There's quite a bit happening in tech this week. Starting with Apple, there's new stuff coming up again. Let's park the Apple Intelligence which has started to arrive via software updates, for a proper test drive, and look at the hardware instead.

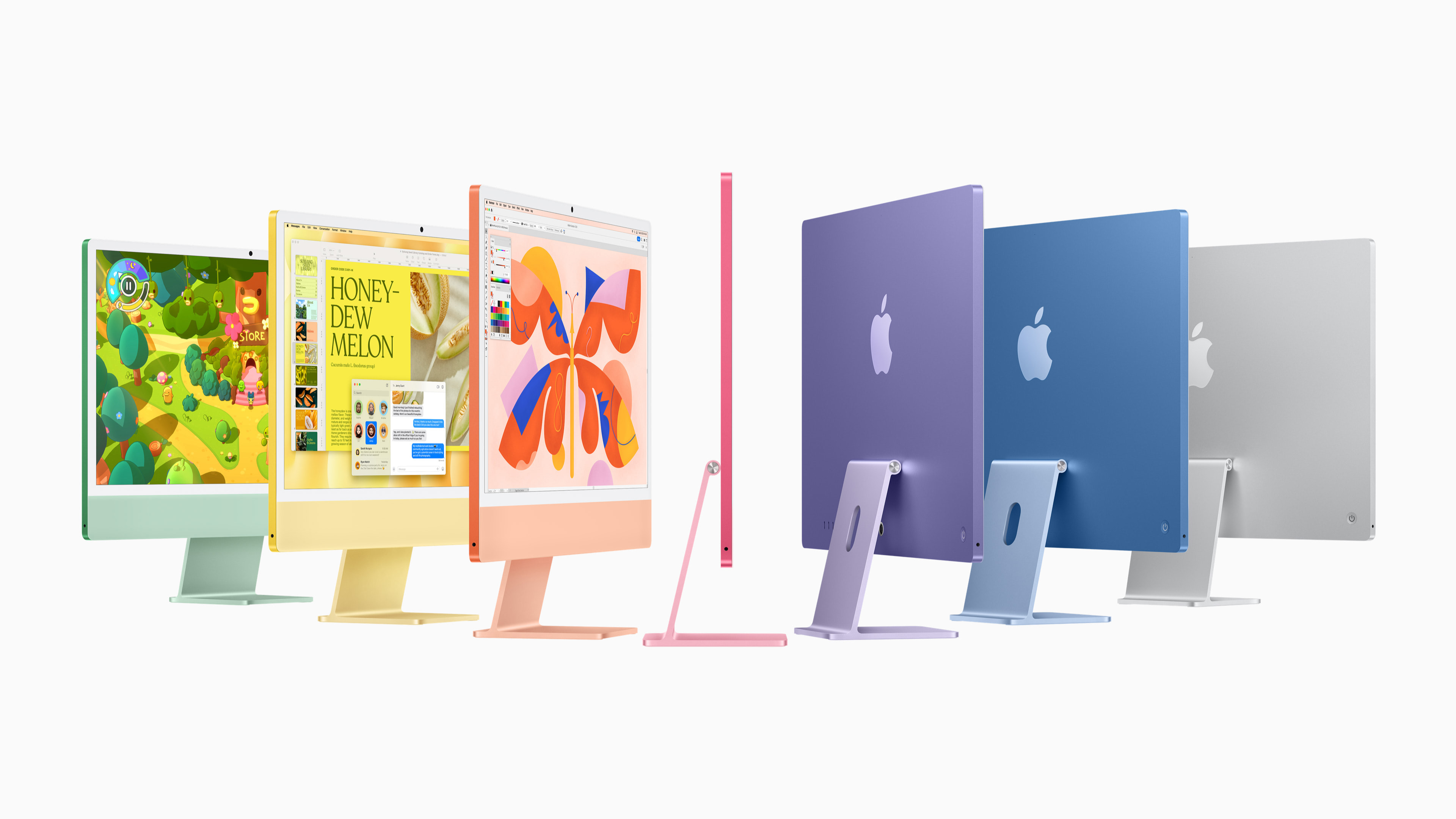

First, there's the iMac desktop with the upgraded M4 chipset which comes in seven colours, including green, yellow, orange, pink, purple, blue, and silver:

Pricing for the iMac M4 starts at $2499 including GST for 8-core processor, 8-core graphics and 16 gigabytes of memory. The 10-core CPU/GPU model with 16 GB of memory starts at $2899 and it gets pricier from there the more options you tick.

Apple's also released a new M4 version of its littlest Mac, the mini. The Mac mini starts at $1099 with 16 GB of memory. Maxing out the mini with 14-core CPU/20-core GPU M4 Pro (new chip!), 64 GB memory, and an 8 terabyte solid-state storage option plus 10 gigabit/second wired Ethernet will set you back $8374 including GST.

What has Apple users excited though isn't so much the uprated M4 chipsets or the pricing, but the placement of the power button on the mini:

See where it is, in the corner but at the bottom of the mini, and at the rear. OK, the Arm-based M4 is very energy efficient and will go to sleep deeply, using next to no power. Chances are you're not going to have to press that power button very often, but still.... was that the only place it could go?

Be careful out there: NZ cyber-spooks to startups

Our intelligence agencies have issued security advice to tech startups amidst a worsening threat landscape, with the help of their Five-Eyes partners in the United States, Australia, Canada, and United Kingdom.

There are bad threats out there stalking startups, particularly "foreign-state actors". You can fill in the blanks which nations that refers to.

The advice is jointly published by the Government Communications Security Bureau, and the New Zealand Security Intelligence Service, and provides the Five Principles of Secure Innovation:

- Know the threats – understand the potential vulnerabilities that might put your product or innovation at risk.

- Secure your business environment - create clear lines of ownership around the management of security risks in a business. Appoint a security lead at board level who factors in security considerations into decisions and initiatives.

- Secure your products - build security into the front end of your products by design. This will help protect your IP, make your products more marketable and ensure your products don’t become a supply chain vulnerability.

- Secure your partnerships - make sure the people you collaborate with are who they say they are and can be trusted with your company’s IP.

- Secure your growth - be aware of security risks as you expand, such as hiring new people into positions of trust and managing risk around entering new markets.

A read through of the PDF document (embedded below) suggests its good, common-sense advice.

It seems to have taken quite a while to come up with though as the announcement refers to an "unprecedented summit in Palo Alto, California" last October with the Five-Eyes heads for domestic security and intelligence agencies talking about the threats startups face and what to do about them.

The document is likely to be mandatory reading for startup founders from now on, as adherence to the now official Five Principles is likely to be a requirement by tech company investors.

Spark's 'financial performance falls short of what is acceptable'

The weak economy with consumers and businesses cutting down on spending is hurting everyone and everything at the moment. Telco Spark has issued share market guidance with lower results expected for the full 2025 financial year in just about every area of its business.

Spark expects lower earnings before tax by $45 million, in the $1120 to $1180 million range. The 75 per cent imputed dividend is down to 25 cents a share from 27.5 cps, and capital expenditure drops to $415 million to $435 million from $460 million to $480 million.

The chairman of Spark, Justin Smyth, said; "the board and management [of Spark] acknowledge that our current financial performance falls short of what is acceptable, and we understand the disappointment our shareholders will be feeling."

Inflation and interest rates heading downwards hasn't helped much for Spark which depends on its enterprise and government businesses doing well, particularly for IT services. Spark is now looking at selling off its remaining share holding in Connexa which was set up when the telco sold off its cell tower network assets to the Ontario Teachers' Pension Plan.

The Connexa share sale is listed under "review of non-core assets" up for divestment or partnering.

Potentially ominously for employees, Spark said it is on track to deliver its net labour cost reduction target of $50 million in-year.

Smyth said Spark is growing shareholder value through its data centre strategy. Data centre construction is a booming business around the world and has been so for the past few years, courtesy of the huge demand for artificial intelligence and cloud computing.

Commenting on the data centre business, Smyth said; "we recognise the need to secure alternative long-term funding options outside of free cash flow to support our development pipeline, and we are currently exploring capital partnerships to achieve this."

9 Comments

The issue with Spark is that there is no management. Management is not dysfunctional just totally absent. There is to much don't rock the boat / cover your arse mentality and not enough the emperor has no clothes. Over the last few years Spark has sold off non core assets (such as AAPT, Lightbox and Spark Sport). I am still questioning if Lightbox or Spark Sport made any money for the shareholders or were just vanity projects by the board. Selling the family silver is not the answer. Building the business is. Laying off staff is not the answer - this actually reflects poor management. Employee engagement is only 67% ( down 3% from FY23) and likely to have dropped since. Data centres are not the answer - there are many potential competitors in that market - some of whom have promised to build data centres in NZ with much bigger pockets. To my mind Spark have no vision ( it is curious that the announcement came just before the AGM on Friday).

Hahaha AAPT - good times eh……..

Re the power button - it’s like the cable connector on the mouse! Grade A CF!

The question that has to be asked is how come Infratil, who owns OneNZ, Spark's main rival, snapped up about a 48% share of the Canberra Data Centre a few years back for a song and has seen it increase in value by zillions since then? How come Infratil foresaw the potential value in CDC that blinkered Spark didn't?

OneNZ seems to have stolen a march on Spark even in mobile....they have certainly been advertising intensively and this creates the general impression that they are now the actual number one in broadband and mobile.

Isn't the Spark board and top management stacked with non-entrepreneurial types? I realize that this isn't the sole answer because in recent years the Fletcher Building board and top management was stacked with those who fancied themselves as entrepreneurial types but turned out to be downright duds and virtually destroyed what was once an excellent business.

I have a modest Spark shareholding (and a similar Fletcher Building holding) and I'm hoping some private equity outfit comes in and puts me out of my misery.

If anyone could point Spark in the right direction I would have thought that it could be someone like the author of this article. What say you Judah Saarinen?

I'm ready. 🙃

Firms like Fletcher's and Spark's destruction of shareholder value are good reasons to use overseas ETFs to escape the NZ stock market :-(

100%! (and Infratil...)

Assets 4.6 billion, liability 3 billion, why pay dividends rather than get rid of interest bearing debt

I'd take the loss and sell those shares

Why does spark need seek outside funding for data centre investment? Do you see Google paying out 75% of profits as dividends and then doing a capital raise to build a new data centre? No google has faith to invest it's own money on its own initiatives. It seems spark management doesn't have faith that spark management can deliver value, better to just people their money back.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.