House price growth is slowing, although prices are still more than a third higher than they were a year ago in some parts of New Zealand.

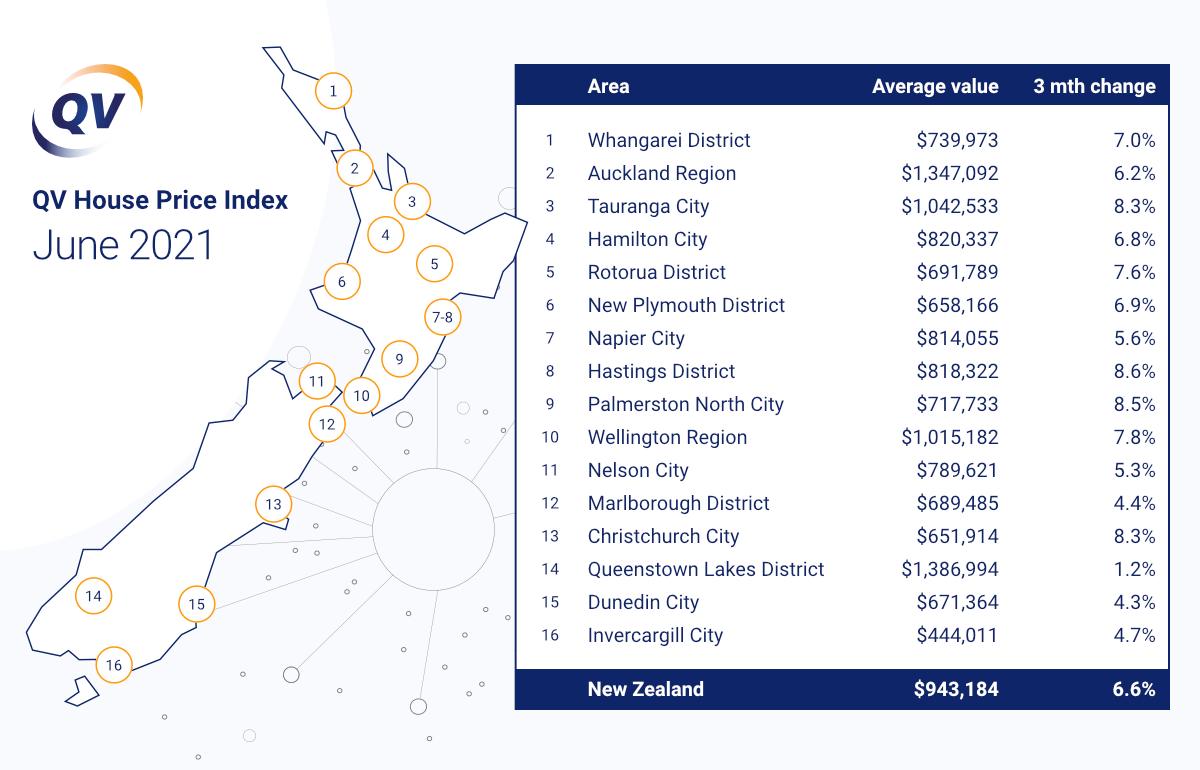

According to the latest Quotable Value (QV) House Price Index, the country’s average house price increased 6.6% in the three months to June - a slower rate than the 8.8% recorded in the three months to May.

However, at $943,184, the average house price was still 25.6% above where it was in June last year.

In Manawatu-Whanganui, the average value was up 36.0% year-on-year, while in Wellington and the Hawke’s Bay, average values were up 33.3% and 31.5% respectively.

QV general manager David Nagel said: “It’s too early to say the market has turned, but this will be encouraging news for government officials and regulators, concerned about the financial risks of an overheated property market.

“This easing comes after a range of government policy announcements earlier this year to dampen activity by property investors and speculators, while there’s also plenty of chatter about interest rates rising later next year.

“But we’re also now into the seasonal downturn that normally accompanies the cooler months, so it’s difficult to attribute the cause to any single thing.”

Of the 16 major urban centres QV monitors, all except Rotorua showed a reduction in quarterly growth compared to May.

The strongest value gains over the three months to June came from Hastings at 8.6%, followed by Palmerston North at 8.5%, and Tauranga and Christchurch at 8.3%.

Central New Zealand continued to show the strongest annual growth rates. Meanwhile the three lowest annual growth rates came from Otago (18.6%), Southland (19.1%), and Tasman (22.9%).

“With our borders essentially closed to new residents, we’ve given the housing supply chain an opportunity to catch its breath with record rates of new houses being constructed, particularly in the main centres,” Nagel said.

“But while interest rates are still at record lows, accompanied with a dearth of property listings in most parts of the country, it’s unlikely that we see house values fall any time soon.

“We’ll likely see a continued slowing in the rate of price increases over the coming months as the property market absorbs the recent changes and winter really sets in.”

92 Comments

Mike Kirk et all called the top of the market in early Feb? Largely due to the alignment of planets!!!!

Very sad but can’t help those moaning DGMs. All the folk I am speaking to seeing packed auction rooms and plenty of FOMO for good properties. The property party continues!

Congrats?

DGMs are important. Any risk analysis needs to understand both sides of the coin. This is why diehard All Black fans are annoying, particularly at World Cups. They're usually brimming with confidence and walking around with their chests sticking out and wearing their fan costumes in foreign countries (and let's be real, most non-NZers don't really care about the ABs). Probability suggests that something can go wrong or else NZ would have retained every World Cup until now. The diehards go into their emotional self pity and usually look for others to blame (French refs, a particular player, bounce of the ball).

If you want the Granny Herald spin to dictate your life, that's your choice. But it's foolish to buy into all the BS about the bubble. People are emotional creatures and can't think rationally about markets and the NZ property market is a superb example. Open your mind, think laterally, and have a Plan B. Something this overblown potentially has huge negative impacts no matter how sweet you think you're positioned for a worse case scenario.

Have you heard the word "RESILIENT" used in relation to the NZ housing market?

Let me tell you that you're likely to hear it used again.

TTP

Yes, we've all seen you describing the market as resilient and look forward to you doing so again in the near future.

We have, it is one of the buzzwords commonly used by the housing lobby spokespeople hoping to get everyone into their narrative.

Have you heard the word "RESILIENT" used in relation to the NZ housing market?

Yes I have. But 'resilient' is a subjective adjective. It can be something that you attach because of emotional sentiment. It doesn't necessarily have any concrete meaning. It would be an adjective that Ashley Church might bandy around with free abandon. Doesn't make him a prophet in my opinion.

I've heard the word RESILIENT used in relation to stage 4 cancer. That's the same thing right, Tim?

The word "RESILIENT" soon puts a shiver through the DGM - a shiver searching for a spine to travel up.

See the DGM comments above - and below.

TTP

That's fairly normal. Nobody wants cancer.

There’s people with stage 4 cancer that have had it for decades and a have normal life expectancy.

Quite a nasty thing to bring up. Hope it doesn’t come back to bite you.

Cool story, bro.

....and in those fine words of our recent Prime Minister Sir John Key ....rising house prices are a good thing to have .....say what ol' boy ......now move along nothing to see here...... and let the greatest wealth transfer history has ever seen carry on .....and long may prices continue their upward trend .....haw haw

Nice analogy but Rugby is a minority sport that nobody cares about outside of NZ.

Football is king and this euro championship has been exceptional. It’s coming home.

Soccer most certainly is king and the Euro has been a great mix of life and death drama as well as the usual effeminate pantomimes from the players. I wish it would come home if only to stop that song, it's a mind virus on a pandemic scale.

Nice analogy but Rugby is a minority sport that nobody cares about outside of NZ.

I made a point of that in the analogy.

Fair enough.

Lol it was literally the point of the analogy

the italians look far more exciting and play a more expansive game - arrivederci

It sure is. To Denmark:-)

A great tournament, go Italia!!!

it's just having a breather..come spring it will be away again. Having Interest rates go from 2.25 to 2.5/2.75 will do jack.

Yes you’d be brave not to think that spring will be very strong and when the borders open up again?

Repeating the same does not make it more true no matter how much you want it to be true.

"A quarter of arrivals to New Zealand in the five months to January 2021 planned to return overseas if the COVID-19 situation improved, according to a Ministry of Business, Innovation and Employment (MBIE) survey"

https://www.interest.co.nz/news/111002/nearly-80-returnees-new-zealand-…

Lots of new compliance, no tax offset, cheap debt signaled to be ending, inability to eject tenants, and new build consents really firing up. All suggest sweating debt on old houses may have peaked for a while, but you just cant tell. In the words of Golum "my precious".

I agree, sweating debt for existing stock is unlikely to persist for investors against those head winds, but new builds will hold their price as they are time-warped back to the previous policy environment.

FHB's should get most of the over-priced old stock in need of maintenance. Good to get on the ladder I guess?

Why pay $700k for a tiny 2 bedroom townhouse with no garage and no garden, in a complex of 10-12 other similar pokey townhouses, when you can pay $500k for a 2 bedroom unit in a nice area with a lock up garage and decent back yard, on a section shared with just one or two other owners? $200k price difference is a substantial renovation budget, and you will end up with a much nicer, more spacious home at the end of it. I foresee investors having to wear capital losses as there will be no buyers for those shoe boxes once they are resold and are no longer "new".

Probably it is a good time to remind the RBNZ the OCR is still at minimum lows which is causing obvious hyperinflation on housing.

Also the Government is due some serious measures for fighting speculation and stop the vicious cycle which lets owners use existing equity in housing to purchase more housing assets. Also introduce a tax equivalent the one any other asset holders need to pay for performance in their investments to even out the fields instead of favoring investment on housing.

Those would be the minimum changes we need added to push offer even more but this time doing some proper planning to allow for new services and infrastructure, not solely relying on private initiative.

Somewhere I read a suggestion that if people release equity to purchase another property, they should be taxed on that equity at that time. Does that idea have merit?

Definitely has merit.

The government are not going to do anything.

Neither are the reserve bank.

Trying to anthropomorphize these organisations into entities that "care about you" will get you nowhere.

The only thing the government cares about is getting a small portion of swing voters over the line once every three years.

The reserve bank doesn't even need to worry about that. The hopelessness of a generation is written off as a "distributional consequence" on one of their spreadsheets.

The truth is that nothing gets better in New Zealand and there is nothing on the horizon to suggest that anything is going to change.

If you ever want to know what policies are or are not going to be enacted in New Zealand, ask the question of what will work most in the favour of the boomer voting block, and you will have your answer.

The social contract has been shredded and civil disobedience is the only recourse left.

Unfortunately you are probably right and this is the reason why so many young people and others that just returned as a result of COVID are thinking about emigrating outside NZ/.

However I am more positive than you in this regard and I am confident social pressure can press the government into coming to reason, not that sure about the RBNZ though.

I'm old enough to have seen the 2009 National government come in and promise to fix the housing situation (while I was being a stupidly responsible citizen and paying off the cost of my education plus 7% interest).

Then the 2017 Labour government came in and promised to fix the housing and immigration situation.

They both turned around and did the exact opposite as soon as they were in power, screwed over the productive members of society in favour of the specufestor and remained popular through a cult of personality with particularly narcissistic leadership.

This country seems particularly keen on electing the person over the policy.

I've not forgotten either. Vote for change until it happens.

Or leaving? I think if the nurses can't get some equivalence with Aus we will have a collapsed health care sector by this time next year. 3rd world stuff. There are plenty of reasons to leave if you are able.

Tried registering with a local GP. None are taking new enrolments in my area. The closest is an hour's drive away, but they're only taking new enrolments for their local residents (fair enough). Cannot even book a casual appointment, for what would be a 10 minute consultation.

I think you're right, give it 12 months.

'House price growth across New Zealand is slowing, but it's soon to know the extent to which the change is seasonal or can be attributed to policy changes'

Hi Jenee, Housing market is still hot and it is just because reserve bank governor mentioned that have data to suport that housing market is cooling, many are reluctant to admit (Believing Mr Orr) that despit everything housing market is still hot and FOMO is at peak.

More action needed now to control instead of wait and watch adopted by Orr. As people in power who can make a difference have no intent even after few months despite market being hot, headline will still be the same / confusion though reality / data will prove otherwise.

Orr and Robertson will always find some excuse and reason to support their narratvie / inaction.

What happened to DTI, no mention anywhere and both Robertson and Orr knew that by lip servise will be able to divert the attention from ever rising house price and were successful.

No talk of interest only as know many investors / speculators who are using their equity to buy by using interest only loan - giving them edge over FHB.

You should visit one auction and will know, if the market is hot or not - not a rocket science.

Great part of this FOMO feeling is as a result of the continuous efforts of the lobby's media as well as because of the fact there are just way too many agents for the amount of properties on sale, causing some of them resorting to aggressive techniques due to the pressure they are under.

In the past week, two 3 bedroom homes in Avondale have sold for a little over $2 million. One of them was listed as 4 bedroom, but the 4th bedroom was a small office at best. If this isn't a sign of a broken market then I don't know what is.

It's been broken for a long time. If we're looking at 3mil for an asbestos unit in Kelston this time next year, it makes no difference to me; I was priced out of the market some time ago. Nothing to do but sit back and laugh, and start thinking about possibilities overseas.

Brisket, This is the sad reality and Jacinda should take responsibility as she was voted to avoid this situation and she instead of helping added to it and many blamed John Key.

I agree with all that and was someone who voted for her for that promise only. More fool me, she has well and truly distanced JK in house price inflation. I think she is the current champ, 25% last year is a really competitive effort.

I think the single moment she will most regret when she looks back at her time in power will be her off-the-cuff comment about 'Kiwis expect their house prices to rise', whatever exactly the phrase was. It really did seem to be interpreted as 'Jacinda's got your back, pile in!' I still remember listening to the last Auckland mayoral debates on the radio; every candidate said they wanted more affordable housing, yet none of them were willing to say they wanted prices to fall. Cowardice or stupidity, who knows? Anyway, they're a fair reflection of the NZ public tbh.

You can still get a solid 3 bed weatherboard in an ok area for a bit over a Mil. Much better next 5 years than renting

That all depends on what happens with mortgage rate increases over the next five years and how that flows into capital valuations.

I know the kiwi boomer hive mind is incapable of conceiving negative growth in house prices. But it's more than likely to happen even with modest interest rate rises and as we shift into oversupply of housing with almost zero net immigration. The risks have never been higher.

Doing a spreadsheet recently on the consequences of borrowing a million dollars from the bank for a lousy house and repaying over decades with various interest rate scenarios was blood curdling even for a top-percentile earner like me.

The only way this bubble doesn't burst is the reserve bank being permitted to ignore its policy target agreements and let inflation rip. And if it does that it's going to only drive more money into housing which will further destabilise the system.

It's almost as if buying property in Auckland now is gambling with money you can't afford to lose.

''Kiwi boomer hive mind''

Nice.

Honestly I cant decide whether they will let it pop when the time comes. It wont be anything we do or don't, some external trigger, GFC 2.0 etc. All they got to do is print a little more money and 'see though' the 'transitionary' inflation.

Yes, what a deal. Would you also bet you 200K deposit (if you have it) on whether that house won't be worth less in 5 years when interest rates are higher than they are now?

It is easy to go around giving advice without any responsibility. Things are already bad enough without pushing people into a severely unaffordable market.

I would say without a shadow of doubt it will not be worth less in 5 years and in that time you’ve had all the benefits of living in your own home at less than rent.

Or you can keep renting and waiting for a house at a 20 year ago price.

I would say without a shadow of doubt that you have not modelled what happens with mortgage rates of even just 4% - 5% coming back (which is almost a foregone conclusion now).

A lot of the good people that this country needs are simply planning to leave. Fortunately the only place in the entire world less affordable is Hong Kong.

+ many Chinese cities

4% or 5% is a forgone conclusion is it?

Now that’s a cooler story

Given that five year rates are already at around 3.5%. Absolutely, bro, you can bank on it.

End of Feb 2017 3yr rate had been rising fast and was at 5.2%, 5 yr rate was still rising and at 5.7% .. want to take a guess what the 1year rate was in feb 2020 before the Covid reductions came in? I'd wager a few bucks the 1 year rate on 1 March 2022 is still well below 5.7%, hell still be below 3.7% almost certainly.. 2.7% nah, that one is a bit less likely.

Let's not forget it's the little people who pay the full commercially advertised interest rates. The big investors are getting cut rates from their connections and will be positioning to be the ones to swoop in and pick up rock bottom prices at the mortgagee auctions to come. It's a win win for the finance industry and their wealthy and hedge fund mates. Then they scoop up the post tax rent and benefit dollars that will go out to those who now need to rent or go into publicly funded housing subsidies. Greed is good is their motto. Rinse repeat. ...and all those awful boxes that won't sell at top dollar to investors or the general public, will definitely be sold to the government for public housing...win win.

You can rent much cheaper than those 200K for 5 years and try to save for a healthy deposit instead of getting into a mortgage on a market with a pretty uncertain future with growing rates in the near future. I doubt you've made any numbers except for those from your investments. The market is just being supported by historic low interest rates and a huge marketing campaing.

Yet you and your disciples are on here day in day out telling us all how great and cheap it is to be renting…

"My" disciples. Total tinfoil hat material.

Well yeah, disciples implies people follow you/ hold you in high regard...

Hmmm, last place we rented was recently back on the market. $630/week.

$630 x 52 = $32760/year

x 5 years = $163,800. And that doesn't factor in any rent rises over those 5 years.

Then there is the non monetary value of not having inspections, risk of being kicked out, useless landlords/property managers that don't fix stuff, and being able to redecorate, have pets etc.

Doesn't look much cheaper to me, once you factor in quality of life, and the likelihood house prices go up or sideways, rather than down.

And I guess you are paying $0 towards your mortgage according to your calculations.

FYI, that would be an extra $202,380 on a 800K mortgage at 30y at 3% interest on top of the initial 200K deposit required according to the 20% LVR restrictions. If you don't trust my calculations, check here. And that doesn't factor in any interest rises over those 5 years.

https://www.westpac.co.nz/home-loans-mortgages/tools-resources/mortgage…

I’m paying 2.25 and end of year I’ll be paying 2.19 or less

Excuse me, then it would "only be" $182,040 at your discounted rate of 2.19 in the extremely unlikely case it will hold for the next 5 years.

My mortgage is less than $300 a week and the house’s market rent is more than $600. Even if the 1 year rate suddenly jumped from 2.25 to 4.5 my mortgage is still less than market rent.

Nothing to do what the point being discussed, this being a purchase of a new home, keep trying.

If you are that certain about something 5 years away you have a serious lack of imagination. I'd be happy enough if you thought there was an 80-90% chance of prices being higher in 5 years, but without a shadow of a doubt? Crazy risk assessment.

Yes I have no doubt whatsoever but that’s why I’ve bought the end of last year and others have not.

You'll probably be fine, but honestly I've never made an investment without considering the downsides and assessing the risk. Hopefully you've kept some cushion or diversified in some way.

The stats are quite clear that you were not the only one buying - you were part of the herd of frenzied buying. Do not pretend to be a contrarian if you were investing in NZ property late last year.

I didn’t “invest” in NZ property. I returned to NZ after being furloughed because of covid.

We needed a place to live as does everyone and I didn’t want my family and I to be at the mercy of a landlord.

I think if you are worried prices will be less in 5 years time from now you will honestly never own anything in your lifetime and a lifetime of renting is not something I’d want to do.

Ah, My mistake, I got the wrong end of the stick and assumed you were investing. Buying a house to live in is a different matter. I still think you're overconfident but assuming your finances are in shape the risk profile is quite different and the intangible benefits much higher.

I bought my NZ house in 2018 in Chch and based the decision on the assumption prices would remain pretty flat, as they had in Christchurch for a few years. I am a little startled by the current craziness and it's a real problem for my friends who are still looking.

I'm building an asset base of products that sell online for less then 10k, I will build supply chains around the world. The products sell for 30% margin. Over 10 to 20 years I will add more products, I can run this business from my computer anywhere in the world, with help of virtual assistants. This is the way to make money, relatively stress free, do it while travelling, and constant income.

Are these the numbers that will in large part set or provide an indication of the upcoming rateable valuations. ?

Cowpat

My understanding is yes, if - as commonly the case with local councils - CoreLogic is contracted to complete rateable valuations for Auckland City Council (to whom I assume you refer).

CoreLogic, prior to privatisation was the former Valuation Department. The basis of their collection of data - i.e. over a three months period - has been continued with QV and now CoreLogic; the three month period was intended to negate the significance of short-term market fluctuations.

As to the importance of the RV, one shouldn't be overly concerned.

Firstly, rateable valuation is used simply to determine one's share of council's total rate budget and it does not influence councils total rate take. If the rate budget is going up by 7%, then on AVERAGE individual property owners' rates will go up by 7%.

Secondly, rateable value is prepared for rating purposes, is a computer generated estimate only, and especially in a volatile market, quickly loses any semblance to an accurate reflection of actual market value. While RV is a good starting point when buying or selling in considering the value of a property, one should not put any weight on it when determining a property's current market value.

Printer8 thanks for that. I will assume the June data is the cut off date for the new valuations. I agree that the valuations do not correlate with prices, but do often set the goalposts , for where a vendor in particular or a purchaser may believe where a property sits without consideration of the entire myriad of factors.

My guess, 15plus % for 2021. Maybe go flat next year but this run isn't done yet

It may well drop next year. Significantly.

We heard that last year.

"Past performance is no guarantee of future results" is generally treated as a warning label: Don't assume an investment will continue to do well in the future simply because it's done well in the past.

Don't assume it won't. If you apply a, "warning, it should have been applied about 40 years ago. Immigration next year will rise, supply still low, interest rates still low (even at 4/5%) and a known fact housing is a save long term bet would say the market will continue up and flat for the foreseeable future.

Last week a house on my street (in Christchurch) sold for 45% more than it was purchased a year ago. Nothing was done to the house, it was in exactly the same condition as when it was sold in 2020. Bought for $1.66M sold for $2.4M. How's that for house price growth?

That’s quite a lot for a place in CHC must be a proper mansion

A nice house in a nice area, where most homes are selling for over $2M now. Its part of the reason why there are so few available to buy - people cannot afford to upgrade their homes to something better without taking on an additional mortgage amount which is probably double what they are currently paying.

Definitely not a bubble. This is just the natural state of affairs. Prices can go up 45% in a year but they can never ever drop. And if they do they will just drop and go straight back up again. That's just how it is and you have just have to deal with that. Your kids will never afford a place to rent or live. This is the natural order of things. Sincerely. A. Boomer.

What a load of rubbish.

That is indeed the natural reaction when you talk to these people.

Look folks, the fact is that I bought a turn key package back in October. I have now sold this fully built property for 260k profit. All I did was transfer a 10% deposit, sign some paperwork, pay the lawyers, and next minute 260k turns up. It's not right how easy it is to make money, but who is going to say no to making a profit?

And no, I am not rich, I am just your average joe with 10% deposit available.

Edit: And yes, I will have to pay tax, but who cares, plenty of profit left to go with another purchase.

Nice work. Right place right time.

It look me close to 15 years to accumulate that kind of money for our deposit.

Question is what are you going to put it into?

Thanks

Back in the same area.

I'm not afraid of buying off the plans considering the area is tightly managed by Fulton Hogan. Many are not keen to do that, they would rather see and touch a house before purchase. That's all well and good but you would be paying a lot more for waiting.

New homes in a new area will be very resilient against any headwinds. People love new. I love selling new as there's no fuss over building reports etc.

So today you are not asking material proof of this, this is how it works right?

BTW good point, putting this into housing will obliterate your gains so probably made the right call selling now.

They don't call it a casino for nothing.

Don't bet against the house.

The market is still pumping.

https://www.oneroof.co.nz/news/39753?utm_content=intro&utm_content=&utm…

Sure, the scare campaign is still pumping.

We welcome your comments below. If you are not already registered, please register to comment

Remember we welcome robust, respectful and insightful debate. We don't welcome abusive or defamatory comments and will de-register those repeatedly making such comments. Our current comment policy is here.