Buyers appear likely to retain the upper hand as the housing market heads into spring, with the amount of stock for sale at a 10 year high.

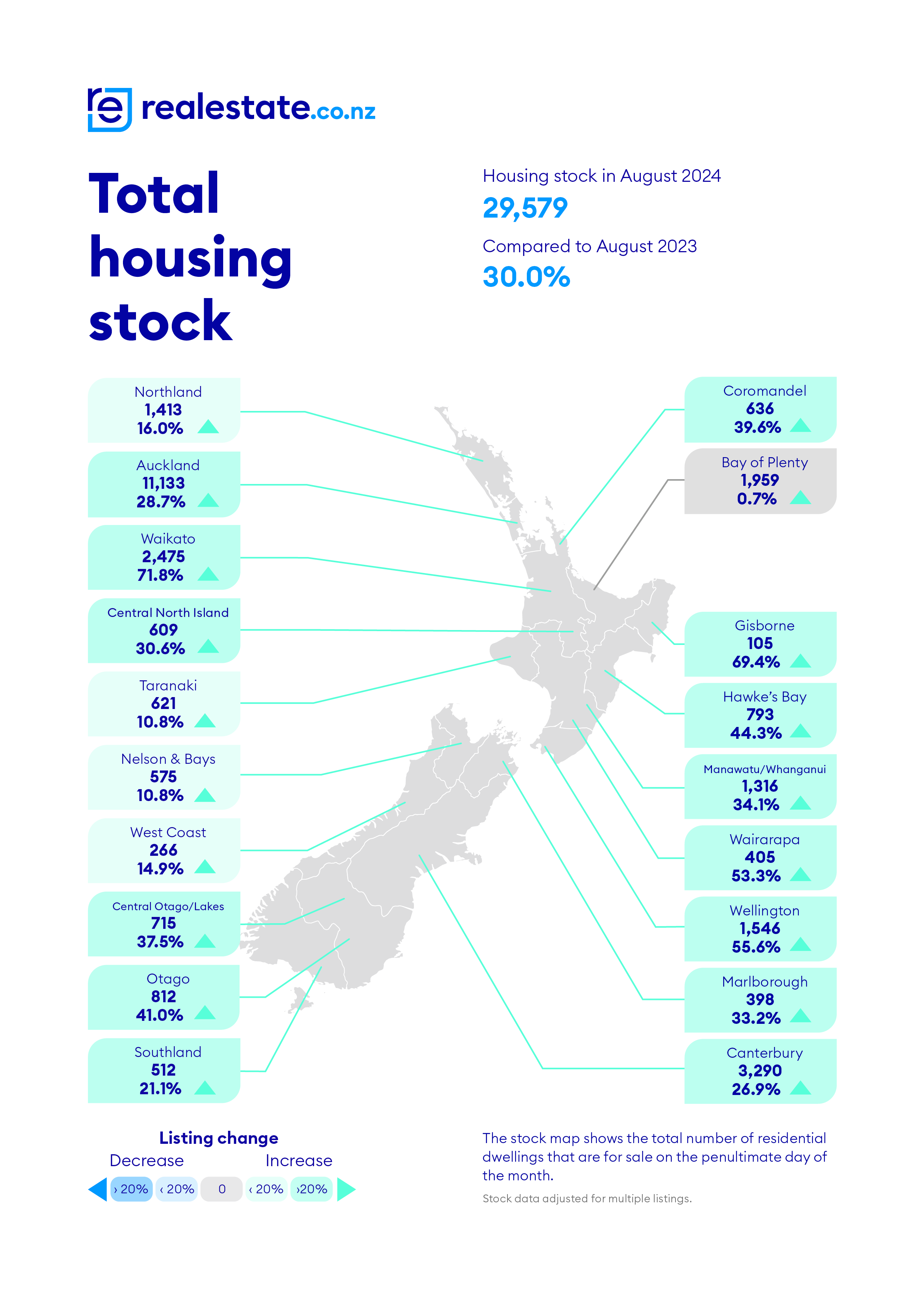

The latest figures from property website Realestate.co.nz show it had a total of 29,579 residential properties available for sale on the website at the end of August. That's a 10 year high for the month of August, and was up 30% compared to August last year.

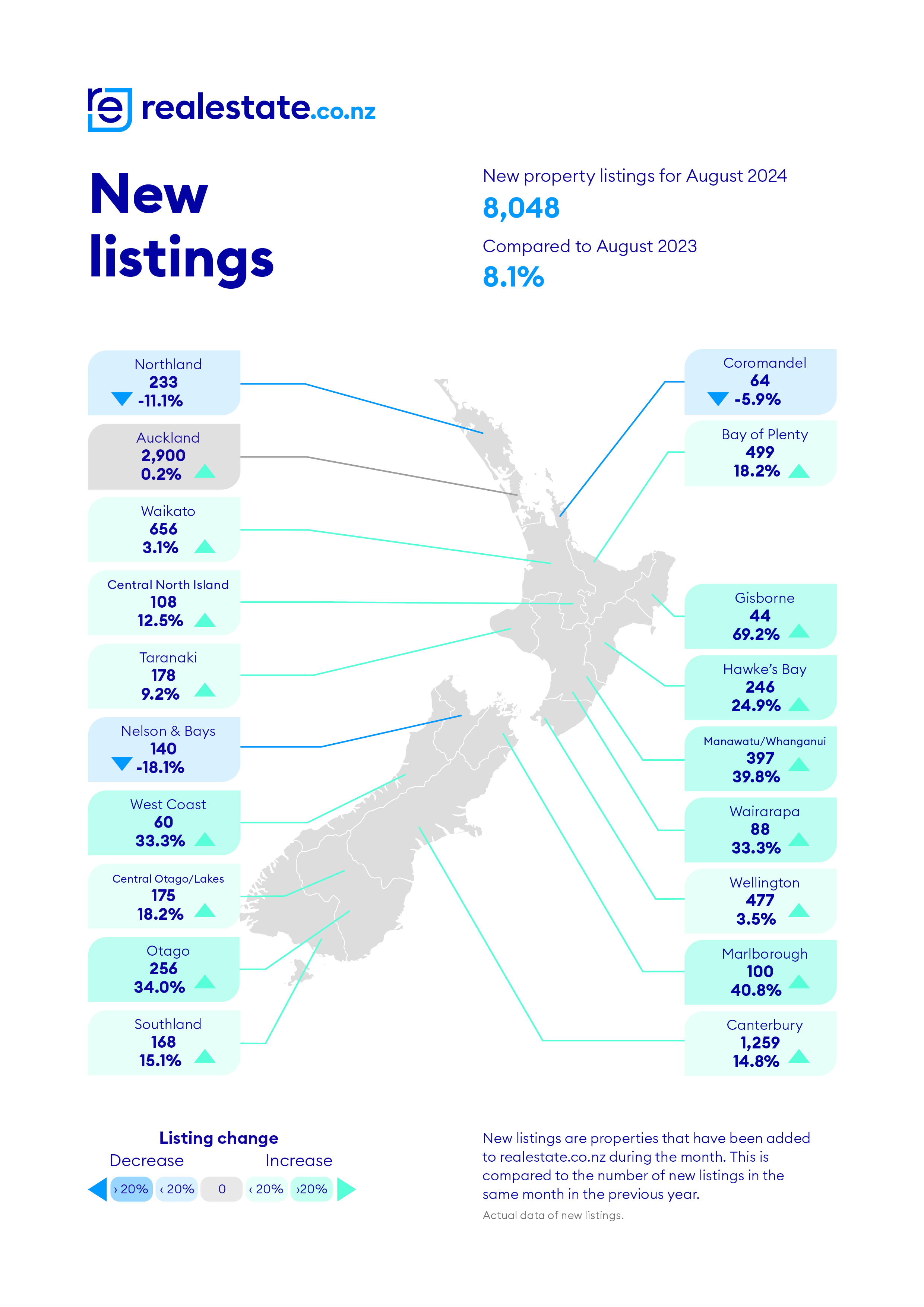

However new listings were flat, with 8048 received by the website in August, almost unchanged from the 8080 received in July, but up 8.1% compared to August last year.

Pricing signals were a bit mixed, with the seasonally adjusted average asking price dropping to $844,595 in August from $848,854 in July.

The seasonally adjusted average asking price has now declined by more than $51,000 from it's summer peak of $895,883 set in February.

However the non-seasonally adjusted average asking price perked up a bit in August, rising to $826,195 from $816,797 in July. However, that's still down by $101,117 from its summer peak of $927,312 in February.

The comment stream on this story is now closed.

- You can have articles like this delivered directly to your inbox via our free Property Newsletter. We send it out 3-5 times a week with all of our property-related news, including auction results, interest rate movements and market commentary and analysis. To start receiving them, register here (it's free) and when approved you can select any of our free email newsletters.

31 Comments

I think first time buyer owner occupiers having the upper hand is fantastic news. From an investment perspective, if well healed, the seasoned investor will inherently have a long term view and be unperturbed. They understand the market sometimes corrects and any paper losses only become realized if they sell. Why some resident Spruikers get so wound up and negative by this fact can only be narrowed down to unrealistic expectations to begin with. Homes are for living in and not speculating on for capital gains.

May this adjustment be complete in whatever form it plays out.

Auckland asking price up 1.3% on the month.

Momentum building.

the seasonally adjusted average asking price dropping to $844,595 in August from $848,854 in July.

"as the housing market heads into spring, with the amount of stock for sale at a 10 year high"

Quoting rises in asking prices is pure hopium until a) actual sales prices stabilise and b) the backlog is cleared.

It just means there are more actual houses coming on the market, instead of it being saturated by Williams high density bullshit

“Oh look dear, oneroof says the market is picking up again. We’d better ask an extra 50k as we’ll surely get it now!” (Scoff)

While many are watching the property market, thinking of a skyrocket like back in 2021, it is worth keeping an eye on what RBNZ is up to. They are setting up a depositor compensation scheme by mid-2025, capping coverage at $100K per depositor per bank. Back in 2008, after the financial hit, they fully covered losses for depositors at nine failing institutions, handing out ~$2 billion to 42K depositors. This time, the coverage has a limit.

Do you have any reference links for this? That is pretty concerning

https://www.treasury.govt.nz/information-and-services/nz-economy/deposi…(DCS,out%20funds%20to%20eligible%20depositors.

What is the Depositor Compensation Scheme?

The Depositor Compensation Scheme (DCS) is set to launch in mid-2025, safeguarding each depositor up to $100,000 per licensed deposit taker in case of a deposit taker failure. If it is necessary for the DCS to be triggered, the DCS will pay out funds to eligible depositors. The DCS fund can also be used to fund the resolution of a failed deposit taker within limits defined in the Deposit Takers Act 2023 (the Act). Resolution is chosen when deemed necessary for a deposit taker to avoid the standard insolvency process due to the risk of loss of critical functions, broader contagion, and financial stability. The DCS will contribute to financial stability by assuring depositors of quick access to their funds if a deposit taker fails.

Thanks. Capping coverage at $100K per depositor per bank is a bit different than $100,000 per licensed deposit taker.

Waikato leading the total stock compared with Aug 2023 with +71.8%.

I've always thought that region was the most stubborn one in NZ, especially when it comes to money. My typical case is you will never make a seller understand their car is not worth the asking price and that a 1h15 drive to Auckland is all you need to save thousands.

Putaruru is a nice city to live in the Waikato area!

/s

Don't forget Huntly. Jewell in Waikato's crown.

on a serious note, Tirau is a nice little town.

A nice waiting room!

Do you mean a nice place to retire? i think so.

Yeah, nothing else is happening there!

Hmm you could easily say nothing is happening in the whole of NZ, most of what it "happening" in larger places is just more traffic.

It reminds me of Three Ways, but the traffic is worse.

Tirau is a great little town. cool shops. I always stop for a munch when passing through. good spot, short drive to Hamilton, Tauranga, Rotorua, and Taupo.

Kind of fake news really, total listings in Tauranga are actually down from the peak. It appears the news is all one way traffic and doesn't report when listings fall, only when they rise. Houses still selling down here no problems, one in my road just sold in a few weeks.

I live in Whangarei and now there are 882 listings for Whangarei district. Peak of close to 1200 a few months back and many selling, sometimes within a week of going to market.

People know interest rates are going to keep falling.

Unless you can show all the withdrawn listings, in the last 8 months, then you are simply fake news.

My feeling is that Auckland is looking worse than Wellington - even if these figures don't reflect it. One factor is that Auckland has about 3,600 new homes listed on trademe - and commonly the developer lists one home when they have ten. So if each of those lsitings represent 2 homes (conservatively) then there is a further 3-4,000 homes on top of the 12,000 listed. In addition, new homes are additional supply - rather than one household buying and selling in the market.

Prices have already started to rise,

wake up Greg hahahaha....

What real estate data supports this? its Monday a School day.... your meant to take your Ritalin each day orally, not save it up for the weekend , grind it up etc etc

Bizzare how we get a small reduction in the motgage interest rates (but still high compared to what we are use to) and RE agents and mortgage brokers are talking things up as if the bottom has been reached. Except they are wrong

Reminds me of the brief optimism there was in Feb Mar before it all fell away as the weak fundamentals kicked in - eg right now the number of listings is huge

Actually Mike H was a bit DGMer this am... I am sure I will see Xmas Decorations any day now.

Just need to look at what happened in the States over summer - despite mortgage rate cuts, sales still dropped

https://wolfstreet.com/2024/08/29/buyers-strike-deepens-pending-home-sa…

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.