By Alex Tarrant

A new shadow monetary policy board set up by the New Zealand Institute of Economic Research (NZIER) believes the Official Cash Rate should remain on hold at its record low 2.5% this Thursday, and has placed more weight on the possibility of a rate cut than a rise if there were to be a change.

NZIER senior economist Kirdan Lees set up the board of nine people, made up of three economists, three business leaders and three academics to provide commentary prior to Official Cash Rate decisions by the Governor of the Reserve Bank.

The board is independent of the Reserve Bank.

"Monetary policy is rife with uncertainty. The state of the cycle is imprecise, how the economy evolves unsure, and the trade-offs across monetary policy objectives up for grabs," Lees said.

"This means a range of possible policy settings might be appropriate at any point in time," Lees said when releasing the board's first evaluation on Tuesday.

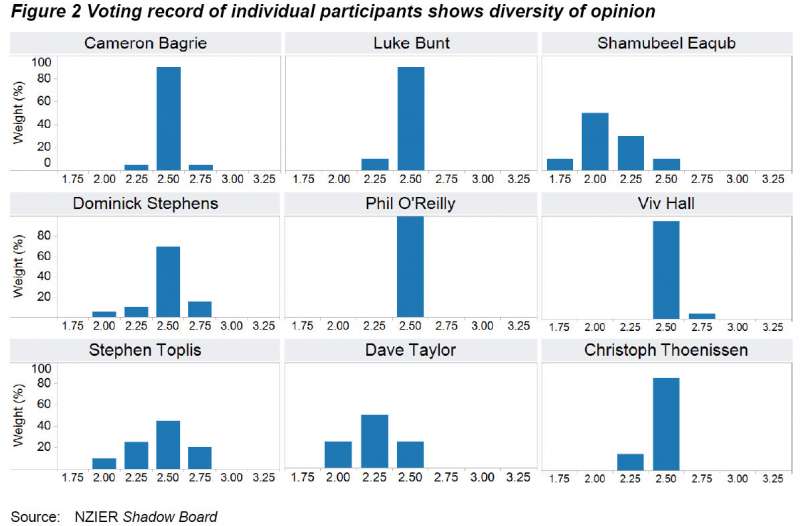

Ahead of the RBNZ's Thursday 8 March statement, Shadow Board participants were asked to give a percentage value for how much they prefered each possible interest rate setting.

These values were aggregated to form a collective Board view.

“The NZIER Shadow Board recommends the current interest rate of 2.50 percent as most appropriate. Participants also placed weight on lower rates being appropriate,” Lees said.

See the combined weightings of board members' views of the appropriate interest rate setting below:

The members of the board are:

Cameron Bagrie, Chief Economist, ANZ National Bank

Luke Bunt, Chief Financial Officer, The Warehouse

Shamubeel Eaqub, Principal Economist, NZIER

Dominick Stephens, Chief Economist, Westpac

Phil O’Reilly, Chief Executive, Business New Zealand

Dr. Viv Hall, Professor, Victoria University of Wellington

Stephen Toplis, Head of Research, Bank of New Zealand

Dave Taylor, Chief Executive, Steel & Tube

Dr. Christoph Thoenissen, Associate Professor, Victoria University of Wellington

See their individual weightings for March 8 below:

About the NZIER Shadow Board

Lees said the NZIER Shadow Board aimed to achieve three goals:

- to encourage informed debate on each interest rate decision

- to help inform how a board structure might operate relative to New Zealand’s current single decision-maker model, where the Governor is responsible for making each decision

- to explore individual board members using probabilities to express their uncertainty.

"The format closely mirrors the Australia Probabilistic interest rate setting project (PROPOL) run by the Centre for Applied Macroeconomic Analysis at the Australian National University," Lees said.

The Board does not meet but each member is asked to give a percentage value for how much they prefer each interest rate. These values are aggregated to form a collective Board view (see above).

5 Comments

Big deal....of course Bollard will not raise the ocr that he cut to pork activity in this recession...activity that seems to be slowing even more going by the tax bag...

So given the certainty that the ratings liar agencies will doubtless downgrade NZ....it stands to reason the govt will have to fork out more to refi the debt.

That's debt which continues to grow.

And where the govt goes the banks have to follow...rates are set to rise on mortgage debt regardless of what the RBNZ does with the ocr.

The can has been kicked too many times...they have run out of road...the BS is coming to an end.

Those with hefty debts, be they states or peasants, are set for a thrashing. That means further drops in the retail activity,,,another slide in gst harvesting,,,fear on the Beehive 9th floor and an end to the spin and humbug.

NZ is in the shite up to its debt ringed neck and the tide is still coming in.

Must be time for another fat wage rise for MPs and the State Service bosses. Haven't they done well.

Only one way out now...auction off a 99 year lease on the Chathams as a naval base...that'll focus Obama

It'd be interesting to know what the exporters among the board people think of this:

'Monetary policy change needed'

http://www.realeconomy.co.nz/260-monetary_policy_change_needed.aspx

With Dr Alan Bollard due to leave the Reserve Bank of New Zealand there is a clear opportunity to review and change the Policy Targets Agreement between the Reserve Bank Governor and the Minister of Finance say the New Zealand Manufacturers and Exporters Association (NZMEA). There is little prospect of any change to the Official Cash Rate in the Monetary Policy Statement on Thursday, but a real debate on whether our monetary policy is serving New Zealand’s interests is urgently needed.

NZMEA Chief Executive John Walley says, “Interest rates consistently among the highest in the developed world have caused a long-term overvaluation of the New Zealand Dollar, hitting exporters hard. Monetary policy has been the biggest reason for this.”

“Borrowing to finance spending, as evidenced by a structural current account deficit, is no way to run an economy. Changes must be made to ensure export competitiveness.”

BERL Chief Economist Dr Ganesh Nana has suggested that the Reserve Bank’s target be changed to:

“The primary function of the Reserve Bank is to monitor the availability of credit to business to ensure the growth of profitable export income-earning enterprise consistent with an external balance of payments target that reduces the nation’s external debt.”

“This seems like a more sustainable approach,” says Mr Walley. “Our living is earned by exporters in offshore markets and import substitution: as it is elsewhere in the world, this must be the focus of our monetary policy.”

“Pretending what we have is working only defers the problem. We must act now to support our tradable sector.”

Cheers, Les.

Fonterra farmers I speak to are expecting a cut in payout of around 50c/kgms next season. The high dollar rather than commodity prices being the reason. Should make Open Country Dairy happy ;-)

So much reliance placed on the opinion of economists (who can't see outside their financial models), business leaders (with vested interests) and academics who have only ever studied the flawed theories. And we wonder why we are lacking any sort of leadership.

So let's rock on up to the back blocks, ask some of our youth who see little of the four walls that make up a classroom, give them a years supply of gummy bears and send them down to Wellington to run the country. I guess that is what you are suggesting.....

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.