By Roger J Kerr

The dramatic (and largely unexpected) increase in US long-term interest rates from 1.70% in 10-year Treasury Bonds before the Trump election win to a 2.35% yield today has caused panic and consternation in interest rate markets around the world.

It was a change in inflation expectations in the US from the Trump infrastructure asset rebuild programme that triggered the bond market upheaval.

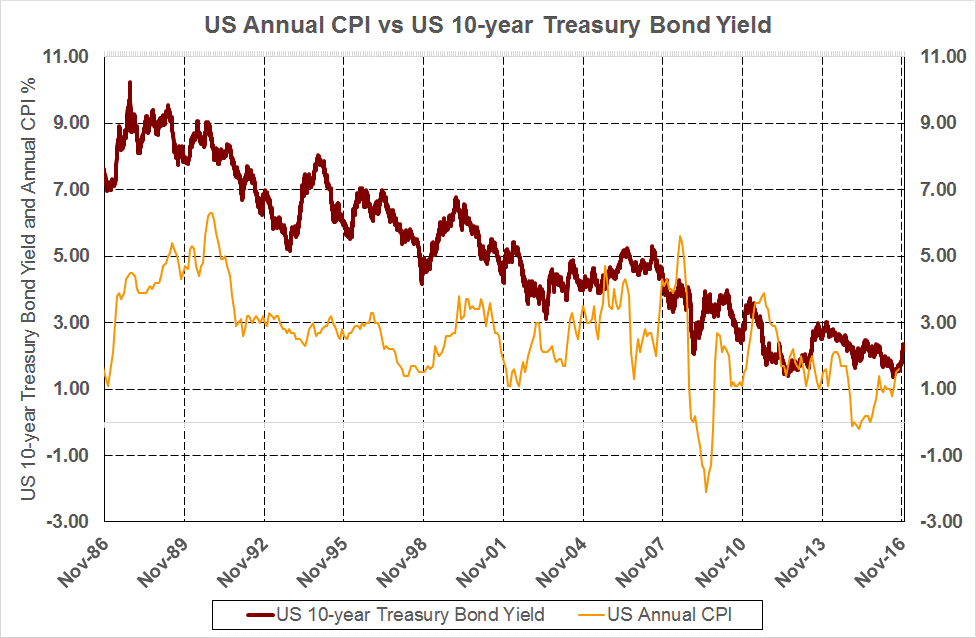

Therefore, looking ahead at potential movements in long term interest rates through 2017 and 2018, the margin that US Treasury Bond yields historically sit above their inflation rate may be a fair indicator of how high US, and thus NZ swap rates may move to.

Of course, the last seven years since the GFC in 2009 have been highly abnormal with unprecedented Quantitative Easing monetary policy settings in the US, Japan and Europe.

Global deflation caused by plummeting oil prices have also disrupted the normal relationship/correlations between inflation and related interest rate levels.

A return to US Treasury Bond yields trading at a yield above the US annual inflation rate would suggest that interest rates could still increase a lot further than the 0.65% lift to date (refer chart below).

Daily swap rates

Select chart tabs

Roger J Kerr contracts to PwC in the treasury advisory area. He specialises in fixed interest securities and is a commentator on economics and markets. More commentary and useful information on fixed interest investing can be found at rogeradvice.com

4 Comments

It looks like risk is just be more appropriately priced (not really it's still too low). I've been saying for at least a year that it's a great time to pay down mortgage debt, and it still is. The signs are still there to take advantage of these low rates for accelerating repayments on the basis that lending will get a lot more expensive over the next 5-10 years.

People who have bought houses at four percent yields should be feeling a bit worried.I wonder if rents will rise as rates go up.it's either that or start paying loads more to top them up or join the masses and sell up

They just put your rent up and your stuck between a rock and a hard place. Unless you own your own home your stuffed, rents will just rise to the point they cannot find a tenant and then drop back till they find someone who can pay it. We have had low interest rates for years and you can still lock in a low rate for years to come. It will be interesting because up until right now if you look back it was always a great time to buy a house.

I wouldn't be surprised to see 5 year mortgage interest rates between 6-7% in NZ within a year of two.

The thing is though most people in NZ only fix for a year or two so 4 and 5 year rates mean nothing to them.

It's likely the curve will continue to steepen as investors don't want to lock into long term given the uncertainty, meaning longer term rates must rise to attract funds away from shorter terms.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.