By Rodney Dickens

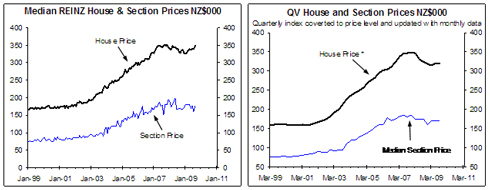

In a February 2009 report I looked at how section prices had increased more than existing house prices between 2002 and 2008 and suggested that section prices would need to fall relative to existing property prices to restore the competitiveness of house and land packages.

In general section prices have fallen since February but not by more than house prices, although we are now seeing section prices fall relative to existing house prices via house prices increasing relative to section prices (see the charts below).

In our property research this year in different parts of the country we have found five developments:

(1) in some segments of some markets section prices have fallen significantly, partly associated with mortgagee sales and more the case in some coastal and resort markets;

(2) numerous examples of developers trimming 5-15% off prices for sections;

(3) two cases in parts of Auckland where a developer recently put up asking prices in response to the market starting to tighten;

(4) cases of developers not dropping carded asking prices but doing selective discounting or deals, often with builders; and

(5) cases where developers felt they were in monopoly or pseudo-monopoly positions and have not dropped prices but are instead waiting for demand to recover enough for people to pay the asking prices.

The last development is probably why the national average section price didn't fall relative to the national average house price during the downturn despite the demand-supply balance in the section market suggesting it should have.

By Rodney Dickens

In a February 2009 report I looked at how section prices had increased more than existing house prices between 2002 and 2008 and suggested that section prices would need to fall relative to existing property prices to restore the competitiveness of house and land packages.

In general section prices have fallen since February but not by more than house prices, although we are now seeing section prices fall relative to existing house prices via house prices increasing relative to section prices (see the charts below).

In our property research this year in different parts of the country we have found five developments:

(1) in some segments of some markets section prices have fallen significantly, partly associated with mortgagee sales and more the case in some coastal and resort markets;

(2) numerous examples of developers trimming 5-15% off prices for sections;

(3) two cases in parts of Auckland where a developer recently put up asking prices in response to the market starting to tighten;

(4) cases of developers not dropping carded asking prices but doing selective discounting or deals, often with builders; and

(5) cases where developers felt they were in monopoly or pseudo-monopoly positions and have not dropped prices but are instead waiting for demand to recover enough for people to pay the asking prices.

The last development is probably why the national average section price didn't fall relative to the national average house price during the downturn despite the demand-supply balance in the section market suggesting it should have.

The upturn in new housing demand we have been predicting for some time in the monthly Building Barometer reports is unfolding and feeding a sharp upturn in section sales. I have also written about the prospects for a stronger than generally expected upturn in new housing demand in a previous Raving. Part of the upturn is being driven by the lagged stimulus from the large interest rate cuts. The massive cut in interest rates has gone a long way to temporarily restoring housing and section affordability, but without dealing with the underlying problem (i.e. house and section prices being unsustainably high relative to incomes).

The upturn in demand is also partly driven by stronger net migration, with higher population growth inevitably meaning increased new house building and more section sales, but again without solving the underlying affordability problem.

In our regular Housing Prospects reports we have consistently warned our clients of a two stage adjustment in house and section prices, with the first stage, which is dominated by falling actual prices, now over. The second stage, which we expect to be a long and winding path, has started with house prices rising, which is helping to improve the competitiveness of house and land packages.

Builders have also put in some sterling efforts to get new housing costs down, although the introduction of double glazing and some other developments, including increased council charges in some places, has reduced the ability of builders to cut house building costs. However, the underling poor economics of house and section prices is just being disguised by low interest rates and a temporary cyclical rise in housing demand driven by net migration.

If our analysis of economic growth and interest rate prospects contained in the monthly Interesting Times reports and our analysis of net migration prospects contained in both the Housing Prospects and Building Barometer reports are close to the mark, the affordability challenge will re-emerge next year in response to rising interest rates and a cyclical fall in net migration.

Housing and section affordability from an international-competitiveness perspective

In our regular pay-to-view reports we look at house and section prices relative to the likes of incomes and rents to assess the underlying value, and we include the impact of interest rates to help assess affordability. However, it is also interesting to look at NZ house and section prices from the perspective of the international competitiveness of NZ firms (i.e. from the perspective of the impact especially section and land prices have on the international competitiveness of the NZ economy).

NZ is a small, export-orientated country a long way from many of its main markets. It is also a country with a low population density meaning one of its major competitive advantages should be cheap house and section prices. Housing is a major part of the cost of living, and it would seem a crime if NZ was uncompetitive in housing costs. Section prices are a key driver of new housing costs, with the charts above showing the relationship between section prices and house prices. So it would be a crime if NZ section prices were expensive relative to section prices in our major trading partners.

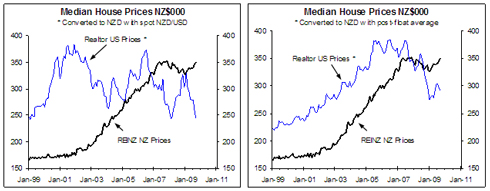

The charts below provide some frightening insights into NZ versus US housing affordability. The left chart shows the REINZ NZ median house price (black line) and the Realtor US median house price converted to NZD using the spot NZD/USD. Based on the current exchange rate the median NZ house costs 43% more than the US median house! This compares to early this decade when the NZ median house cost around half the US median house, when both were considered in NZD.

However, the NZD/USD has a habit of swinging wildly, which can temporarily distort the picture. Consequently, the right chart shows the REINZ NZ median house prices relative to the Realtor US median house price with the latter converted to NZD using the post-float average rate of US 60 cents. Even when the post float average NZD/USD is used the NZ median house price still weighs in at 20% more than the US median house price, while early this decade the NZ median price was around 30% below the US median price in NZD.

The upturn in new housing demand we have been predicting for some time in the monthly Building Barometer reports is unfolding and feeding a sharp upturn in section sales. I have also written about the prospects for a stronger than generally expected upturn in new housing demand in a previous Raving. Part of the upturn is being driven by the lagged stimulus from the large interest rate cuts. The massive cut in interest rates has gone a long way to temporarily restoring housing and section affordability, but without dealing with the underlying problem (i.e. house and section prices being unsustainably high relative to incomes).

The upturn in demand is also partly driven by stronger net migration, with higher population growth inevitably meaning increased new house building and more section sales, but again without solving the underlying affordability problem.

In our regular Housing Prospects reports we have consistently warned our clients of a two stage adjustment in house and section prices, with the first stage, which is dominated by falling actual prices, now over. The second stage, which we expect to be a long and winding path, has started with house prices rising, which is helping to improve the competitiveness of house and land packages.

Builders have also put in some sterling efforts to get new housing costs down, although the introduction of double glazing and some other developments, including increased council charges in some places, has reduced the ability of builders to cut house building costs. However, the underling poor economics of house and section prices is just being disguised by low interest rates and a temporary cyclical rise in housing demand driven by net migration.

If our analysis of economic growth and interest rate prospects contained in the monthly Interesting Times reports and our analysis of net migration prospects contained in both the Housing Prospects and Building Barometer reports are close to the mark, the affordability challenge will re-emerge next year in response to rising interest rates and a cyclical fall in net migration.

Housing and section affordability from an international-competitiveness perspective

In our regular pay-to-view reports we look at house and section prices relative to the likes of incomes and rents to assess the underlying value, and we include the impact of interest rates to help assess affordability. However, it is also interesting to look at NZ house and section prices from the perspective of the international competitiveness of NZ firms (i.e. from the perspective of the impact especially section and land prices have on the international competitiveness of the NZ economy).

NZ is a small, export-orientated country a long way from many of its main markets. It is also a country with a low population density meaning one of its major competitive advantages should be cheap house and section prices. Housing is a major part of the cost of living, and it would seem a crime if NZ was uncompetitive in housing costs. Section prices are a key driver of new housing costs, with the charts above showing the relationship between section prices and house prices. So it would be a crime if NZ section prices were expensive relative to section prices in our major trading partners.

The charts below provide some frightening insights into NZ versus US housing affordability. The left chart shows the REINZ NZ median house price (black line) and the Realtor US median house price converted to NZD using the spot NZD/USD. Based on the current exchange rate the median NZ house costs 43% more than the US median house! This compares to early this decade when the NZ median house cost around half the US median house, when both were considered in NZD.

However, the NZD/USD has a habit of swinging wildly, which can temporarily distort the picture. Consequently, the right chart shows the REINZ NZ median house prices relative to the Realtor US median house price with the latter converted to NZD using the post-float average rate of US 60 cents. Even when the post float average NZD/USD is used the NZ median house price still weighs in at 20% more than the US median house price, while early this decade the NZ median price was around 30% below the US median price in NZD.

How can a small, export-orientated country facing huge disadvantages because it is half a world away from some of its major markets expect to be competitive when housing costs 30% more than in the US?! We don't have historical data on US section prices, but just as is the case in NZ, there will be a distinct link between US house prices and US section prices (i.e. US section prices will also be distinctly cheaper than NZ section prices).

Of course, we can debate whether NZ house and sections prices are artificially and damagingly high or whether US house and section prices are ludicrously low. The short answer to this question, as justified in the Housing Prospects and Building Barometers reports, is that NZ, not US, house and section prices are the ones that are out of line with the likes of incomes and rents. However, this doesn't mean the problem will disappear any time soon. What is clear to me is that the speculative bubble in house and section prices has defused in the US, while it is still a work in progress in NZ.

In August 2009 the average UK house price was GBP 155,968 according to the UK Land Registry. This converts to NZ$340,829 at the current spot NZD/GBP and to NZ$434,451 using the post-float average. This compares to a NZ median price of NZ$350,000 based on the REINZ September 2009 data, which at face value suggests NZ is cheap in comparison to the UK.

However, comparing the UK to either NZ or the US is problematic because it has a much higher population density. NZ has a land area of 270,500 sq km and a population of just over 4.3m (i.e. around 16 people per sq km), the UK has a population of approximately 61m in a land area of 244,110 sq km (i.e. around 250 people per sq km), while the US has approximately 307m people spread over 9,158,998 sq km (i.e. around 33.5 people per sq km). Of course adjustment should be done for land that cannot be occupied, like deserts and mountains, but even after this adjustment the UK population density would dwarf that of NZ meaning land prices should be significantly higher in the UK even before allowing for it having a higher average income.

The same problem exists when comparing NZ and Australian land prices. The Australian land area is 7,692,024 sq km, meaning 2.9 people per sq km based on 22m population. However, with only around 10% of Australian land being arable versus around 50% for NZ (assuming we can believe what we find out from Google searches), the population densities in NZ and Australia aren't too different if calculated based on arable land.

The median Australian section price in the June quarter was reported to be A$174,000. This converts to NZ$213,324 at the current NZD/AUD exchange rate, which is below the average rate for the last 10 years, or to NZ$204,705 using the average NZD/USD over the last 10 years. At face value this seems high relative to the NZ median section price of $170,000-175,000, but with Australian incomes reported to be around 25% higher than NZ incomes it is eye-ball with NZ section prices on an income adjusted basis. However, Australia, like NZ, is listed as one of the markets that is "severely unaffordable" in the latest Demographia study.

Demographia is an international organisation that among other things provides annual insights into housing affordability in developed countries including NZ and Australia. The 5th Annual Demographia International Housing Affordability Survey: 2009 was released early this year. New Zealand is among one of the markets that is "severely unaffordable".

As Dr Shlomo Angel says in the introduction to the latest survey, "Wendell Cox and Hugh Pavletich repeatedly remind us of the causal connection between land supply restrictions and housing affordability in their annual surveys." Hugh is based in Christchurch and oversees the NZ survey. He is constantly campaigning for more affordable section prices in New Zealand, with the key issue being around land supply restrictions and the need to free up more land for Greenfield residential development on the fringe of existing urban centres.

'Smart growth'

We see councils as having played a part in driving section prices to unaffordable levels in some parts of the country. In one extreme case the total fees paid to one council associated with subdividing new sections is around $50,000, which makes providing affordably new sections laughable.

The "smart growth" philosophy adopted by some councils has contributed by limiting supply increases (this seems to be relevant to the two Auckland subdivisions we are aware of where prices were increased recently). Councils have a major financial headache with infrastructure costs that is making them less inclined to rezone new Greenfield areas for residential development.

However, we believe councils need to seriously rethink trying to recoup full infrastructure costs up front from developers/section buyers versus on a drip feed basis from ratepayers. We see a competitive advantage being available to councils that can take a lead on this issue (i.e. the ability to compete population growth away from neighbouring councils that are wedded to the flawed/dubious "smart growth" philosophy).

However, part of the issue relates to the scramble to land bank on the fringe of urban areas during the 2002-2008 boom and the associated high raw land prices some buyers have paid. The high prices paid by some investors/developers during the boom years limit their ability to supply sections at the sorts of prices we expected to be needed to achieve significant sales over the next several years (i.e. assuming interest rates increase roughly as we expect and the recent upturn in net migration abates).

The problem in parts of the country is that the land market isn't a competitive market in the true economic sense. In some places, a relatively small number of people/firms own much of the subdividable land and quite understandably they are not keen to cut asking prices where they have monopolistic or pseudo-monopolistic positions. Where this situation coincides with a council wedded to smart growth (i.e. focused on trying to squeeze people into higher density housing that many don't want to live in and generally doesn't stack up on a cost effective basis), there is a recipe for "trouble at the mill".

The long arm of the law (of economics)

The wonderful thing about economics is that it works, even if some of the laws of economics can take a long time to come home to roost. This can be the case in the property market when vendors respond to an adverse demand-supply situation by opting not to sell rather than sell at lower "market clearing" prices. This happened in the Auckland CBD office market after the 1987 share market crash, with no properties selling for two years after the crash. However, the laws of economics are patient. Where section/land asking prices are too high the market will respond with lower sales than hoped for by would-be vendors.

_________________

* Rodney Dickens is the Managing Director and Chief Research Officer for Strategic Risk Analysis (SRA), which is a boutique economic, industry and property research company. Rodney produces regular free reports on topical issues and on specific property markets. Find out more about SRA here and sign up to SRA's free reports here.

How can a small, export-orientated country facing huge disadvantages because it is half a world away from some of its major markets expect to be competitive when housing costs 30% more than in the US?! We don't have historical data on US section prices, but just as is the case in NZ, there will be a distinct link between US house prices and US section prices (i.e. US section prices will also be distinctly cheaper than NZ section prices).

Of course, we can debate whether NZ house and sections prices are artificially and damagingly high or whether US house and section prices are ludicrously low. The short answer to this question, as justified in the Housing Prospects and Building Barometers reports, is that NZ, not US, house and section prices are the ones that are out of line with the likes of incomes and rents. However, this doesn't mean the problem will disappear any time soon. What is clear to me is that the speculative bubble in house and section prices has defused in the US, while it is still a work in progress in NZ.

In August 2009 the average UK house price was GBP 155,968 according to the UK Land Registry. This converts to NZ$340,829 at the current spot NZD/GBP and to NZ$434,451 using the post-float average. This compares to a NZ median price of NZ$350,000 based on the REINZ September 2009 data, which at face value suggests NZ is cheap in comparison to the UK.

However, comparing the UK to either NZ or the US is problematic because it has a much higher population density. NZ has a land area of 270,500 sq km and a population of just over 4.3m (i.e. around 16 people per sq km), the UK has a population of approximately 61m in a land area of 244,110 sq km (i.e. around 250 people per sq km), while the US has approximately 307m people spread over 9,158,998 sq km (i.e. around 33.5 people per sq km). Of course adjustment should be done for land that cannot be occupied, like deserts and mountains, but even after this adjustment the UK population density would dwarf that of NZ meaning land prices should be significantly higher in the UK even before allowing for it having a higher average income.

The same problem exists when comparing NZ and Australian land prices. The Australian land area is 7,692,024 sq km, meaning 2.9 people per sq km based on 22m population. However, with only around 10% of Australian land being arable versus around 50% for NZ (assuming we can believe what we find out from Google searches), the population densities in NZ and Australia aren't too different if calculated based on arable land.

The median Australian section price in the June quarter was reported to be A$174,000. This converts to NZ$213,324 at the current NZD/AUD exchange rate, which is below the average rate for the last 10 years, or to NZ$204,705 using the average NZD/USD over the last 10 years. At face value this seems high relative to the NZ median section price of $170,000-175,000, but with Australian incomes reported to be around 25% higher than NZ incomes it is eye-ball with NZ section prices on an income adjusted basis. However, Australia, like NZ, is listed as one of the markets that is "severely unaffordable" in the latest Demographia study.

Demographia is an international organisation that among other things provides annual insights into housing affordability in developed countries including NZ and Australia. The 5th Annual Demographia International Housing Affordability Survey: 2009 was released early this year. New Zealand is among one of the markets that is "severely unaffordable".

As Dr Shlomo Angel says in the introduction to the latest survey, "Wendell Cox and Hugh Pavletich repeatedly remind us of the causal connection between land supply restrictions and housing affordability in their annual surveys." Hugh is based in Christchurch and oversees the NZ survey. He is constantly campaigning for more affordable section prices in New Zealand, with the key issue being around land supply restrictions and the need to free up more land for Greenfield residential development on the fringe of existing urban centres.

'Smart growth'

We see councils as having played a part in driving section prices to unaffordable levels in some parts of the country. In one extreme case the total fees paid to one council associated with subdividing new sections is around $50,000, which makes providing affordably new sections laughable.

The "smart growth" philosophy adopted by some councils has contributed by limiting supply increases (this seems to be relevant to the two Auckland subdivisions we are aware of where prices were increased recently). Councils have a major financial headache with infrastructure costs that is making them less inclined to rezone new Greenfield areas for residential development.

However, we believe councils need to seriously rethink trying to recoup full infrastructure costs up front from developers/section buyers versus on a drip feed basis from ratepayers. We see a competitive advantage being available to councils that can take a lead on this issue (i.e. the ability to compete population growth away from neighbouring councils that are wedded to the flawed/dubious "smart growth" philosophy).

However, part of the issue relates to the scramble to land bank on the fringe of urban areas during the 2002-2008 boom and the associated high raw land prices some buyers have paid. The high prices paid by some investors/developers during the boom years limit their ability to supply sections at the sorts of prices we expected to be needed to achieve significant sales over the next several years (i.e. assuming interest rates increase roughly as we expect and the recent upturn in net migration abates).

The problem in parts of the country is that the land market isn't a competitive market in the true economic sense. In some places, a relatively small number of people/firms own much of the subdividable land and quite understandably they are not keen to cut asking prices where they have monopolistic or pseudo-monopolistic positions. Where this situation coincides with a council wedded to smart growth (i.e. focused on trying to squeeze people into higher density housing that many don't want to live in and generally doesn't stack up on a cost effective basis), there is a recipe for "trouble at the mill".

The long arm of the law (of economics)

The wonderful thing about economics is that it works, even if some of the laws of economics can take a long time to come home to roost. This can be the case in the property market when vendors respond to an adverse demand-supply situation by opting not to sell rather than sell at lower "market clearing" prices. This happened in the Auckland CBD office market after the 1987 share market crash, with no properties selling for two years after the crash. However, the laws of economics are patient. Where section/land asking prices are too high the market will respond with lower sales than hoped for by would-be vendors.

_________________

* Rodney Dickens is the Managing Director and Chief Research Officer for Strategic Risk Analysis (SRA), which is a boutique economic, industry and property research company. Rodney produces regular free reports on topical issues and on specific property markets. Find out more about SRA here and sign up to SRA's free reports here.

Opinion: Housing affordability problem to re-emerge as interest rates rise

Opinion: Housing affordability problem to re-emerge as interest rates rise

28th Oct 09, 2:08pm

by

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.