By Alex Tarrant

Auckland is heading for a housing crisis, due to low levels of building consents and because New Zealand's skilled labour workforce is heading across the Tasman, Labour Party leader Phil Goff said today.

However, Finance Minister Bill English said later on Tuesday he thought there was still spare capacity in the domestic contruction labour market, and that government was focussed on building skills of young people and the unemployed to meet any future shortages.

English also said government would have an on-going discussion with the new Auckland Council on housing affordability, with the issue of metropolitan urban limits likely to be on the agenda.

Speaking to media in Parliament Tuesday morning, Goff reiterated his comment on Monday that consents were half of what they needed to be in order to meet demand for new homes. Latest figures from Statistics New Zealand showed building consents in December were the lowest for a December month since records began in 1965, down 26.5% from December 2009 to 994.

"That will force up rents at an even faster rate than what we’re seeing now. If we’re building half the houses we need to, then that will mean a housing shortage and higher prices – higher sale prices and higher rents," Goff said Tuesday morning.

Money "misused" on tax cuts for the rich should have been used by the current government to stimulate the building industry and create a more skilled labour force that would have been able to cope with looming house shortages in Auckland and quake-hit Canterbury, Goff said.

"We should have our building industry working at the moment, we should have our people in training. Again it’s a sad reflection that last weekend 6,000 people – Kiwis – turned up at the Australian jobs expo, wanting to leave this country. Three thousand eight hundred did so in the month of December alone," Goff said.

"I think the way of doing that [getting building work started] would have been to look at how you used the money that was misused on tax cuts for the rich [for instead] generating growth, in generating some housing starts that would have created employment across the board and would have kept our skilled people here in New Zealand," he said.

"We will need them in the next few months. Christchurch will have a skill shortage, Auckland will have a skill shortage, and that means the cost of the homes that will be built, and the cost of rents, will just keep going up."

Stimulus money from taxing the rich?

When asked where government should get the money for stimulating the building industry, and whether Labour would reverse the tax cuts in order to do so, Goff said the cuts would would be well in place by the next election.

"I’ve signaled the changes that I want to make there that will be fairer. But I can’t overturn history," Goff said.

Goff has previously outlined that higher income earners, "well into six figures," would be in line to pay a higher tax rate if Labour got into power after the November 26 election. However, questions are being asked whether this, along with Labour's proposals of targeting tax dodgers, cutting proposed spending on initiatives such as a Navy missile upgrade, and making small changes to property laws, would produce the extra revenue required for its spending plans.

Work force needs training

Government had to get people back into training, Goff added.

"I was down in Christchurch on Friday. The earthquake was five to six months ago, we should surely have been using the Canterbury Polytechnic Institute of Technology to be preparing people with the skills they need to ensure the costs aren’t forced up because we don’t have skilled or semi-skilled workers to do the jobs," he said.

The reason housing starts had dropped was because the Government did not introduce a "counter-cyclical stimulation in an area that should have been stimulated if we wanted to keep a skilled labour force that we will desperately need in the next six months, as the demand for houses goes up," Goff said.

English - Govt to work on skills, look at housing affordability and urban limits

Meanwhile Finance Minister Bill English said later on Tuesday that, because the domestic construction market had been so flat, he thought there was "still some spare capacity there".

"But in time we would expect skills shortages to re-emerge. That’s why we’re focussed on the pathways for younger people, and for people on welfare, because those are the two pools of available people who need to be re-skilled to meet those shortages," English told media in Parliament.

"An economy where unemployment is dropping and there’s skill shortages is an economy we want to get to as fast as we can," he said.

English also touched on the issue of housing affordability, saying even though prices had been flat, there were still affordability issues. Government would work with the new Auckland Council to look at housing affordability, he said.

"The housing market’s going through change, I think that’s pretty evident. Peoples’ expectations about capital gain have dropped right back," English said.

"I think the tax changes are having some impact, the migration flows are a bit uncertain about who is coming and who’s going. We’re still, probably, a market where, on the fundamentals, there’s likely to be a period of adjustment," he said.

"So in the meantime we want to focus on housing affordability, and the fact is even though prices have been flat in a market like Auckland, it’s still very difficult for people to buy into it. It will be an ongoing discussion with the city council up there about what impact they can have on the supply of affordable housing."

"Certainly housing affordability is still a significant issue, even though the market has been pretty flat," he said.

Metropolitan Urban Limits and Housing Affordability

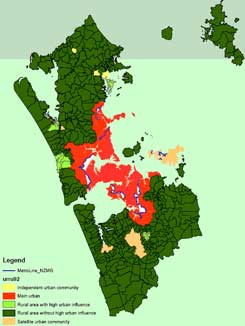

English expected Auckland's metropolitan urban limits would be discussed with the council, and that the council would probably review previous policies from around ten years ago.

English expected Auckland's metropolitan urban limits would be discussed with the council, and that the council would probably review previous policies from around ten years ago.

The current Auckland Metropolitan Urban Limit was formerly adopted in 1998.

As previously reported on interest.co.nz, Motu economist Arthur Grimes said in 2009 that development in Auckland was a risk of being stifled by high house prices, with current metropolitan urban limit (MUL) policies making houses more expensive. Research Grimes did with Yun Liang in 2007 found that land just inside Auckland's MUL, or growth limits, was valued at approximately 10 times land just outside the boundary.

By changing the MUL framework to reduce land prices, it would be less expensive for businesses to operate inside the expanded boundaries, and lower house prices would mean workers would be better able to afford to live in the city rather than being forced away by high prices, Grimes said in 2009.

He recommended Auckland's growth limits be reviewed in a more flexible manner, rather than having long periods between boundary reviews, especially because of the increase in Auckland's population (38% between 1991 and 2006).

"Auckland is a polycentric city with a population that grew, on average, by 2.2% between 1991 and 2006 (census years), a 38% increase. Simple application of growth limits, with long periods between boundary reviews could, under these circumstances result in considerable inefficiencies and inequities, including problems of housing affordability (Grimes et al. 2007).

Our results therefore imply that growth limits within Auckland should be reviewed in a flexible manner that accounts for the impacts of an increasingly binding constraint," Grimes and Liang said.

See the previous article on Grimes and Liang's MUL study here.

More recently, Environment Minister Nick Smith said poor land planning policies that led to excessive section prices need to be reformed in a Resource Management Act revamp.

MULs were subject to the review, and focussed on in a working paper released by Smith in October last year. See here for Hugh Pavletich's criticism of Smith's announcement last year.

The working paper said MULs were blunt instruments in New Zealand compared to how they were used in other countries.

"They tend to be applied rigidly and do not consider the social and economic benefits and costs of their use. For example, the objective of the Auckland MUL is simply to protect rural and coastal environments," it said in the paper.

"MULs are used effectively as a tool elsewhere in the world (eg, Melbourne and Portland) because they are one part of a broad suite of tools, including ongoing monitoring of land supply, and are kept under review. This is central to their effective use."

(Updates with comments from English, video of English, discussion of metropolitan urban limits, video of Goff)

Building consents - residential

Select chart tabs

156 Comments

Why aren't the builders, building, Phil? Answer: Because more properties than are being built aren't needed either now, or in whatever time-frame it is, that developers need to build 'more of them' today. They won't build what they can't sell.

Also the type of house being built relates to the land allocations that makes smaller and cheaper designs impossible to justify.

More land of the right cost is needed and those with fancy values on their existing stock should be left to sweat it out.

Time for a land tax on undeveloped land?

Basel,

Great question. I hope Bill English is watching.

cheers

Bernard

No ...Dont tax undeveloped land , rather incentivise people to free it up for development. For example, allow a 2 year "window' where you can get Resource Consent for subdivisions for FREE , instead of it cositng $60,000 per section , you have 2 years and there are no Local Authority charges.

Also, the new subdivisions should be exempt from Council Rates for the two year window.

This will be a major incentive to everyone with land holdings to allow it onto the market .

This supply -side measure will make land more accessible to Kiwi's wanting to buy their first home and get rid of the speculative bubble in "landbanking" and other such undesirable and unproductive activities.

Boatman - great ideas!!!!! An incentive system to develop rather than a punitive system to not develop!

Best idea I've heard for a long time

Please write to Bill English - if you don't I will! So let us know

Good call with the free resource consent within a time frame.

Bernard - The Emperor still fully-clothed then?

If people are leaving for Australia won't we need less houses? Phil and his crew did nothing to stop the housing frenzy of the mid 2000's as it kept them elected as NZers felt good about themselves. Labour left no money in the kitty as they spent it buying elections and then they expect a miracle from National. We need to pay our MP's more and get the right people into parliament on both sides of the house. Has Phil ever done a decent days work in his life?

Neither Key or Goff have ever worked on anything that contributes to the building of NZ, so that argument is neutralised.

Ex agent

The trouble is the tradespeople are leaving from elsewhere in New Zealand.

House prices and rents in provincial areas flat to falling as they depopulate. Some are moving to Auckland but many are moving elsewhere.

cheers

Bernard

With more and more people leaving, the demand for housing falls. People coming to live in NZ from overseas also tend to be families, often with extended families, rather than single or solo parents. So a family only needs one house, while a NZ family made of up two solo parents need two.

I don't see a problem with a lack of building consents, aprt from the fact that our housing stock will be getting older on average, and often it can be cheaper to build a new house than to restore and extend an old one for modern living.

A big reason for the lack of building consents, is the amount of detail, documentation and red tape now required to build a house, due to the leaky building thing. If is fine for developers who build vanilla flavoured instant pudding/ cookie cutter houses all over the country, which lack any personality or design fair. However if you want an architect designed house, you are paying huge money for them to do all this documentation. Perhaps the reason why only a small percentage of NZ houses are architect designed.

This article makes perfect nonsense.

Can I have what this Goff guys smokin?

lol

Mr Goff ..... what planet are you on!

1. Rents can not rise forever - if they get too expensive, people will just move in together or turn the garage into a bedroom etc

2. What is this 'demand' you are talking about - first you say there is an "exodus" to Australia, so aren't there going to be extra houses left by those who emigrate ?

3. You know very well that one of the biggest industries in NZ is "who can pay the least tax", so any tax change will only make these people look harder for the loopholes.

4. If you further tax the rich, aren't you limiting growth and further pushing capital away from this country?

5, The property market is based on supply and demand - why do you think there is such a low number of building consents - the numbers just don't stack up to build, let alone buy !!

6. I can smell a "vested interest" in your comments regarding property Mr Goff to keep the "property bubble" going? Own a few properties yourself Mr Goff ? "Friends" with bankers ?

If you want to get votes, why don't you show some guts and put a capital gains tax on every second and subsequent property owned ?!

Create a flat tax at 20% for ALL and raise GST to 20% .... problem solved !! and it would eliminate point 3. as above,which is a huge drain on this country's finances, for the benefit of a select few !

Crazy Horse

6. I can smell "vested interest" ... "Friends" with bankers ?"

A. Of course. The Banks, which are not domestic, have the government of the day, regardless of colour, over a barrel, forever. If the Government implements any change that has a significant reduction in property prices, the banks, who are already carrying either (a) toxic loans, or (b) nursing marginal loans, will pull the pin and squeeze hard. And no government can afford that. That is the problem with overseas owned banks. They have too little domestic skin in the game. Do you think for a minute the banks arent reminding the government, and the RBNZ, of this situation every day? It's Heads they win .. Tails you lose.

7. why not show some guts and put a capital gains tax on every second and subsequent property owned ?

A. A capital gains tax on second and subsequent properties, while it sounds good, can be "avoided" by not selling.

Money "misused" on tax cuts for the rich .. WTF does that even mean?

It means that Goofy believes the same Marxist clap-trap that Cullen did , that your income is not your's to have by right ........ But by the generosity of the government you may keep some of your income ......... Provided you don't desert Labour again , in the traitorous way you turned on Clark and Cullen in 2008 . ....... And if you waddle down to WINZ and sign up for WFF or KiwiSaver , you'll get even more of your own munny back .

You should know by now that, in the scheme of things, "the political game" is played by two main teams, one team is socialist (Labour? Left Wing?) and one team is capitalist (National? Right wing?). The role of the socialist team is to implement it's socialist policies at all costs, sprinkling confetti (welfare), to its constituents, without regard to it's consequences, eventually doing an old-mother-hubbard routine, leaving the cupboard completely bare. That's ok, because they have increased the size of their loyal congregation (at what cost you might ask) , but the cost is not what matters, increasing their current and future congregation, is the name of their game, ensuring their eventual return to power and get their hands on the purse strings. The role of the capitalist right wing is to refill the larder-cupboard and undo the damage done by the socialist-left-wing. The political cost of repairing that damage is enormous, and when the reparation is complete, the electorate is so dis-illusioned and fed-up with the pain prefers to re-install the socialists who will preach forgiveness and resume their congregation-building charismatic ways, commencing the next game. It is the way of life the capitalist-right-wing only gets to refill the larder, then out.

Wrong. Both Labour and National are exactly the same but appear to be different enough that the public is fooled into believing they have a choice. They present a false left-right paradigm, and an illusion of democracy. Google Hegelian Dialectic.

I agree Matt, he doesn't know what he's talking about and has brought into the left right marketing propaganda.

There are just two parties but there is only one way of thinking - what's in it for me, and they then set-out to win votes calling them-selves poles apart.

Some sneaky reporter should print the list of MP's who hold second and third properties. You will probably find the reason why MP's talk housing up is because they are property sprukers.

Hi guys, have added in video of Goff so you can see him saying it.

Where's the money coming from.....?

Still ruling out a capital gains tax, might cut some of National's proposed future spending, won't sell SOEs.

Where's the money going to come from?

Cheers

Alex

Simple, really - just put a bigger cog on the printing press!

Time for a land tax on undeveloped land?

Yes yes yes and yes... Also streamline the building consents process, currently it's taking nearly two months to get one for new home and costing an arm, a leg, one kidney and your first born... For a commercial building, add your wife onto the cost!

more garbage from goofball Goff

He's full of unjustified comments, and empty on articulated real solutions

He's so bad he even makes national look good!

Leave him alone!

He's the closest we have for Mr Bean - Actually he's not that funny!

And the scary thing is that Goff may well be in power come November, if NZ'ers vote for the Green party in sufficient numbers. The one positive things about this is that it would drive NZ into a collaspe within the first 6mths. Such a crisis would force NZ to make the necessary changes - under the direction of the IMF.

Pity for Goff and the Green party that the supporters they propose to respresent would be by far the hardest hit in the case of a financial collaspe. Remember the IMF formula - the budget is balanced 20% from tax increases and 80% from cuts in government spending. So bye-bye to the welfare gravy train.

My question is will the Iwi leaders liquidate their assets to support "their people", who will be very hard hit by the slash to government spending.

If I thought the Greens were serious about their statement last week on introducing a property tax and it was a precondition of them forming a coalition I would vote for them - that's how bad I think the current imbalance is.

There is no building because costs are to high and profits are low. Get rid of the RMA and bring in some good competion for supplies and it might be worth building again. In my case Resource consent for 2 sections cost me $60K and a list of very expensive conditions that make it to expensive to build even though the land was free.

In my case, I wanted to add another small bedroom and alter our bathroom. The building consent alone was $4500. The total cost was no more than $20,000 - that's at least 22.5% of total cost. A friend did similar thing in QLD - his permit cost $600 !!!!

Reading from people asking to increase taxes - any taxes - makes me cringe. The less tax we pay the better off we are! (This is true at least for those who earn their money).

Not really:

a) Less tax -> more money in our pockets -> more spending -> bollard has to increase interest rates -> less money in our pockets, more going overseas

b) Less tax -> less spending on health -> poor people dying in the streets

c) Less tax -> less spending on education -> less skilled workers -> lower incomes -> less tax

d) Less tax -> less spending on welfare -> more people stuck in poverty trap -> less tax

e) Less tax -> less spending on important infrustruture -> lower growth -> less tax

add

f) Less tax -> less spending on welfare -> more crime -> more police, more prisons -> more dissatisfied rednecks who want less tax

Completes the circle.

"d) Less tax -> less spending on welfare -> more people stuck in poverty trap -> less tax"

Not quite... Welfare IS the poverty trap. More tax -> more spending on welfare -> more people caught in a position that by working harder or bettering themselves they will receive less 'entitlements' -> Less people paying tax.

The entitlement mob that have squeezed the pips dry for so long are making people say "so long" to New Zealand.

When a simple shack costs more than a man's and woman's wages can stand, it is not rocket science that they may look elsewhere for quality of life, not the burdens of life..

There is land a plenty, but there is no will to spend the rest of your life in abject poverty owing all to the banks and the bludgers that pervade New Zealand.

There is little of merit to encourage the young to work as the dole and the wff will sustain them in their hour of need.

The middle classes will be ground down paying for this largesse.

Those politicians and others on the public payroll will always increase their entitlements in whatever way they can.

The fiscal miss-management over the labour years and ridiculous expenditure on property bubbles has encouraged sensible people to look elsewhere now.

Only those people who have never produced anything of note except the desire to encourage others to emigrate will be left holding the can, which will be kicked down the road until the last idiot leaves with whatever money he has left after the latests scams.

A lifestyle in New Zealand is not working.

A lifestyle of the rich and infamous in Ireland is not working either, nor Italy.

It is now a worldwide problem as per the actions in Eygypt, Tunisia, etc.

Why pay for someone else's mistakes for the rest of your life.

This is not a dictatorship, but that is the fiefdom thoughts of the politicians as they manouver for votes to sustain their bloated lives.

Over priced property, led to over priced idiots in power expecting the gravy train to keep powering along.

They seem bemused that there are problems. They caused them.

Floundering around, buying up the Maori vote with the sea bed and foreshore theft will only alienate those people who do work, not those who do not.

It is not in the National interest, but it is plain to see that some people will do anything to remain in Government.

The internet is all powerful as Eygypt has learnt.

There are hard workers who come here to better them selves by working.

Do you think they will come here to be second class citizens.

When they see the results of this vote buying, they will see their futures are better suited to an environment where work is not a four letter word, where graft means working not theft, where investment is a return on your money, not the theft of your money.

There is no justice for all those people who have already had their life savings stolen via the simple expedient of fraudulently offering a raw deal, not a fair deal.

Investing is now a matter of what is the catch. And yet the fraudsters still exist.

Briers and his ilk aided and abetted by an indifferent governments are still in business.

So are all the bubble headed stupid people who are trying to maintain their bubble investments, aided by successive governments.

When did it become normal to miss-lead the public.

National and Labour and the other long small minded parties are the problem, not the solution.

We need cohesion, not division. It is the only way forwards.

We do not need people in power who are are ensuring that the suffering will be done by others.

No different to the Army in Egypt and North Korea and many other examples.

As many people point out we go around in circles with comments here.

The circles we go around are never ending, unless we have a cut out point.

The same problems will always remain as long as the same people keep making them.

With you paying the price.

Does anyone actually still listen to this guy??

I think Fill Gap needs to buy some better wool, cause we can all see him for what he really is.

I heard a disturbing story from a guy in our church who takes in Foster kids. It is really good that some people feel that they can help these poor kids, however he said that a number of these people pass their kids on to Auntie & Uncle & vis versa so that they can claim the foster allowance. I have no reason to doubt this guy, but I am shocked that this goes on and our tax dollors are paying the bill.

Why tax higher? Higher tax for skilled workers or companies and they move offshore to our near and far neighbours. Don't overtax the mobile areas

Report released a week or so back from Tauranga City Council on development costs and housing:

Argues that removing urban limits would have limited impact on reducing housing costs (sorry Hugh!) but does recommend change to allow for alternative funding mechanisms such as "Municipal Utility District Schemes" which they use in Texas (one for Hugh!)

As silly as it may sound Goff happens to be right this time.

As Olly predicted there will be a housing and rental crisis in Auckland, which will spead through the country little by litle as time goes by.

The statistics aren't showing this yet but at the cutting edge the evidence is mounting.

As an experiment Olly followed the advertising of two properties for sale- one private and one through an agent. The first was in Pakuranga, a 25 year tidy 3 bedroom home in an area where such houses sell typically for around $550-$600K with a price guide of $595K.

Over 2 weekends of open homes 80 groups ( approx 195 people) came to the open home and there are 3 offers

being prepared right now.

The other property was a 1 bedroom trendy but very old flat in the central city selling through an agent with a price guide of $390K

Over two open homes 70 groups ( approx 160 people) came through that and there are 2 offers being prepared.

The question is: If the market is flat ( which the statistics confirm) why are there hoardes pf people even bothering to look?

And for you cynics out there, instead of poo-pooing this strange state of affiars, how about doing your own research and go to a few open homes and count the viewers instead of sniping away without the facts?

It would be interesting indeed to see if what Olly sees is the same as what you see.

Let us know (1) what the offers are for on those two little gems, BigDaddy, versus the 'price guide' and (2) if they go through. As I've stated many a time: Only a buyer with the means can facilitate a transaction . It doesn't matter a hoot, what bids are being prepared or what deals are being done, if the ability to pay is not there. (Psst: Here's a clause you might be familiar with," Subject to the sale of <my property> by <date>..."

And why are people looking? Obviously they're doing the same as you. But they're probably scared stiff of where the market is going to go, and are kicking the tyres. Not as buyers; but as the sellers they really are!

I was thinking the other day BD, if prices are always going up, like you guys say they do, and incomes aren't going to relative to the increases, which historically they haven't at all, then aren't we pricing our children out of the market? I mean I'm 27, no children, but if they keep going up and it keeps getting more and more unaffordable, my children are never going to ever have a place to live, and they will have to move overseas. Do you think this is about right? Would like to hear your opinion.

I have been in the housing market 40years next month and the one thing I have learnt is that over time inflation takes care of prices and wages, always has and always will. Please dont say house prices were only 3 times houshold earnings then, because mostly only the men worked full time and wives worked part time. We have been through this current cycle many times in the last 40 years and every time you hear the same thing... property will never be a good investment again, what a load of rubbish. My 1st house cost 4,950pounds in 1971, you would have to pay $230,000 pounds to buy that same house now and couples still do.

The problem is you should be looking at the last 80 years and not 40 years....The GD should be in your period for consideration because a) We are looking at a second GD and b) we have not in the last 100 years come across peak oil & minerals, or the BB retiring or huge debt or nearly 7billion ppl...all these are game changers...

regards

"one thing I have learnt is that over time inflation takes care of prices and wages, always has and always will."

Your a fool. You want to know why? because after 40 years YOU STILL haven't learnt that "inflation" makes people poorer, not richer, not better off!

If you even had half an economically sound brain you would NOT want property (yours or anyone elses) or anything to go up at ALL (relative to existing currency) if it can be help!

Why? because printing money (QE now being the deceptive polite term) from thin air makes your income and currency worthless, it makes the cost of living go up meaning you have to work even harder to just get by. Particularly if the currency value is lessened via "speculation".

You have spent 40 years as a slave to the banking industry along with everyone else out there that just doesn't see the "con" which is fractional reserve banking (money from thin air)

"Please dont say house prices were only 3 times household earnings then, because mostly only the men worked full time and wives worked part time. " ""

what a stupid statement! whether wives worked part time or full time, it is the ratio of the house price to the household income that is critical

We are much worse off now because many wives work full time AND yet the median house price is 5-6 times that of the median HOUSEHOLD income.

One wonders if there is hope for some people's understanding!!!! Clearly having a lack of financial education in our schoolign system is showing through!

In 1971, kerewin, you were probably earning, what £25 per week, £1300 per year. Let’s say you and the little lady both worked at that rate for an annual income of £2,600. Ignoring everything else, you could have bought your £4,950 house with about 2 gross years pay. Today the median UK wage is £500 per week, £26,000 per year. So a couple, today, would have to work nearly a gross 4.5 years to buy that same home, now valued at £230,000.

Now I am sure you did lots of ‘added value’ things, but can you roundly see how much more work today’s couple have to do to buy the same thing? Inflation has destroyed two and a half years work effort for them, for they can only buy the same thing you did. To be in the same situation as you 'they' would have to earn £60,000 each. And whilst I am sure some do, most don't.

You do know the whole country isn't all in Auckland right?

well I've been to a few open homes since January and they've all been dead

Hi guys I've updated with comments from Bill English after nabbing him in Parliament. We got onto metropolitan urban limits so I threw in a section on that as well.

Housing affordability could become a big election issue yet :)

Matt in Auck - Many thanks for that Tauranga link

Cheers

Alex

Good work Alex . .... If you can nab someone from the Labour party , kindly ask them why they're currently being so childish about closer relations with Australia , our friend and colleague for 150 years ........... Yet it was Labour ( Queen Helen ) who dropped us into a free-trade deal with China , no problems there ...... ?

[ sorry for the bold type , buggered me keyboard ........ bloody mango juice everywhere ....... 'tis the season ! ]

An RE agent just quoted Goff and told me that now is a good time to buy because prices are going to go up.

I just Goffed my lunch up listeneng to Phil...

Bill English is one of the few politicians talking any sense whatsoever. Good to see he still thinks the housing market has some correction still to go, I think he's right and Goff's allusion to another housing boom is garbage (and scare mongering).

From what I'm heariing through Auckland Council contacts the Council is seriously reconsidering its historic approach, whether that be some extra greenfield rezoning, or making it easier to develop high density. I am hopeful this is going to lead to a significantly improved housing supply response in time. If we can authorise the use of Municipal Utility District Schemes then we are really starting to talk.

Matt in Awk

An almost decade long property ponzi scheme FULLY SUPPORTED under Labour has got us where we are now. As for National, they would not have done ANYTHING different, hence nearly 2.5 years of doing NOTHING of substance either.

The saddest thing about this country is we continue to employ and vote for this lot of clueless losers OVER & OVER again hoping something will change! "Bang head against wall syndrome " is a real disease in this country.

WE KNOW what must be done, Problem is we must FIRST put those in charge who also know and have the political balls to implement it ASAP

Can we stop all of this ridiculous nonsense about a land tax on undeveloped land.

I have 1400m^2 here in Mount Wellington, Auckland, and if I wanted to I could put a house out the front and anothter out the back.

Out the back I have a large vege patch, a washing line, my 1963 Rover Coupe that I am restoring, and nine mature fruit trees, all different. Out the front I have large flat lawn, which on any given day will have about a dozen of the local kids playing games on. Why? Because the only other place to play is the road.

So can you tell me what part of my land is not developed?

Some of us actually see it as a valuable resource.

The comments are that you wont be taxed on the land/house you live in/on....and yes its valuable....

regards........

"people with the skills they need to ensure the costs aren’t forced up because we don’t have skilled or semi-skilled workers to do the jobs," he said."

and what happens to them after they have rebuilt Chch? move to oz?

You cant train tradesmen in 6months....not properly anyway....shortages well that might mean the existing ppl get well paid for a few years and frankly I think they deserve the money more than lawyers and Pollies...

regards

Matt in Auckland, about your link on Tauranga.

Fact:Tauranga is the most expensive city in NZ in ratio to income, right?

Actually wrong!

Household income figures are rather distorted by the over representation of retirees, many who have motgage free properties anyway.

I've just been looking at the property situation in Tauiranga and it is currently not expensive, the median house sale last month was $320,000, so that must mean half were below that price. A working household with income of $80,000 can afford these prices, indeed there seems to be opportunity for some good buys.

And why are the vendors offering their properties at those 'good buy' prices, muzza? Because they see the prices rising from here? I don't think so!

Muzza, there is some merit in your point, but only a little!

the median household income would be much lower than 80K, even taking out retirees

I'm guessing a bit here, but I suspect the median WORKING household income wouldn't be any more than 50-60K, so that is still a multiple of around 5 to 6

housing shortage? skill shortage? my rates just went up

"Mine haven't. In fact, I'm hoping just to keep my job. So whatever it is you do, I can't afford to pay your new rate :).."

Just got of the phone from Olly and he advises that the two properties mentioned in my earlier post have both been sold-unconditionally.

The Pakuranga property got $575K ( suggested asking price $590K). Took 3 weeks and over 90 groups through plus 450 hits on Trademe.

The small city apartment sold for $384K ( suggested price $390K). 75 groups through, 750 hits on the agents web site. Time taken 2 weeks.

Why the big disconnect between the media comments and statistics, and the facts on the ground?

Is it possible that both are right?

@BigDaddy: From your first post "..The first was in Pakuranga,....with a price guide of $595K.." ~ From yours above "..suggested asking price $590K.." Sure; that's only $5k, but a difference of about 1% on the actual sale price from original asking price; a little nip here, a little tuck there.....Do you now see how 'the facts on the ground' and 'the statistics' can vary, and why there is sceptisism surrounding what anyone to do with real estate industry says?!

yes and sales prices below asking prices, which is indicative that things still aren't hot

can you post the links to the properties BigDaddy? $384K sounds a lot for a "small city apartment" (by small I guess you mean 1/2 bed)

The last CBD apartments built were consented in 2006. Auckland City then introduced PC2 requiring the smallest 2 bed CBD apartment to be 70sqm (70sqm x $7000/sqm being what it costs to bring an apartment to market - land, consenting, build, financing, bank required margin etc.) and increased tax from per unit by $40k plus, so that a 2 bed apartment can't be built and sold for under $500k.

Response in 2006 from the people who wrote these rules when challenged on the affordability issues these rules would bring was "in NY and Sydney only wealthy people can live in the CBD, Auckland should be the same - they can move to Waitakere or Manukau"

$384K is therefore cheaper than replacement.

But here in Auckland there are no swathes of unproductive land, and people don't want to live in the peripheries due to traffic and petrol costs. So how would such a tax solve the problems here in JAFA land?

There is no pending housing shortage in Auckland...

The fact is, they have been busy far too long having sex with themselves....

But just in case I'm wrong how's this for a policy response:-

a- Free Condoms and Vasectomies for all consenting Aucklanders....or,

b- Inverse working for families entitlments... that's where you pay extra tax rather than getting a rebate for having more than one child.

Why should All New Zealanders have a Land or Capital Gains Tax, just bcuz Auckland has a population problem?

"Greed and gullibility is not just a JAFA affliction."...

Indeed... but any potential housing shortage, is resultant from Population Growth as much as that from Greed or unrestrained Credit Availability.

What housing shortage? There isn't one and there's never been one and there almost certainly never will be one. It's the desperate fantasy of over-extended and debt-riddled PIs and real estate slimebags. Sure, they obviously still have some pull - look, Goofy has suddenly changed his tune about housing and is now calling it the PI and RE lobbyists way! I'm sure there's no corruption there.

That's right. If there is a housing shortage there would be homeless ppl and no vacant houses for sale or rent.

Yeah I find it quite scary how badly Goff seems to grasp most situations.

Given the sheer number of alternative sexualities within his party , Goofy is well advised to grasp most situations with complete mental clarity ............. No camping out , for a start !

Your point is well made Hugh , what " services " has the country received from the government for the ramp up in annual spending by an additional $ 30 billion . The Centre for Independent Studies concluded ( during the reign of Queen Helen ) that there was no benefit whatsoever to the country nor to the economy from Michael Cullen's spendfest .

The extra money being siphoned out of the productive sector is enough to completely eliminate income tax !

Could RBNZ have done anything differently, better during our bubble?

What could they have done differently, better during our bubble?

Worth a read:

'The $47 billion rural hangover'

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=107…

"Privately, central bank staff admit they were incredulous that, at the height of the boom, banks were willing to lend up to 110 per cent of the value of houses. They were also concerned about the banks' love affair with dairying, and their failure to realise that high commodity prices and land prices might not last."

(Nice comment Hugh.)

Cheers, Les.

"Through from the early 2000's to late 2007, that Government stood idly by allowing a housing bubble to get underway - pumping the housing stock value from under $300 billion to $640 billion and conning economically challernged Kiwis in to between $60 - $80 billion of mortgage debt unnecessarily."

Get real Hugh. They may have stood idly by but they had already kicked off the housing and farming bubbles by a combination of upping the RBNZ's inflation target and allowing the formation of Fonterra - both in late 1999.

I believe they knew exactly what they were doing.

So the answers to my questions,

"Could RBNZ have done anything differently, better during our bubble?

What could they have done differently, better during our bubble?"

- are YES and they could have used simple prudential measures to appropriately restrain credit growth. For example a robust LVR regime, per Texas, or, what RBNZ have lately started to do with rural lending, see:

'The $47 billion rural hangover'

http://www.nzherald.co.nz/business/news/article.cfm?c_id=3&objectid=10704031

It seems these kinds of measures are effective where land-supply is constrained. Where land-supply is less constrained they are still maintained and damaging bubbles are avoided, eg. Texas.

What can be learnt from these observations?

What stopped RBNZ implementing such approaches, back when it would have mattered?

Cheers, Les.

Les, my assumption is that the RBNZ (and the Govt for that matter) works in the best interests of the banks rather than in the interests of hard working kiwi's. So while it *could* have done something it chose not too. Its no different to the actions of the RBNZ today ...

You may well be right Matt. Other's have expressed similar views on this site, eg. Colin Riden and influence from, "the powers that be", etc.

I don't know. However, it seems odd to me now, having spent a while trying to understand this area, that there were/are indeed reasonable alternatives RBNZ could have used to supplement the OCR regime to better control inflation. Sure, they hit the PTA CPI target band mostly, but it's seems so perverse that money supply inflation, credit growth, went pretty much untouched leaving us with a potentially destructive property bubble, a weakened export sector and not a small amount of private debt..... For a non-specialist like me it's been fun to think around the subject and dream up a few ideas that might help solve the problem. However for the professionals in this area, with their specialist knowledge, evidence from other jurisdictions, surely it must have been a no-brainer what was required, eg. stuff like the capital adequacy regs. that have now been implemented, a Texas style LVR regime - they maintain this, even though land-supply regs. are relatively liberal - go figure.

One could argue that money supply inflation, credit growth was not a target, but isn't it the case that the OCR regime is meant to sensibly restrain this via the debt price signal so that the indirect measure of the CPI is stable? It must have been obvious it wasn't working effectively with the collateral damage I mentioned above mounting day by day. Yet it seems there were no advisories from the specialists involved to remedy the situation. It's hard to fathom?

If I'd have practiced my engineering and science in a similar way, I think I'd have been quite concerned about a professional negligence liability. It would not have been ok for me to remedy a problem with one component in a system, yet neglect risks to that system as a whole, that I should have recognised as the specialist, while I addressed the component level problem.

It's hard to fathom?

Cheers, Les.

Colin Riden - don't worry, the above poster has a problem with geometry, and acknowledging physical limits.

I call them 'flat-earthers' - it's the only geometric configuration that could support unlimited growth, but I sort of went off the idea, when the Apollo shots appeared in National Geographic.

Looked pretty finite to me - even the big flat desert bits.

For those interested in the facts and not slanted self serving political point scoring:

One solution could be do make all premits free on new builds as long as no residential property has been on the site before.

Sore Loser,

Your post is far too long, suggest you keep it short and to the point if you want most to read it

Mr Goff

You seem intent on talking about the Rich. Well Sir, you qualify as one of those people yourself. Why don't you sell that investment property like you said you would and donate the profits and your earnings over $50,000 to the new Maori Statutory board.......as Lenny Brown has a shortfall......

And you're still a schoolboy loser. There's no shortage. There's no wave of rich immigrants. Nothing is coming to save your mum and dad. They should not have bought that overpriced investment property, and they should not be letting you play with their computer. Go to bed, it's late and you have school tomorrow.

My home and beachhouse were paid off many years ago. No debt here, wee boy. Can't say the same about clowns such as yourself. That's why we piss ourselves laughing at you.

Bernard

You shouldn' t let this site be high-jacked by the rantings of political crazies ilke "sore loser"

This site is about finance and related topics and even we agree or disgaree with each others views, and even get a bit testy at times, off the wall political diatribes such as the one above have no place here.

BD - actually, the biggest failure on this thread, is Bernard himself, up the top of the thread.

He demonstrates - and given what has been posted/linked here over the last year or more it's hard to see how he still can - a lack of understanting of the physical world.

As do most 'financial' folk, almost certainly including yourself. Talking of deckchairs (sorry, I know it's hackneyed) is only worth doing if you're keeping an eye on the sinking process.

Simple geometry ( as in, Form 2, age 12) is a start. Then simple geography (similar age/stage) tells you much of the rest. The math is perhaps Fourth Form, say age 14.

Now, Big Daddy - name me one - just one - economic activity which doesn't need energy input? Even Berlusconi's girl had breakfast. When she did, if it was cereal, she consumed - used - 10 calories of fossil fuel oil, for every calorie that slipped between her lips. If she had meat for breakfast.................that went up to 27 calories of oil, for one...........eaten.

We essentially eat fossil oil. And every activity is the same.

Then we get some kind of disconnect - folk who don't look at a building, and see it as expended fossil energy - used once and gone. You'll be one, and by his comments above, Bernard is still another. These 'cheap land' subdivisions, radially, exponentially expanding out from all cities forever, presumably are meant to have real people in them, consuming real food, using real transport, needing real maintenance. Unfortunately, displacing real farmland. Which makes food. Which.......but energy is the key.

Here's a good stab at the situation:

There's more - depleting quality, cherry-picked EROEI, exporting nations using more internally (Indonesia and Egypt were oil exporters, now importers) and so on, but:

Even if that graph is 10 years pessimistic, and even if the right hand side is too steep by a factor of 2, it's a sinking.

The questions are: What will 'work' be, what will 'incomes' reduce to/through, how will those developments be serviced transport-wise, what will replace the polybutylene?, alkathene?, conduit?, tarseal?, coloursteel?, heck, even: what will deliver the replacement windows?

Folk like Hugh P, Bernard H, and I presume you, don't address those issues. At all.

Finance rides atop the real, doesn't function without it. Never forget that. That graph suggests it's time to consolidate, not expand.

Wrong place.

It's disingenuous to exclusively blame a govt --- any govt --- for the greed and naiveté of almost everyone else in the country.

Intelligent people could see that the housing market was bubbling and would eventually burst.

Some got in and out quickly, making a profit and then watching for the inevitable pop, while others said "no thank you!" and stayed clear.

It was the dribbling imbeciles who piled in and shrieked about "free money" and how "you can't lose!" and they are the ones whinging about how govts shouldn't have let it happen.

But it was their own fault for being ignorant pigs.

LOL.

Its not free money man its "wealth creation" ahahahaha

Hi guys, great comment stream, for the most part - please don't be childish and call each other nasty names. I deleted one comment that wasn't nessecary and there are a couple of others on the borderline, to quote the Eagles.

Roadhouse Blues (great name btw) - here's a story I did in 2008 on MPs who had interests in trusts and housing. Time for an updated version when the next set of pecuniary interests is published.

http://www.interest.co.nz/news/over-half-our-mps-have-interests-trusts

I think housing affordability is going to be a bigger issue in this election than in previous ones. Should be fun.

Cheers

Alex

If David Cunliffe dons a red wig and skirt , and plunges a political knife into Phil Goff's back , Labour will have an improved chance of winning the election . Surely Cunny must have heeded the lesson from across the ditch .

Julia Gillard showed us all , in Aussie style & grace , how to biff out a flailing leader ( yes , flailing ! Goofy is spinning out in all directions ) .

.......... I'm not a great fan of Cunny ( and he seems not to care for me , too ) , but he has gotta be a better option for Labour as a leader than Goofy .

Come on GBH, think it through .. Goofy is what is stopping Labour from getting back into power... why would you want him to go?

By now you will have information from the Campbell program on the cost of building consents - ranging from $2,500 to $7,500 for the same service. Which means those charging at the higher end of the scale are either incompetent or are plain straight out lying about their costs.

And the comment from English ..." training young people ...." apparently to take up the slack in the building industry. So he's going to replace experienced carpenters with inexperienced newly qualified carpenters. Easy to see how eg., we ended up with leaky homes!

Dumb pronouncements by dumb politicians makes my blood boil!

"The Duke" and any others who talk about a shortage of homes keeping prices up.

Firstly; some estimates from previous columns by Bernard Hickey and Rodney Dickens:

Around 1 in 10 properties today is owned by "investors"

Around 1 in 10 "investment properties" have no tenants in them. Thanks to investors being blinded by greed for capital gains.

Confirm this by a look-around any neighbourhood.

BUT in any case, if urban containment policies are pursued for long enough, refer to the papers of British experts like Paul Cheshire or Alan Evans, to see the results of 5 decades of this in Britain. Yes, the TREND in house prices is steadily UP. Actual SHORTAGE of houses steadily increases. CYCLICAL VOLATILITY of PRICES, INCREASES. Each bubble takes prices to new heights, before crashing back to the "trend" line or slightly below.

The "building supply" response to each price bubble, has become steadily weaker, and the building sector become steadily weaker. This in spite of the identifiable shortage of homes now being in the millions.

So yes, you CAN have serious crashes following a bubble, even when there is a shortage of homes. Timing is everything if you are an investor. If you are a young first home buyer, you are extremely unwise to buy at any time other than when prices bottom out after each bubble has burst.

Phil, those numbers seem a bit odd to me. If they are correct then surely they mean that only 1% of houses are empty? If that is the case then it would seem that there very def. is a shortage of rentals.

1 in 10 properties are owned by investors. So that is 10 properties out of every 100.

If all investment properties are owned by investors and 1 in 10 of those are empty,

then that is 1/10 of those 10 properties owned by the property investors, i.e., 1 house.

Convert that to a percentage of the total number of houses, (100) and you've got 1%.

100 houses x 1/10 x 1/10 = 1 house

Isn't even 1% an excess of housing? I mean, current tenants live in rentals ie: the houses aren't empty, so the empty one are the ones surplus to requirement, for whatever reason. Each year people give 4 weeks etc. notice, move about, many at Christmas, as they finish school, go back overseas or move jobs, and their vacancies provide fresh supply to the market ( that's why we have a squeeze in Jan/Feb. as movers relocate, and 'the panic' sets in to find a roof!). But after that we have an excess of maybe 25,000 houses.

I really don't know. But I think you raise an important point. Just what percentage of rental properties should be empty before a rental shortage can be declared? Any ideas?

Sorry! That's not one for me. But it strikes me as odd, that there could be up to $7.5mio per week ( if there are indeed 25,000 houses empty nationwide at say $300 per week) loss of income in the market, that someone is paying for or getting some tax relief on.

When designing apartments 3-4% vacancy assumed (for when deciding how much furniture moving lifts/loading spaces will need to be designed for etc.)

There needs to be some vacancy in rental and selling markets or the process of moving and/or buying a house would get rather complex - with 100% occupancy you could only move if you found someone to swap with or someone who could swap with someone else who could swap with you....

1 in 100 is historically a LOT of empty houses. That IS my point. You don't need 1 in 100 houses empty just to allow for market churn.

But this is like an early phase of what happens under urban containment policies. This is just the FIRST bubble and bust of many. Each one will get worse, while an ACTUAL SHORTAGE of houses will eventuate, and worsen.

The way to tell when this has happened, is when RENTALS are in a logical relationship with house prices. When rises in rentals have been left far behind the house price trend, you know you have a bubble with lots of empty investment homes. In fact, there has never been a time in NZ history before, where the actual DOLLARS of renting are so much LOWER than the cost of paying a mortgage. The Sunday Star Times recently published an economist saying that the disparity was as high as several thousand dollars per year.

In Britain, where actual SHORTAGES have applied since the 1950's, rentals are just as much a killer as mortgage servicing.

Totally agree with Philbest. The RE agencies are trying to scare people into buying property. One of the cardinal rules of investing is not to make decisions based on emotions, only facts, this is what a lot of people do not realise. People who make decisions when they are greedy or fearful inevitably lose their money. Thats why if you invest in property at the moment right now, you will lose your money.

If there was a fundamental shortage, which there isn't, wouldnt there be a lot of families on the street? I'm flat hunting at the moment and there is heaps to choose from.

"Thats why if you invest in property at the moment right now, you will lose your money."

Yeah, that would be true if you give the vendor his asking price or mor than that. I am first home buyer and I am shocked to see some buyers do that.

My wife has decided we would not give any property more 95% of it's CV. 90% if the house needs renovation.

If we don't get the price, we move on

To be honest, in uncertain economic times, taking on debt is a really bad idea, sit it out for a year or 2, seriously, no one knows which way the market is headed, and with so much uncertainty around I would have to say its going down.

Most of the Auckland district's rateable valuations are being revalued this year. See the revaluation schedule here;

http://www.qv.co.nz/valuations/valuationtypes/councilratingvalues.htm#6

Meaning the current CVs were done in 2008 and reflect market conditions (sales) in the prior year, 2007 (the height of the boom).

It is likely that most CVs around the Auckland region will reduce in this 2011 revaluation period.

I would advise anyone considering a purchase in one of these areas to be revalued by QV this year - that they pay QV to do a private valuation before purchasing - then you'll get a good idea about what your soon-to-be-released new, lower CV is going to be.

See my post below.

I wonder if the new CV's will be lower Kate. Over the past few months I've been keeping an eye on property listings in the West Harbour/Royal Heights area as I want to buy a home for my family and I. For various reasons this is the area I want to live. My son and I, together with my partner have been living in an extended family situation with my parents for too long and I'd like to change this sooner rather later. I will need a mortgage to acheive this as I don't have $300k (max purchase price I can afford if I can get finance with only a 10% deposit) lying around.

I've been using the CV's (Sep 2007) as a benchmark to gauge what the properties are worth and I've seen most asking prices are 10-30% above the CV. I've seen registered valuations (Oct/Nov 2010) 5-10% above the CV. I've seen recent sale prices 5-10% above CV but below the initial asking price. Only a very few are pricing at what I think are realistic prices (-5% of CV), and I've seen a very few adjusting their initial asking price down (not below CV though).

I've also noticed that the CV's vary considerably on comparable properties (similar size house, section and construction) within a few k radius of each other.

Yes, in general they are very likely to be lower than the 2007 peak (see QV graph here);

http://www.qv.co.nz/aboutus/pressreleases/nationwidepropertyvaluesstabilise08022011.htm

Had a quick look for example at Oriel Avenue, West Harbour:

10 Oreil sold April 2010 for $272,500 (CV $290,000)

13 Oreil sold June 2010 for $350,000 (CV $395,000)

18 Oreil sold August 2009 for $323,000 (CV $350,000)

At the other end of the street:

121 Oreil sold Feb 2009 for $311,000 (CV $380,000)

115 Oreil sold Dec 2009 for $369,000 (CV $375,000)

71 Oreil sold March 2009 for $335,000 (CV $320,000)

So out of those only one sold above its 2007 CV.

Of course Oreil Ave might not be typical - hence the reason why knowing the actual sales prices for the street and very near surrounds you are looking in is really important.

Thanks Kate, maybe the prices I've seen over the last 3 months are just the dead cat at the top of it's bounce. Here's hoping anyway.

Problem is, if QV revalue at the peak of any cycle then the new figures are going to be flawed anyway.

As PB says above:

"If you are a young first home buyer, you are extremely unwise to buy at any time other than when prices bottom out after each bubble has burst".

Does anyone know if we've bottomed out yet?

Does anyone know if we've bottomed out yet?

Truth is - no one "knows". We can all but "guess".

This graphic is worth considering;

http://businessrenegade.co.uk/a-suckers-rally-you-decide/

Lot's of commentators (particularly the bank economists) are trying to tell us we have simply reached the "new normal".

If you look at that against the graphic - well the slope on the downwards leg is steeper than the one upwards. So it took us roughly 2002 - 2007 to get to the peak - so less than 5 years to get to back down to a return to mean. Which means if fear and capitulation are going to set in - well this is likely the year.

It's important to note how dramatically (and swiftly) Bollard had to reduce the OCR in order to keep that housing bubble from spectacularly bursting when tshtf in 2008;

http://www.rbnz.govt.nz/keygraphs/fig7.html

That wiggle room/'saviour' isn't around this time around! Had he not intervened then, I reckon Bernard would have had his 30% drop - but alot of NZers (those who took on the mountainous debt during the bubble) might be poorer off for it.

Yeah, it's amazing how much effort he put into preventing the burst but didn't do much to prevent the bubble in the first place. Yet his statements seemed to always be concerned about the housing market.

I've had a look at the Oreil Ave properties you listed above and it brings me back to my query below about valuations.

10 Oreil has been subdivided at some point and the section size doesn't show on the CV:

1/10 Oreil - Land $150k, Imp 140k,

10 Oreil - Land $155k, Imp 205k,

13 Oreil - 1351m2, $200k, Imp 195k

18 Oreil - 948m2, $225k, Imp 125k

121 Oreil - 727m2, $190k, Imp $190

115 Oreil - 762m2, $190k, Imp $185

71 Oreil - 703m2, $200, Imp $120

These 2 are currently listed on TradeMe:

66 Oreil - 684m2, $200k, Imp $90 - asking $329

51 Oreil - 379m2, $165k, Imp $155k - asking $315. (also a subdivided prop, 51A - 502m2, $180k, Imp $155).

Obviously improvements are going to vary between properties, and the newer one of a subdivision will have a higher value. Without details it's not possible to really compare this part of a valuation but I do know that the bulk of these properties are very similar in construction/style and were all built about the same time (1980's). Yet, the "values" do vary considerably.

I would think that the section is much easier to compare but the numbers above don't seem to be based on any logical criteria. I know a CV is only an estimate at a point in time and are used for rates purposes only but it's probably the starting benchmark for most property owners and potential buyers.

According to Bob in his post below the section value is more related to the number of houses you can fit on it. In what way - the more houses you can fit the more value? That doesn't compute to me.

I'm doing the research/homework to be an informed buyer but if I'm using flawed data then I'm just as uneducated as all the sheeple who have gone before me.

The only data which is not flawed is the actual, recent sales data for properties in the same street (ideal) and near surrounds (that said however, there can be massive differences within a one to two street radius).

Yes, unfortunately CVs are used as a benchmark by most buyers and the way QV does them (in the main without viewing the actual properties) brings up lots of anomolies. Take cross-leased subdivisions as mentioned above. One where both dwellings have separate drive/accessways are generally more valuable on a per m2 basis than those with a common driveway. If a common driveway, the rear property usually fetches the higher per m2 price - all other things being equal.

A section which lends itself to subdivision/cross lease in future because the existing dwelling doesn't encroach on the balance of the land - is more valuable than the next door neighbour who might have the same amount of land, but where the existing dwelling makes future subdivision more difficult.

So, you can't simply come up with a per m2 formula for a particular street/neighbourhood - but generally that's what QV do.

I am currently looking in the Glenfield area and the Auckland GIS reflect a 2010/2011 valuation for most properties

In any case, my mortgage broker has told me in order for the bank to approve a loan, they are asking for a valuation report.

The fact that it is a falling/buyers market we plan to give a lowball offer to all the properties,a and try to get around 5-10of RV.

BH predicted that properties was going to be dropped around 30% about 2 years ago. Well they fell but only 5% by now. Even if they fall, it won't be drastically, neither will the rise be drastic.

According to QV website - North Shore City is being revalued as at 1 July 2011 - the new valuations will be released in October 2011.

I believe you are referring to the The Auckland City Council's GIS system which shows the 2010/2011 rates which use the 2007/2008 valuations to apportion/calculate the amount owed in rates.

The valuations (against which rates are calculated) are not updated yearly, but rather every three years. This is the year they (the valuations) will be redone.

philbest,are you from j ville?london 79/80?lots of nz towns were gutted by central govt policy 72-78(approx)maybe the beancounter days are nearly over?

Here is the government's current answer to affordable housing in Auckland:

http://www.hnz.co.nz/hnzc/web/rent-buy-or-own/gateway/available-gateway-land.htm

We all know there are various reasons as to what caused it and most of them have been mentioned - immigration policies, land supply issues, excess credit supply, greed, and so forth. Yes the government, the RBNZ and the consumer could all have done better to prevent it.

But, there is one issue I haven't seen mentioned and I think is also of concern. That is the "valuation" side of property/land. I know how the market is meant to work - willing seller, willing buyer sets the "market value".

In most cases when people borrowed against their equity, when the bank lent 100% a valuation would have been required. When the council sets rates a valuation is used.

According to the link above the property is valued at $395k and is available to someone earning $100k or less. Aside from the fact that this is outside the income/price affordablility multiple of 3, the land value of a 209m2 section is apparently worth $126,905.

Properties not that far up the road in the older part of West Harbour and Royal Heights with sections 3 times the size have government valuations as per Sep 2007 rates notices of around $200,000.

Am I the only one who sees a flaw in these numbers? Is the smaller section way overvalued or the bigger ones massively undervalued? Is there a problem with the valuation methodology or am I looking at it the wrong way?

The value of a section is more related to number of house it can take than just pro rata on size.

To Justice Ref "fool" 15th Feb 7.02pm, Matt in Auckland 15th Feb 7.25pm and Nicholas Arrand 15th Feb 8.00pm.

I must be a fool because I only ever worked for one company for 34 years before retiring 12 years ago at the age of 49 to NZ. Only ever had one house at a time and only 3 altogether between 1971 and 1994, What we did that your generation does not do is make do with 2nd hand everything B & W TV and no phone. I also renovated each house to make improvements. In 1971 our first house cost 4,950 pounds with 4,450 mortgage. In 1994 we sold our last house in the UK for 225,000 pounds with no mortgage. I then moved to Japan for 11 years working as an engineer before I came here in 1998. I spend my foolish days playing golf, fishing and pottering around my 21 acre estate in Kerikeri. I admit it, I am an idiot.

By the way when we bought our first house for 4,950 pounds my wife only worked a few hours a day 3 days a week until kids arrived, then not at all. In 1971 wives generally stayed at home. What happened when they all started working, well the family income went up which promptly increased the prices of houses. It would have been better for them to have stayed at home.

Yours sincerely

Stupid fool

You sound like more of a muppet than I do, why retire? I'm never going to, and neither has my grandfather, and hes 89.

I am happy for you both. I loved work but I also wanted to do other things while I was young enough.

I am your generation, keriwin; at 58. And whilst I chuckled at Justice's comments ( out of an understanding his frustration, mind you, not at his words!) I ask you to re-look at the generalisation of my calculations. And again ask you if you cannot see why inflation is so destructive. If you subscribe to the notion that 'economics' is the path to a wealthy life, then the Japanese situation is what you ( and I) really need. If you have retired, you need you accummulated income to now go further. That's deflation. Everything will become cheaper for you then, to buy with those savings you have tucked away.

Depends, when we bought in March 1971 we paid 4,995 (deposit 500 pds) and was earning 23 pds a week (I think). in July 72 we sold that house for 10,250 and bought a bigger house for for 10,750 increasing my mortgage by another 500 pds. Over that time the wages for my job went to 40pds a week.. In this case inflation was a great friend to me.

Now in NZ I have two sections and a rental house with a avocado orchard (100 trees). I believe if inflation doubled the prices of everything and I can keep my cash etc well invested I would be better off. I agree that inflation would not be good if you have one house, a wage that does not go up or cash etc that gives a poor return.

So I agree and disagree with you. As I will be getting NZ super in 3 1/2 years and as I understand it my wife will also even though she will not be 65 and that is indexed linked that will be an additional $580 a week which will make us feel rich.

Keriwin - your 'wife to work' morph, was just the same as the growing number of obese people now, and the housing 'bubble'.

Folk don't seem to get it, but the continued need for exponential growth (to underwrite profit/interest) drives increases in everything. The boardrooms want growth in the bottom line, now. So we are urged to buy more everything, and the growth required more earners, producers and consumers.

Bit of a juggle, because they took the consuming housewife, and stuck her in an office - no consumey. Luckily, the fast/convenient food market did the trick - saving her the time she'd 'lost'.

This last round, being exponentially the biggest by far, could only happen by doing up houses (no other sphere took enough physically) and then had to overshoot into bumped-up values. Nowhere else to go. Nowhere ever again, either. The next doubling is too big.

The irony, is that the processed food requires far more energy to prepare, produce and deliver, and energy is the Achilles heel of the whole thing. Watch the increase in vegie gardens, farmers markets and chichen-keeping? Back to the future.

I currently have a 2 bedroom 87m sq unit in Eastern Bays on market that I bought in 2007 for $430,000. I have spent $25k on it. The current CV is only $415k and there is virtually no interest in the property. The number being floated is $430k which would have me taking a hit which I don't really want to do. Interesting that I had queues of people lining up to rent it at $460 per week.

Will give it another month and probably rent it out again.

To SoreLoser - I have read your posts and to be honest they are quite difficult to read. Using lost of caps means you are shouting at people and to be honest bagging Aucklander's is beyond tired now. Besides we contribute approx 75% of the tax take of this country.

However, I will let you in on a secret. If you would like to know what Aucklanders really think about the rest of the country then I will tell you - we don't :-)

Well if you plug $460.00 per week into the National Bank calculator here;

http://homebuyerscentre.co.nz/calculators/calculator.aspx?PostingID=43

The amount able to be borrowed with that kind of weekly payment is $238,684.06 - so it's no wonder folks are renting it instead of buying it.

Hi, I hope you get want you want, but one thing for sure if you keep it, it will go up in value, history shows that. The anti property types on this site have no history or any idea what they are talking about even though they think they know the future. Hang in there and it will be ok.

Thanks. I had a similar size house in Mt. Albert which I sold in 2006 for $460k and I know which area I would prefer to live in.

Originally bought this one for my Mum and figured you can't go wrong in the Eastern Bays which is true over time. Was wanting to get the equity out to pay down the mortgage on the family home. But the good thing is we are not desperate.

history is no predictor of the future (just ask the Japanese!)

so many things over the next 10 years will be much different to the past 10 years, that it is seriously simplistic to argue that the trends of the past 10 years will be replicated over the next 10 years

to name a few

- markedly ageing population, meaning less people in the prime house buying age, plus selling off of properties leading to more supply to market

- heavily indebted younger generation of potential first home buyers coming through (not uncommon for people in their early to mid thirties still having large student loan balances remaining)

- fewer young kiwis able to go and live in UK for several years and bring home lots of cash as a house deposit, due to immigration changes and a weaker UK economy

- housing mortgage serviceability already pushed to the limit, even with relatively low - by NZ standards -interest rates (so its almost mathematically impossible for house prices to boom again)

- peak oil - higher petrol prices ( and flow on effect to other costs) further eroding net income and ability to service bigger debt. Also will push up interest rates, adversely affecting housing demand

- family income potential maxed out (ie. 2 full time incomes now common - what more can one do, send the 10 year old off to work?)

- rental yields generally poor compared to the starting point at around 2002 (7-8% yield was very common)

- less favourable tax environment for property

Keriwin - I challenge you to counter each of those points

Look forward to it

I also worked out the rental yield estimate on the property here;

http://homebuyerscentre.co.nz/calculators/calculator.aspx?PostingID=41

I get a yield of 4.27% (before tax), assuming rates at $3,500 pa, insurance of $500.00 pa, no vacancy weeks and maintenance of $500.00 pa. No other costs.

It drops to below 4% if there are say, 4 weeks vacancy.

And given you can get 5% on no term deposit these days; http://www.interest.co.nz/news/kiwibank-launches-no-term-deposit-5 - perhaps a rent review is warranted?

You talk as if this is the first crises we have ever had. When I was really young growing up in Cardiff we played in bombed out roads, had no shoes and our food was provided by ration books, maybe that is why we grew up being smart with our money. I did not say the last 10 years, I have owned property for the last 40 years. Just after we sold our last house in the UK 1994 the news was full of people talking like you that house prices would never go up again and investing in houses would never be a good idea again, well the house I sold for 225,000 pounds in 94 was sold again in 2006 for 1 million pounds. So much for the last generation of geniuses.

I do not believe in peak oil, there is loads of oil around, for an example I read a couple of months ago that the oil in the mid west is greater than that discovered in Texas and the Gulf. Don't believe everthing you read from people who have a vested interest.

Last week we had a physicist friend stay with us and he has spent the last 30 years working on fusion, he told me that it will be up and running by 2050 and that means one bath full of salt sater will produce enough power for a family for 30 years. The test facility us under construction in France now.

I spent 34 years working as an engineer in the car industry, so believe me I have seen non petrol car technology working for the last 20 years. Big business is not ready to go there while people buy the peak oil nonsense and pay the high price.

Don't worry about property yeilds, as long as you can make the payments inflation and time will make you money.

Don't worry about property yeilds, as long as you can make the payments inflation and time will make you money.

That's just plain dumb advice.

Sadly, it sounds like the Richmastery formula that so many people took on the way up and find they are having to put good money after bad now on the way down.

Sadly, Keriwin, many people are not only going to put their 'good money after the bad' following that advice, but all they have ~ and more. Many are going to be left with nothing but the debt used to secure the property. My concern is not for the young, hard done-by they may have been ~ they have the rest of their working lives to sort things out ; but for those approaching retirement, who having paniced at the sight of 'not enough' looming large, and have gone in with eyes wide shut....'the yeilds don't matter...' A Blue Chip opportunity, comes to mind.....

You are right , Keriwin : The history of mankind has always been littered with crisis , the proverbial " storm-clouds-on-the-horizon " .......... And yet , we continue to muddle through .