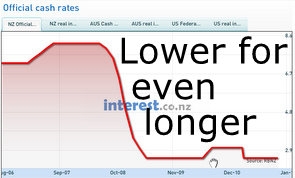

ASB's and ANZ's economists have changed their views on when the Reserve Bank of New Zealand (RBNZ) will next increase the Official Cash Rate (OCR) to December 2012 from June 2012, arguing the European debt crisis created uncertainty over the economic outlook.

ASB Economist Christina Leung said the European debt crisis felt like it was coming to a head with the growing risk that Italy or Spain could fail to raise money and need to ask for help.

ASB still assumed Europe would be able to contain the crisis, although it noted Germany's vehement and continued resistance to measures that could contain the crisis, including any move by the European Central Bank to expand its role buying Italian and Spanish bonds.

"We have pushed out our view of when we expect the RBNZ to lift the OCR to December 2012, from June 2012. The first half of next year no longer looks soon enough for the RBNZ to have confidence that the risks to the global economy have been sufficiently defused, even assuming Europe contains the crisis very soon," Leung said.

"An ever-increasing proportion of mortgages on floating terms will also give the RBNZ a lot of traction when rates eventually go up. That, combined with still-muted credit growth, suggests the RBNZ will have the time to wait until it is very confident the global and NZ recoveries are firmly on track," she said.

"We expect the first few 25bp OCR increases to be consecutive, but to be spaced out beyond that on the way to a 4% peak. In the current environment the OCR outlook is likely to be fluid, as a lot depends on Europe’s actions. It is entirely possible that Europe acts quickly now to reduce the risk of Europe’s debt problems triggering a full-blown financial crisis – and that OCR increases occur earlier in the year. And, back in July, the RBNZ was close to lifting the OCR. But there is still the risk the ambulance, currently parked somewhere near the top of the cliff, is itself pushed over the edge."

Leung said New Zealand's direct exposure to Europe was less than 10% of goods exports.

"What will matter more during a period of European weakness is how well Asia’s domestic demand holds up during a period of weak European (and US) growth, as NZ’s export fortunes are increasingly tied to the Asia Pacific. But interest rates remaining low for longer, combined with weakness in the NZ dollar while uncertainty remains, would give NZ some added insulation," she said.

ANZ view

ANZ's economists said in their weekly Market Focus the European situation was deteriorating and continued to dominate local nuances.

"While the direct impact on the NZ economy to date has been mild, we’re becoming more wary regarding what the first half of 2012 may bring. In this environment interest rates will stay lower for longer and we’ve pushed out prospects for the OCR moving up until late 2012," they said.

ANZ expected the Reserve Bank to conclude a permanent solution was unlikely in next Thursday's December quarter Monetary Policy Statement.

Wholesale interest rate markets are expecting the Official Cash Rate will actually be cut over the next year.

"We’re not concerned by this. Markets will be markets: they play a risk-return game, and if we see the OCR moving down it won’t be by 25 basis points. It was only in July that the market thought the OCR could approach 4 percent by the end of 2012!," ANZ said.

"We’re relatively bearish regarding the global scene but are mindful of marketdriven swings and the support NZ is getting via a lower currency. In such a situation it’s the spirit of one’s view that matters. Pushing out prospects for a hike until late 2012 is really saying the OCR is going nowhere for a long time."

(Updated with more detail on ANZ's view, feature image)

121 Comments

OCR Cuts coming ...

which will be irrelevant as banks funding costs start to increase.

OCR is irrelevant if attention is paid to liquidity factors.

Most of the banks seem to have surplus funds to lend out so action on LTV and the delayed CFR impost would be more useful in curbing any surge in property values.

.

Listen to the market...not the economists

True cuzz, very true.

For those expecting the world economic outlook to improve in the short term, you need to go away and play with the fairies.

It appears most economists and RBNZ have short term view, and havent taken into account the true financial position of many of the European countries, and the US for that matter. You just have to look at their income to debt ratio, to realise that we (the world) are in dire straights and a miraculous solution will be found overnight.. For things to improve, the finacial merry go round mentality has to stop where paper is trade and shuffled from one ailing country to another.

Hopefully Mr Keys solution to sell the countries silverware will in time give us hope in time with an improved economic blimp. But like all good things this will be short term, when we go to the cupboard and it is bare.

Buckle up and hold on tight peaople - the ride has just begun!

at this rate nationals going to have to sell extra assets just to meet that budget surplus forecast.

Yipee - does that mean even greater drops in House Prices than the 50% you guys have been predicting?

Cheaper to be an Owner Occupier now ...

Day to day maybe, but only if you ignore the risk of a huge loss....so someone getting a 95% mortgage and if there is a 50~60% drop is wiped out.....bankruptcy is probably easier/quicker and cheaper.

regards

quick everyone, buy 10 houses!!

It is now cheaper to buy - as evidenced by the surge in first home buyers in the market currently - battling multi-offer situations.

i wont be surprised if you and others with your attitude end up like this..

http://www.stuff.co.nz/business/money/6047322/Investor-bankrupt-after-empire-collapses

he's left us

Just stating facts.

In Jungian theory there are those who see the facts, and then there are those intuitive enough to link those facts to other information and draw conclusions from them. Sensing versus Intuitive.

The country has been run by Sensing types, but unfortunately real progess is only made by intuitives. Hence why New Zealand continues to fall behind in most measures you could care to apply.

SK is actually correct for some parts of the country at current mortgage rates. The best possible future is that interest rates will stay low until the economy improves and then they wil go up. There is however the very real possibility that banks find their cheap sources of funding cut off because they are not seen to be safe due to over-exposure into certain markets, rates go up, people can't pay, bad debts increase, bank funding cost increases, and it all becomes self-perpetuating. It would be foolish to think that Australia and NZ are immune to this happening.

So there is a risk.....gains right now are small....and questionable....V what looks like quite large risks of a large equity loss....

seems a silly gamble to me.

regards

My view....it's starting to clear now....the crystal ball has a blood red tinge to it....can't quite see the city that's burning...fat bankers are running from the scene...scumbag pollies right behind them...followed by regulators and bureaucrats....oh and look there's Ben Bernanke with a printing machine under one arm....hell's teeth that sod can run...printing as he goes....the ground is awash with toiletpaper banknotes on fire...haha the fat bankers have turned back to scoop up the paper....crushed they will be...the mob is over the top of them already...

Hmmm ... Apocalyptic visions .... yes the Black Horse is the capitalist system waxing then waning .... the one to worry about is the Pale Horse - now that's the one of death & poverty - won't say the name ....

The bank economists are clearly not that bright, so let me give them a helping hand.. there will not be any OCR hikes next year or the year after that, or the year after that for that matter. Its very simple really, NZ inc is defaulting on its debts already ... Sure politicians use a different term, but its all the same really.

Oh they know well what's going down Matt...the salary....protect the salary....!

No no ... you can't be right. I heard the WP economists explaining the surge in economy and the OCR up to 4% by December.... in fact BH was warning floating rates of 8 - 9% in existence right now a while ago. Something must be broken.

.

Now Dean Leftus gone - Anyone know whatever happened to Phil Jones and his disciples ?

One day we're going to look back on this folly and laugh.

As we tend the goats whilst dressed in homespun loincloths.

Why are interest rates low at a time when debt needs to be discouraged, funding is difficult to secure and expensive?

Its to do with the way the monetary/financial system functions. This is explained pretty clearly in plain english by,

http://www.positivemoney.org.uk

and their NZ site,

http://www.positivemoney.org.nz

There are two types of debt, productive debt and non-productive. Productive debt produces a good and makes a profit on the deal.....so businesses need low cost debt in order to grow, or help them with cash flow. The non-productive debt is consumption, speculation. The former we desperately need, it brings in export dollars and employs ppl, the latter we need to reduce, yes. Interest rate manipulation is a crude tool, and Pollies should have given the RB better tools, one of teh best looks to be the ability to vary the LVR ration on housing....a norm is say 80% and teh RG can vary that by 1 or 2%......Of course the banks didnt want it, nor developers, not estate agents, PIs and not voters because they were all speculating.....gambing to make a profit.....and those ppl would vote against a govn who did that......so the Govn 10 years ago was Labour, they did diddly but instead rode the tax windfall so they cold spend it.....now without doubt in my mind National would have also done nothing.......they would have made the bubble worse probably.....

Sadly I see no one or party in Govn today that is thinking medium term let alone long term....MC with the Cullen fund and kiwisaver is about it....godo ideas and very much needed.

So if you put interest rates up right now some nasty things happen.....businesses, more of which will probably fold causing higher un-employment....or they will contract their output.....our housing bubble ponzi scheme is tottering on the brink of a drop if not a collapse.....so it would be dangerous to fiddle too much right now, rasie rates and it will be carnage.......mind you with the EU and GFC its probably moot....I expect its going to implode and its looking like before Xmas.....welocome to The Greaty Austerity....it will amke the Great Depression a walk in the park.

regards

"teh RG" = "the RB"....typos at their best...

regards

How long before Bollard's near zirp forever farce falls on it's face...tripping over rising credit costs...because suckers, there is no way the RBNZ can print the billions to supply the banks the loot they need to refi...that's the loot they borrowed remember...the 'covered bonds' shite and all the other loans....

You are the fool with the mortgage....you are the sucker set to be told that you must pay more...in a market with zero real growth...how you like then apples?

If the big four here are not brought to their knees by NZ's property bubble, I cant see but they will be by OZ's. So the Q is what happens to your mortgage when a bank goes bankrupt and closes? I assume the portfolio is sold off en mass.....so maybe you find that your mortgage is owned by a loan shark....nice.....not. Or maybe they look for ppl with small outstanding mortgages and foreclose.....nice way to make a quick buck.....all sorts of nasty ways debt will bite.

Of course "covered bonds" are doggy doodoo....but without some sort of cast iron guarantee banks wont get "affordable" funding....so the risk now falls onto depositors....Bollard's "living wills" for banks guarantees depositors are in line to be screwed....so the only option left is bank runs....watch for it starting, guess look in Bunnings and if you see the shelves of safe boxes emptying, get in quick.

regards

Well, might be nearly time to fix at 5.5 for a year or so. It's never been so cheap to own your own property, enjoy living in it and pay it off faster with low rates.....

and if a Depression happens? (and thats more like when).....and property, which is currently over-valued by close to 100% drops 50 to 75% and we go into a depression that will last 20 years and make the GD look like a walk in the park, what then? Well a huge % of ppl will be looking at a personal/family financial disaster......and the ones not in that position such as myself will face huge tax burdens due to others stupidity such as you as our Govn is forced to bail the banks so the entire financial system doesnt freeze up and we cant buy food......

"enjoy living in it" sure if you understand that your property is your open prison for a substantial part (if not all) of your earning life.....if you are lucky to not be one of the 20~25% unemployed that is....and living under a bridge.

The banks already admit that 2012 wont see rates rising....I have been saying that for a long time...so they are publically at least a long way behind the curve....if this is going to be as bad as I expect, then the OCR is going to go <2% in 2012. So the only Q is if banks can get their short term funding fix.....or not....so fixing sort of protects you from that mayhem, maybe....assuming the bank(s) dont shut thier doors........

regards

Is this a wind up ? have you escaped from the Mason Clinic ?

You think its all rosy in the world then? That the Govns can stop a Great Depression mk2?

regards

The OCR is already lower than 2% in many parts of the world but although times are tough, its no 'Great Depression'.

The alternative to owning is to rent, and rents are very high in NZ relative to income. Rent prices are a major driver in house demand.

So you can pay a mortgage, or rent and pay someone elses mortgage. If your landlord is feeling the financial pinch, guess which way your rent is going? There is no free lunch.

So I dont agree with you on many levels.....

No Great Depression....yet.....all they have managed to do is delay and have a somewhat controlled descent.....

If you have a large amount of equity and have had a house for say 15 years, then all you lose is a paper profit.....and yes the residual mortgage payments make it hard to justify going out and renting. If however you are looking to buy or have bought inside 5 years then a 50% drop will send you under water or even wipe you out and you will probably lose the house and end up renting anyway...if the landlord will rent to you because you could well be bankrupt and look a bad risk.

If you are renting however and the landlord tries in desperation to put up the rent you just move to a new LL who just bought a house at 1/2cost and can rent it to you far cheaper.......you move and the old landlord goes bust and is living under a bridge.....

Alternatively, you are a renter with a good credit history of paying a large rent on time....so you get a mortgage at far less money than the old rent.

The loser here is the LL who paid too much and stupidly thought he could carry on pillaging a renters pockets at will to pay for his mistakes.....this isnt the case.......the LL does not have a monopoly.

regards

Landlords will always charge what they can get, they won't lower rates until there is an excess of rental properties available, ie. supply exceeds demand. Nowhere in your scenario would that happen. There is a housing shortage now, which is why houses are so expensive. Its not a conspiracy, its supply and demand.

House prices will decrease when there are more homes for sale than there are buyers, which sure isn't the case now. Minor interest rate changes will let new owners snap up homes perhaps, or cause the worst of those homes to remain unsellable (the older, uninsulated junk homes that litter the landscape in NZ) but it wouldn't be a 50% drop like you envision. High building costs also drive up prices for new homes and old ones alike.

If you think peoples incomes are going to crash, then thats another story, but for that to happen, the Chinese would have to stop buying our food. I don't see that happening anytime soon.

There is always an excess of property available.....I know several renters, they pretty much all move every year or two as the LL tries to put up the rent....When house prices collapse there will be mortgagee sales galore....... No to housing shortage IMHO, ppl speculate which is what is driving prices.....that is the main driver for high house prices, carry on believing that if you wish.

Prices are declining or static in most areas and when you consider inflation at 2% thats true for much of NZ. House prices are currently 5.5 or 6 to1 when they should be 3 to 1....therfore a 50% drop to the 3 to 1 wage current at taht time.....so that 50% estimation of mine is probably light I suspect. House prices driven by high building costs is one way to look at it, the other is high prices allow the suppliers to over-charge.....so its possibly backwards IMHO....

Chinese buying food, check out the comments on Chinese buying our milk, or rather they are not.

You dont see it, I do and soon.....shortly I think we will see whos right..... Consider the asymetriacl trade/risk. If you are right, anyone whos out of property looses a % of capital due to inflation not being covered because of being in cash......if I am right and the drop is severe and I see a depression the drop of which will take 5 or 6 years at 10% per year...then you or PIs anway stand to lose huge amounts and end up in mortgaee sales.....I was in London in 1992~4 I watched such ppl with 10+ houses go to the wall very quickly........

regards

Haha these dimwits property spruikers make me laugh.

Not only are they commiting a criminal act by borrowing fraudulent and leveraged money(the equivalent of receiving stolen property), the are blind to the fact that our persons per household is at a historic low. Wait for the empty houses when we see a small move upwards. There is precedent for it as people lose their jobs and move back home or share housing.

Now to rely on China to keep purchasing our overpriced animal protein is folly. Animal protein is a luxury not a necessity, taking twenty times the land area compared to vegetable sources. If we were really smart we would be concentrating on foods with a high water content, there will be plenty of demand for that going forward.

Borrowing money is the equivalent of receiving stolen property?

Where will it end on this site - keeps getting more and more ridiculous.

Well how would you explain the money supply SK? I haven't ever seen you make comment about it.

Furthermore I have never had anyone here refute the fact that we don't actually operate in a capitalist economy. You probably think you are a capitalist, but you would be deluded.

Think this site is now infested with Occupy Main Street & Whole Earth Catalog commenters. Where is the balanced advice on making financial decisions?

[sending this message via morse code 10m deep in my bunker] ....

Well I gave Bernard a serve not so long back for the totally unbalanced property spruiking articles by Olly. His latest effort was tempered a bit, but it is the property proponents that are the worst of offenders in the mantra of limitless gains with no risk.

It is still stolen money and it amounts to criminal behaviour.

Stolen? So, I borrow the home loan from my bank to help pay for my house...... and now I discover this? I thought they were kind of stealing all that extra 1.2% margin interest from me?

Only 1.2%? How do you figure that one?

There isnt enough money supply here for everyones mortgage, the banks borrow from overseas and then charge the home owner a bit more, thats their profit margin.

I can't believe that anyone who reads these forums can make such a stupid statement? Where exactly is that money borrowed from? Or more to the point who exactly?

Don't be so harsh scarfie. The guy/girl is a newbie here. I've yet to see them post as yet. How often do you see the mainstream media, examine how the banking system actually works? All you hear is constant assertions about how New Zealand doesn't have adequate capital here for our needs and we're dependant on offshore sources. Its become a constant refrain.

What is unexplained to the public is that banks have been used offshore money markets is largely, to allow access to absolutely massive flows of global liquidity, which is courtesy of the downtrodden masses in China's new "Satanic Mills" who are robbed by their governments low exchange rate policy, are being used to suppress the interest rates banks pay depositors. We complain when our dollar falls and the cost of imported fuels rise similarly, image how Chinese workers feel when you consider their slave wages.

Even Alan Bollard acknowledges that his control over interest rates is constrained by these international investment flows.

Perhaps I am being harsh, but is it really so hard to go and pull out an encycopedia and look up money supply? Then in ingnorance come on here and take the high horse(see comment below targeting beneficiaries/students).

But hopefully they will show some diligence, or perhaps even find Iain Parker's blog "Public Credit or Bust".

Time to step up a gear or go down in flames:)

Well, happy to pay a reasonable margin on top of the 90 day rate on floating - but 3% margin a bit too much.

So exactly where exactly does the money come from that you are borrowing? I mean the bank is just a conduit right, matching borrowers and lenders and taking a margin on the way through? So for your mortagage there is a matching depositor/s?

Our banks borrow from overseas banks at the international rate. We are mostly borrowing from the americans right now as i understand it since the europeans cant agree on how to restore trust in their inter-bank lending.

The rest comes from our own money supply which is balanced against inflation, a supply that is usually pretty tight in NZ.

If you really think it is that simple then good luck to you, you will need it.

I was keeping it simple so you could have a chance at understanding it.

You comments show otherwise.

Its sad that you wish New Zealand to suffer. NZ excels at one thing: growing grass. It is too wet and cold to be a good place for growing cereal grains, leave that to the North American midwest and the Ukraine. We are the most efficient exporter of animal protein on the planet, which pays for the generous social programs you are no doubt on.

Grass that grows with the aid of fossil fuel derived fertiliser. So you advocate using something that is only 5% efficient, just because we are more efficient than anyone else using the same 5% efficient method?

You don't need fertilizer to grow grass in NZ! Go to the South Island and count the sheep on the hills and mountains. There was sheep farming there a hundred years ago, sustaining *millions* of sheep with no nitrogen derived from fossil fuels! How is that 5% efficient? That grass would grow whether you had an animal eating it or not.

I don't know about 'proof' but here is an example.

Any business is trying to maximize profits, so they will charge what they can get. I don't understand how thats confusing but try to follow this:

Q. You have a house which you want to rent out, and someone offers you $500 a week for it. Another guy comes along and offers $400 a week for it. Both offers are otherwise identical. Which do you take?

A. The higher offer, because you like money.

Does that make sense to you now?

So why are you charging less? ie whats compensating for the reduction in a higher income?

regards

Thanks for the comments happyfunball, as you pointed out later however property prices are still mostly dependent on the flow of credit into/out of the economy,

"There isnt enough money supply here for everyones mortgage, the banks borrow from overseas and then charge the home owner a bit more, thats their profit margin."

So if credit (from overseas, or the NZ central bank, or as I see it the banks themselves) does flow into the economy / banks then house prices rise, and if credit stops flowing in, then house prices will fall.

I think you will find this is consistent with what you can observe happening to NZ. Supply of and demand for housing pales in comparison as an influence. This is because you are only in the housing market if you have access to enough money to buy a house.

So prior to 2008, easy credit, more housing demand, increase in house prices.

After 2008, tight credit, less housing demand, decrease in house prices.

Makes NZ look pretty silly for structuring its economy around overseas finance though. This means we have imported a financial market crash which started overseas.

The movement of credit affects interest rates that the banks charge for loans, NZ banks are essentially middlemen. The credit wouldn't stop, it would just get more expensive (ie. rates go up).

Average prices have come down (outside of Auckland) significantly since 2008 as unemployment increased, which is a decrease in demand. People can only buy what they can afford, exactly right.

But average prices are not what anyone in particular should worry about. I dont want to buy the average house and neither do you. You want to buy a specific type of house in a specific area for a specific price. There are many categories of houses and some are increasing in price and others are going down.

New, warm, safe and modern housing on good lots is going up in price as new immigrants from first-world nations move to NZ and want a nice (for them, normal) home. Building such homes is getting more expensive faster than property values declined.

Other homes, ex rentals, drafty villa's etc are valued for their land primarily or rental value (to starved Kiwi's) who will just 'harden up' and live in those conditions.

There are still investment opportunities, but its no longer a good investment to be a slumlord IMHO. Buy a nice house and don't worry to much about the 'average' price.

It doesn't matter if the banks are middle men or are the faucet for credit. If they reduce credit, then as you said "People can only buy what they can afford, exactly right.", then this reduces demand, which reduces the market price. That applies to every market segment / price, not just the top or bottom ends or in certain parts of NZ. I don't know what point you were making about the average price?

Credit conditions heavily influence price.

No, it doesnt lower price, its not that simple. It just provides a downward pressure on prices. Which way the price goes is based on the many factors affecting house prices, of which borrowing costs are just one.

Stop! You're trying to depress us all. Personanlly, I don't care if prices fall since I plan to stay long term - would rather have low rates = low outgoings.

Anyway, we now have a PM who is optimistic for the future .... so it's all good. Sun came up this morning (figuratively), the tomatoes are growing, dogs happy .... busy job, strong demand, .... banking the tax cut....

"Stop! You're trying to...." doh....that's what the investors in bluechip and the other filth said when they were warned back in 05 that they had invested in scams and rorts and that they would likely lose their capital....:"stop you're trying to......"

The question has to be asked...is the OBR intent to 'protect' taxpayers from bailout costs on bank failures.....more or less likely to lead to the failures????

And then we can ask....will bank failures under an OBR gameplan not lead to secondary failures as punters rush to withdraw their savings...

In short folks....the OBR is a farce and a failure....either English and Bollard wake up to the reality that they cannot have their cake and eat it too....or we end up with the farce....and the farce will lead to the failures...and the run on the banks...all the banks....get the message!

A far better approach is to provide the same level of guarantee as across the ditch for savers in bank accounts.....to come clean with the public and admit that the govt is more concerned about preventing property values imploding because the whole economy is tottering along on credit and an implosion would lead to a Greek outcome....while at the same time actually having the guts to nail the banks to the wall of prudent lending...to impose criminal punnishments for failing to do so...ie we need a govt that honestly wants to shift the economy away from being 100% reliant on credit....

And in my opinion we do not have that.....the OBR gameplan is evidence that we don't....it is a recipe for bank runs....the medicine will make the disease worse....

If the Govn and hence the country is protected from having to bail the banks, aka Ireland and we can do an Iceland then from my point of view thats probably better for NZ as a whole....

This debt is private debt, those stupid enough to take it on casually deserve the outcome.....good or bad.....

regards

Think it through steven....there is no protection...you cannot remove the country from the market...The OBR is a tweak and fiddle gamble that banks will be prudent knowing they lack the deposit guarantee....but they can't can they....because the whole economy and every one of the banks is critically dependent on the bloated property bubble...and that means they must be imprudent and lend no matter what the risk...it's a lend or fail game steven....and the RBNZ regulations are no better than a wet bus ticket telling off...there are no criminal punnishments what-so-ever....no punnishments at all....it's all good chaps together down at the clubrooms...

No way am I going to be left naked when the tide goes out.....what about you steven?

I agree Wolly....mostly....look at Iceland....V Ireland.....and yes I agree on the reliance on property, residential, commercial and farming. When it blows its going to be very bad, as Mervin King says, worse then the GD. Hence why Bollard's living wills idea is so critical....once thats in place the EFTPOS side of things continues to function....so we get to buy food. Meanwhile the mortgage/lending/savings side goes bankrupt and comes back on line some time later, the critical thing is banking still functions.

Look at what the RBNZ is doing v the RBA, our own Dr Bollard looks to be doing far more and is more alert and switched on.

"what about you steven?"

Well in a generic sense,

Sell anything like shares, use it to pay down debt, they are going to drop big time.....

Keep some savings, some few K as emergency money, at least 2 banks savings accounts if not 3, have Internet banking on these, you can transfer any time of day then. Is there a transfer limit with Internet banking? I think there is $500 cash a day limit withdrawl. My wife and I have seperate bank accounts so thats $500 each anyway per day.....we can also transfer between......So diversify banking such that 2 or 3 banks all have to fold at once to leave you "penniless".......as above.....so also consider 2 credit cards, one VISA one Mastercard, different banks of course, wife has one, you have one.

I assume that I can withdraw $500? per eftpos card. I assume also I can do the same with VISA and matsercard as seperate transactions.....so I think I can walk up to a machine and take out $1500 per day x 2 (incl wife).....then just transfer internally via Internet to the CC(s) that cash out of my accounts anyway......

Debt reduction.

Sensible ppl wont have HPs and especially long term high value, high interest HPs on things like cars etc.

Some small amounts in gold and silver.....at most a few K for "joe" average. Gold protects wealth, silver coin for day to day use, kind of hard to imagine it will be used/needed, but still.

Consider short term cash like things, outside of banking, so Govn bonds....I would think varying time frames, no more than 2 years.....

If it starts to look really bad then withdrawing some weeks worth of cash will be the final move....

regards

Just as a point of interest Steven, investigate the possibility of taking out large sums of cash now. Then go further and ask about USD. A few clues to be had there I reckon:-)

The only way out of this mess is if Treasury and the Reserve Bank can manage to safely devalue the property bubble and the only way I can see for it to be done in a controlled and orderly manner is if the government forces councils to dismantle artificial constraints on development, whist simulataneously providing rate holidays of sufficient duration to allow homeowners to be compensated for the difference between the value of their mortgage and the new normal. Otherwise banks would be receiving alot of "jinggle mail" like their counterparts in America. The Treasury would then have to inject money into the balance sheet of the council to compensate for lack of rates revenue coming in. To steralize the inflationary effect of the rates holiday on the general economy, a special levy would have to be imposed to mop up excess liquidity. This would have to happen before a major economic shock precipitates the whiplash of the carry trades, fleeing back to their traditional safe haven in U.S. bonds and therefore leading to severe interest rate hikes. At the moment its the massive amount of global liquidity that is holding down our interest rates, not Alan Bollards OCR managment. He's all but admitted he's basically blowing in the wind when he makes announcements.

Low global interest rates have restrained the rise in longer-term interest rates relative to the upward pressure monetary policy has been able to exert on shorter-term interest rates during this tightening cycle. This has seen the yield curve progressively flatten and become negatively-sloped during the past few years.

The rate holiday you suggest would punish those who already paid off their mortgage and reward the over-leveraged.

Why can't we hold house prices stagnant while keeping inflation at a manageble rate? Eventually things will even out as the dollar declines in value and salaries increase.

I'm not saying it will be easy but surely thats the best option.

Inflation is the rate at which prices increase. If house prices are stagnant, there is no inflation (of house prices). Unless the government passed a regulation setting house prices (probably close to LVR) then you can't do anything like this. Even if you did, since house price increases drives most inflation / dollar devaluation you can't really anyway.

How do you propose to devalue the dollar anyway? The FED doubled their monetary base in 2008, and that has not had a similar effect on their exchange rate. You can't cause devaluation, unless you have a mechanism to do this.

"house price increases drives most inflation" I would somewhat disagree on 2 fronts.....what you describe are 2 things a) driving, this suggests push inflation rather than pull.....b) and housing doing it.... To answer

a) I would have said in the past we had pull inflation where more money in ppls pockets allowed then to spend more... I would suggest there is the ability to pay and that is the biggest driver at the bottom/first time buyer part of the market....so the second time buyer takes the extra money and lerages that up into something "better" etc etc...at the first time buyer side price is very sensitive.....I have certainly noticed that myself.....

b) Housing I think follows infaltion generally.....rather hard to break that out for sure though.....its a very interesting point.....chicken and egg, just what comes first.

From now on however I think price of materials and oil will cause push inflation, but ppl wont see price increases...hence infaltion will be very low and house prices wont rise much and could fall....

regards

Steven,

I would actually agree with Nic. As you must consider that house prices are a zero sum equation, because any capital gains that accrue to the seller, are matched by higher mortgage costs of the buyer and therefore less discretionary income available to be spent into the economy. There is no more money in people's pockets that can be spent. The only way there has been more discretionary income available for people to spend is due to the massive liquidity flows which have suppressed the prevailing interest rates during the Great Moderation, thanks largely to the emerging economies policy of suppressing domestic spending power with their foreign exchange manipulation strategies. The other is ability of homeowners to access equity release mortgages.

n fact, over recent times, some house owners have been directly accessing this wealth by increasing the mortgages on their property. This is ‘housing equity withdrawal’, and is sometimes referred to as active equity withdrawal. Passive equity withdrawal occurs when a house is sold and the seller has a lower mortgage on the property than the buyer; the end result of such a transaction is that equity is withdrawn from the property.

Total housing equity withdrawal has been substantial in recent years; one estimate puts it at $3.6 billion in the year ending March 2006. This is very high, given that total growth in household consumption in this year was $5.5 billion. However, it seems that only a proportion of this equity withdrawal was spent. [2] Nevertheless, the withdrawal of equity from housing – as well as from farms and businesses – can have a significant impact on the level of consumption. In turn, this can, and does, affect inflation.

http://www.rbnz.govt.nz/monpol/about/2989594.html

I would argue that the constantly appreciating house prices and rents, put pressure on people's discretionary spending which drove them to make higher wage demands, which business had to oblige, since until the end of the Labour Government's term in office, a very tight labour market prevailed.

The Bank of New Zealand's head of research, Stephen Toplis, said the tightness of the labour market was the single biggest problem facing the economy. Job security left people feeling "bullet-proof" and comfortable spending up large both on housing and through the retail sector and becoming less resistant to price rises, he said.

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=104…

I think we are discusing different things here...not sure.....I still dont see that you have supported the point that house price appreciation is a or the main driver of inflation.

"There is no more money in people's pockets that can be spent"

In this situation the only way ppl can pay more for a house ie inflation is to either earn more, or get access to more borrowing via a higher LVR....in the last 15 years a norm of 80% seems to have given way to a LVR of 90%+....Not sure [low] interest rates play a big deal as that varies so it should cancel out....but its rather dynamic...

"As you must consider that house prices are a zero sum equation" again I fail to immeditely see what this has got to do with the contention that house prices drive inflation rather than follow it....(give or take a bit)

regards

QE did lower the value of the US dollar, but its a race to the bottom as everyone else is trying to do the same thing to gain a trade advantage. NZ cant join in because of inflationary concerns and our dollar went way up.

I disagree that property prices are a zero sum game, they are more like an intergenerational wealth transfer. As young people gain debt they work harder to pay it off, creating a real rise in productivity.

Foreign investors are also putting money into the economy when they come from overseas.

So what mist?

The problem isn't the materially scarcity, but instead, is the question of how we're somehow going to absorb the excess productive capacity of the modern industrial system. China can't continue to ensure the survivability of the majority of its export orientated firms, without at the same time suppressing the purchasing power of its workers. So thats why it requires other nations to continue to have current account deficits in order to absorb its produce. Thats what the whole capital recycling game is about. Nobody else can compete, not te PIIGS, not even America. The fundamental structural imbalances in the economy are such that I see no alternative, but a massive trainwreck, not seen since the rise of Soviet Russia as an industrial power and the consequent depression.

From the rich walnut paneling and carved arches to the molded Italian Renaissance patterns on the ceiling, the circa 1925 council chamber room of Akron's municipal hall evokes a time when the America's manufacturing heartland was at the peak of its power. But when the U.S.-China Economic & Security Review Commission, a congressionally appointed panel, convened there on Sept. 23, it was not to discuss power but decline. One after another, economists, union officials, and small manufacturers took the microphone to describe the devastation Chinese competitors are inflicting on U.S. industries, from kitchenware and car tires to electronic circuit boards.

http://www.businessweek.com/magazine/content/04_49/b3911401.htm

however Im not sure how much of the JK tax cut was actually spent....I know my one, such as it was went onto my mortgage.

regards

"The FED doubled their monetary base in 2008, and that has not had a similar effect on their exchange rate. You can't cause devaluation, unless you have a mechanism to do this."

This is because broad money aggregates didn't change, the expansion of the Federal Reserve Bank base money had little effect on the broader money supply, since it is private banks who create the money supply. The expansion of base money only lowered the price of money, not increased the quantity. This is due to the fact that both lenders and borrowers, consider many variables other than merely the price when they make their investment decisions. They also consider likely return on capital, not to mention their individual ability to shoulder the debt, and likelihood of being able to repay them.

The monetary multiplier model of fractional reserve banking no longer holds true, and likely hasn't since FDR requisitioned people's private gold stock, in 1931 and imposed instead a fully fiat monetary system instead.

Bank of England. " Subject only but crucially to confidence in their soundness, banks extend credit by simply increasing the borrowing customer's current account, which can be paid away to wherever the borrower wants by the bank 'writing a cheque on itself'. That is, banks extend credit by creating money. This 'money creation' process is constrained by their need to manage the liquidity risk from the withdrawal of deposits and the drawdown of backup lines to which it exposes them. Adequate capital and liquidity, including for stressed circumstances, are the essential ingredients for maintaining confidence ...'"

http://www.bankofengland.co.uk/publications/speeches/2007/speech331.pdf

he base-multiplier model of money supply determination (which lies behind the exogenously determined money stock of the LM curve) was condemned years ago as 'such an incomplete way of describing the process of the determination of the stock of money that it amounts to misinstruction ...'(Goodhart 1984. Page 188)"

http://carecon.org.uk/DPs/0512.pdf

" money multiplier, as an introduction to the theory of fractional reserve banking. I suppose students have to learn that, and it is easy to teach, but most practitioners find it to be a pretty unsatisfactory description of how the monetary and credit system actually works. In large part, this is because it ignores the role of financial prices in the process ...'"

http://www.rba.gov.au/speeches/2008/sp-gov-150508.html

happyfunball,

Yes those who've recklessly borrowed during the boom will be rewarded for their profligacy, but indirectly they will not be the only ones who will benefit. With lower house prices, people will have greater discretionary incomes and therefore more money to spend into the economy. Should the international carry trade collapse as I predict, and interest rates spike, then people will be in a better pay the higher rates. With higher tax revenues coming in the government will be able to pay off the public debt earlier. Yes the dollar will decline but people will be worse off as prices rise on imported retail goods and energy and therefore be less able to be able to afford their mortgage payments. This is what happened in America and England during the initial stages of the GFC back in 2007. Wages won't be increasing any time soon in the current economic environment. The Reserve Bank governor, Mervyn King, is predicting a wage squeeze not seen since the 1920s, as people's living standards are caught between financial sector deleveraging and rising living costs. It would be truly delusional to assume that it also doesn't hold true for New Zealand.

http://duncanseconomicblog.wordpress.com/2011/01/26/the-inevitable-cost…

Agree and worse....something has to give.....as petrol and "essentia"l items go up, then the obvious cutable items is less HP and moving to lower rent areas....the former will put a deflatioanry pressure on consumerism which is a huge % of the economy......as will rising import costs. The latter has to raise the risk of house price drops..... Mervyn King is also talking about a Depression as bad as or worse than the GD.....when someone in this position says it (finally) you have to consider its a serious risk...IMHO....

regards

Well how do you hold property as such a position? I cant see it myself....take Japan, they are into their third decade of sort of trying to do this.......slow deflation of house prices with massive un-repayable govn debt so it doenst look to have worked to well....

Especially as we have the PIs etc buying more and more at low interest rates....now a CGT would probably dampen that somewhat, make it so that a rental business has to profit with cash flow and not end game tax free capital gains....also a LVR law that allows the RB to vary that ratio would probably help.....but they are more to help stop a bubble than deflate one...ie send a policy message on the future...

Anyway I think its moot......this is a global debt bubble and bubbles burst fast and nasty....aka Great Depression mk2.

regards

Japan has actually done pretty well notwithstanding claims of a "Lost Decade". They managed to deal with their property bubble bursting prettty well, far better than America or Europe likely will be able to. I'd put it down to their populations racial homogenity and superior social cohesion.

"Certainly anyone who visits Japan these days is struck by the obvious affluence even among average citizens.

http://www.theatlantic.com/international/archive/2011/02/the-myth-of-japans-lost-decades/71741/

"Why the disconnect between the reality and the famous "Lost Decade" designation, subsequent to the crash of the Bubble Economy in the late 1980s?

"If we believe the evidence of our eyes, we necessarily must look again at those economic growth figures. Preposterous though it may seem to an unacclimatized Western observer, it appears that Japanese officials have been deliberately understating the nation's growth."

http://www.atimes.com/atimes/Global_Economy/GI21Dj01.html

I think the Reserve Bank will have to telegraph ahead their intentions to devalue the country's property prices down in an orderly fashion and which I think will probably freak out the carry traders who will no longer consider New Zealand as such a good investment prospect with the value of our economy so disproportionately underpinned by the property market. Interest rates will therefore rise, but the economic impact would be muted by the government and Reserve Bank's intervention. Property investors would be deterred investing so much with high interest costs crimping on their returns. I just don't see any other way out of this mess whilst avoiding a repeat of the Great Depression which you're obviously prepared for.

Yes, japan is an interesting case, so many ppl harsly critised Japan, yet now they are faced with the same situation they dont seem to be doing such a great job.

Im fairly sure that the reason Japan coped so well is its huge domestic savings rate that the Govn could borrow for next to nothing...however those savers will become more and more withdrawers as they use their money to live on in retirement. So the Japanese govn will ahve to come out onto the international market and borrow, them with a debt of 200%+ gdp? ouch.....cant ses it staying "managed"

regards

"I'm fairly sure that the reason Japan coped so well is its huge domestic savings rate that the Govn could borrow for next to nothing...however those savers will become more and more withdrawers as they use their money to live on in retirement."

While we hollowed out our industrial capacity, they massively invested in theirs and protected it through neomerchantalist exchange rate manipulation. Though Japan has been undergoing a similar process since the real estate boom in the 1980s, though they've been fine since new industries have emerged to replace those that have moved overseas. We replaced our industries with tourism, horticulture, fishing, real estate, and the financial sector, instead lol. And we wonder why our economy has performed so abysmally since the 1970s.

US living standards are far above those of Asia, especially if you take individual levels of effort and ability into account. An important reason for this is that we don't prevent mercantilist Asian governments from subsidizing the building of excess capacity by manufactured goods exporters who then proceed to beat each others brains out to keep the capacity employed.

When I lived and worked in Japan thirty years ago I was sure that once the Japanese had wiped out the US color TV and CB radio manufacturing competition they'd collude and gouge us on prices. But that never happened. The large export subsidy provided by the undervalued currency keeps competitors alive who would otherwise have fallen by the wayside long, long ago.

*I'm talking "overall" -- many who would have comparative advantage over foreign competitors on a level field are unfairly injured, while others benefit.

http://economistsview.typepad.com/economistsview/2006/04/its_a_fish_eat_.html

. Moreover, though the hollowing out of industry has caused great concern several times in the past, it has not actually led to a serious situation, because drains resulting from business enterprises moving overseas only account for a small portion of the economy as a whole and new growth industries have also emerged at the same time.

http://www.yomiuri.co.jp/adv/wol/dy/opinion/international_090914.htm

I think in the long term, the Japanese economy will be fine. As you say, retiring thrifty Japanese will be withdrawing their savings and will have to spend up large on healthcare. The government will have to respond by hiking consumption taxes which are now set at a miserly 5% and will have to use the greater fiscal revenues to pay off the maturing debt. See even the IMF agrees with me lol

Among various revenue measures, raising the consumption tax is the most appealing.

At just 5 percent, the rate of the consumption tax is among the lowest in the world and because it is broad based, by international standards, there is ample scope for raising additional revenue by raising the rate. Staff analysis reported here suggests that a gradual increase in the consumption tax from 5 percent to 15 percent over several years—a level that is still modest by OECD standards—could provide roughly half of the fiscal adjustment needed to put the public debt ratio on a downward path within the next several years.

http://www.imf.org/external/pubs/ft/sdn/2011/sdn1113.pdf

mist42nz,

I never considered bad debts on the banks books as tax deductible expense. But then this would mean banks would become a drain on the public, because they wouldn't be contributing towards government revenue. And how long before there are adequate solvent borrowers able to pledge their future income in exchange for a bank loan?

I really like your analogy which compares the housing market to second hand used car sales, at least after the bust lol. Yeh, Russell Norman is just too cerebral and remote to make a convincing used car salesman. John Key does a far better job. After all he managed to sell the country the OECD liberalization policies that other countries hav had to get imposed on them.

The run on the banks will take two forms.....the first is already underway as more savers like me move capital to Australia to gain the protection of the state over there....the second will be a move to place eggs in several baskets....no more will Kiwi savers have an account in a bank....they will have accounts in every bank and their capital will be spread like butter. That is the only way to avoid having all your capital frozen solid in one bank and under the control of pointy heads in wgtn....When the morning news informs you that X bank has collapsed into the OBR and your deposits are frozen....you will know you have to remove capital from the other banks pretty dam quick.

Im not sure foreign money is covered, or has to be....OZ pollies can just say take 100% of the foreign money first, they dont live here, cant take me to court or vote for me....

regards

Wrong steven....the RBA boss knows dam well the system has to be safe for the foreign capital investment or risk seeing billions depart overnight...it is the guarantee that ensures the capital stays put...and our RBNZ does not understand this.....go figure!

The billions will depart overnight anyway.....we shall see....

regards

There is a book that clearly lays it all out. We are heading for a one world Government and a single monetary system. This currently is just the process to get us there. You should read the book for yourself as it has been the number one selling book for decades now. Available at most good retailers.

The Edmonds Cookbook?

I've got one of those ...... sadly , it hasn't improved my ability to rule the world , nor to bring in a unified monetary system ......

..... but my meat-loaf & scones are better than ever !

riffles through pages

Russian Fudge. Chinese Chews.

It's a sign ...

Indian curry , Brazil nut bars , Turkish delight , Sour kraut ....... it's a sign alright .....

..... I wonder if Edmonds are in cahoots with the CIA ?

There's a black helicopter hovering overhead. I think this means we've cracked the conspirac

..... either that or the Americans wanna filch Edmonds secret ingredient custard powder mix , under the guise of a Free-Trade-Agreement ......

Blast you , Barack Obama !

How to Brew, by John Palmer?

lol

Its no joke. Its one of several plans for a new monetary order, mooted in the Concil on Foreign Relations publication, written in 1974 entitled, Alternatives to Monetary Disorder. Its a matter of public record. I actually read it a couple of years ago. Options included a transition to a currency framework still underpinned and managed using the U.S. dollar as a reserve currency, to one defined by multinational currency areas (Eurozone, Amero etc), or the introduction of a single global currency. They've been building towards a global currency in incremental steps and have been awaiting a crisis to overcome objections to its intrusion against national sovereignty, before foistering it upon the world.

http://www.foreignaffairs.com/articles/31246/joan-spero/alternatives-to…

“Here it is,” Medvedev told reporters today in L’Aquila, Italy, after a summit of the Group of Eight nations. “You can see it and touch it.”

The coin, which bears the words “unity in diversity,” was minted in Belgium and presented to the heads of G-8 delegations, Medvedev said."

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=aeFVNYQpByU4

"To the internationalist, national sovereignty is the overriding obstacle. In order for a Global Central Bank and world currency to exist, some other political arrangements will have to be formed. Robert Mundell understood this political problem when giving a lecture in 2003 titled, “The International Monetary System and the Case for a World Currency.” His response was frank: “a global single currency could not be achieved without a global government. To enforce a single currency would involve big problems of organization.”[29]"

http://www.forcingchange.org/one_world_one_money_with_endnotes

www.singleglobalcurrency.org%2Fdocuments%2FArticleWallStreetJournalRobe…

Yes, well we know all about the New World Order & the global currency and the EU/UN socialist govt..... not really much you can do to stop it.

Most of us are just focusing on the daily realities in front of us .... working, paying bills, paying the mortgage, etc. ...

With all your research skills maybe you could earn a good living as an academic?

MortgageBelt,

The NWO isn't a socialist agenda can be better described as synarchy, a political order its founder, described as transcending conflicts between social classes through collaborative managment of political affairs through three Councils, academia, judicial, and commerce. Synarchy is premised on control and stability. The needs of the unwashed masses matter not to synarchists. Look at whats happening in the Eurozone, with their austerity drives.

http://en.wikipedia.org/wiki/Alexandre_Saint-Yves_d%27Alveydre#Developm…

centers.law.nyu.edu/jeanmonnet/papers/09/090501.pdf

As for working in academia, I do not wish to be involved in an institution so subject to groupthink that suppresses truly independant thought. I'm looking into organizing a public forum

mist42nz,

You obviously are familiar with synarchy, though the movement arose in response to the popularity of anarchism, not communism. After all Communism was synarchistic in essence, as they saw workers as mere factors of production. They weren't egaliteareans or even humanists. Karl Marx saw Communism as removing the constraints that capitalism imposed on the productive powers of humanity. He saw the fully unleashed productive capacity of industry as the ultimate goal of humanity, which is what Soviet communism and Keynesian capitalism delivered, though far too much of industry was devoted to war production during the Cold War.

Nope, the opposite, huge localisation....the global banking system as such if this "Greatest Depression" ever happeens I think will be gone. There will be in effect firewalls between different countries banks in the future such that the "flash fire spread" coming around the world cant happen again....

regards

I think he means the Bible rather than Edmonds. So, if we are heading towards a one world Government then we need not worry about our national assets being privatised/sold because that may be simply opening the way for the Global Socialism to acquire/control NZ assets/infrastructure thus being socialised again - thereby keeping the left happy (eventually).... make sense?

Communism has not really died as per the Wall falling ... the origins of the EU, the 12 stars in their logo, the ownership of The Economist, the links to Catholicism, etc all point to the new emerging power bloc in Europe - the money/debt/currency problems are just birthing pains ....

For depression in NZ. AKA. "Holiday time"..We will print the cash, fix the rate of exchange..and queitly have a Claytons depresion.With everyone moaning about how empty the supermarkets are with procesed overseas crap. Employment will stabalise as we fix the old cars rather than waste Overseas exchange on new ones.In fact just the same as it was pre 1984.Only this time,our home manufacturing sector might have trouble finding people to satisfy the home demand.As manufacturing on the home front grows.Bring it on!..

Give you some spuds for that spare Snapper mate. Any chance of a Lamb for a bit of sparky work. Anyone swap a load of firewood for a hand to run some plumbing?

Just jacked the rents up yesterday on a couple of residentials - 30$ a wk increase.

Should I not have done that because of the situation in Iceland?

Do as you pls.

regards

Hey! - I'm just trying to catch up to Australia!

:The good news for Sydney landlords (or bad news for Sydney renters) is that rents are heading north.

Over the past year we have seen Sydney rents increase by 5.9 per cent for houses and 5.4 per cent for units.

That brings the weekly rent for a typical Sydney house up to $550 and to $513 for units.

One of the guys I used to work with went to sydney for "more money" he's come back...rent etc made him worse off....

regards

Yeah he probaby had more reasons that he never mentioned....

Waddaya call a team of lawn-bowlers wearing baggy green caps ?

........ the Australian Cricket 11 .

Whaddaya call a Kiwi cricketer with 150 up , on the scoreboard ?

....... a seam bowler .

If Chris Martin played cricket for England , what would they call him ?

..... an all-rounder .

People have short memories,when the SHTF..its usually in the form of a Cluster f@#$%,and as great events cast their shadows long before them..its not that hard to see into the near future based on the probibilities..The Euro is going to collapse..or their has to be fiscal/political, union in the EEC.That wont happen!.. Israel will live with a nuclear Iran ,who will have warheads by next april That wont happen either.If hostilities break out the price of oil will go balistic.If Israel does Iran Russia and china will be highly pissed..they are pissed now as the defence shield is hemming them in..The S.T.A.R.T. talks have broken down.and Pakistan would rather have the Chinese than the yanks in town,keeping a close eye on their Nukes.The World got a whole lot more dicey,the thing that wipes debt is war where the winner takes all.

Notice that Westpac do not have their normal Monday weekly commentary this week.

Does this mean they actually do not know what on earth is going on? Immigration down, Inflation down-ish but maybe uppish next year, OCR down but maybe up next year, Spending down but uppish during World Cup, business confidence down-ish, ... what is going on?

Maybe they are desperately trying to shore up their credit lines. Maybe they won't exist next week unless the Australian government loans them billions of dollars. Maybe I am trying to start a run on the bank...

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.