By David Skilling*

Farewell wolf warrior diplomacy?

A defining characteristic of Chinese foreign policy under President Xi has been its aggressive ‘wolf warrior diplomacy’. But there have been recent changes. There was a different Chinese tone at October’s G20 meeting in Bali.

And over the past week or so: lead wolf warrior Zhao Lijian, the MFA spokesman, was moved to a peripheral role – suggesting a change in approach; China’s Ambassador to Australia noted the potential to overcome obstacles in the relationship – including the lifting of sanctions on Australian exports; and the outgoing Chinese Ambassador to the US, and incoming Foreign Minister, said he was ‘deeply impressed’ by the American people. And China is stepping up engagement with Europe.

This may represent course correction, reflecting the need to strengthen the Chinese economy. The previous approach was clearly counter-productive; and China is facing a much more competitive environment. And it may be easier for Mr Xi to do this after the CPC meetings in October.

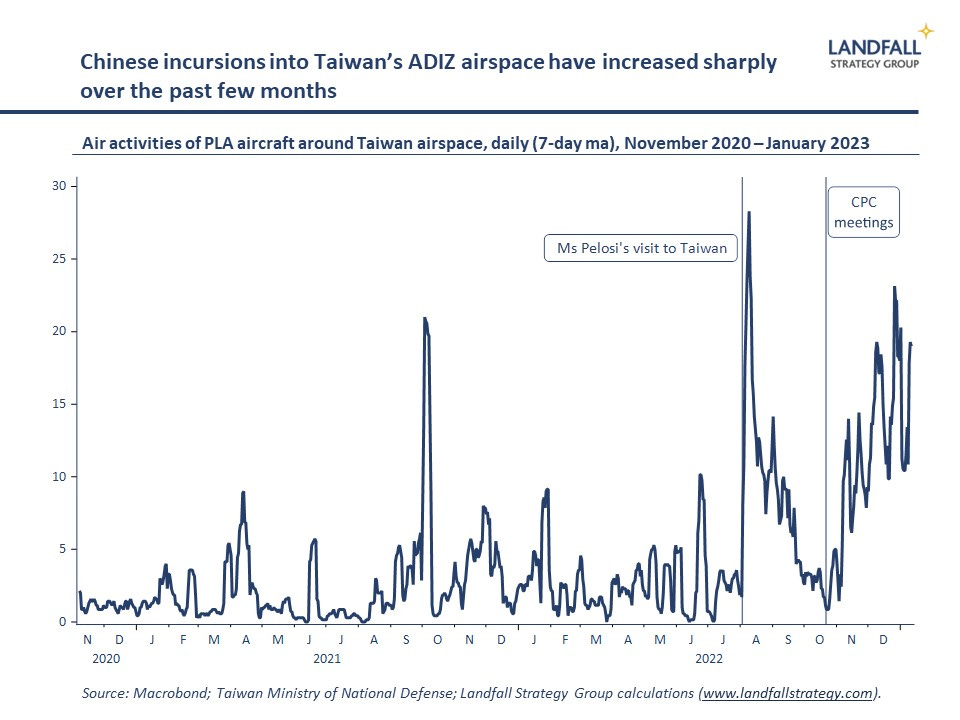

But the strategic logic behind US/China strategic competition remains intact. On this, I read ‘The Long Game’ by Rush Doshi over Christmas, which makes a persuasive case on the long-term game plan of the CCP. Indeed, China’s behaviour remains unchanged elsewhere: continuing incursions into Taiwan’s ADIZ; and imposing new restrictions on visas for Japanese and South Korea visitors to China.

Commodities make the world go around

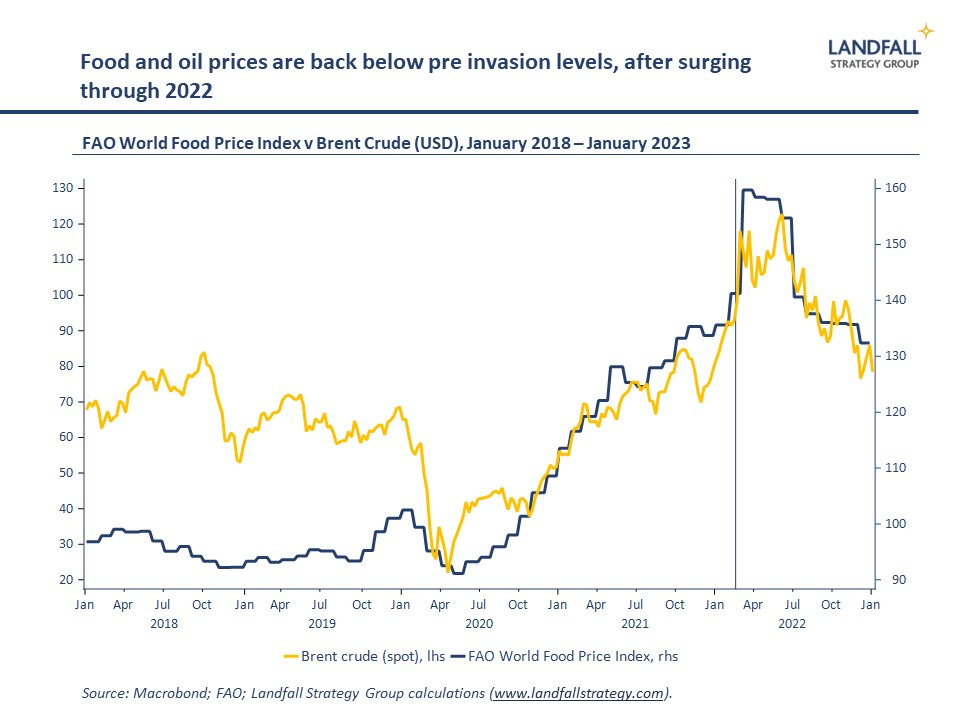

Despite headlines about technology breakthroughs, the world still runs on commodities – from energy to food and industrial metals. And recent developments in commodity prices and flows provide a useful gauge of global dynamics and relationships.

Commodity prices have been volatile over the past year, on the Russian invasion of Ukraine and economic uncertainty. But remarkably, the FAO world food price index is now below its pre-invasion levels after spiking higher in 2022; European gas prices have retreated on warm weather, efficiencies, and very high reserves (as I noted last week); and oil prices are roughly where they were a year ago.

But this volatility has left a mark. Commodity exporting countries, such as the Gulf states, have done very well with expanding current account balances – that are now being reinvested. And commodity importers, such as in Europe, have widening current account deficits – and have had to adjust their growth models (with success so far).

And the net zero transition will lead to further changes in the balance of power and trade relations. In general, renewable capacity will strengthen the energy independence of economies. And a new geography of energy flows is emerging. This week, for example, the CEO of Italian energy company Eni was the latest to note the potential for a north-south link connecting Africa’s renewable and hydrocarbon assets with the European market.

Slowing global flows

After a strong Covid recovery, growth in global trade flows is easing. Container shipping data to November shows that international movements are reducing, suggesting some further weakness ahead in world trade flows. Industrial production, which tends to be traded across borders, is also moderating around the world. And export growth from leading Asian economies – from Singapore to Taiwan and South Korea – that tend to lead global trade flows is now in negative territory.

As a consequence of this ‘demand destruction’, measures of global supply chain pressure are reducing. Many indexes of shipping container costs are back below pre-Covid levels. And congestion outside major ports has reduced markedly over the past several months. All of this will contribute to reduced inflation.

Looking forward, the big wildcard is China’s reopening. The removal of Covid restrictions in China may cause some further disruptions to global supply chains, to the extent that Covid-related sickness leads to problems with production and logistics in China (although so far, there is not much evidence for this). But the pent up consumer and industrial demand from China may lead to stronger trade flows and place some pressure on global supply chains and costs. We are already seeing Chinese tourists beginning to move, trade flows may follow.

Peak West and multipolarity

One of the regular themes in my small world notes is the emergence of a multipolar world. And across the West and beyond, we can see fluid, overlapping networks of countries developing.

The US has imposed sweeping restrictions on engagement and technology transfer with China on semiconductors, and is trying to bring key countries along. [For background on semiconductors, I’d recommend ‘Chip War’ by Chris Miller]. The Netherlands and Japan are moving towards the US position; Korea is reluctant to fully commit. But a fully united ‘Western’ response is unlikely because of differing economic interests (see my note on ‘Peak West?’).

More broadly, there is daylight between the US and Europe on a range of strategic economic issues. There is growing European pushback against the US Inflation Reduction Act that includes subsidies and local content requirements around green investment. German Chancellor Scholz was the latest to call for a European version to strengthen the competitiveness of European firms.

‘The US, our partner . . . they call our industry. And they tell them why are you investing in Europe? You should come over to the US. Calling German firms and Belgian firms in a very aggressive way — don’t invest in Europe, we have something better’, Belgium Prime Minister Alexander de Croo

Other groupings are emerging. At their end of year meeting in December, China and Russia agreed to work together to ‘actively advance BRICS membership expansion’ beyond Brazil, Russia, India, China, and South Africa. Saudi Arabia, Turkey, and Egypt are reportedly engaged in the membership process. Although not a fully coherent grouping, note that these countries abstained or voted against UN resolutions to condemn Russa.

Elsewhere, the Middle East/China energy relationship is developing. And Africa is being courted. The new Chinese Foreign Minister’s first trip this week was to five African countries; and US Treasury Secretary Janet Yellen is visiting South Africa, Zambia and Senegal next week.

Japan

Japan Prime Minister Fumio Kishida has been on the road this week, as well as other Japanese Ministers, across G7 capitals as part of preparations for hosting G7 meetings this year. Key announcements have included: a major defence agreement with the UK (note also Japan’s recent deal with the UK and Italy to jointly develop advanced fighter aircraft); enhanced cooperation with France; and strengthened military relations with the US. He is Washington today to meet with President Biden.

This is the latest chapter in Japan’s emergence as an active part of the security architecture across the Indo-Pacific: from membership of the Quad, to strengthened security relations with the US and Australia and others, and constitutional changes to allow it to take a more forceful military posture. It has taken a tough approach on Russia’s invasion of Ukraine; as well as on Taiwan.

‘Japan is stepping up big time and doing so in lock step with the United States, partners in the Indo-Pacific, and in Europe’, Jake Sullivan (US National Security Advisor)

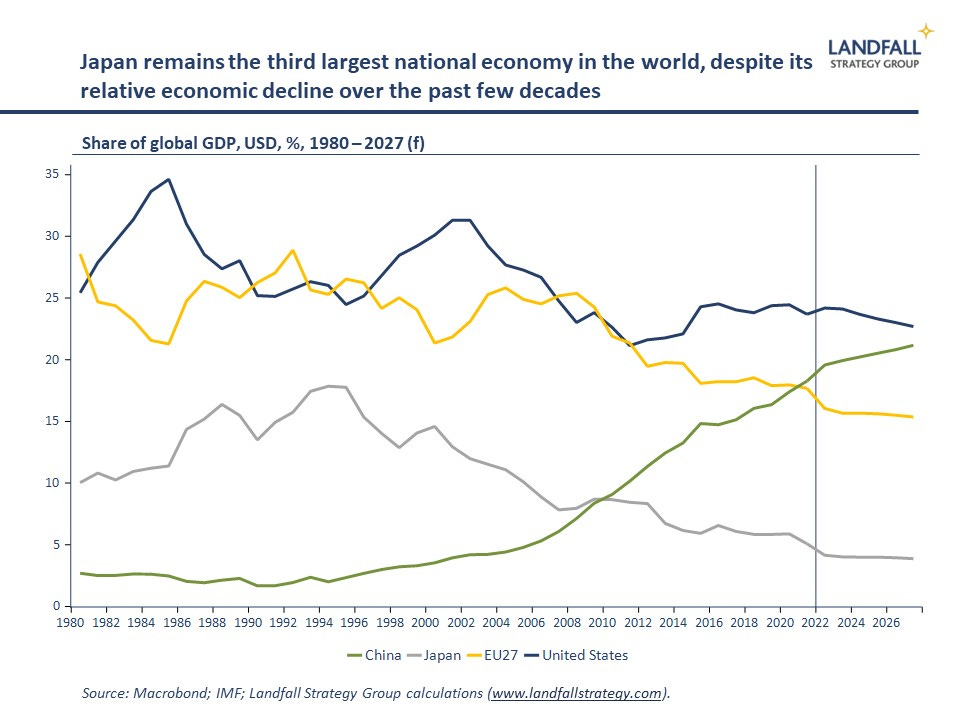

More broadly, Japan was instrumental in keeping the TPP alive after the US walked away. And it is part of all the major economic groupings in Asia (from RCEP to IPEF). Despite an aging population and weak headline GDP growth over the past few decades, Japan remains the 3rd largest national economy in the world – with leading technology positions in areas from robotics to semiconductors and hydrogen. Keep an eye on Japan as an increasingly indispensable country in the Indo-Pacific.

*David Skilling ((@dskilling) is director at economic advisory firm Landfall Strategy Group. The original is here. You can subscribe to receive David Skilling’s notes by email here.

**Get in touch (by reply email or at contact@landfallstrategy.com) if you would like to access the full paper referred to in the article above.

18 Comments

Back in the seventies it was often mentioned that Japan was playing a "long game" and would make a big power play again someday.

By the way "Japanese Ministers" is a grammatical error and should be Japanese ministers.

Don’t know that General MacArthur was as anywhere near as good as he thought he was but he was precognisant enough to visualise Japan’s future post WW2, as being vital to USA strategically,geographically, economically and set that play in motion. The soon after Korean war cemented that in. Now Japan is really rearming and more importantly altering its military footing from pure defence to include offensive capacity . Hard to do too much in the Sth China sea and surrounds, if Japan is alive and kicking.

Now Japan is really rearming and more importantly altering its military footing from pure defence to include offensive capacity . Hard to do too much in the Sth China sea and surrounds, if Japan is alive and kicking.

Yes. Japan's military spend is already the 3rd largest in the world. People don't realize that. Also, their expertise goes beyond making Playstations. Just look at their infrastructure. NZ looks like like it was developed by hillbillies in comparison.

https://www.aspistrategist.org.au/the-limits-of-japans-military-awakeni….

Japanese PM betrayed memory of victims of Hiroshima and Nagasaki - Medvedev

Russian Security Council Deputy Chairman called the joint statement made by Fumio Kishida and Joe Biden that any potential use of nuclear weapons by Russia in Ukraine will be an irredeemable hostile act against humanity a "horrible shame"

Great article thanks David, happy to see this will be a new series.

US may lose control of world finance due to conflict in Ukraine — French expert

Emmanuel Todd is certain that the United States is in a phase of long-term decline and, against the backdrop of its waning influence in the world, it has decided to press for greater influence in its "original protectorates," acquired after World War II

Emmanuel Todd believes political systems mirror family structures. If his argument is correct then the collapse of the two-parent nuclear family in the west predicts increasing distrust of politicians and more electors not bothering to vote.

Now that the supply shock pendulum has swung to the other side - AKA recession - we can start to see just how weak the economy has been all along, covered up by the price effect. Trade which everyone though was blistering really wasn't at all. https://youtube.com/watch?v=D0Ntkt Link

WTO of course reduced estimates for trade in '23, but still imagines volumes will grow by 1% (good luck with that, given what trade stats said in Nov & Dec). But admit that could get ugly next year, maybe -3% volume which we know is still optimistic. Link

'David Skilling introduces his new bi-weekly Global Briefing Notes.'

Does 'bi-weekly' mean twice-weekly, or fortnightly?

Dictionary

Definitions from Oxford Languages · Learn more

biweekly

/bʌɪˈwiːkli/

adjective

adjective: biweekly; adjective: bi-weekly

-

done, produced, or occurring every two weeks or twice a week.

"a biweekly bulletin"

adverb

adverb: biweekly

-

every two weeks or twice a week.

"she followed her doctor's instructions to undergo health checks biweekly"

noun

noun: biweekly; plural noun: biweeklies; noun: bi-weekly; plural noun: bi-weeklies

-

a periodical that appears every two weeks or twice a week.

"an English-language biweekly"

Translate biweekly to

Use over time for: biweekly

Translations and more definitions

People also ask

Is biweekly every 2 weeks or twice a week?

Is biweekly twice a week or fortnightly?

What is every 2 weeks called?

Is biweekly twice a month?

Merriam-Webster · https://www.merriam-webster.com › ...

4/01/2023 — The meaning of BIWEEKLY is occurring every two weeks : fortnightly. How to use biweekly in a sentence. What do bimonthly and biweekly mean?

-

Look up the adjective biweekly in this dictionary and you will see it defined as "occurring every two weeks" AND as "occurring twice a week.

Dictionary.com · https://www.dictionary.com › browse

Biweekly is commonly used to mean one of two things: once every two weeks or twice per week. It can be used this way as an adjective, as in a biweekly ...

Wiktionary · https://en.wiktionary.org › wiki › biweekly

AdjectiveEdit · Occurring once every two weeks; fortnightly. · Occurring twice a week (but see the Usage notes).

Cambridge University Press & Assessment · https://dictionary.cambridge.org › ...

4 days ago — happening or appearing every two weeks: The magazine is published biweekly. (Definition ...

Biweekly - Definition, Meaning & Synonyms

Vocabulary.com · https://www.vocabulary.com › biwee...

Things that happen biweekly usually happen once every two weeks. Or twice a week. Just to confuse you. In the publishing world, this word is straightforward: a ...

Biweekly definition and meaning | Collins English Dictionary

Collins Dictionary · https://www.collinsdictionary.com › ...

Biweekly definition: A biweekly event or publication happens or appears once every two weeks. | Meaning, pronunciation, translations and examples.

Biweekly Definition & Meaning | Britannica Dictionary

Encyclopedia Britannica · https://www.britannica.com › ...

BIWEEKLY meaning: 1 : happening every two weeks; 2 : happening twice a week semiweekly.

biweekly adjective - Definition, pictures, pronunciation and ...

Oxford Learner's Dictionaries · https://www.oxfordlearnersdictionaries.com › ...

Definition of biweekly adjective in Oxford Advanced Learner's Dictionary. Meaning, pronunciation, picture, example sentences, grammar, usage notes, ...

AccountingTools · https://www.accountingtools.com › b...

31/10/2022 — Biweekly is an event that occurs once every two weeks. The term is typically applied to paying employees once every two weeks, ...

Related searches

I vote for removing bi-weekly in all its forms from our lexicon.

... " bi-weakly " could be urban slang for a bisexual guy who's not very strong ...

That's why I "like" the English language...

... me too ... luckily I was born in Zealandia , not China ... 'cos my English is much gooder than my Chinese is ....

That's Southern Hateterror please GBH.

semi-weekly is twice a week.

Thanks N_0. I needed a good laugh.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.