systems have not been addressed, but only papered over".

Heinberg.

Yep, Black August first though......eventually we will do a WW2 size (global) project to get alternatives going...however I think its looking like we are going to have a rout in the markets and a Depression....maybe the WW2 sized project will be what gets us out (a bit)...

regards

But at least the All Blacks won...

won what? is the world cup over already?

:D

regards

Yes Steven all done and dusted....we won...everybody had a good time and went home...!

You must have been bogged down on the pooter and missed our Glorious March where we triumphed over a little fancied English side...we beat them up and scored more points too..!

You really need to get out more,.. my bruva of a another muva............{ : > )

Na, rugby isnt my game, kayaking, tramping, biking, 4wding, camping.... yes....

:D

regards

But none of those involve any ball skills....come on mate ...modesty doesn't become you, ...I'll just bet your a dab hand at tossing the balls around .

I love the Kayaking and the fishing from it....but that whole tramping thing is a bit on the creepy side....I suppose the camping could be too..

I just peeped on another thread there Steven where you were announcing your heritage..?

Was that a good idea...?

what difference should it make?

Ive travelled the world a lot....been right around it on a slow ship a few times and other places, it gives you an appreciation on how lucky we are when you have seen how the developing word lives up close....Brixton.....lol.......now im snug....

;]

regards

Did you see any polar bears on those voyages Steven ?

or any Russian bears ?

O.K.

to avoid offence is it true that London police now refer to certain rubgy players as the All Coloureds

" Christmas Trees " have been re-named as " Seasonal Festive Ornaments " , to avoid offending non-Christians in Great Britain ( i.e. the Muslims ) .......

...... ahhh , dear England , .. ..so much back , so little spine !

The RWC begins only in 32 days and we already have some heavy scrums here - exciting.

I believe that Kaikoura is hosting the battle of the giants , Equatorial Guinea vs Andorra .......

...... you'll be going along to that , Walter ?

You are correct Roger the battle of the giants – I bought a ticket for the wrestling match NZElly vs AUMartha - heavy weight 90kg plus. Memorial Hall 15th of September 8pm - hurry almost sold out.

Walter...you have obviously never looked at Elleys profile pics...!

She's mega-hot ! ......... little wonder that hubby has her knocked up all the time , due to drop her bundle any moment now ..... A little kiwi-froggy tadpole . .. aaaahhhhhhhh !

Hmmmm. I do like that cute frog picture. FYI, hubby is getting sent off to the clinic very shortly. Poor man, I told him it was either that or 20 years of abstinence ;)

The unkindest cut of all ....... snip , snip .... and a man is spending the next month walking alround like a cowboy who has just peed his pants .......

Just got here for a quick read...good to see you hit the ground running there GBH...a lot o fun to be had as I peered my way down the thread...but you got it covered...

Don't drink from your helmut...n check your shorts for cane toads before bed....their burrowers ya know...nothing worse than a frog in your scrot.............mmmm.

Tell that to the AB's , if they play France in the RWC .......... nuttin' worse than a frog in yer scrot ! ...... c'mon team , play with the official balls ......

A digitally connected younger generation who have been utterly screwed by an older generation of gready speculators, bankers and ecconocrats who continue untouched to receive obscene incomes and bonuses. Sounds like a recipe for blood on the streets. The decent hard working and saving members of the other generations may well join in.

Gold not looking so risky, anymore.

Curiously, Wolly, Gummy Bear and Steven have all been enrolled on this site for the same length of time.

you forgot me....

My apologies ....

Sorry for the interuption Andrew R...carry on with that hypothesis...

AndrewR - so have I. We're all one person, it just depends on the lithium dose. (we made the mistake of employing our nurse on other criteria).

BH,

Option 1 & 2 are out of the question.

I'm not seeing the downside of Option 3, frankly.

If you don't like the low risk corporate welfare type investments in fiat government bonds, then invest in riskier, wealth-creating endeavours!

Isn't that what you're always going on about anyway - diverting investment money into productive businesses?

As for inflation - Japan has had ZERO effective inflation since the mid-90s.

They are still the No.2 economy in the world and they have one of the highest living standards in the world.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.