Last week I joined Gareth Vaughan of interest.co.nz for a joint podcast with Andrew Coleman. He's a New Zealand economist who has worked in academia and for the government, including Reserve Bank, Treasury and the Productivity Commission. In the last few months, he’s written a 13 part series for Interest looking at how we currently fund New Zealand Superannuation and what alternatives we should be considering.

Why we’re talking about more tax – the rising cost of New Zealand Superannuation

As I've mentioned previously, part of what's driving the debate around whether New Zealand should have a capital gains tax is when you consider the government’s long term fiscal position the conclusion you reach is that something radical will have to happen: either benefits will have to be reduced significantly, or taxes will have to be increased. If we're increasing taxes, how are we going to go about that? That, by the way, is the subject of Inland Revenue’s long-term insights briefing consultation on which is going on at the moment.

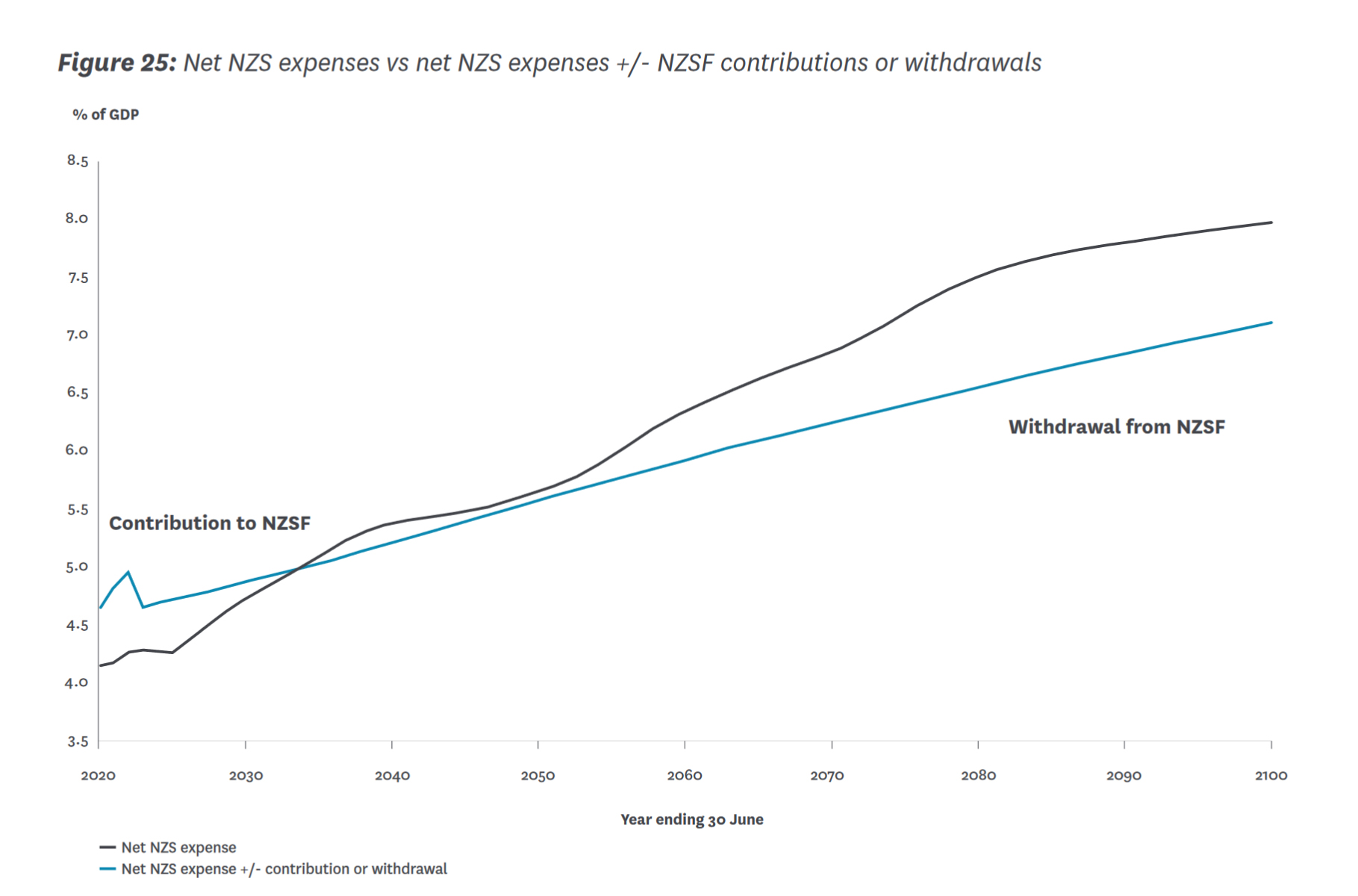

(He Tirohanga Mokopuna 2021, Treasury)

Coleman has written extensively about the issue of funding New Zealand Superannuation and in the podcast he went through the issues behind why he wrote the series and what alternatives he proposes. It was very informative, and I highly recommend listening to the full podcast. Here are a few key takeaways.

New Zealand’s unique approach to funding superannuation

Firstly, the way New Zealand currently funds New Zealand Superannuation is very unique in that it is entirely funded out of current taxation. That means the current cost of New Zealand Superannuation, over $20 billion a year before tax, is being paid out of current taxation. This is unusual by world standards, because most other countries in the OECD adopt some form of Social Security tax to pay for their public superannuation. In Britain they have National Insurance Contributions, in America, they have Social Security. Throughout most of the EU you will see Social Security taxes in place. Apart from us, only Denmark in the OECD has no Social Security taxes. Other countries use social security taxes to pre-fund superannuation; people pay social security taxes which are then drawn down when they reach retirement age. We fund everything out of current taxation.

Allied to that, and a matter that makes our tax system unique, is that most other jurisdictions operate what's called an exempt, exempt tax (EET) approach to private retirement savings. That is a person gets some form of tax deduction for making a contribution to a private superannuation savings scheme. The superannuation schemes are not taxed, but when you withdraw funds on retirement age you pay tax at that point. On the other hand, since 1989 we have adopted the complete opposite approach (TTE). We don't give a deduction for contributions to superannuation schemes such as Kiwisaver, which are subject to the ordinary rules. However, withdrawals are tax exempt.

Point of order Prime Minister…

Just as an aside, I note that one of the Prime Minister’s comebacks to questions around capital gains tax was that if introduced it would apply to KiwiSaver. (Actually, when the last Tax Working Group proposed a CGT, they didn’t actually seem to think to go there). The PM’s comment glossed over the fact that KiwiSaver funds are subject to tax. If they've invested in bonds, these are subject to the foreign financial arrangement regime. If they've invested in overseas stocks, those are taxed under the Foreign Investment Fund which because the 5% fair dividend rate automatically applies, is a quasi-wealth tax.

Time for social security taxes?

That point of order aside, Coleman’s key point remains that our treatment of private superannuation schemes and funding of public superannuation is quite unique by world standards. So how are we going to meet the growing cost of superannuation? He suggested that maybe we should look seriously at Social Security taxes.

A Capital Gains Tax won’t be enough

Gareth and I raised the question of alternative taxes, such as a capital gains tax and Coleman made the point that the likely cost of New Zealand Superannuation scheme is going to rise towards somewhere around 8-9% of GDP. Hence the need to be thinking about how to fund that cost. Capital gains taxes don't generally raise that much, typically, somewhere between one and two percent of GDP. That still leaves a funding gap of between 6-8 percent of GDP. It's very doubtful a wealth tax, by the way, would make that gap up. In his view, the inexorable conclusion is that Social Security taxes are going to be needed to fill the gap.

How the 1989 changes helped distort the housing market

We also had a very interesting discussion about how the changes in 1989, which by removing the incentives for private savings, drove investment into residential property. He published his research on the matter in 2017, just at the same time that myself and the Honourable Deborah Russell, published Tax and Fairness. Separately we had reached the same conclusion, that the 1989 changes to the savings regime had driven people to start over-investing in housing.

Time for KiwiSaver 2.1

Coleman calls his answer to funding New Zealand Superannuation KiwiSaver 2.1 It would be a compulsory savings regime, but it would be for younger taxpayers, basically those under the age of 40 who were not old enough to vote back in 1997, when a referendum on a question of a compulsory superannuation savings scheme was overwhelmingly rejected.

Coleman’s argument is that younger taxpayers are currently funding what they want and need, such as health, education and transport. But they're also having to fund the superannuation of older taxpayers, who voted for the current system which benefits them. KiwiSaver 2.1 as a compulsory superannuation savings scheme would be a transition to a fairer system which would include some form of social security tax. The idea would be to be gradually building up savings in a similar way to Australia, which, although it doesn't have significant social security taxes, does have a compulsory savings scheme. There would be this transitional period, as the older workforce aged out, but all new younger workers would be part of the new KiwiSaver 2.1.

Taxing older, wealthier superannuitants

As part of the transition Coleman sees it requiring more taxes from older persons, which is where our discussion got to talking about capital gains taxes and wealth taxes. He's not a particularly big fan of wealth taxes. But he sees a capital gains tax having an efficiency aspect to it, which means it should be part of the tax system.

Incidentally, one suggestion I have seen about taxing superannuitants involves applying a separate tax rate to persons receiving New Zealand Superannuation. This would be a way of clawing back payments from those who have other means without going down the route of the deeply unpopular means testing that happened in the early 1990s.

I thoroughly recommend listening to the podcast. Coleman’s analysis highlights the need to keep in context why we're having this discussion about capital gains and wealth taxes and that's to do with everyone realising that we have to address the rising cost of funding New Zealand Superannuation and related healthcare costs for the elderly. These issues are not going to go away because the demographics are inexorable, contrary to what politicians might hope as they repeatedly kick the can down the road.

Tax deduction notices

Moving on, Inland Revenue makes great use of tax deduction notices as a debt collection tool. These enable it to require a third party to make deductions from payments due to a taxpayer with an outstanding tax liability. The power is contained in section 157 of the Tax Administration Act 1994, or related provisions of the Child Support and Student Loans Acts. I once saw a notice where a supplier to someone with tax debt was told to withhold 100% of any payment that was going to be made to the person in default.

Inland Revenue typically issues thousands of deduction notices each year.

| Deduction Notice issued to: |

FYE 30 June 2020 |

FYE 30 June 2021 |

Total |

| Bank | 5,222 | 7,388 | 12,610 |

| Employer | 21,333 | 43,535 | 64,868 |

| Total | 26,555 | 50,923 | 77,479 |

(Figures obtained under the Official Information Act)

Inland Revenue has just issued a draft standard practice statement providing guidance on how it would use these notices.

I think it's appropriate Inland Revenue has the power to issue deduction notices. My concern, however, is I've seen them issued for under $1,000 of tax debt which in my view is an inappropriate use for what is a fairly small sum of tax debt under $1,000. When a deduction notice is issued to an employer in such circumstances this essentially notifies the employer that the relevant employee is behind on their taxes.

Are these notices breaches of privacy?

In my view, a deduction notice in this situation represents a breach of privacy and employers really do not need to know about relatively small sums of tax debt owed by an employee. Instead, and I will propose this in my submission on the draft, I believe Inland Revenue should make greater use of tailored tax codes to collect the unpaid tax from an employee. The employer still has the responsibility for deducting the tax through PAYE but now all they know is the tax code has changed. They don't know the reasons why. This preserves the privacy of the person who has been the subject of the tax deduction.

I think this is important. I discussed this issue with a previous Privacy Commissioner, and he was of the view that, yes, it seemed like a breach of privacy. But as he noted, he couldn't really do much about it because Inland Revenue had the legislative power to issue the notices. Still just because Inland Revenue can doesn't mean it should, and I think there are opportunities for improving matters. Looking at the UK, it’s common practice for HM Revenue & Customs to use adjusted PAYE codes to collect arrears of tax. Submissions are open until 15th November.

How many anonymous tip-offs does Inland Revenue typically receive each year?

Across the ditch the Australian Tax Office (ATO) revealed this week that in the past five years it has received over 250,000 tip offs about potential tax evasion. According to ATO assistant commissioner Tony Golding "We get on average over 3500 tip-offs a month from people who know or suspect tax evasion or shadow economy behaviour.” The ATO believes there is about A$16 billion in stolen, unpaid tax each year.

By comparison, according to Inland Revenue it receives about 7,000 anonymous tip-offs each year. These are important sources of information even if sometimes the tip-offs are malicious and stem from toxic relationship or business breakdowns or partnership breakdowns. Regardless of this issue Inland Revenue will follow up (the ATO says 90% of tip-offs lead to further investigation.

How many audits is Inland Revenue undertaking?

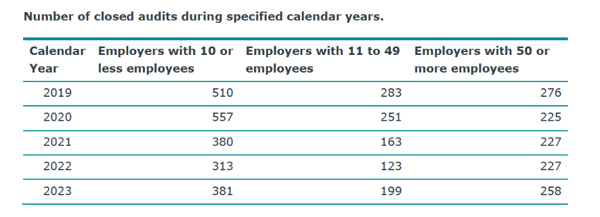

On the issue of audits and my thanks to regular listener and reader, Robyn Walker of Deloitte for reminding me, Inland Revenue publishes Official Information Act responses and there are often some very interesting releases. One of the latest OIAs relates to the number of audit cases carried out on businesses between 2019 and 2023.

It’s interesting to see the impact of Covid and the quite marked drop-off in audits for those employing fewer than 50 employees.

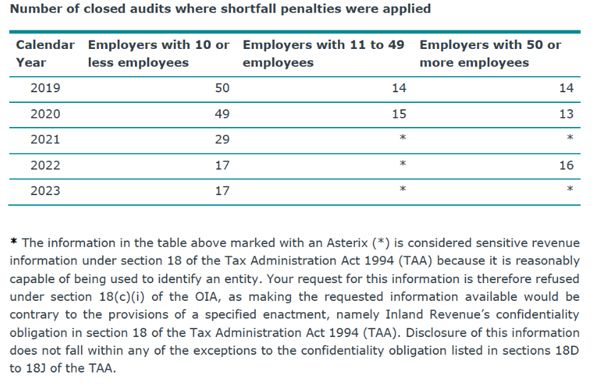

There's also data on the number of shortfall penalties applied as a result of audit. Now shortfall penalties enable Inland Revenue to impose penalties of up to 150% of the tax involved where tax evasion has happened although the more common range of penalties is 20%. Again, the somewhat sparse data makes for interesting reading.

That's all for this week. Next week, we'll be taking a deep dive into Inland Revenue with a look at its annual report.

Until then, I’m Terry Baucher and you can find this podcast on my website www.baucher.tax or wherever you get your podcasts. Thank you for listening and please send me your feedback and tell your friends and clients. Until next time, kia pai to rā. Have a great day.

27 Comments

a) raise the age of super (pension) eligibility to 67 like it is in Australia. Then tie it to life expectancy. It can stay at 65 on medical grounds.

b) add comprehensive CGT + gift tax + inheritance / estate tax. All forms of income need to be captured in an equitable tax system that levels the playing field.

c) if we are still short of funds then move to income or asset testing the NZ pension (super). The Australian pension is asset tested.

d) the above should provide enough liquidity for social security taxes to be implemented.

Yes to capital gains tax and inheritance tax (and because of inheritance tax, inevitably gift tax and busting open family trusts and closely held companies).

But no, don't raise the eligibility age for New Zealand Superannuation from 65: because the people who are most likely to need NZ Super at 65 are those who are most likely to already be broken and impoverished by 65, or even 55, after a life of physically difficult low-paying jobs.

Keep the age at 65, but put everyone who signs up for NZ Super on a special tax rate that will discourage those who have significant income from other sources from applying for it.

https://www.auckland.ac.nz/assets/business/about/our-research/research-…

Why should the government get it's hands on intergenerational wealth? We should be encouraging that. Nz didn't even have a CGT unlike almost every other country. IMO they should have a CGT but exclude Kiwisaver from it. It would make Kiwisaver far more attractive.

Time to admit that we've given up on any pretense of equality of opportunity? Personally I'd love to see each generation start from a level playing field and achieve according to their merits, rather than the children of wealthy parents starting with a virtually unassailable head start.

Wellingtoninvestor,

Why should the government get it's hands on intergenerational wealth? Let me turn that question round and ask why not? I regularly dealt with IT for clients in the UK and while nobody was eager to pay it, the tax was generally accepted as part of a system that raised money from both income and capital. I see no reason why wealth should just be passed to succeeding generations intact, though I very much doubt if we will see one here.

How about a limited inheritance tax, designed to claw back superannuation payments received? Maybe easier than asset testing super payments.

So in other words, a tax on being alive?

No, more or less the opposite. Society will provide for you in comfort during your retirement, but if you die with significant assets we use them to repay that societal generosity rather than immediately showering the next generation in unearned income.

Not the deal I'm contributing to the current super recipients on, so no thanks.

And if the next generation hasn't done anything to do it, given we're already giving super on a non-tested basis, then the government is doing even less to justify dipping into people's accumulated family possessions.

This only stacks up from a logic perspective if your default presumption is that all property inherrently belongs to the state, which is a terrifying prospect.

There's no need to have that default presumption. The difference is - I look at my parents and house and believe it belongs to them. You apparently look at your parents house and believe it belongs to you.

If I inherit a share of my parents house, that is completely unearned income and I see no reason why I wouldn't pay tax on that. In fact, I probably will as they are in the UK.

Well, their house was once my home. And I have little interest in it from a monetary perspective. I would love to raise my family there.

The state, however, has no such ties to my parent's house. So why should they be able to insert themselves into the equation?

Other countries allow for this roll-over relief if you move into a family home within a certain timeframe of inherting it. We never hear about this kind of nuance in this debate; nor the thresholds for inheritance taxes in other jurisdictions. The tax debate in NZ is always framed in a way that is about rinsing as many Kiwis for as much as possible, with ill-defined political sops like 'fairness' or 'unearned income' being thrown around as if it heads off any criticism or scrutiny, or even attempts to put things like estate/gifting taxes in some sort of international contexts other than "BUT OTHER COUNTRIES HAVE THEM AND WE SHOULD TOO!!!!!".

The wealth is still being passed on, the person receiving it will just be paying "income tax" on currently untaxed income.

To be honest, I think we should frame it as "comprehensive income tax" rather than CGT, and then include capital gains, inheritance, gifts in it. You get income, you pay tax on it.

Yes to capital gains tax and inheritance tax (and because of inheritance tax, inevitably gift tax and busting open family trusts and closely held companies).

But no, don't raise the eligibility age for New Zealand Superannuation from 65: because the people who are most likely to need NZ Super at 65 are those who are most likely to already be broken and impoverished by 65, or even 55, after a life of physically difficult low-paying jobs.

Keep the age at 65, but put everyone who signs up for NZ Super on a special tax rate that will discourage those who have significant income from other sources from applying for it.

https://www.auckland.ac.nz/assets/business/about/our-research/research-…

No. The deal is that I have paid taxes to help others draw down on Super with the understanding I will get it.

If I'm not going to get it, then I don't want to contribute to anyone else getting it.

This is the entire social contract that underpins super. I am halfway through my career, I cannot pivot to save enough as well as pay down my mortgage before I will need to retire, or I die, whichever comes first, in addition to my current burden of taxation. Even less so if the government is going to clip the ticket on inherited anything, given I will have to free-up additional funds if I want the pleasure of being able to retain my family's property that was purchased with already-taxed earnings in the event my parents pass away.

With those audits undertaken numbers, it's not hard to see why a small business would spin the wheel.

Always enjoy Terry's articles. Two points of order.

1. The rush of money into housing (and out into the economy) started around the same time in UK, NZ, Canada, etc (1989/90). The main driver was the 'liberalisation' of the banks, which caused a rush of lending on housing. It was credit driven, although obviously once the housing market took off, our tax settings catalysed the ponzi.

2. The challenge of meeting the needs of older people in the future is not a financial challenge. In a few decades time, we will need more nurses and care workers, more medical machines, more accessible public transport. That means we will have fewer people and resources to do other things. As an economy we will need to spend more of our 'real resources' on care. That will require us to use tax and other policy settings in the future to free up those resources - fewer people selling us crap we don't need in Briscoes, more people working in care homes.

Saving up bonds and other financial assets for the future sounds like a splendid idea, but it's misguided - it won't change our population makeup or magic up doctors and nurses. We would be better off investing in the infra and change we need now.

More people doing care work. I can just remember the 1950s in a small town and most women were married and hd children and were full time caring for their husbands and children. So in the past caring occupied almost half the adults of working age.- the big difference being 7 day week and all waking hours.

Yea, unpaid care runs the country, which is all fine if a single earner can pay the bills (that should be our economic target)

Jfoe,

I always enjoy your posts, but please, hands off Briscoes. May other shops are guilty of "selling us crap we don't need" but Briscoes is different. Why? I have shares in them and have enjoyed a very decent return on my money. Joking aside, the company has no debt and pays a good dividend.

Damn, I should have remembered your fondness for Briscoes and gone for beds and broomsticks (or whatever they're called)

fewer people selling us crap we don't need

Thank you for highlighting that there is an alternative to importing people, redeploying people away from unproductive jobs that have come about because someone decided to make life more complex than it needs to be.

Banks must pinch themselves to make sure they aren't dreaming every day. They've managed to enslave half the population in this country at one time or another with their credit creation - and there is a line of wannabe slaves knocking at the door each morning! Life is good.

Still baffles me why the economic/tax commentators do not seriously include UBI in current tax discussions.

They just seem to play around the edges, floundering around with suggestions that are already in place elsewhere and not working particularly well.

Time to innovate, do something different, lead the World.

Yes, it's a wonder the UBI we already have (super) hasn't been discarded due to poor efficacy...

KiwiSaver 2.1 It would be a compulsory savings regime,

all very good to have a saving scheme, though problem No1: Not everyone works during their working age period, so some of the population will not have any savings. Problem No2, for some workers who are on lower income, their retirement savings will be very little, so little that's not enough for retirement.

So in this new system, the states will have to step in to rescue, and a liability paid by all tax payers.

then the real question: where is the benefit of the Kiwisaver 2.1 for young people, who will need to fund other people's retirement anyways?

-------

Also I've said it before, Colman's argument around fairness does not stand. if young people's tax paying for older generations retirement is not fair, therefore young people should refuse to pay for it so that it's fair. this logic does not stand. because if it does, why does single person pay tax to raise other people's children, or why working people to fund unemployment benefits? you see where the holes are? People pay taxes are never meant to get exact same dollars they paid into. Taxes are a government to take part of the GDP to run a country, that's it. and a state funded retirement scheme is to maintain social welfare so that we don't end up poor retirees coming robbing us with gun and masks.

if we really want to be fair, we should focus on let the super rich paying a fair share, not those poor retirees, who're mostly in basic living anyways.

Blah, blah, blah...

Reality: Half of all voters are aged 50+ and that's going up by 1% a year.

Super 2.0 etc. is never going to happen.

NZ super currently costs 5% of GDP and will peak at 8%.

France, Italy, and Spain all spend over 10% right now and nothing's blown up.

P.S. Why doesn't the expenditure as % of GDP start falling in the chart above as the baby bubble moves through?

The political class always demands more, more, more.

How about eliminating the BS spending first?

NZ Super costs $23 billion at present.

Let's save taxpayers from the rapacious bureaucrats starting with the culture ministries.

Eliminate:

- Sport $163 million - pay for your own recreation

- Women $13 million - so tiny it's pointless

- Pacific Peoples $116 million - ask a random PI woman to point out a single personal benefit

- Arts, Culture, Heritage $537 million - want to ponce around at the orchestra or gallery - pony up.

- Maori Development $692 million - many maori are quite capable of developing themselves thank you

- Te Arawhiti $472 million - as above, maori are just as capable as all other NZers, no need for special "relations"

There's $2 billion saved just like that or 10% of NZ Super.

Now let's go after more useless spending

Science, Innovation, and Technology $4,419 million - the state is "innovative" [eye roll emoji].

Let's cut that in half, freeing up $2,210 million

Environment $3,270 million - err, so giving more money to the political class will stop global climate change???

Let's have half of that as well, reducing spending by $1,635 million

After 30 minutes extraordinary graft we have saved

$1,993 million

$2,210 million

$1,635 million

That's $5,838 million savings for taxpayers or one quarter of the cost of NZ Super.

How easy, and nobody will notice other than the employees released from the wealth-destroying public sector to be employed [perhaps] in the wealth-creating productive private sector.

Face it, the Kiwisaver system isn't working if we were honest, esp because so many don't contribute so get zero super contributed (every worker should get 3% (every worker gets a compulsory super contribution in Aus))

Want another $500k in retirement - shift to Australia

NZ System = reitre on $350k

Austrailian = retire on $850k

(approx figures aboave based on 3% employee and 3% employer contribution in NZ kiwisaver v 3% employee contribution and 11.5% contribution by employer being the current requirement, based on $80,000 earnings from age 20 to 65. See sorted.org.nz and play around and you'll see this is a good approximation)

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.