The economy went into reverse gear again in the last quarter of 2020, with GDP dropping 1%, according to Statistics New Zealand.

The fall is somewhat bigger than had been expected, although economists had warned that a number of outcomes were possible.

The latest drop means that, according to Stats NZ, GDP declined 2.9% over the year to December 2020, the largest annual fall ever in GDP for New Zealand - as a result of the lockdown.

The figure that the economists look at closely is the latest quarter compared with the same quarter the previous year. On that basis, economic activity was 0.9% lower in December 2020 compared with December 2019.

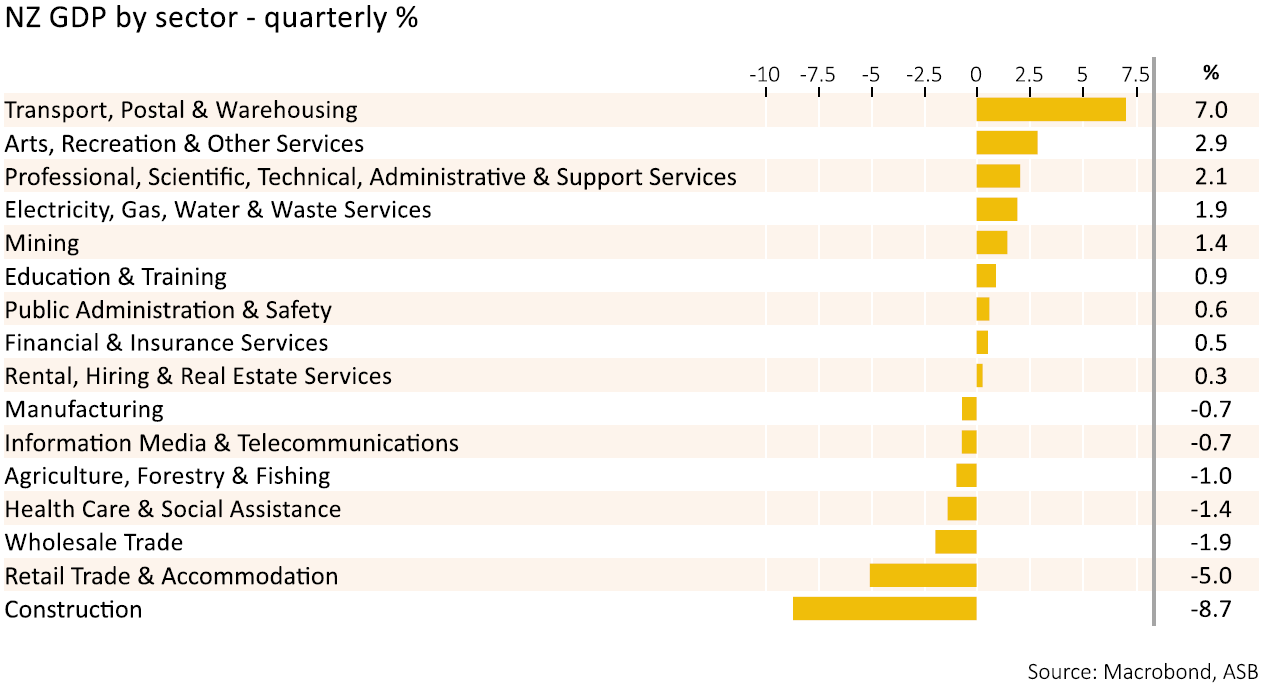

One feature in the latest GDP figures was a fairly large (8.7%) fall (from very high levels) of the construction sector.

Kiwibank chief economist Jarrod Kerr said the fall in construction over the quarter "was much deeper than expected".

"Most of the pullback in construction can be attributed as a ‘payback’ of sorts from the spike in the third quarter. Commerical construction was particularly weak, although residential construction was up over the quarter."

The latest GDP drop opens up the likely possibility that New Zealand may see a 'double dip' recession, as the March 2021 quarter is likely to record the worst impacts of there being virtually no overseas tourists here this summer. The technical description of a recession is two consecutive quarters of negative GDP growth. Of course, we went into recession last year after falls in GDP for both the March and June 2020 quarters.

Capital Economics Australia & New Zealand economist Ben Udy said the decline in activity in the fourth quarter "reflects the fading of pent up demand and means that New Zealand a second recession is imminent as GDP is bound to decline in Q1".

"GDP is set to decline again in the first quarter of this year. Electronic card transactions fell in January and February. And the week-long lockdown in Auckland in March means a decline in consumption is all but confirmed. Similarly, the New Zealand activity index eased in both January and February."

Udy says further ahead, high house prices and rising business confidence should result in a sustained rebound in investment. "...Overall, we’ve pencilled in a solid 5% rise in GDP in 2021."

ASB chief economist Nick Tuffley and senior economist Jane Turner said fourth-quarter GDP "was much weaker than expected".

ASB had forecast a -0.1% decline.

"Q4 GDP is 0.9% below year-ago levels, also much weaker than expected. The RBNZ was expecting Q4 GDP to remain up 0.3% on year-ago levels," Tuffley and Turner said.

'Questions on performance'

"The extent of the Q4 fall raises questions around the true extent of NZ’s economic performance through the pandemic, but also raises questions over how strong [first half] 2021 growth will be. The absence of foreign tourists is having a greater negative impact on GDP than previously estimated, compounded by the possibility of capacity constraints holding back the stronger parts of the economy (i.e. construction). The implications are mixed, as some sectors are constrained by weak demand but others may be constrained by supply."

For the December quarter 2020 the Reserve Bank had forecast a quarterly figure of exactly 0.0%, while major bank economists were split between those seeing a small drop in economic activity and those who felt there would be a small rise.

The latest GDP figure follows a massive, record, 13.9% (revised down from 14%) rise in GDP in September as the economy bounced back hugely from the 11% fall - lockdown induced in June.

Stats NZ national accounts senior manager Paul Pascoe said activity in the December quarter shows "a mixed picture"

"Some industries are down, but others have held up or risen, despite the ongoing impact of Covid.”

In terms of industry groups, seven out of 16 industries had declines in activity.

Largest contributors

"The two largest contributors to the drop were construction, and retail trade and accommodation. Both industries saw strong September 2020 quarter results," Pascoe said.

“Falls in construction services, commercial building, and infrastructure were partially offset by continued growth in residential building activity. Construction activity remains at historically high levels, despite this quarter’s fall.”

On the other hand, parts of the retail trade and accommodation industry continue to be affected by the absence of international tourism.

“Businesses ranging from hotels and motels, to restaurants, cafes and bars faced much lower activity in calendar year 2020 than in 2019, with far fewer international tourists in the country because of border restrictions,” Pascoe said.

The two largest positive contributors in the quarter were transport, postal and warehousing, and business services. However, both industries are still operating below pre-Covid levels and are weaker over the calendar year 2020 compared to 2019. Transport services, in particular, have been impacted by the lack of international travel.

The December 2020 quarter results capture the beginning of what is traditionally the international tourism season, which has tended to peak during the summer months.

Economic growth

Select chart tabs

174 Comments

Stagflation?

The definition of stagflation is:

"Persistent high inflation with high unemployment and stagnant demand in a country's economy"

We may have weak GDP but not persistent high inflation nor high unemployment

We have high inflation just not in the CPI

I just view CPI as a subset of total inflation.

Obviously it is not capturing house price inflation.

We have high inflation just not in the CPI

What do you call what we are seeing in the housing market, is that not inflation or should we consider it as just profits?

Yvil - Look at the cost of living, commodities, house prices etc and this may just be the start of whats to come. It seems to be a global trend.

Agree. Stagflation most likely. Well done creating this much to be avoided outcome.

Stagflation on the cards!

And here RBNZ thought we could continue to achieve economic growth by lending disproportionately more to the demand side of the economy than to the supply side.

This development also dampens the likelihood of government action against house unaffordability. Such an action at this time would lead to an even bigger socioeconomic disaster now, given only the industries directly linked to housing seem to be in the black.

The figures aren't showing too much of the wealth effect of 20% house price rises. Perhaps it's not enough (they need to aim for 50%) or perhaps the wealth effect is a load of old cobblers.

The wealth effect = go out and spend against a potentially temporary capital gain in your house, money you'll have to pay back even if your house value decreases. This is our road to recovery. Sounds like a solid plan

How many could-be startups and enterprises would this QE-driven housing boom have killed off? The quick and easy double-digit gains from housing trumps the high risk, value-adding ventures that demand blood, sweat and tears from their promoters.

Smaller startups generally get killed by our minimum wage being too high relative to the median. Why put in the hard yards at a startup when for marginally less money you can get a far less demanding job.

Exactly Dago. That is exactly what central bankers want everyone to do. Go out and spend, but a bigger house with those really cheap mortgage rates, max out on your credit card. When you’ve done that use buy now pay later and, once you’ve done that sign up to a scheme where you can get your salary paid in advance. Who on earth would advocate such a ridiculous monetary system? But all the Central Bankers are playing the same game. You/We have a ask why? How is this likely to end?

It doesn't matter how much liquidity is pumped into the System, or the price of it (% rate) if it all immediate gets tied up in long term asset speculation.

If it doesn't hit Main Street, to be turned over and over again, it's just making us all poorer, and so we'll stop spending even more.

Who would have thought house prices could rise so much, at the same time as the economy is shrinking?

Don't try to understand Pinko Logic - it's disjointed and steeped in delusion.

It is a hedge against anticipated inflation.

You're on to something here.

Just like older couples don't conceive merely at the first try, it is the same with QE.

Look at the Yankees, their Fed are now projecting a 6.5% growth.

https://www.ibtimes.com/fed-boosts-us-growth-forecast-65-year-3164090

Just carry on with QE till you see growth.

At the very least, US' QE and corporate handout scheme supports millions of high-paying skilled jobs in their pharma, O&G, banking & insurance, manufacturing and tech industries.

The only ones who benefit from unnecessary handouts (the likes of accommodation supplements) from the NZ government and RBNZ's QE are a handful of property investors and perhaps the salespeople at their local Ford dealership.

Corrected you there, car salespeople came number two.. after the house salespeople, lucky in Aotearoa.. you could do short stint to sell couple cars before graduate then move the rank into selling houses.

CWBW...undecided whether your post is serious or just a troll. Smart money would prolly be on it being a troll but with an Elo of 1000 you may be serious.

Does GDP matters anymore as under Jacinda Arden anything that matter is House Price Growth and that is fantastic 10% per month in February.

May be that is as far as her understanding of economy goes. Typical Kiwi believing that Economy = Housing

Housing & Kindness. The two pillars of the NZ economy.

Correct Housing And Kindness/compassion to speculators (Investors)

AND

Apathy and Compression to FHB.

At least she does know what a GDP is now.......

This is a lagging indicator, but let's have a stab at what Bold Grant will say next week as a result of it?!

(Suggestion)

"Look. I'd love to be proactive and bring forward some much-needed economic rebalancing, but given last week's GDP figures I've decided that now is not the time. I'll be in a much better position to make a decision after the next quarter's figures hit my desk"

(NB: Can't they see that removing disposable income from consumers by tying it up in illiquid asset speculation has only one effect - to reduce the velocity of money, and so the activity in the economy? No, obviously)

bw..well said.

Yes well said, bw

May be opportunity to throw money as any excuse is welcome to support the Pyramid, which under any circumstance has to be supported to avoid free fall. Thankfully PM Jacinda Ardens understand and has promised to dedicate her every breadth in power ( another 2 years) to support and promote rising house price.

Long Live The QUEEN.

You do realised that this govt only employ two Phd right? one is in Geography and one is Theology. In the past you do have Dr x Dr y for RBNZ, but yea.. now? NZ voters deserve what's coming next..wait.. wait... wait.. GDP ups! (on Q4 2021, when NZ housing cost finally beats the crap of Luxembourg).. Kiwis on top of the world!.. again (after Everest, America's Cup and many other achievements).. let's do this, keep on boogey folks!

Agree.... but it’s not just NZ, it’s the same central bank policy driving this around the world.

It means year-on-year GDP dropped 0.9%.

QE bypassed the real economy?

I guess it will eventually look like this and this.

On a nominal basis annual Dec. 20 GDPE grew 0.9929%. Those that have an exposure to a cross section of NZ government debt are in receipt of an average return of ~2.99% p. a. Hence no inflationary relief for the long suffering taxpayer. So maybe it's in our best interest if the RBNZ hoovers up the high coupon stuff and pays the banks OCR in return.

Yeah, of course it did, went straight into housing.

This is why money should be handed out to the poorest first, not given to the richest. There's both more of them and they spend in the real economy, not just put more money into unproductive housing. Would have had the added bonus of lowering our $$ (good for exporters, you know, the businesses that are seeing us through) and probably would have caused some real inflation which they have been chasing for years.

Orr and Robertson have got their response so idiotically wrong it's unbelievable.

I would have liked some stimulus money to spend.

But as you say, it has bypassed anything productive for the country and straight into housing ponzi

Not sure why they didn't release money into more large infrastructure projects that would benefit all of NZ.

The problem is, many landlords are greedy c***s and raise the rent the moment they hear about poor people getting handouts.

Yep, should have also been a rent freeze for a year as well, if they had done it.

They definitely wouldn't have thought of that though.

When basically inept people who cannot think through ramifications of their actions are put in charge, it's no surprise they put in policy that radically backfires on their mandates and intentions. Remember this time last year GR coming out saying they were going to use COVID as an oppourtunity to do an equality reset? Remember how Orr's main mandate is for financial stability? Both of these are significantly worse than they were a year ago.

Will they resign for stuffing up? Will they apologise? Will they even suggest they might have made mistakes? Ha! If only we were so lucky to have leaders that held themselves accountable.

Accidentally reported, sorry. Can someone just take that button away from me?

Hey, I called GR inept, not GV ;-p

Shuush.. if Kate read/hear about it, she'll go bantering that # hash tag rent freeze request link again.. don't burst our viva la vida.. here please.

Nah. Taxpayers' money will just end up propping up the black market from drugs to duty unpaid cigarettes. WINZ are already managing them well.

Here's a crazy thought for you: perhaps not all poor people are drug addicts

In the lead up to the referendum on legalising dope stats were published by the pro dope lobby which suggested that almost half of kiwis use currently illegal drugs (such as THC). Use of dope is more common amongst the poor. This would imply that whilst not all the poor are druggies, most of them are. (The correlation between income decile and likelihood of using THC would almost suggest that using THC improves your odds of lifelong poverty!)

Funny how cannabis is brought up in this context as a drug, but somehow alcohol isn't. They're both drugs, both consumed by rich & poor alike. Oh wait, rich people prefer cocaine.

Do you really think it's the drug use that causes people to become poor? A simple divorce can make a middle-class worker bankrupt. Or getting pregnant at a young age and being abandoned by the 'father'. Or losing parents. Or having shitty ones.

I can't believe how blind, arrogant, simple-minded and downright spiteful some people are when it comes to explaining poverty.

Regardless of the true cause of poverty, the stats suggest that somehow most (certainly not all) of the “poor” can afford expensive drugs that the rest of us can’t find room in our budget for and that they use government support to be able to afford it. This supports CWBW position that tax payers are proposing up the black market. Perhaps non monetary government assistance should be explored? (Along the lines of bargain boxes delivered weekly, with rent and power allowances paid directly to the vendor, clothing vouchers, stationary vouchers & free public transport - all in lieu of monetary transfers, extraordinary expenses can be applied for and approved on a case by case basis)

I bet most of us on this site spend more on booze than those on welfare spend on (currently) illegal drugs. Cannabis is not expensive and can go a long way.

Expensive??? Don't make me laugh.

"that the rest of us can’t find room in our budget for" - if you can't find $30 per week in your budget for entertainment then I've got bad news: you're poor. Thus, most likely a drug addict.

You need to use percentage of disposable income spent on entertainment as opposed to absolute dollar values to get a fair comparison. I spend less than 0.01% of my weekly income on alcohol and less than 1% on entertainment (most weeks). Any individual item that costs more than 1% of your income should be treated as expensive and the need for it should be reevaluated frequently.

So what you're saying is that poor people shouldn't spend more than, $5-6 on entertainment per week. Wow. You're saying that if you make more money, you're allowed to drink - otherwise you're considered a drug addict if you do.

Can't you see how ridiculous this is?

Sure, so long as you define an addict as someone who requires and consumes a substance / service past when they can afford to do so.

Entertainment spending is a luxury that some of us have to give up whilst building wealth / escaping poverty. Entertainment doesn’t have to cost a lot. We have many scenic walks and cycle trails in NZ that are the envy of the world whilst being free for the general public to access. NZ also has free public rugby, soccer, cricket , basketball, etc facilities. A Netflix subscription only costs a few dollars a week. Our libraries are free, online games may cost a bit up front but the per week cost averaged over the time you spend on it shouldn’t be too bad (hopefully?). You pretty much have to go out of your way to need to spend more than a few dollars a week on entertainment.

"Entertainment spending is a luxury that some of us have to give up whilst building wealth / escaping poverty." - Wow. Do you actually understand what you're saying?

By the sounds of it you really think that some people don't deserve to spend $30 per week on entertainment. Poor people don't deserve fun. Poor people should be limited to playing basketball or rugby even on rainy days. Because everything else you mentioned costs money.

Cycling, netflix, online gaming all have a big upfront cost, plus ongoing costs (last time I checked, internet, computers and bikes weren't free).

So how much difference do you think spending $10 per week vs $30 per week would make in the life of a poor person? If you really do care about their well-being and getting ahead in life so much, I hope you keep asking your landlord friends not to raise rent at all.

Yes, non-transferable food stamps would be a very good solution.

Moreover, with food stamps it would be possible to control the type of food that can be purchased by beneficiaries: for example, it would be possible to automatically exclude junk food from the likes of KFC, fizzy drinks etc. This would also have the added benefit of reducing public healthcare costs, later on, due to obesity, diabetes etc. This would help them and society at large. The only problem would be the stigma associated with using food stamps at the counter - problem that could be minimized with the current self-service checkout systems now common in many supermarkets.

LOL yeah let's control what poor people should be allowed to eat! Those f***ers shouldn't be allowed to have fun OR eat anything they like!

I understand your outrage, some poor form comments above. But I do think food stamps could be explored more from a cost/benefit perspective. For example if its streamlined and purchased in bulk maybe the poor could have more food than now and maybe kids can eat 5 plus a day which is probably impossible on current benefit payments.

I think proper education would be a much better and humane solution. Many people eat junk food because it's a source of joy. "Comfort food" is a real thing, and taking that option away from people who already don't have much to be happy for is just cruel.

Also, junk food tends to be cheaper than healthy food. A slice of bread with some apricot jam costs pennies, but decent quality (i.e. low sugar but tasty) cerals with milk are $2-3 dollars per meal. Not to mention the pinnacle of luxury, avocados...

People of all income levels make mistakes - why should only the poor be punished for it? If a rich person can deduct mortgage interest from his tax (i.e. get free govt money), should we control what he spends that additional profit on?

How is junk food cheaper? It's convenient sure, but not cheaper? People just eat it because they're lazy.

A 150 gram packet of chips = $1.50 ($10 /kg) vs 1 kg of potatoes $3 k/g

Muesli bars are $2 a pack ($15 /kg) vs Apples as little as $2.20 kg. Bananas $3 kg or Muesli at $5 per kg or porridge $3 /kg with a little bit of milk (or water????).

All taken from Countdown.co.nz. I can go on....

Pak n save buddy. Eating healthy is cheap despite what the academics claim. 5kg bag of brown rice, lentils, carrots. I'm in the new 39c tax rate and the family still have casseroles that are largely vegetable based costing $3-4 a head. Why? Because I enjoy it. I'm picking most folk eating crap are lazy and not concerned with their health. It's just too hard.

I hope you're not advocating the use of smashed avos.. You might give boomers a thrombo

CourtJester,

At last, a sane and empathetic voice. I am not sure whether to be sad or angry at how many on this site want to put the boot into those at the bottom of the ladder.

i am well aware of the dangers of anecdotal evidence. Though not religious, I help distribute food parcels for my wife's non-denominational church and have had my eyes opened. I have been in properties i didn't know existed(in Tauranga). I now know some of their stories and yet, many insist on sharing what we can give them with neighbours. I admit to having led a pretty privileged life.

Good on you for taking care of the less fortunate.

I blame echo-chambers. If all your friends are rich landlords you'll assume that it only takes a bit of "hard work" and everyone can get rich. Thus everyone who isn't rich must be a scumbag.

Or that THC helps numb the pain of lifelong poverty..?

Lets not bring alcohol (drug) into this discussion shall we standing on our little high horses.

I spend less than 0.01% of my weekly income on alcohol. I do wonder how that compares the the majority of those who identify as poor?

Either you have extremely high income, you drink significantly less than 1 beer per week, or you can't do maths. Place your bets now everyone!

Anyone drinking a single $10 beer per week would need a weekly income of $100,000 to match your stats.

@mfd

I don't actually think I've had an alcoholic beverage all year.

I think you're normalizing alcohol consumption. Though to remove the stick-from-my-ass, I have smoked cannabis this year.

Guess that event makes me a criminal.

That's perfectly fine. I'm not a heavy drinker myself, but even one pub trip a week quickly knocks up to 1% of my after tax income.

" I have smoked cannabis this year." - Oh no!!! You're on the path to poverty now!

Most landlords would drink beer bought from Pak n Save so probably more like $1.75 for a beer.

A valid point, still comes under option 1 as you need a near million dollar annual income to afford one of them a week for 0.01% of your income.

A million a year is more common than you realise.

I drink a glass of wine at weddings and that is about it these days. 5 glasses to a $20 bottle = $4 per glass, x 2 weddings a year =$8, divided by 52 weeks = $0.15 /week divided by 0.01% = $1,500 / week (minimum).

Option 2 it is. To be clear, I have absolutely no problem with you not drinking much. But I do have a problem with you claiming your own, almost teetotal, habits as a yardstick for measuring the lifestyle of 'the poor'. Anyone earning half as much as you is not a bad person if they choose to drink a bottle of wine more than once a year.

I said spending over 1% is considered expensive. Ie if you made the $1500 per week (minimum I mentioned above) you could drink 100x as much as I do before it starts to count as an expensive habit by my yard stick.

The 1% figure is an arbitrary figure I use in my personal assessment of fiscal matters. Others may have alternative wealth building strategise with varied tolerances for frivolous spending.

Each to their own. I just autotransfer ~40% of my regular salary into my savings, investment and charity accounts and don't worry too much about the rest so long as it doesn't look like running out.

I wouldn't preach the same to anyone on a low salary, as these things do not scale linearly. There's a certain cost floor to just exist in some kind of comfort. I've been lucky enough to have a pretty smooth life and as such can't pretend to understand the lives of those without my run of luck (decent genes, stable family, decent upbringing, reasonable intelligence and good opportunities - all of these were luck of the draw)

This is classic right wing ideology. It doesn't gel with reality as study after study shows that when you give poor people more money, they don't increase their spend on undesireable goods. A major one is here. http://documents1.worldbank.org/curated/en/617631468001808739/pdf/WPS68…

"Across 44 estimates from 19 studies, we find that almost without exception, studies find either no significant impact or a significant negative impact of transfers on expenditures on alcohol and tobacco."

Beating up on the poor might sound like fun, but when evidence doesn't back you up, maybe you should just keep quiet.

Poor in general globally maybe. Those who have a history of substance abuse are different.

https://www.marketwatch.com/story/this-is-what-happens-to-the-finances-…

Then your reasoning is poor as is your article as it focuses specifically on those with a drug problem, an exceedingly small percentage of people (2.3% in NZ, which includes people from rich to poor).

Your argument is that we shouldn't give out money to poor people because a small percentage of them will use that money to buy drugs.

Given the alternative, where we have exploding levels of homelessness, housing stress, crime and inequality as a result of giving money to rich people to gamble on housing... I would call your reasoning myopically ridiculous. You have focussed on a tiny portion of people, when we are trying to save an entire economy. An appeal to extremes logical fallacy.

Thanks for taking time to retort ignorant and bigoted comments.

Personally, I wouldn't bother.

I believe we established above that a large number of beneficiaries spend more than they can afford to on dope (and as such are by definition addicts).

Perhaps non-cash welfare for those who fail a semi-annual THC test? Non cash welfare has the added advantage of being automatically inflation indexed to exactly the right level for the right things. A bargain box a week will feed you the same as it did last year regardless of food price inflation. Free public transport let’s you travel around the same as you did last year regardless of fare increases. Free doctors visits are just as effective now as last year regardless if fees go up. A stationary set this year is just as useful as the one from last year regardless of price difference. Power allowance could be expressed as kw/h as opposed to $$, etc. the government could get discounts for bulk purchases, everyone wins! it is difficult to see how it can possibly be bad!

Maybe they’re addicted to paying too much rent? On a serious note, you’re well out of touch if you think beneficiaries are the problem. How many millions in accommodation supplements go to landlords each week? Maybe then you’ll find the true parasites in this country

The stats say it's 2.3%. If you want to make up bullocks based on assumptions, that's up to you, but don't claim they are true.

"In the lead up to the referendum on legalising dope stats were published by the pro dope lobby which suggested that almost half of kiwis use currently illegal drugs (such as THC)". NO they did not. They were given as the number of people who have EVER tried weed, NOT those that currently use drugs regularly.

In fact the best info we have is summarised on wikipedia: "Cannabis is the most widely used illegal drug in New Zealand and the fourth-most widely used recreational drug after caffeine, alcohol and tobacco.[15] The usage by those aged between 16–64 is 13.4%, the ninth-highest level of consumption in the world,[1] and 15.1% of those who smoked cannabis used it ten times or more per month." - 10 times a month you would barely be considered an addict, that's 2% of all people (15% of 13.4%). So 2.3% as reported by the Ministry of Health is about right.

Again, you have some sort of crazy idea that over half of the country are addicts to illicit substances not backed up by evidence. Your myopia on the subject is telling, if you were affected by drugs in your family some way, that's fairly unusual still. But to assume that over 50% of the country are going to run out and spend stimulus money on drugs, therefore causing massive social harm, is so bats#%t crazy, it's not funny. Then using that false assumption as a reason for not giving poor people money when all evidence suggests doing so would have positive social and economic outcomes, is again, quite batty.

The biggest addiction problem we have in this country is our addiction to cheap leveraged money that we can then use to pump up the price of housing and force poor people to pay for the costs and consequences. THAT is the addiction we need to focus on the most.

https://www.moh.govt.nz/notebook/nbbooks.nsf/0/b0d88c5d60fc5cb8cc256ad1…

This article suggests 43% of males and 27% of females use cannabis in any given 12 month period with consumption heavily weighted by a small number of factors many of which are associated lower incomes. I believe the author to be the Ministry of Health. You need to be careful with studies where a self selection bias may be present. The methodology used is often just as important as the findings.

It doesn't 'suggest' any such thing. It SAYS that 21 percent of the sample used marijuana in the last 12 months. And it says tha 3 percent of the population were frequent users (classed as smoking 10 or more times in the last 10 days). So the report you cited contradicts your claim. Either you didn't actually read it, or you cherry picked the statistic that came closest to supporting your view (which was about 18-24 year olds who had tried marijuana in the last 12 months).

So you have gone from 50% of the population to be drug addicts, to 30% having used it in the last 12 months, then shown a report that indicates less than 3% are real users of the drug that may actually be addicts.

Your credibility at reading is pretty much shot. "This article suggests 43% of males and 27% of females use cannabis in any given 12 month period" - cherry picking, you didn't happen to mention that this is only for people 18-24, i.e. the highest users by age group. Talk about misrepresenting the data. The actual data for the whole population is "26 percent of males, 16 percent of females" for anyone that has used it in the last 12 months, about 20%. These aren't addicts. Most of these are occasional users. Only 1-6% percent of users are suggested as needing real help.

Again you are blowing this completely out of proportion and generally just making stuff up to support your case.

Orr and Robertson probably pretend Japan does not exist and Jacinda tries to Twink Japan out on the Google

GDP is irrelevant. We are all becoming richer selling houses to each other at a higher and higher price. Ask queen Jacinda.

Oh no we've hit the wall of the exponential graph. 3% targeted growth works until we hit the edge of the petri dish. Does anyone really believe that in ~24 years we'll have double the GDP (read: waste) of now?

Where is the wealth effect that people have been talking about? I thought we were meant to be super rich by now.

Oops, sorry, by "we" we meant the already rich

- Jacinda & co

"Overall, we’ve pencilled in a solid 5% rise in GDP in 2021", wow, IMO that's pretty optimistic and must rely on a lot of assumptions (resumed travel and continuing business confidence with no more lock downs). And that's only growth because last year was so bad due to lock downs.

I told you so.

Housing is the economy, try killing it accidentally or intentionally and chaos takes on a new meaning.

Can't wait for NZ QE II.

I don't get your point.

Nobody has tried to kill housing. In fact, the exact opposite happened. And yet here we are with negative growth.

If not for the housing market you think it'll only drop 1%?

The entire comment section for the last 12 months are filled with violent doomsayers and desperados hoping the housing market to crash and wants the government to make it happen through bureaucracy and taxes.

You are making a massive leap to come to the conclusion that you are correct.

House prices could be exactly the same as they were a year ago, and we could still have the same GDP results.

The sentiment in Interests comments section isn't relevant.

It's only the economy in a metaphorical sense. It cannot be the economy as it doesn't produce anything unlike a factory or farm.

Nope, the housing housing market is real and does contribute to the economy. If it doesn't, home builders, landscapers, land valuers, building material manufacturers and distributors, road builders, plumbers, electricians and heck of a lot more won't exist.

You need to correct your thinking for clarity.

Get back to us when NZ starts exporting them overseas.

The FBB stopped that little money earner.

Housing can not be the real economy. If it can, then Japan's lost decade didn't need to happen. The issue with this is that housing is an type of asset. When it comes to asset, there are people involved, then there is speculation. Yes, housing market does have certain level of contribution to the economy. But the economy can not fully depend on its housing market. It's a simple theory. If no one can afford houses, all those jobs will be gone. It will be even more devastating.

It can, so long as there is credit expansion to support it. This is not a housing crises, this is a we are addicted to debt crises.

People still use all those services when house prices are static or falling don't they?

Try again. Repeat after me: Housing is a product. A house does not produce anything

15% GST on a new build, council levies? Gov needs new builds to.clip.the gst ticket. Keep letting those immigrants in.....I'd be super surprised if Labour curtail this when borders reopen

It's a good point, gst revenue from new build housing must be huge.

You're talking about the construction industry. Selling the same houses back and forward to each other six times in five years doesn't do any of that.

This comment defies reality. Do you believe the last quarters GDP results are somehow the result of the upcoming announcement from Labour around housing affordability? Or do you think the housing market has been "killed" over the last quarter? You know the quarter when RBNZ removed lending restrictions, dropped rates, and dumped billions of additional lending into our housing sector.

Surely this comment is some sort of parody that has gone right over my head. But the fact you often spout complete nonsense makes me concerned it was said in earnest.

CWBW...posting links to your own previous comments that nobody liked or agreed with?

Seems entirely reasonable that with a shrinking economy that house prices will go up another 25% in the next 3-4 months. Globally a speculative mania with everyone taking a punt at every crazy idea is going on. Like 1987 in New Zealand and very close to 1929 in the US markets.

Pinkos are beyond help. Best to avoid getting infected with their mental disease. Now that's a vaccine that should be developed lol :)

Imagine if Grant Robertson commits to increasing subsidies to landlords next week. I'd laugh so hard as the Pinkos celebrate, as more of them would end up homeless as a result.

"Be kind" - kindness is NOT forcing people to be dependent on the state - that's called Being EVIL.

Y'all know the drill everyone. Revert to our core industry that is property.

Do your DIY renos, paint over parts showing water damage, and find a bigger sucker to sell onto.

Easy as 1-2-3.

a-b-c

You would like to think it would make those in charge step back and ask if setting the housing market on fire by fueling massive increase in speculative borrowing hasn't flowed through to the economy, maybe its not the best idea? But I'm not sure I expect that sort of introspection.

Yeah.

Helicopter money could have stimulated the economy without setting the housing market on fire....

Let's hear what our economic sage G Robertson has to say...expect more BS

Fritz...helicopter money would have been a lot better. The stimulus just flowed through to already wealthy people (as on paper gains) and the majority of them did not spend a cent more than they would have. Now if money (rather than on paper only gains) had been given to everyone (a good amount of) it would have flowed through the economy. When you give cash to people they spend it, especially those in the lower quartile.

Also would have been much fairer and not increased the wealth gap and the social divide. If you have property and/or shares (like me) every move this Govt has made has been a financial wet dream whereas if you are in the lower socio-economic group you (and future generations) have been sold down the river. The two best ways to ensure that our people in the lower quartile never have the opportunity to (financially) improve themselves is to keep house prices and rents rising and maintain our policy of mass "net negative" immigration. And yet many of the people this Govt are damaging so badly are its most ardent supporters.

Agreed Karl. Like the latest US stimulus package, ie US$1400 for any individual making less than US$75,000.

Ed..yeah it works. Hard to quantify but I reckon I personally made (on paper) 300 or 400K due to the stupid way it was done and my elderly and (reasonably) well off parents probably more. And I can tell you not one cent of it went back into the economy. But target the stimulus at low wage earners and they will spend the lot thus putting the money into circulation, which perversely was what the Govt said they were trying to do. I am sure it is not stupidity and that makes the govts crimes even worse.

Let me refinance my mortgage at the rate OCR rate for 10 years and I'll go out and spend like a wounded bull.

I mean I don't *have* to buy a new microwave oven, custom kitchen, refrigerator or new colour TV, but I'd be a hell of a lot more likely to do it if I could get a long-term fixed rate for less than a tenth of what I've got now.

And I've always wanted a National Style-O Resonator....

Don't you want your MTV.

With 10 year fixed mortgages at rates comparable to our current 5 year rates (2.99%) we would indeed be spending up large!

Part of the problem is that we love comparing ourselves to the Aussies and they can fix for 4 years at 1.89% so why fix now when you might be able to fix later and free up even more money once our rates close the gap a little!

RBNZ customer lending metrics last published 18th January for week ending 1st Jan. Due to the RBNZ hack there will not be another release until end of March. The 18th January release showed a steady increase in missed payments week to week over the the previous 5 months. All 3 sectors. Home loans,Consumer Loans and Business Loans. At the same time a continuation of loans being restructured to interest only. Assume those are the ones coming off full payment deferral. Coincidentally the end of March is when RBNZ understanding with trading banks over non preforming home loans will come to an end. Pump and dump.

People will be forced to sell. But at least with the increases of the past 6 months they may not be underwater

and the banks won't need to keep them on the hook for the balance of the mortgage.

https://www.rbnz.govt.nz/-/media/ReserveBank/Files/Statistics/tables/c6…

We are superb at sailing.

But our economy is f$%&ed.

And we have hopeless economic managers at the helm.

Just a 1% drop compared to this time last year is actually very impressive considering Covid.

It's the last 3 months I am focussing on, and looking forward. What's the plan?

"The latest drop means that, according to Stats NZ, GDP declined 2.9% over the year to December 2020, the largest annual fall ever in GDP for New Zealand - as a result of the lockdown."

The 2.9% included the big lockdown, of course that is going to show a big drop.

But if you compare this December quarter to the previous December it is only 1% drop. I would think tourism alone would account for that, my guess is we would have quite a lot of growth if the borders were open right now. And with the vaccine hopefully the next December quarter will include tourism.

Counter to that though, we've had a couple of new lockdowns in this quarter which will flow into the next lot of figures. March is a big month for a lot of people, if people are hesitant to spend it will case a few headaches.

People need to remember that a lot of hospo and retail businesses are on the edge. I suspect many people who comment here are white collar professionals, small business owners (outside hospo and retail) and investors, most of us are insulated from the carnage. It seems every week another well established restaurant or cafe closes down.

I reckon the only reason unemployment isn't rising a lot is because immigration is now low, and quite a few people working in those sectors were on visas and have left NZ.

Plus the numbers of new entrants at uni this year seem pumped up to compensate for lack of international students. That might also be a factor in keeping unemployment subdued.

When you really want to take the rates to negative...

So are we expecting an emergency OCR drop this week? Or at the next meeting?

It almost feels like one big conspiracy...

It probably is, just have to play along. When you are surrounded by crazy people best to pretend to be crazy so you don’t get hurt...

Yep.... the central bankers are acting as one led by the FED. Watch what they say and do. Steve Liesman was the only journalist to ask about fed control of the yield curve. JPowell shifted about a bit then spoke in a round about way but didn’t answer the question. Markets didn’t like that a 10yr bond spiked.

GDP low or negative, therefore keep interest rates low or lower.

mb..I think they will fight hard to keep rates low but I also think it is a fight they will end up losing in the end.

Not really, GDP is a factor, but not the only factor. You will need to look into consumer confidence, short term and long term bond yields etc.

Those recent talk about interest rates hike were a bit premature right. This is typical debt cycle, and unfortunately the debt have gone even higher. Soon we'll hear talks abt negative rates again, which will push asset prices even higher, and the poor more desperate... NOT sustainable!!!

(better) alternatives will have to be letting massive default happen or UBI, the latter is more humane~~

Interest rate hike, tapering of monetary and fiscal measures, not now or in near future as now economy will blackmail both Jacinda Arden and Mr Orr to support and throw money or economy will screw.

So chill as both Jacinda and Mr Orr has more to lose than individual so both will do anything and everything to support - will act fast and will act hard, if it comes to supporting the ponzi.

NZ Labour Party - Let's keep Moving

AND PEOPLE THOUGH THAT COMPASSIONATE JACINDA WAS REFERING ALL BUT WAS ACTUALLY REFFERING TO SO CALLED INVESTORS - SPECULATORS FOR HOUSE PRICE - Lets Keep Moving

Government will ignore this, they have more pressing issues like celebrating the Americas Cup, why worry about this and housing, print some more $ and party time.

Labour's getting Lion King here, let the good times roll & don't complain...

They're all over everything but what they should actually be doing

As with stick market, investors over leveraged will end up facing margin calls. Will then have to offload some houses. Market will get flooded. Will be too many sales for buyers. Plus investors bought high and are stuck with an asset whose equity will fall. When stock holders have to sell to pay more interest in more risky debt, then price of asset sold drops further. Then it’s deleveraging time. But this won’t happen in no housing of course. Rbnz will fell justified printing more for now. Bond market will want its pound of flesh

Watch this space

The market wants what it wants. If RB use their last bit of ammo there's nothing left for them to do anymore. Will get interesting

No mention on today’s noon news about this, but hey! We have the boat race and Covid to report.

Trans tasman bubble seems to be the PR story of the day from Labour, nice way to distract the masses.

We all know the 2-way bubble wont happen anytime soon.

yea but no one buys it when the Cook Islands anymore so we're hearing about this one instead.

nifty... what comes first, a million NZers fully vaccinated or TT bubble? We might not have either before the end of July!

Easily the travel bubble. They'll be lucky to even get 1 million people wanting to take the vaccine by the end of the year.

This weaker than expected Q4 GDP will give more fuel for A Orr's dovish stance. No doubt he will state "we need to keep monetary policies accommodative to help with weak GDP figures"

He has to maintain his importance relevant

"Recession"is still a much dreaded word but in today's world when Reserve Banks can simply print endless amounts of money, a "recession" is becoming meaningless measure

Really good article explaining how central banks exacerbate inequality and disparate economic situations between different parts of the economy, then how their tightening policies have to cannibalize and eat their previous loose policies to favour real wealth generators, not fake pumped up asset wealth.

Really good article explaining how central banks exacerbate inequality and disparate economic situations between different parts of the economy, then how their tightening policies have to cannibalize and eat their previous loose policies to favour real wealth generators, not fake pumped up asset wealth.

Oh no, not a good time to buy that property... job loses on the horizon

Even better, employment is a Reserve Bank target. They can use their preferred precision instrument of credit creation, carpet bombing the economy with another round of QE.

A weaker economy raises all asset prices!

Gross Demestic Product (GDP) isn't that meaningful to New Zealand at the moment. Most per-capita wealth is being gained from revaluing assets and not productive enterprise.

My other point would be that GDP is only a useful measure on a per-capita basis.

Double Dip Recession.....

Attend house auction and see what reserve bank and government can do even in double dip recession.

Double Dip Recession?????

Quick, slash interest rates and send them deeply negative!!!!!

Central Bank policies are the equivalent of driving your car deep into a swamp, then sitting there madly revving the engine and spinning the tyres.

Someone needs to explain inflation to me because it totally depends on your situation in life as to how it affects you personally. For starters if your a home owner with no mortgage like me, then inflation is low in single digits, however if your a FHB saving for a house then inflation is currently running at like triple digits because in a couple of months house prices went up more than you earn in a whole year !!!! How on earth can that be considered 2 or 3 % inflation ? Food prices alone have moved more than that and petrol prices have cranked up in the last couple of weeks, will Auckland see $3 a litre for 98 by Christmas ? I think so.

They say it’s because your house is an asset.

Standard coffee $4.50 min at my local now. Also a small takeaway salad cup size... $10!!! Bugger that for a few lettuce leaves. That's inflation in my books.

And people are still willing to pay for them! KFC put up the price but the queue is getting longer at the drive thru!

Nah, that's just KFC's usual utterly abysmal customer service.

A cheap Asian feed was $11 - $12 just 2-3 years ago, more like $15-16 now.

Thats what I wondered. If basic living costs are going up while the value of money remains constant, its the same as saying the value of money is dropping while living costs remain constant. I mean how else are they calculating inflation?

Naa, another bull sheep news, scare mongering as usual. wait until the next Q1 of 2021, some banks already snapped up those FLP, all in the name soon to be distributed direct into GDP report (yes, of course in form of further housing inflation/aka activities) - Housing, is the critical factor reporting of F.I.RE economy, hence being hide from the inflation but it's clearly from JK time, it has been stated brilliantly the correlation between surging of Housing cost, this will in turn pulling up the GDP index.. so wait and see my bet? Q1 2021 GDP is (hmm..down 1, down1, down1).. FLP concert..open border with OZ.. hmn I take 4 up (1up, 3recoup the miss).

To achieve that, as per banks predict/requested by 'guesstimate' by mid/Q2 then Q3 the housing cost should increase by 25% then 35%.

The pandemic black swan (BS) event arrived one year ago and everybody went crazy that the economy would go tits up... but then we found out she gave birth to a chick which turned out to be a golden swan. What did we learn.... some people got the BS while many others got golden times

And what does history tell us about divisions in society when there are high levels of debt?

It doesn’t end well.... but again, most won’t see it until it’s too late.

An emergency cut to the OCR is required because apparently low rates means high growth and high rates means low growth. But the data of the last 70 years suggests otherwise.

Brings a whole new meaning to the term “Extend and Pretend”.

.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.