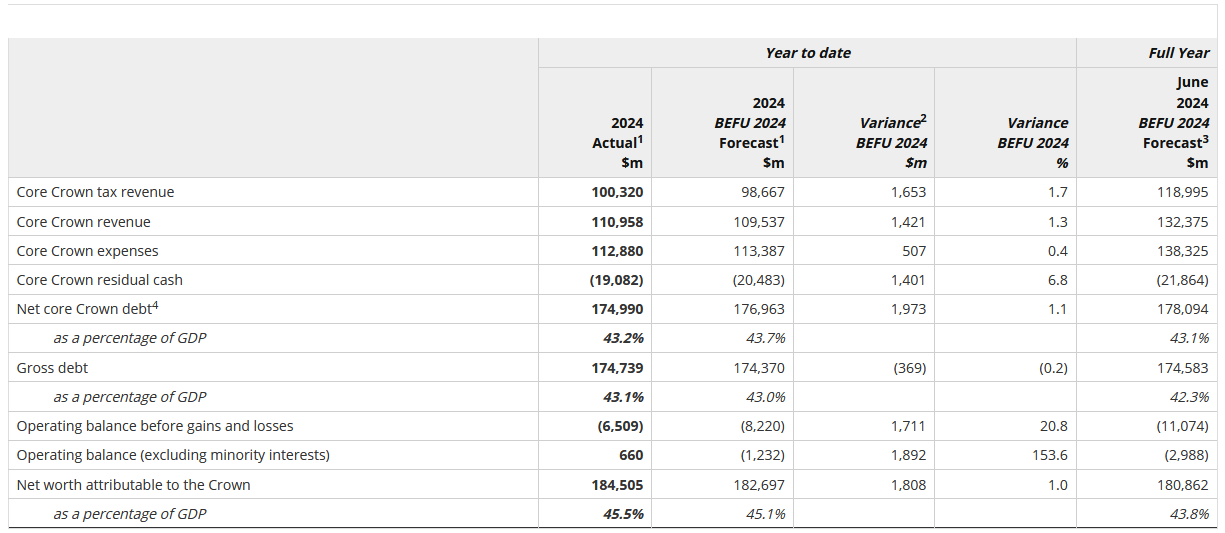

The Crown finances for the first 10 months of the 2024 financial year have come in some $1.7 billion better than was forecast just last week in the Budget - due to higher than expected tax revenues.

The interim financial statements of the Government to April 30, 2024 released by Treasury on Wednesday showed an operating balance before gains and losses (OBEGAL) deficit of $6.5 billion for the 10 months, which was $1.7 billion smaller than forecast in last Thursday's Budget.

According to Treasury the Budget Economic and Fiscal Update, which the latest interim accounts are compared against had its economic forecasts finalised on April 5, the tax revenue forecasts finalised on April 30 and the fiscal forecasts finalised on May 9.

And yet, there is a reasonable level of variance in the 10-month outcome when compared with those forecasts - variance that has come out favourably for the Government.

Treasury said core Crown tax revenue, at $100.3 billion, was $1.7 billion (1.7%) above forecast.

"This largely reflects higher-than-expected tax revenue from Portfolio Investment Entities (PIE) on the back of strong investment performance and RWT on dividends due to an uplift in dividend payments by Trusts ahead of the increase in their tax rates. Both of these variances are expected to persist until year end, however they are unlikely to impact into future years," Treasury said.

Core Crown revenue at $111.0 billion was $1.4 billion higher than forecast. Treasury said this was largely due to core Crown tax revenue, as stated above, but was slightly offset by lower-than-expected revenue from the Emissions Trading Scheme because of fewer units being surrendered and a drop in the price of New Zealand Units from the forecast price of $58.35 to $55.25.

Core Crown expenses at $112.9 billion was lower than forecast by $0.5 billion.

"Without the Treasury’s top-down adjustment and finance costs core Crown expenses would be $1.2 billion lower than forecasts, with the variance spread across a number of areas. The variance is expected to be mostly timing in nature," Treasury said.

Therefore the operating balance before gains and losses (OBEGAL) deficit of $6.5 billion was $1.7 billion smaller than forecast, with this variance mainly driven by the variances in core Crown revenue and expenses as discussed above.

"The operating balance surplus of $0.7 billion was $1.9 billion stronger than expected. The majority of this variance was due to the OBEGAL variance discussed above and favourable valuation movements," Treasury said.

"The core Crown residual cash deficit of $19.1 billion was lower than the forecast deficit by $1.4 billion. This was largely a result of net operating cash outflows being $0.9 billion lower than forecast (favourable), mainly because of stronger tax receipts for broadly similar reasons to the variance in core Crown tax revenue."

Net core Crown debt at $175.0 billion (43.2% of GDP) was below forecast by $2.0 billion. This favourable variance was largely driven by the residual cash deficit described above. Gross debt at $174.7 billion (43.1% of GDP) was broadly in line with forecast.

Net worth attributable to the Crown was $184.5 billion (45.5% of GDP) which was $1.8 billion higher than forecast. This was largely driven by the variance in the operating balance result described above.

9 Comments

Begs the question ... Was the government played by treasury? i.e. to keep the budget freebees to a minimum?

No. The pro "low tax" coalition of National, Act and NZ first decided the raise the trust tax rate from 33% to 39%. This makes the de-facto rate many SME's will pay in NZ 39%. Don't worry thought he large multinationals still pay zero & landlords get their reinstatement of interest deductibility. Any way this increase only came in on the 31st march 2024. So if you paid a dividend prior to this date you would only have to pay a 5% RWT not 11% you If you paid a dividend of 1 million on 31st March, RWT would be $50,000. On 1st of April it is $110,000.

So what happened? A lot of companies paid a dividend out before the increase....This is sort of a one off hit though. In fact I think RWT income will crash in the 2025 FY as companies won't want to pay 11% RWT or will at least hold off as long as possible.

Indeed.

My point was that Treasury should have factored this behavior into their estimates. Perhaps they did? Perhaps the effect was bigger than they expected?

Or were we played by the government?

Or is this government just as inept as the last one?

Great, that's $100m less interest payments on that debt - great news.

If only. Those interest payments are locked (bonded) in. It will reduce the need for future debt though.

It's crazy that the increase in DWT take wasn't forecast.

The exact same thing happened a couple of years ago when the individual top tax rate went up to 39% from 33%.

It is just a timing benefit though, those retained earnings would eventually need to be paid out as dividends at some point in time anyway. Now, they've just been shifted forward, so hopefully the forecasters will factor in lower DWT takes in future periods.

Maybe the staff member that usually checks this stuff was let go in a round of cost saving redundancies.

Were there any cuts at treasury?

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.