Content supplied by RLB

Rider Levett Bucknall’s Q2 2016 RLB Crane Index® released today highlights the strength of the Auckland construction industry, which shows no signs of abating.

The RLB Crane Index® tracks the number of cranes in the significant centres of mainland New Zealand. The crane count provides a good, simple indication of new building activity as well as general economic activity in each of these locations.

A record 47 cranes currently tower across Auckland’s skyline since the RLB Crane Index commenced in Q2 2014. During the past 6 months, 33 new tower cranes have been erected whilst 19 have been dismantled as site work on construction projects came to an end. That’s a net increase of 14 cranes since Q4 2015’s 33 cranes.

Mr. Chris Haines, Rider Levett Bucknall’s Auckland Director commented, “The construction industry in Auckland is now stretching the supply chain across the North Island. There remains resource and supply concerns with the likely increase in the future workload with the NZ National Convention Centre and City Rail Link now under way and the redevelopment of Commercial Bay at the Downtown shopping centre soon to commence.”

“As a way to cope with this high level of contractor demand, we are seeing an increasingly active Australian contingent of main contractors, sub-contractors working in the Auckland market, in turn putting pressure on the Aussie supply chain.”

With the release of the 5th edition, RLB has commenced the indexing of crane activity across New Zealand. This indexing enables the historical crane activity in all key cities to be graphically represented. The 3rd edition of the RLB Crane Index® (Q2 2014) has been used as the reference date for the calculation of the index.

The RLB Crane Index® shows that since the reference period, Auckland has seen a crane activity increase of 88%, Christchurch of 36% with Wellington showing 50%. Crane activity in New Zealand as a whole increased by 38% during this period.

Mr. Chris Haines continued, “The Q2 2016 RLB Crane Index® has identified a total of 98 cranes currently erected across New Zealand, an increase of 19 or 24% increase in number since Q4 2015.Auckland accounted for 14 of the additional cranes in New Zealand.”

“A total of 62 cranes have been commissioned since our last Crane Index with 43 removed across the country. Auckland and Christchurch account for over 78% of New Zealand cranes. Hamilton, Queenstown and Tauranga all showed crane numbers increasing with Dunedin and Wellington steady,” he said.

According to the 2Q 2016 RLB Crane Index, the strength of the residential sector across New Zealand is seen by the addition of 12 cranes. This increase represents 63% of the new cranes observed. The residential sector now accounts for 35% of all cranes working in New Zealand, up from 28% previously.

The commercial sector accounts for 42% of all cranes, down from 51% previously. Commercial projects have 41 cranes, slightly down from 40 at the last Crane Index. The Education and Civil sectors are the next largest with eight and six cranes respectively.

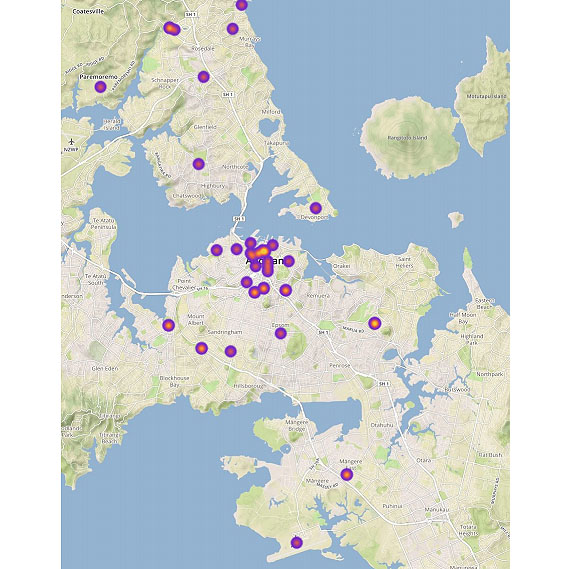

As a new initiative, the RLB Crane Index® hotspots map offer a pictorial representation of the collected data for each city using a heat map indicator to indicate the level of crane activity.

The full report is here. You can find an updated list of major Auckland projects here.

13 Comments

Will the efforts of the reported crane numbers translate into exports to offset those previously recorded by the dairy industry and be enough to monetise growing mortgage debt associated with this rising numerical observation?

Stephen.... I thought u were a smart guy....

You should know by now...the answer in No... :)

LOL - it was framed as a rhetorical question.

We know but that doesn't make it any less entertaining answering it.

Well if we make some assumptions that the 41 cranes for commercial buildings are financed via a 15 year lease. This is a reasonable assumption as the building must be profitable before any lending will occur. Say they have an average value of $40m with $32m in finance. Once the buildings are complete and occupied with the lease money rolling in you may get an offer of $80m per building from a foreign buyer. So there's a potential profit of about $50m allowing for some interest costs.

For 41 cranes there's probably 20 buildings being completed per year, and for $50m profit from a foreign buyer. This would result in about $1b income per year. That excludes any IT services that may be exporting from those buildings.

While these are rough numbers I have pushed them entirely towards foreign sales, in a lot of cases the owners may plan on holding onto the completed building which is common. In short there's no way the building's being constructed will make up for the dairy industry losses.

What they might do is free up a lot of low grade office for conversion to apartments to fuel the residential bubble.

"It could be argued that this is because A#3r1$@ is home to #@! million simpletons who don’t understand irony. And that we are healthily cynical."... J Clarkson (well, not all of us either..)

Just like the diesel truck hubometer readings, its very hard to determine if there is any useful work going on. For example a good number of truck movements may be related to the delivery of pink dildos.

Dildos have a wide range of productive uses, and not just for throwing at politicians. You should use an example with something truly useless like trucks delivering central bankers.

Er, isn't record crane activity a sign of bubble and boom. When are these projects completing?

There is a huge amount of work announced and yet to be started or completed.

Suggests another two years of party time.

The thing about commercial property is that banks expect it to make a profit, unlike residential. The commercial activity will be sustainable as there will already be lengthy and profitable leases in place.

The hotels being built are needed. There's a lack of beds in Auckland the same as there's a lack of beds in Wellington.

Where the boom in tower cranes becomes a problem is when there's massive oversupply but unlike the 1980s there are tenants to go in the buildings.

Public projects are a whole different thing though. Is the money being borrowed on behalf of local or central government. Something I'm not sure about.

I just bought a crane! Im now going to flick it off for double after a quick paint job. All that was needed eh.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.