Workers on median incomes are making real gains in their pay, but the income levels are rather low and the pace of these gains is slowing.

The basis of our KiwiSaver analysis, and our housing affordability analysis, starts with income levels. We have been tracking this data for a long time now.

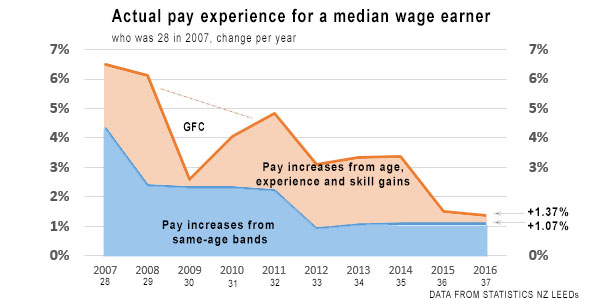

Most political conversations about wage increases just deal with pay increases at the most broad level, overall for all workers. The latest QES release from Statistics NZ showed that full time earnings rose +1.7% in the year to June. This is a mish-mash of everyone.

But individually, we know that your pay rises as you age and gain more experience. Workers change jobs for higher pay. They seek new skills and experience and get [some] compensation benefits for these new attributes.

And after your late 30s, pay rises start slowing; your skills are close to their maximum and your desire and ability to change jobs decreases. But sometimes mobility is forced on you, and that may actually mean you go backwards somewhat in the pay stakes, especially if your skills are no longer as up-to-date as what employers want or need.

In addition, you may seek fewer working hours as you age; at least, you are not as keen on overtime. In some cases you may switch jobs from one with a heavy manual basis to one less physically demanding. These are common changes. And your income may reflect these changes.

The IRD collects pay details when employers pay their DED (PAYE) transfers. This data, by age, by gender, by region, is anonomised and published by Statistics NZ in the LEEDs series (Linked Employer Employee Data series). It does not cover everyone (not everyone is an employee), but it is a huge sample, probably exceeding 80% of the workforce. As such, it is a much more comprehensive set of data than the Quarterly Employment Survey (QES).

From this we can track median incomes, over time.

And we can see the impact of pay as workers age - what benefits they get from upskilling, what they lose as their skills atrophy and change to more sedentary roles.

In addition, we can see a compound impact of the business cycle - in this case, how the GFC may have affected income growth.

And as we are taking about a decade view, we can deduct CPI inflation to get a sense of the 'real' change - is inflation eating pay gains or are actual gains still being made?

This is what the data shows:

| Year | Age | Median, pa | change | change | change for same age |

change due to age rise |

| (nominal) | (nominal) | (real) | (nominal) | (nominal) | ||

| # | $ | % | % | % | % | |

| 2007 | 28 | 42,276 | +6.5 | +4.4 | +4.3 | +2.2 |

| 2008 | 29 | 44,862 | +6.1 | +2.0 | +2.4 | +3.7 |

| 2009 | 30 | 46,020 | +2.6 | +0.7 | +2.3 | +0.3 |

| 2010 | 31 | 47,876 | +4.0 | +2.3 | +2.3 | +1.7 |

| 2011 | 32 | 50,190 | +4.8 | -0.4 | +2.2 | +2.6 |

| 2012 | 33 | 51,742 | +3.1 | +2.1 | +0.9 | +2.2 |

| 2013 | 34 | 53,462 | +3.3 | +2.6 | +1.1 | +2.3 |

| 2014 | 35 | 55,264 | +3.4 | +1.7 | +1.1 | +2.3 |

| 2015 | 36 | 56,085 | +1.5 | +1.0 | +1.1 | +0.4 |

| 2016 | 37 | 56,856 | +1.4 | +1.0 | +1.1 | +0.3 |

| Change over 10 yrs | +17,165 | +43.2 | +18.9 | +23.8 | +19.4 | |

| Change over last 5 yrs | +6,667 | +13.3 | +8.8 | +7.1 | +6.2 | |

| SOURCES: Median pay from Stats NZ LEEDs, CPI deflator from RBNZ Inflation calculator | ||||||

Note: this perspective does not separate pay by gender. Male medians are higher than female medians, especially as age rises.

My colleague Craig Simpson will look at the implications of this data from a KiwiSaver, retirement savings point of view in a separate article.

But the figures above show a number of trends.

Firstly, median pay levels are not high. At these levels (about $27.30/hour) it is very hard to save meaningful amounts.

Secondly, while inflation has fallen, 'real' income growth has fallen too to a modest +1% pa. True, it's not going backwards as median earners in many other developed counties have experienced, but to be fair, they started at higher rates of pay.

Thirdly, the GFC has had a very noticeable impact on wage growth. But it did not have any noticeable impact on pay gains due to rising age, experience and skill levels.

But when our benchmark worker passed into their late 30s, those skill and experience gains all but evaporated, leaving them with just the modest annual increases for their age band.

This data is for a median person. Remember, half the employees in this huge sample will have done better, half half will have done worse.

The other thing to remember is that this data is 'before tax' and before family tax credits (WfF).

Income tax rates can have an important role to pay in determining take-home pay.

In 2007, the median income earner would have had a marginal tax rate of 33c in the dollar and be in the 10% of taxpayers who paid 12% of all individual income tax. This median earner took home 79.1% of their gross pay in their hand (ie $33,455 in 2007 dollars).

In 2016, the median income earner would has a marginal tax rate of 30c in the dollar and is in the 7% of taxpayers who pay 8% of the individual income tax. Today, a median earner takes home 82.3% of their gross pay in their hand (ie $46,779 in 2016 dollars).

So lower income tax rates have added +3.2% to take-home pay over the ten years of this review. In 2016, that equates to $1,819 dollars.

Of course, the 'bargain' for some of these tax cuts was a rise in the GST from 12.5% to 15% which happened in mid 2010. Assuming all income is now spent on purchases that incur GST (which is probably unlikely but is the most aggressive assumption), that means that today's median earner is paying $1,421 more in GST than in 2007. The 'bargain' has been maintained with the income tax benefit ($1,819) being more than the maximum extra GST cost ($1,421). However, the net benefit of just under $400 per year is unlikely to be much assistance in saving for a house deposit or bulking up a retirement plan. The bottom line is that income-tax cuts and GST rate increases don't really change the picture we see when we just review the data at 'gross income' levels.

23 Comments

Can we see a graph with these stats vs median house price inflation, maybe by region if possible?

Just want to see the huge void opening up between them.

Now here's the thing , you cant draw too many conclusions form datasets that are averaged , and don't tell the wider story .

I am heading towards 60 , and have children in their early 20's one of whom has a gross salary in higher than I earn ( due to skillsets now in demand in IT ). The other is in the construction industry and earns about the same as a young doctor

They are actually earning a lot , but are always broke

Quite honestly , these youngsters DO have the capacity for high earnings , but their spending patterns are completely different to ours at that age , online shopping for things they don't need , lattes at $5 a pop , credit cards used for endless dinners out and travel to exotic places, and all manner of wasteful and useless expenditure ( in my view )

Its little wonder they cant afford home-ownership

And if they are " broke " now , just wait and see what happens when they settle down and start a family , and have to turn every cent before spending it

So the datasets actually hides a lot when we look at averages .

OK, you say that it's challenging to draw conclusions from aggregated data sets; yet you want to make wide-sweeping generalizations about age groups based on your subjective impressions of their spending habits (without any data whatsoever).

Don't you think you're contradicting yourself?

Geez Boatman - haven't we had this conversation before???

So you want ignore median or average datasets but accept a single "case study of one anecdote" as gospel...c'mon...

No wonder the younger generations despise us .....there is no doubt, its unequivocal, and irrespective of modern consumerism and purchasing habits of phones and laptops its harder now - exponentially - do we need to shout it?

WE HAD IT FAR EASIER TO BUY A HOUSE OK?

Way less debt over our heads exposed to the vagaries of interest rate rises and less competition from global buyers (And boomers most likely did it on one income)

Since we are doing anecdotes - my facts.

Bought first house in 1997 in Forrest Hill Auckland - $198k - fixed price, almost no competition bidding the price up - total household income was around $100k.

Same house now - $900k plus (and it was a very basic spec build job)

Current incomes for the same jobs with same experience level- $120-130k tops.

So if 1997 me was now 2017 me I would have to service $700K MORE debt (350% increase in DEBT) with a household income increase of 30% TOPS for same period....

Yeah these youngies are all lazy and need to stop drinking coffees....

I'm 50 years old and sick of listening to this BS..............and your poor kids listening to this "we had it harder" crap....it's monty pythonesque.

You sound like someone living so far in the past and unable to accept that your offspring face a more complex and difficult scenario than you did

Was even easier back in the 70s you could start with a section 600+sqm put a Beazley or Keith Hay on it, a few years down the track, put up a garage, lawns and gardens were always a work in progress, not much in the way of landscape gardening for those.

You had the ability to capitalize your family benefit, education WAS free, you had State Advances loans.

You were kind of in a nappy valley situation, but most managed to move up the ladder. These, though are a great deal of the people keeping the doors shut for up and coming generations now. Show me one subdivision without onerous covenants on it now.

Spot on comment... median prices up 500k in last 10 years.....median wage up 17k in that same period .. seriously how can people sat it was easier in the past.

In the past nz property wasnt sold like it is now on the global market to the highest bidder. In the past a household could survive on one income....problem with the past is people actually forget....ok it wasnt easy however the young today have a much tougher journey

No amount of lattes is going to save them ....not when properties are rising 50,000 a year....

To save money I lived with flatmates. My wife hated it. One just about burned the f*** house down then a week later pissed on the floor. We kicked him out. These are the Irish guys coming over to do a bunch of shoddy building work. We drink budget tea bags, shop around for the cheapest utilities, wrestle with fat slobs at PakNSave and never buy iPads. Then the moment I have enough to buy a house I'm competing with all the lazy sods who can't save a penny but are running around with kiwisaver/subsidy/parents money.

You say the statistics are too generalised to be any good then go on to generalise based on your kids. Perhaps you need to look at the person who bought your kids up?

Yes all very fine but, where in all this do we get a picture of how once their disposable income was sufficient to save for a house, even in Auckland, whereas now house prices are rising far faster than people can save (particularly in Auckland and a few other centres). Real wage may well be just keeping slightly ahead of inflation, but inflation no where near reflects the increasing cost of housing, otherwise we would have never ended up in the situation of a house price to income ratio of over 10. In other words in terms of of the things that matter most, people are going backward significantly.

365 x $5 (daily latte)

$1100 (latest iphone model)

$100 x 52 (Friday night on the razz plus a shared Uber)

$5000 (winter holiday to Thailand)

1.3% of a median house value in Auckland.

All adds up I guess.

About $12k. Whilst not insignificant, and a complete waste of money in my view, there are plenty who don't piss money down the drain like that.

Not to mention that's over an entire year, pretty sure and Auckland house rises by 12k every few weeks for the last few years.

$13,125. Boatman - I know that probably sounds like a lot to you. You think back to when you were trying to buy your first house, and how much easier it would have been if someone had handed you an envelope with 13 grand in it. But unless you're actively trying to buy your first house today, you have no idea what the pace of price increases has done to "normal" savings logic. It has absolutely demolished it.

I spent 18 months trying to buy a house before succeeding about 4 months ago. In that time the median house price went from $660k to $821k. That's $161k. Literally before my eyes. The increase in the minimum deposit alone was $32k over this period.

The cliche "iPhone and flat whites" objection simply doesn't make sense in this environment. All you do is out yourself as somebody who bought a home in a very different time and is completely out of touch with today's reality.

And give your kids a break - they're already locked out of the housing market no matter what they do. Are you really going to give them grief for choosing to enjoy their youth instead?

(and before you ask - I succeeded in buying a house only because of a very generous inheritance. I probably have that in common with virtually all of my peers who have also bought houses in Auckland in recent years).

Well it would if that was what everyone was doing, all of the time.

Let me assess this through people I know who look to buy

Lattes maybe twice a month, if that, make own food

I phones - more like 2 year old Huaweis, some even hand-me-downs

Friday night out, maybe once a month, if there is good music on somewhere. Drinking? Not so much, certainly not getting trashed, home by midnight, age wise you get past that pretty quickly

Shared Uber - cheaper than getting done DIC

Holiday in Thailand - hey, dreams are actually free, you know

Thanks for doing the work DC, it's a great piece of info. New Zealand incomes are low at median $27. Not the 100K plus that many here skite about. Thats very few.

It's time the Nats stoped talking increasing GDP as the goal. I think they are scared of talking about increasing incomes - because it would show up their failure.

Who needs a bigger GDP, if their income does not budge.

Good analysis so to summarise

Median pay up 17k in 10 years

Median house prices up 500k+ in that same period....

500/17 = factor 29 to 1

Great comment Joe Public.

Why does analysis have to be so complicated? John Key, there is a tsunami coming in the form of voter unhappiness at how the Government is dealing with the housing issue. I say tsunami because JK can't see it or does not wish to see it but when election day arrives just like when the wave hits the beach -it will be too late to effect change!

Cheers mentorman I have to give David some credit for calculating the 10 year median wage increase of 17k, which is aproximately 1.7k a year against 50k a year house price appreciation.

Let repeat that

So over the last 10 years with John Key in power 8 of those years

Median Wages up 1.7k a year

Median house price up 50k per year roughly.... wow weeee !!!

"Why does analysis have to be so complicated?" If you can't dazzle them with science, then baffle them with BS

Boatman, John Key and I are in the same camp.

Young people have every chance to skip the lattes and phones, save and buy an apartment, pay the thing off, and then buy again. Boat mans point is that deferred gratification is becoming less common. The more people bang on about how hard it is, the less young people set strong goals. House prices are high, sure, but interest rates are incredibly low, and a lot of us baby boomers had a brood of theses young kids to look after on single incomes when interest rates were in the High teens, when we were only in our 20s ourselves, and a whole lot of essential like cars cost the same as they do now. Sorry, but that was a whole lot tougher.

Am born in the 90s and I agree.

Dave2 - Going by Greg's Big Mac index data the other day it was 75,000 b macs to buy median in Central Auckland in 1995 vs 185,000 macs today. Appears to be tougher to buy today. Got to forgo a lot of b macs before you can luxuriate in low interest rates.

You'd need to look at lifetime cost of the loan including interest as big macs.

You can worry about interest when you have got around to saving the extra 22,000 big macs for that initial 20% deposit. Of course back in 1995 real interest rates were ~9.5% so for every big mac you saved then you got an extra one as a bonus. At end of day big macs operate in the real world and housing is more of vested interest rort. Though I 'spose there is the odd vested interest out there now trying to restrict the supply of big macs.

http://www.tradingeconomics.com/new-zealand/real-interest-rate-percent-…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.